Creating concise and accurate accountant job descriptions is a tough task.

Given the many roles in accounting, businesses often have difficulty writing job descriptions that are both specific enough to attract the right talent and flexible enough to adapt to changing business needs. What’s more: they often underestimate the importance of communicating company values.

Missteps in any of these areas might mean your job description attracts less-than-suitable candidates. This can lead to mis-hires who damage team morale, productivity, and customer relationships.

Luckily, we’re here to help. Below, we discuss the key skills to look for in accountants, how to write an effective accountant job description, and how to attract and assess accountant candidates.

Table of contents

- What is an accountant?

- Key skills to look for in an accountant

- How to write an effective accountant job description

- Accountant job description template

- 3 things to avoid when writing a job description for accountants

- Next steps: Attracting and assessing accountant candidates

- FAQs

- Engage and assess skilled accountants with TestGorilla

What is an accountant?

An accountant is a professional who manages financial records, ensures compliance with tax laws, and provides financial advice. They analyze and report on financial transactions and may specialize in areas like auditing, tax, or management accounting. Their expertise and financial accounting skills help individuals and businesses make informed financial decisions.

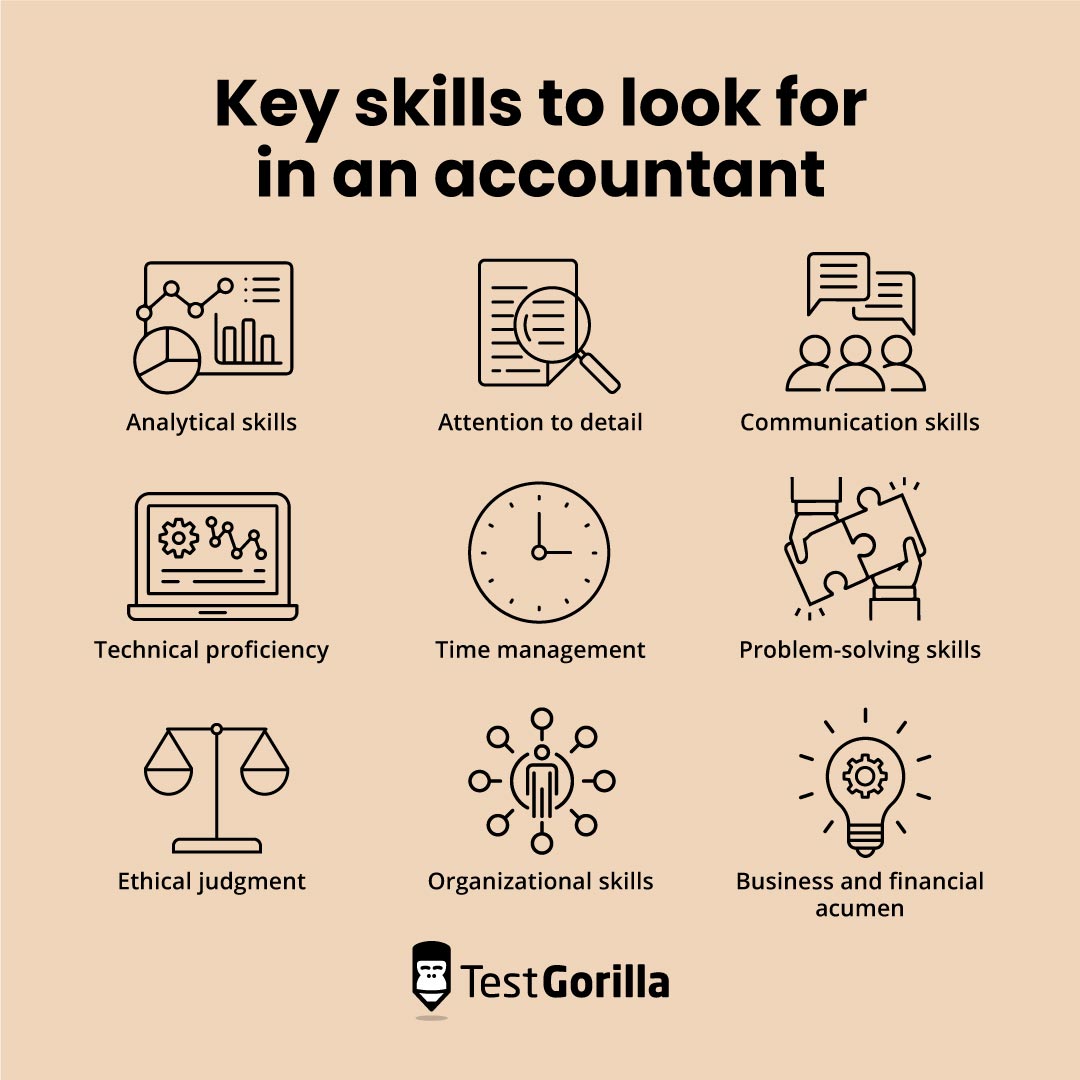

Key skills to look for in an accountant

Talented accountants should have a variety of skills, including:

Analytical skills: Analyzing numbers and trends

Attention to detail: Ensuring accuracy in calculations and documentation

Communication skills: Explaining financial information clearly to clients or management

Technical proficiency: Using accounting software and tools with expertise

Time management: Meeting deadlines, especially during busy tax seasons

Problem-solving skills: Identifying and rectifying discrepancies or inefficiencies

Ethical judgment: Upholding integrity and confidentiality in financial reporting and practices

Organizational skills: Efficiently managing multiple clients, documents, and financial data

Business and financial acumen: Understanding broader business operations and financial strategies to provide insightful recommendations

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How to write an effective accountant job description

Here’s how you can provide clear and accurate details about the role and your company:

Specify and explain skill requirements

Accounting is a wide-ranging field with various roles, each with their own sets of responsibilities. For example, forensic accountants, tax accountants, and management accountants each have their own unique skill sets and specializations. So, begin by defining the skills your candidates need to succeed as an accountant within your organization.

Does your accountant need to be well-versed in financial forecasting and analysis? Or do they need skills in budgeting and performance evaluation? Be clear so you attract and engage the right candidates.

Identify core responsibilities

Engage with relevant departments to understand the future accountant’s role within your organization. Clearly list primary duties and daily tasks, ensuring they accurately reflect the job's scope. This way, you’ll give candidates a clear picture of their potential daily routine and major responsibilities, which may range from managing financial records to conducting financial audits.

Clarifying core responsibilities helps avoid the costs of mis-hires by attracting qualified candidates who understand the role's expectations and have the skills to succeed.

Put your culture front and center

Emphasizing your company culture gives potential candidates insights into your work environment and values, helping them assess alignment and fit with your organization. Those who appreciate your culture are more likely to apply, while mismatched candidates might refrain.

Prioritize the aspects of your company culture that most accountants gravitate toward, like learning and development, ethical standards, and work-life balance.

Accountant job description template

Here's a template to help you craft your own job description for accountant roles. Be sure to modify it so that it’s specific to your role and organization.

Company introduction

In this section, describe your company's culture, industry scope, size, and mission. Offer a brief overview of your organization's operations and core values. Focus on your organization’s long-term goals.

Consider explaining why you’re hiring an accountant and how they’ll fit within your existing teams.

Benefits of working with [your company]

Here, highlight the special benefits your company offers. Does your business offer flexible work opportunities, leadership development planning, or generous paid time off? Advertising these advantages can set you apart from competitors and attract top accounting talent.

Accountant job brief

[Company name]

Job title: [For example, Junior Accountant, Senior Accountant, or Accounting Manager]

Reports to: [For instance, Senior Accountant, Accounting Manager, or Director of Finance]

Position type: [Full-time, part-time, on-site, remote, or hybrid]

[Salary and benefits information]

Check out our detailed guide on what to pay an accountant.

Accountant responsibilities

Preparing financial statements like balance sheets and income statements to gauge an organization's financial health and measure performance

Calculating taxes, ensuring regulatory compliance, filing tax returns, and providing tax planning advice

Conducting internal or external audits to ensure financial data accuracy and compliance with accounting rules

Helping make budgets and financial forecasts to guide business decisions

Analyzing financial data to identify trends, inefficiencies, and areas for growth

Ensuring recorded financial transactions are correct and fixing discrepancies

Giving financial advice to management and suggesting improvements to financial processes

Adapting with evolving industry standards and emerging technology trends, including changing tax laws or new accounting software

Qualifications and training required

Bachelor’s degree in accounting or finance (or advanced accounting degree)

For advanced roles, Certified Public Accountant (CPA) or other relevant certification

Proficiency in software tools like QuickBooks, Microsoft Dynamics, SAP, or Oracle Financials

Knowledge of generally accepted accounting principles (GAAP)

3 things to avoid when writing a job description for accountants

When crafting an accountant job description, avoid these three pitfalls:

1. Being vague

Avoid vague terms. Rather than saying "manage finances," specify tasks like "prepare monthly statements" or "conduct quarterly audits.”

In addition to driving some applicants away, unclear job descriptions can lead to candidates misunderstanding the role's demands – potentially causing dissatisfaction, underperformance, and increased turnover. Without a clear understanding of their role and responsibilities, even a skilled accountant might not perform to their full potential.

2. Failing to account for the future

Accounting is an ever-evolving industry, with continuous changes in technology and regulations. Inflexible job descriptions can become outdated, leading to potential disputes with new hires over tasks like using updated software or following new data privacy rules. To avoid this, include a bullet in your job description emphasizing the need for the candidate to adapt with evolving industry standards and emerging technology trends.

3. Ignoring company culture

Focusing solely on skills and duties without mentioning the company's work environment, values, or benefits is a misstep. Talented accountants want more than a job that matches their skills. So, attract candidates who resonate with your organization's values and beliefs.

Next steps: Attracting and assessing accountant candidates

After you’ve written your job description, post it on job boards and in other relevant places where strong candidates will see it. Once you have applicants, you must assess them to select and hire your new accountant.

TestGorilla’s multi-measure testing approach combines role-specific, personality, and cognitive ability tests into single assessments, helping you gain comprehensive insights into your candidates.

For example, our Advanced Accounting test helps identify candidates with strong accounting and bookkeeping skills. Our Enneagram Personality test reveals candidates’ personality types and core beliefs.

Our other role-specific skills tests, like the Accounting Terminology (US) test, assesses candidates' hands-on knowledge of accounting terms and principles.

For the best results, customize your tests with structured interview questions, like our interview questions for accountants. We also have questions geared specifically toward junior and senior accountants.

FAQs

How can our mid-sized business create a job description that stands out amongst those of larger firms?

Highlight your unique company culture, the chance for varied roles, and growth opportunities. Emphasize personal development, mentorship, and the impact one can make in a mid-sized environment. For more tips, read about our six easy steps to hire an accountant for your mid-sized business.

How detailed should the job description be for a junior accountant role?

Although a junior accountant might lack extensive experience, you should still detail their core responsibilities and expected tasks. This clarity helps candidates understand their suitability and growth trajectory.

Engage and assess skilled accountants with TestGorilla

Crafting a high-quality, engaging job description for accountants requires a strong focus on candidates’ skills, the role’s responsibilities, and your company culture. An effective job description helps your business attract the right talent.

Once you’ve finalized your job description and attracted applicants, use TestGorilla’s multi-measure testing platform with 300+ assessments to engage and assess your accountant candidates.

To discover how TestGorilla can help you find the best accountants, sign up for a free account, take our product tour, or schedule a free 30-minute demo.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.