Today’s employers are in a tough spot with employees leaving left, right, and center. One big reason? Inadequate pay. Replacing employees is no easy feat, and it’s even trickier for roles like accounting that need a specialized skill set. That’s why you must do everything you can to hire good accountants for the long haul, and offering them competitive compensation is a great starting point.

In this article, we’ll share relevant salary benchmarks, tips about benefits, and more so you know exactly what to pay an accountant and how to land someone exceptional for your business.

How we researched this topic

To ensure the information in this article is accurate and reliable, we’ve used data from the US Bureau of Labor Statistics (BLS), specifically the latest Occupational Employment and Wage Statistics (OEWS) report for accountants, plus Forbes and a few more reputable publications.

The BLS – a trusted government resource – gathered the primary data in its report by surveying approximately 1.1 million establishments in the US from November 2020 to May 2023.

Below, we’ve compiled the most relevant information, giving you a clear picture of what accountants earn so you can make informed decisions.

Key takeaways

The average salary for US accountants is $90,780 per year or $43.65 per hour, while the median (most typical) salary is $79,880 per year or $38.41 per hour. These vary by geographical location, industry, and experience.

New York-based accountants and those in the US federal executive branch make the most money. Idaho accountants and those working in state governments earn the least. Credentials like an MBA, CPA, CMA, and CIA can boost pay.

Beyond salary, benefits like healthcare, 401ks, etc., can help attract top candidates, while talent assessments can help you judge who to hire and what to pay them.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

National salary statistics for accountants

Pay metric | Annual wage ($) | Hourly wage ($) |

Median | $79,880 | $38.41 |

Mean | $90,780 | $43.65 |

Top 10% earners | $137,280 | $66.00 |

Bottom 10% earners | $50,440 | $24.25 |

Median salary vs. mean salary

Knowing the difference between median and mean values can help you better understand this data.

The mean is the average. It’s calculated by adding all the salaries and dividing by the number of people. The mean helps to understand overall trends but can be skewed by extreme values.

The median is the middle value. Half the people earn less than the median, and half earn more. The median is better for showing what’s typical because extreme values don’t affect it.

Why is this distinction so important? Let’s say most accountants earn $70,000, but one CEO accountant earns $1 million. This very high salary can push the mean higher – for instance, to $150,000 – making it seem like most people earn more than they do. However, the median could still be around $70,000, giving a better idea of what most people make.

Factors influencing salaries

While nationwide statistics give you an idea of accountant salaries, you must understand how wages differ at various levels to set the proper pay for your open position.

Here are some factors that influence accountant salaries:

Geographic location. Differing costs of living and demand for accountants affect pay across locations. For instance, New York City-based accountants may earn more than those in Houston, TX, because it’s costlier to live in New York. Similarly, a high demand for accountants in business hubs like San Francisco can lead to better salaries than those offered in smaller towns.

Industry. The unique accounting needs of different sectors impact salaries. For example, investment banking accountants who handle larger transactions, stricter regulations, and higher stakes can earn more than accountants working in non-profit or retail.

Experience level. When it comes to pay, experience matters. Seasoned accountants with experience handling complex tasks, making strategic decisions, and managing teams have more earning potential than junior bookkeepers.

Education and certifications. Higher education and accounting certifications typically boost salary potential. For instance, a Chartered Public Accountant (CPA) who rigorously studies accounting functions and can conduct audits and attestations will make more than a non-certified professional.

Responsibilities and skills required. The scope of an accountant’s job and the skills required directly impact pay. An accountant focused on day-to-day bookkeeping for a local mom-and-pop store will likely earn less than someone managing international transactions and tax compliance for a multinational business.

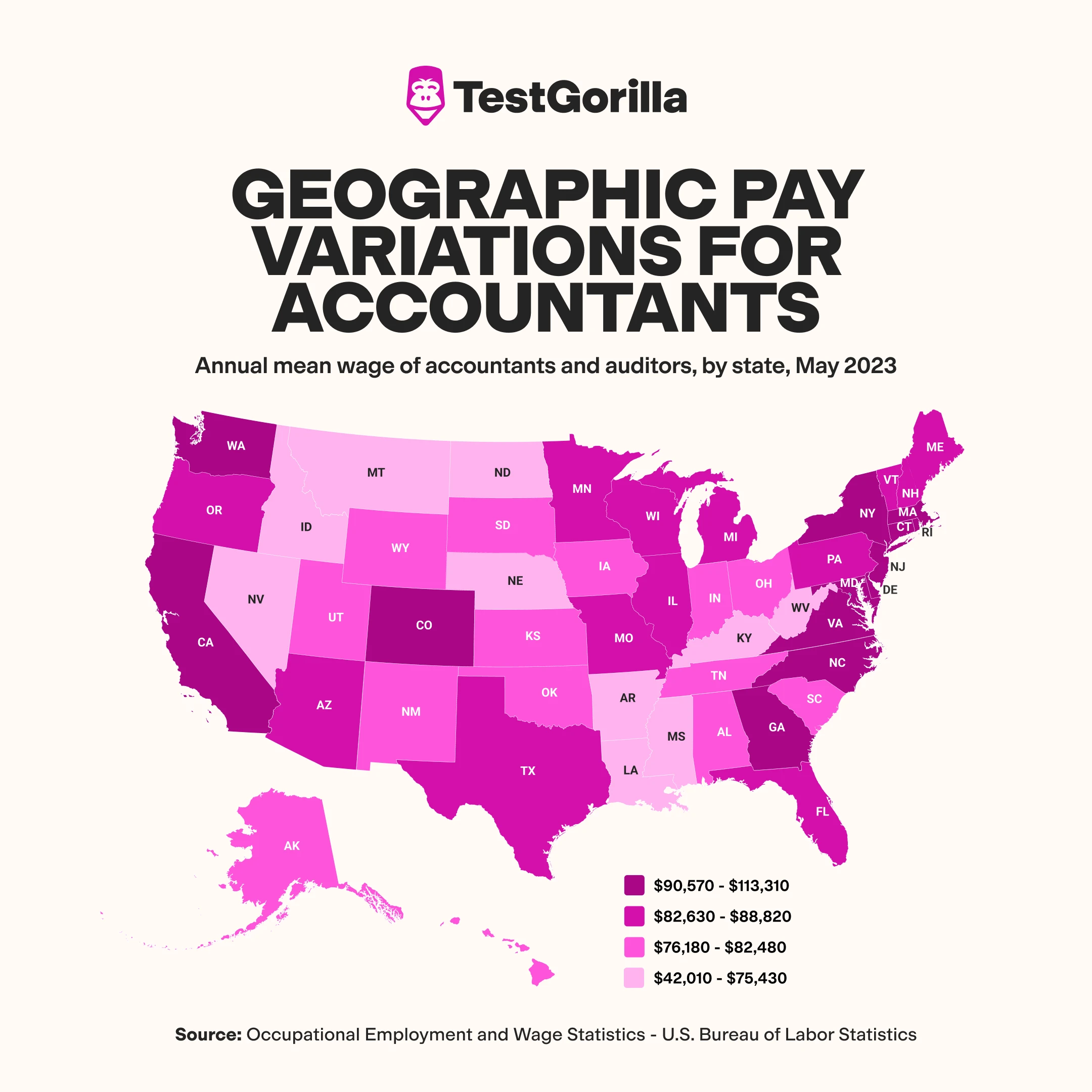

Geographic pay variations

Let’s dive deeper into how accountant salaries vary by location.

5 highest-paying states

According to the BLS, these five areas pay accountants the most – an average of $90,570 to $113,310 per year:

New York (NY)

District of Columbia (DC)

New Jersey (NJ)

California (CA)

Massachusetts (MA)

5 lowest-paying states

Meanwhile, these states pay accountants the least – an average of $42,010 to $75,430 per year:

Idaho (ID)

Arkansas (AR)

North Dakota (ND)

Mississippi (MS)

West Virginia (WV)

Why the differences in pay across states? One reason is the varying cost of living. For instance, according to Forbes, the average monthly rent in California is $1,958, but only $880 in North Dakota. Another reason is the demand for accountants. The BLS shows that California – a bustling economic hub – has the highest employment level for Accountants. North Dakota is in the bottom five.

Industry-specific pay data

We crunched the BLS data, and here’s how average wages differ by industry – from highest to lowest:

Industry | Mean wage |

Federal executive branch | $115,230 |

Utilities | $105,333 |

Federal government, including the US Postal Service | $102,490 |

Information | $99,705 |

Mining | $96,651 |

Professional, scientific, and technical services | $95,817 |

Lessors of nonfinancial intangible assets | $93,250 |

Cross-industry, private, federal, state, and local government | $91,280 |

Wholesale trade | $88,335 |

Manufacturing | $88,323 |

Construction | $87,149 |

Agriculture, forestry, and fishing and hunting | $85,263 |

Management of companies and enterprises | $85,049 |

Real estate and rental and leasing | $84,886 |

Transportation and warehousing | $84,299 |

Religious, grantmaking, civic, professional, and similar organizations | $84,289 |

Federal, state, and local government, excluding schools, hospitals, and the USPS | $83,510 |

Retail trade | $82,676 |

Offices of mental health practitioners | $79,415 |

Local government, excluding schools and hospitals | $79,220 |

Repair and maintenance | $79,084 |

Local government, including schools and hospitals | $78,240 |

Healthcare and social assistance | $77,936 |

Arts, entertainment, and recreation | $77,135 |

Educational services | $76,571 |

State government, excluding schools and hospitals | $73,560 |

State government, including schools and hospitals | $73,210 |

5 highest-paying industries

Industries with high revenues profits, specialized skill needs, and strong demand for accountants tend to pay them more.

Below are the top-paying industries and our take on why they pay well.

Federal executive branch: This includes accountants who work for the President, Vice President, and Cabinet and federal agencies such as the IRS and the Department of Defense. They handle complex budgets, tackle regulatory compliance, and oversee large-scale public programs critical to national governance.

Utilities: Accountants supporting hydroelectric, nuclear, biomass, solar, and other power generation businesses must demonstrate precise financial management and deal with expensive, large-scale infrastructure projects.

Federal government, including the USPS: Accountants in this industry support legislative branches, judicial positions, and independent federal agencies like NASA, often managing nationwide operations.

Information: Accountants supporting web search portals, software publishers, media streaming, and other cutting-edge IT businesses earn more because they work with high revenues and intricate transactions.

Mining: Businesses in oil and gas extraction, coal mining, etc., pay accountants well because they tackle complex cost structures, international regulations, and substantial capital investments.

5 lowest-paying industries

Sectors with simpler accounting, tighter budgets, and lower revenues tend to pay accountants less. Let’s dive deeper into these industries and consider what could drive this.

Repairs and maintenance: This sector typically involves household, automotive, electronic, and other small goods and repair businesses. Accountants support local operations, straightforward tasks, and limited budgets – leading to lower pay.

Local and state governments: Though this industry includes larger government businesses like schools and hospitals, accountants are paid less due to budget constraints and public sector pay structures.

Healthcare and social assistance: Accountants supporting businesses like psychiatric units, rehab facilities, and childcare centers might make less because tasks are straightforward, and these businesses prioritize paying those directly involved in patient care and community services.

Arts, entertainment, and recreation: Companies working in casinos, travel accommodations, museums, etc., generally operate on lower profits and unstable revenue streams, leaving less room for high-paying accounting jobs.

Educational services: Accountants supporting schools, junior colleges, etc., earn less because these institutions prioritize funding educators and student programs.

Pay by experience and education

Here’s how accountant salaries can differ by experience and education:

Average wage by years of experience

Entry level (0-1 year): Approx $54,000 per year

Mid-career (2-6 years): Approx $75,000 per year

Experienced (7+ years): Approx $90,000 per year

Education and certifications to boost earning potential

According to the BLS, the entry-level education required for Accountants is a Bachelor's degree. Below are some additional credentials that can help boost accountants’ pay.

Certified Internal Auditor (CIA): This is valuable for internal auditing, risk management, and compliance roles, which are usually in demand in high-paying industries like banking.

Certified Management Accountant (CMA): Focused on management accounting and corporate finance strategy, this certification helps with leadership roles.

Master of Business Administration (MBA) with an accounting focus: This opens doors to executive roles like Chief Financial Officer (CFO) or controller. (Looking for a CFO for your business? Read our guide about how to hire a CFO.)

Certified Public Accountant (CPA): This highly recognized certification lets accountants work in lucrative areas like auditing, tax strategy, and financial consulting.

Benefits beyond salary for accountants

When evaluating a job offer, today’s employees look at more than just salaries. Here are some powerful employee benefits that could give you an edge in the war for top accountants:

Health insurance. Good health plans for accountants and their dependents can enhance your job offer. Adding vision, dental, and life insurance can really set you apart.

Paid time off (PTO). Offer paid leave – including vacations, sick days, mental health days, and so on – to give accountants the downtime they need.

Retirement plans. Offering a 401K plan or similar can be a huge selling point for accounting candidates who understand the value of these plans.

Flexible and remote work. Flexible, hybrid, or remote work suits jobs like accounting and could open the door to a much wider talent pool.

Learning and development opportunities. Consider fully or partially funding accountants' certifications like CPA or CMA – a great way to attract candidates who have the drive and skill but can't afford these exams.

Additional perks. Childcare and commuter benefits are just a few more out-of-the-box ways to shine among employers and attract parents returning to work, candidates from further away, and others.

Hire right with TestGorilla's talent assessments

Understanding salary benchmarks can provide some context and help you determine a budget for the role. But, you must align your final offer with candidates’ real-world skills and abilities. This way, you not only pay accountants fairly but also get the best bang for your buck.

TestGorilla’s library of 400+ science-backed talent assessments can help you thoroughly evaluate your accounting candidates before making an offer. Combine up to five tests to create a custom accounting assessment.

Here are a few suggestions:

Technical knowledge

Software expertise

QuickBooks Online (US version) test

Xero test

Cognitive and soft skills

Numerical Reasoning test

Problem Solving test

Attention to Detail (Textual) test

Personality and culture

Culture Add test

DISC test, Enneagram test, and other personality tests

Motivation test

These assessments, combined with the right accountant interview questions, can show what candidates bring to the table – from accounting skills and software expertise to their motivations, working preferences, cultural contributions, and more so you can decide who to hire and what to pay them.

Sign up for a free account or schedule a live demo to explore TestGorilla today.

FAQs

How much does it cost to hire an accountant for a small business?

It depends on your geographical location, industry, and nature of your business. For instance, a standalone shop owner could pay accountants less than a local retail chain. As of May 2023, US accountants earn a median pay of $79,880 per year or $38.41 per hour.

Is it better to hire a full-time accountant or outsource accounting services?

It depends on your business needs. A full-time accountant is great for consistent, high-volume bookkeeping or accounting tasks. In contrast, a part-time accountant, freelancer, or external agency might work better for ad hoc needs, such as filing annual taxes.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.