50+ engaging interview questions for an accountant position

Accountants help businesses make better financial decisions by aggregating invoicing information and tracking the movement of funds. They manage sensitive and confidential information, which means the role comes with lots of responsibilities – and with demanding clients who require exceptional accuracy.

Hiring a candidate with the necessary skills and expertise in accounting can be a challenge. Candidates must know how to record transactions, handle audits, ensure compliance with rules and regulations, manage budgets, and support management in ensuring the company is in good financial health.

One of the ways to evaluate your future accountant is to send them an Accounting (Intermediate) test and then invite the most skilled applicants to an interview.

In this article, you’ll find over 50 engaging interview questions for an accountant position, along with some sample answers.

Table of contents

- 20 common interview questions for accountants

- 5 sample answers to common interview questions for accountants

- 15 technical accounting interview questions to ask candidates

- 5 sample answers to technical accountant position interview questions

- 18 behavioral and situational interview questions for accountants

- 5 sample answers to behavioral and situational interview questions for accountants

- When should you use those interview questions for an accountant position in your hiring process?

- Use our skill tests and accounting interview questions to hire talented professionals

20 common interview questions for accountants

Check out these 20 common interview questions for accountants that will help you better understand candidates’ work experience, accounting knowledge, and skills.

1. Describe the three types of financial statements.

2. How do you organize important documents?

3. Errors can be detrimental to accounting processes. How do you reduce the risk of making errors when completing your work?

4. What skills do you think accountants need to be successful?

5. What is the difference between public and private accounting?

6. Name three examples of common budgeting methods.

7. When do you capitalize rather than expense a purchase?

8. What is PP&E and how do you record it?

9. How do you continuously improve your accounting skills?

10. What is double-entry bookkeeping? Please name some of its rules.

11. Do you prefer to work independently or as a team?

12. How do you track accounting laws and regulatory changes?

13. What are trade bills?

14. How would you determine whether our company can afford short-term commitments?

15. What is the accounting equation?

16. Are you willing to work longer hours during tax season?

17. Describe your experience with defining which business metrics to track.

18. What is the difference between accounts payable and accounts receivable?

19. How will AI and automation impact the accounting industry?

20. What happens on the income statement if inventory increases by $10?

5 sample answers to common interview questions for accountants

We’ve selected five key questions from the previous section and provided sample answers to them to help you assess the depth of your candidates’ knowledge and review their expertise. Use these sample answers to compare candidates’ responses.

1. What is the difference between public and private accounting?

Public accountants manage financial documents for various clients, from small companies to large corporations. These professionals don’t work for a specific company, meaning they can liaise with any business that needs their services.

On the other hand, private accountants will prepare financial reports internally for one company. They can work more closely with managers and record business transactions on internal systems. These transactions are important in accounting because they represent a company’s exchange of goods, money, or services.

Candidates will be well familiar with the difference between public and private accounting if they have a set career path. This knowledge is crucial for achieving goals such as improving company compliance and maintaining accurate records.

Another way to determine the level of applicants’ expertise is by sending them an Accounting Terminology test before the interviews.

2. What is PP&E and how do you record it?

Property, plant, and equipment (PP&E) are long-term tangible assets that companies list on their financial statements. Some examples of assets include:

Buildings

Vehicles

Machinery

Land

Office equipment

A company can use PP&E to generate profit, meaning accountants must record this information on a balance sheet. Recording PP&E is important because companies can see where they spend their money.

One way of recording the assets is to consider the investment, depreciation, capital expenditures, and dispositions. Candidates may talk you through the following steps of recording PP&E:

Calculate the gross PP&E using gross yield = gross annual rent / current market value

Add the gross property, plant, and equipment to capital expenditures

Subtract the accumulated depreciation from the value

To calculate and accurately record PP&E, accountants must have strong mathematical skills. Send your candidates a Financial Math test to ensure they can handle finance-related calculations such as net value and profit maximization.

3. How do you track accounting laws and regulatory changes?

The accounting industry is always changing due to new technological developments, state laws, and regulatory processes. Candidates must stay current with all this to ensure they’re producing high-quality work and projects, such as understanding their clients’ businesses and the legalities of their companies.

Common ways to track accounting laws include to:

Monitor regulatory agency websites

Follow accounting firms on social media

Build strong professional relationships with other accountants

Join industry associations

Attend regulatory conferences

Talk to team members and managers

Use compliance software such as AuditBoard and MetricStream

Subscribe to accounting blogs, YouTube channels, and newsletters

Failure to comply with specific regulations can harm the company’s reputation because it could face fines and even legal action. So, to determine whether they’re the perfect match for your company, it’s essential to ensure that your candidates have sound knowledge of financial regulatory requirements.

4. Describe the three types of financial statements.

Accountants must understand three types of financial statements: the income statement, the balance sheet, and the statement of cash flows. These informative tools enable professionals to determine a company’s financial health in different ways.

Candidates with top financial accounting skills should be able to name these statements and explain how they work. They could provide the following definitions, benefits, and processes of each statement:

Income statement: Also known as profit and loss, income statements show all forms of income and expenses over a specific time period. They also focus on revenue and losses to help accountants gain valuable insights into the company’s performance.

Balance sheet: Accountants will use a balance sheet to record important assets, liabilities, and shareholder equity. This document evaluates the company’s capital structure in terms of rates of return, amount of investment, and dedicated funds that belong to investors.

Statement of cash flows: The cash-flow statement summarizes how much money is entering and leaving the company’s account. It is a great way of tracking expenses over a given time period, such as a month, quarter, or year. Accountants can also use it to track any debt obligations.

Navigating these statements can be challenging, especially if candidates lack the knowledge or skills to work with these documents, such as strong mathematical skills and the ability to analyze general business data.

You can find top talent by sending candidates a Financial Due Diligence test, which asks questions about monitoring a company’s financial health.

5. Errors can be detrimental to accounting processes. Tell me how you reduce the risk of making errors.

Two-thirds (66%) of the leaders of accounting firms said they plan to offer training about the latest regulatory changes to employees to ensure their work is error-free.

However, knowledgeable candidates might not require extensive training during onboarding if they have strong attention-to-detail skills and are making an effort to stay up-to-date with new laws and regulations. Strong candidates will be able to complete tasks effectively and without making mistakes.

Those who are willing to consistently work on improving their attention to detail, time management, and mathematical skills are also more likely to produce error-free work.

But candidates should also have specific strategies in place to reduce accounting errors and enhance the client-company relationship.

Some of those might be to:

Check every record before uploading it

Back up important taxes and expenses files

Use accounting software to prevent human error

Confirm specific details or calculations with team members when necessary

Diligently save all receipts and documents

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

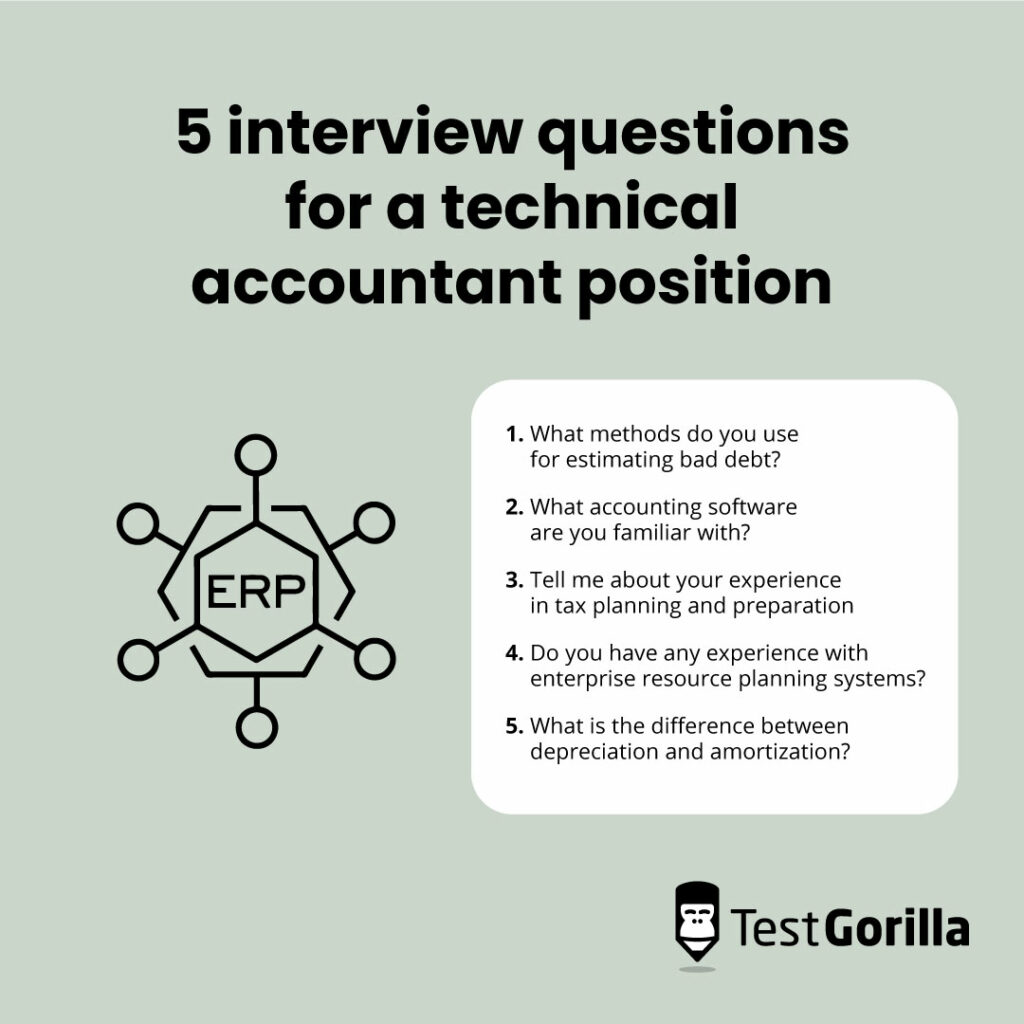

15 technical accounting interview questions to ask candidates

Below are 15 technical accounting interview questions to ask job applicants. These questions can help you identify tech-savvy professionals who know how to use accounting software.

1. What accounting software are you familiar with?

2. How would you set up an internal control system for processing invoices?

3. When a company uses double-entry accounting, which elements of a ledger must be equal?

4. Name two or three types of special journals.

5. What is the difference between capital and revenue transactions?

6. Do you have any experience with enterprise resource-planning systems?

7. What methods do you use for estimating bad debt?

8. How do you consistently improve your mathematical and technical skills?

9. How do you define big data? Why should accounting teams be familiar with it?

11. A client has four bank accounts. How many ledgers should they have?

10. What is the difference between depreciation and amortization?

12. Describe an accounting process you have developed in previous roles.

13. Tell me about your experience in tax planning and preparation.

14. Explain each major-line item on an income statement.

15. What processes do you use to evaluate financial risk?

5 sample answers to technical accountant position interview questions

You can easily assess candidates’ technical accounting proficiency with our sample responses to five of the most important questions from the previous section.

1. What methods do you use for estimating bad debt?

There are two methods candidates might mention for bad debt estimations: the percentage-sales method and the accounts-receivable aging method. It’s also essential that candidates understand what bad debt is because their knowledge could save your company from potential bankruptcy.

A simple definition is that bad debt represents any outstanding loads or balances that a company cannot collect from customers. In this case, they might hire a debt collector to recover outstanding balances.

Below are the two common methods for estimating bad debt:

Percentage sales method: The accountant will multiply the yearly credit sales by the estimated percentage of bad debt. For example, let’s say that the company has a net credit of $70,000 and that the accountant concluded that 8% of the credit is uncollectible. This means that the company’s bad debt for this year is $5,600 ($70,000 x 8%).

Aging of accounts receivable: In this method, the accountant will calculate open accounts receivable using the age of the outstanding invoice. They can then estimate the average percentage of bad debt in each category based on historical data and apply it to the corresponding outstanding balances to estimate the bad debt provision. This method is better for determining account allowances.

Send candidates an Accounts Receivable test to assess their accuracy in recording transactions and managing customer accounts. With this assessment, you could find top accounts-receivable specialists for your team.

2. What accounting software are you familiar with?

Accounting software helps accountants record and report a company’s finances efficiently.

Software programs may also reduce human error and ensure top accuracy in financial documentation. Specific features such as workflow automation and project management tools help streamline accounting processes.

Hiring candidates with solid technical skills is essential for building a strong accounting team. Not all candidates will have experience with the software you’re using, but they should still understand how accounting software works.

Some of the best accounting software programs include:

Xero

QuickBooks Online

Traverse

Sage Business Cloud

FreshBooks

NetSuite

Kashoo

Zoho Books

BlackLine

Xero, for example, is a popular program to track expenses, bank reconciliation statements, invoices, and VAT returns. If you need to assess candidates’ experience with Xero in particular, send them a Xero test.

3. Tell me about your experience in tax planning and preparation.

Tax planning and preparation can feel daunting to new accountants. However, they should still know all the basics because supporting their clients at the end of the tax year is a crucial task. Even if candidates don’t have experience, they can still discuss what tax planning and preparation mean in accounting standards.

For tax planning, accountants must maximize tax breaks and reduce tax liabilities in a company using a few strategies, such as itemizing tax deductions and making charitable donations on behalf of the company.

They can also keep the taxpayer in the lowest tax bracket possible to lower the amount of taxes a company owes.

In terms of tax preparation, accountants will organize tax returns and other general tax forms. This process keeps the company on top of any expenses regarding income tax returns. This is important because it enables them to know if they qualify for any returns and organize tax flow.

4. Do you have any experience with enterprise resource planning systems?

An enterprise resource planning system (ERP) is a type of software that supports and automates HR, finance, procurement, and supply-chain management processes. There are many industries (like, for example, retail and manufacturing) that use these systems.

Senior accountants may have more experience with ERPs, but understanding what they do and how they work is still essential for all job applicants.

Some of the most common ERP systems include:

Oracle Cloud Enterprise Resource Planning

Microsoft Dynamics 365

SAP ERP

Odoo

ERPNext

SAP S/4HANA

WebERP

Dolibarr

Tryton

Are your candidates able to name some of those examples?

5. What is the difference between depreciation and amortization?

Depreciation represents the value reduction in fixed assets within a tax year, which is an important concept in accounting because it allows companies to earn back asset costs. These assets may comprise transport, buildings, and equipment that a company buys in larger lump sums.

On the other hand, amortization is the process of distributing the cost of intangible and tangible assets. These expenses usually cover long-term investments such as computers and vehicles over their lifetime.

18 behavioral and situational interview questions for accountants

Understanding how candidates react to complex situations is essential – you must determine whether they have the right attitude to work in your company.

Use these behavioral and situational interview questions for accountants to find a suitable professional for your team.

1. Talk me through your process of managing tight deadlines.

2. If you spot an error in the work of a team member, what do you do?

3. How do you stay motivated when doing repetitive tasks?

4. What career objectives have you set for this year? What steps are you going to take to achieve them?

5. Take me through your latest budget preparation.

6. What role do you play in the audit process?

7. Tell me about a time you had to describe a complex accounting process to someone with minimal accounting knowledge.

8. How do you ensure accuracy in your work?

9. Describe one of your biggest professional challenges and how you dealt with it.

10. Give me an example of a time when you had to explain a complex process to team members.

11. What is the first thing you would do if you got this accounting role?

12. Have you ever had to deal with a professional failure? What did you do about it?

13. Tell me about a time when you managed to reduce costs for a previous employer.

14. If you could only use one financial statement to evaluate the financial state of our company, which would you choose?

15. Talk about a time when you could not get your point across effectively.

16. How do you adopt a new system or process?

17. How would you monitor your team’s performance?

18. Describe a challenging financial analysis problem you have faced before in your career. How did you solve it?

5 sample answers to behavioral and situational interview questions for accountants

You can make sure you hire the right person for your team by evaluating candidates’ responses and determining whether they have the right skills and knowledge for the role.

Use these sample answers to the five most crucial behavioral and situational accounting questions to check your candidates’ suitability.

1. Talk me through your process of managing tight deadlines.

Candidates with excellent time-management skills will know how to handle tight deadlines in accounting, because they’ll have specific techniques to do so, such as scheduling, using calendars, and timeboxing.

Hiring a candidate who can effectively organize their tasks is essential, as this helps you ensure they complete their tasks for the company or for external clients within the allotted timeframes. Tax returns, budgets, and financial statements are all time-sensitive.

Some accountants might use time-tracking software, such as Trello or Asana, to improve their time management skills when working on large projects.

2. Tell me about a time you had to describe a complex accounting process to someone with minimal accounting knowledge.

Sometimes, accountants must explain financial statements, records, or data to coworkers from another department. Those who don’t have expertise in accounting may struggle to understand specific terminology and processes. Therefore, candidates must have strong communication skills to describe complex accounting processes, such as paying invoices or calculating employee payroll.

Send candidates a Communication test to see how skilled they are in summarizing and clarifying information to others, using active listening during a conversation, and interpreting non-verbal cues.

3. How do you stay motivated when doing repetitive tasks?

Repetitiveness can decrease employee motivation; like many other jobs, accounting comes with some mundane but necessary tasks.

Examples include updating financial data, reviewing business transactions, and recording payments on balance sheets, which, despite being monotonous, are essential to keeping clear, transparent accounting records.

A lack of motivation can lead to low productivity levels because motivation and productivity are related, so candidates must be self-starters to maintain high-quality work.

Taking regular breaks throughout the day or setting small goals, such as completing a specific document, can help employees feel more motivated and stay on track.

To learn more about candidates’ expectations and whether they align with what your company has to offer, send them a Motivation test.

4. How do you adopt a new system or process?

Your company might implement a new accounting system or process that employees must learn quickly.

For example, you may decide to try another popular accounting software program that has more advanced payroll or budgeting features, if those are essential for your business.

So, it’s important to hire candidates who are flexible and willing to learn, adapt to new processes, and develop their skills. Therefore, listen out for answers that show that applicants have a growth mindset and are willing to adapt to changes.

Some strategies they might mention include to:

Learn more about what’s changing

Take part in training programs

Research the new system or process

Ask questions to managers and team members

5. Describe a challenging financial analysis problem you have faced before in your career. How did you solve it?

Accountants may face many problems with financial analysis, including disconnected systems, inaccurate budgeting, and a lack of comparability between financial assets.

But how they overcome these problems is more important than the issue itself.

Candidates should give an example of a challenging situation in the past and the steps they took to solve it. For instance, the lack of real-time information can stop an accountant from evaluating the company’s recent performance. Self-service analytics, which is a type of business intelligence software, can help the accountant review more updated financial reports.

A Problem-Solving test can help you determine who among your candidates has the ability to deal with complex situations in the workplace.

Hiring a staff accountant? Check out our tricky staff accountant interview questions.

When should you use those interview questions for an accountant position in your hiring process?

First, administer skill tests to see who your most skilled candidates are. Then, invite them to an interview, where you can use your selection of the above 50+ accounting interview questions.

This helps you ensure you’re interviewing candidates with relevant work experience, accounting knowledge, and technical skills. Using candidate assessments, such as psychometric and aptitude tests, can enhance your recruitment process by helping you identify the most skilled accountants early on.

All you need to do is select up to five skill tests from our test library. Pick tests that match your open position and send all applicants an invitation via the platform.

You can also personalize the assessments by adding custom questions related to your company’s requirements.

By incorporating skills assessments into your hiring process, you will reduce unconscious bias, improve employer branding, and avoid passive candidates who don’t fit the job description.

Use our skill tests and accounting interview questions to hire talented professionals

Everything you need is in this guide, but where do you start?

Our test library contains more than 300 tests covering cognitive skills, personality traits, typing speed, business judgment, and more. Remember to include the Accounting (Intermediate) test in your assessment, along with up to four more tests for an in-depth overview of your applicants’ skills.

For a comprehensive assessment of advanced accounting knowledge, particularly under international standards, consider the Advanced Accounting (IFRS) test. Meanwhile, validate a candidate's advanced understanding of US GAAP with an Advanced Accounting (GAAP) test.

If you need more information to convince the rest of your hiring team, check out the science behind TestGorilla to see how tests help reduce bias and enhance the candidate experience.

You can also book a free demo to discuss your hiring process with experts. We’re proud to be among G2’s top five fastest-growing software products for talent assessment, so your recruitment will be in good hands.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.