21 accounting behavioral interview questions (+ answers to look for)

When hiring for an accounting role, you need to look beyond the numbers. Relying on resumes alone can lead to bad hires and poor culture fit, affecting both team dynamics and individual employee performance. What’s more, the process of managing or replacing a mis-hire inevitably costs your organization time and money.

Incorporating behavioral interview questions in your hiring process enables you to explore how a candidate may behave in a role, including their ability to work in a team, and whether their values align with your organization’s.

When combined with other pre-employment testing and interviews, behavioral questions provide a fuller picture of your candidates so you can hire the best person for the role.

In this article, we give you 21 example questions and look at how they can improve your hiring process.

What are behavioral interview questions?

Behavioral interview questions provide insights into candidates’ behaviors and personalities, helping you understand how they may act in the workplace generally and in specific situations. These types of questions assess an applicant’s soft skills rather than their technical or job-specific abilities.

Behavioral interview questions often ask candidates to describe a time when they encountered a certain problem or situation and how they responded to it. For example, to assess conflict resolution, you can ask your candidate to describe a time when they successfully managed a conflict in the workplace.

Or, to find out if they have leadership potential, ask them to give an example of when they led a team and what steps they took to help the team achieve its goals.

While behavioral questions add more detail to the overall picture of a job applicant, they shouldn’t form the sole basis for hiring (or not hiring) someone.

When used alongside multi-measure pre-employment testing, these types of questions are a useful tool to help you find the right person for the job.

Why ask behavioral questions during an interview?

When hiring for an accounting role, incorporating behavioral questions in your prescreening process can assist you in recruiting someone with the attributes and behaviors best suited to the role and your organization.

For example, you can ask questions to help determine how an applicant would work under pressure when meeting deadlines at the end of the financial year or during an audit. By asking the candidate how they previously handled a similar scenario, you can gain insights into their time management, prioritization, and problem-solving skills.

Behavioral questions can also help you gauge a candidate’s attention to detail. This is a crucial soft skill for those dealing with large volumes of financial information. You could ask them to give an example of a time they noticed an error in a financial statement and what they did to address it.

Accounting roles involve a high degree of responsibility. For this reason, you want to hire a trustworthy person who acts ethically in their role. Behavioral questions that explore these topics help you to identify candidates who demonstrate a high level of honesty and integrity.

Understanding how a candidate would respond in scenarios they are likely to face in the role gives you a better idea of whether they would be a good fit before making a final hiring decision. It helps you avoid mis-hires, which can cost you both time and money.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

21 behavioral interview questions for accountants and answers to look for

Ability to work under pressure

Accountants commonly work in a high-pressure environment. They may need to manage large workloads, such as multiple company accounts or a sizeable portfolio of clients. The nature of the work is deadline-driven and competing priorities often arise.

Behavioral interview questions help you explore how well candidates handle this pressure and identify those whose answers demonstrate that they:

Can self-prioritize their workload

Work calmly and logically, even in stressful situations

Have quick decision-making abilities

Are flexible and adaptable

Someone who struggles in high-pressure situations or can’t effectively prioritize tasks are typically not a good fit for an accounting position.

Questions that explore these concepts include:

Give an example of a complex accounting problem that arose in a previous role. How did you approach the problem and what was the solution?

Describe a time when an unexpected issue came up requiring last-minute amendments to financial reports. What steps did you take to address the situation?

The end of a reporting period can involve a sudden increase in workload. What actions do you take to manage your stress during this time and ensure your work remains of a high standard?

Teamwork

Accountants often work in a team environment, either with other accountants or within a broader finance team, so it’s important to assess an applicant’s ability to collaborate.

When hiring for an accounting role, you’ll likely want to prioritize candidates who:

Manage conflict effectively when it arises

Actively listen to other's opinions and suggestions

Empathize with others

Have a sense of individual responsibility in a team situation

Have strong interpersonal skills

Understand the value of collaboration and teamwork on both an individual and company level

Examples of questions that assess an applicant’s teamwork abilities may include:

Tell me about a time when you had to work with a colleague or a team on an accounting project. What was your role and how did you help the team achieve its goals?

Can you give an example of a situation where a colleague disagreed with you during an accounting project or task? How did you respond and maintain a positive working relationship?

Describe a time when you collaborated with non-financial departments on a company-wide project and explain your approach.

Attention to detail

Accountants work with large volumes of information and data. Therefore, your ideal candidate needs to be detailed and precise to ensure they accurately prepare reports and identify any errors or inconsistencies.

For these reasons, you will likely want to seek out applicants who approach their work with a meticulous mindset and can identify and address missing information or accounting errors.

To do this, you could ask questions such as:

Tell me about a complex accounting project you have worked on involving large amounts of financial data where attention to detail was key. How did you approach the task?

Give an example of a time when you picked up on an error in financial records. What did you do to address the error?

When transferring data into lengthy or complex financial reports, how do you maintain your attention to detail?

Customer service

For client-facing accountancy roles, it’s essential to understand how your candidate will interact.

Behavioral questions let you explore how applicants prioritize customer needs and handle the dynamics of client relationships. They also emphasize candidates who can develop strong connections to retain existing clients and gain new ones.

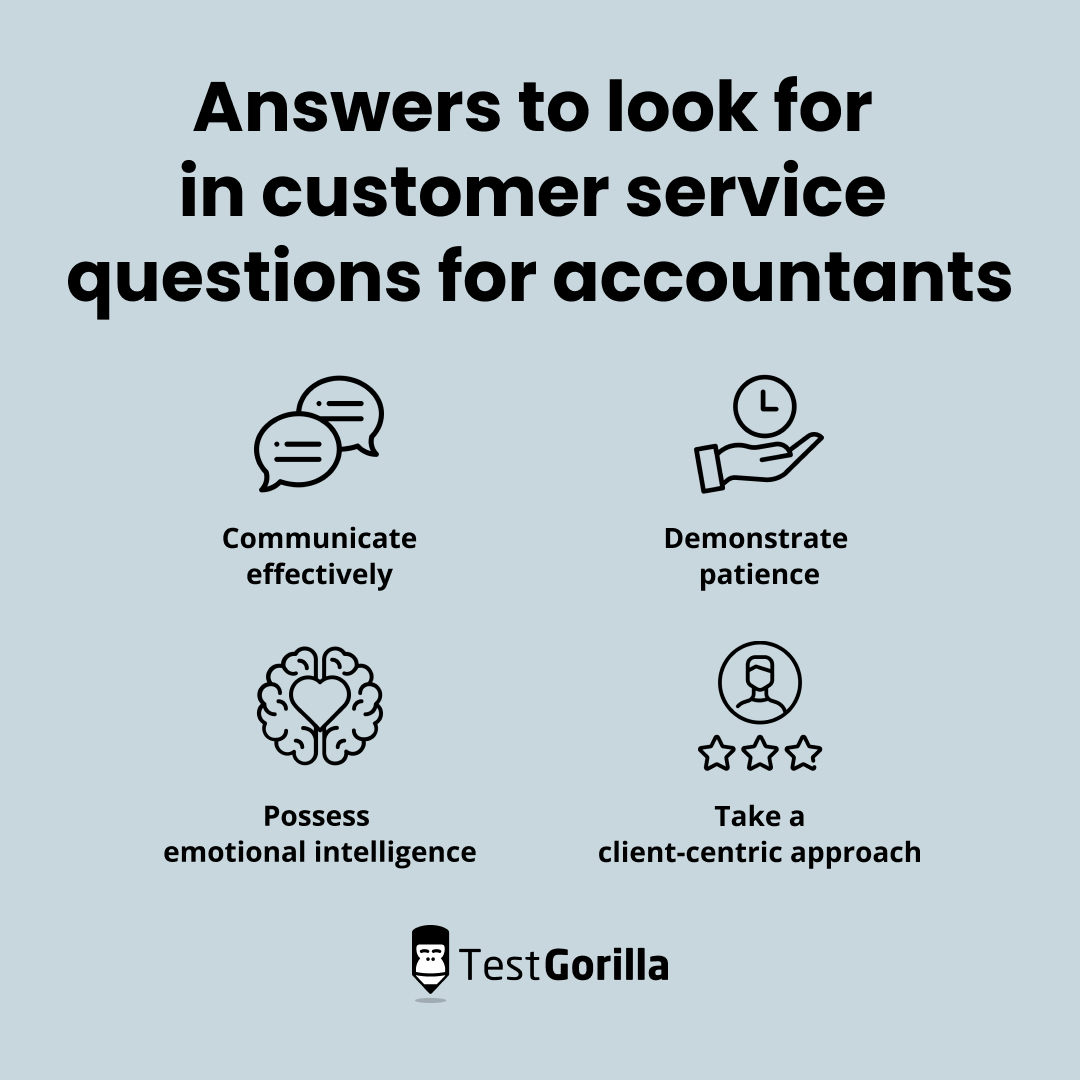

You’ll likely want to identify applicants who:

Communicate professionally and effectively with clients

Demonstrate patience, especially with those from non-accounting backgrounds

Possess emotional intelligence

Take a client-centric approach to their work

Examples of questions that help you understand how a candidate interacts with clients include:

Tell me about a time you received a complaint or concern from a dissatisfied client, due to an error in their tax forms, for example. What did you do to resolve the situation?

How do you engage with a client to understand their unique accounting needs? What steps do you take to find a personalized solution for them and ensure a positive client experience?

Clients are typically not as well-versed in accounting terminology or concepts. Give an example of a time when you had to explain complicated financial information to a client and how you did so effectively and professionally.

Time management

Accountants are required to work to strict reporting timeframes and project deadlines. Failure to do so can lead to your organization facing financial penalties.

When hiring an accountant, you’ll likely want to explore their ability to meet deadlines. Candidates who can do this are typically goal-oriented and demonstrate strong organizational and prioritization skills.

On the other hand, candidates who take a scatter-gun approach to their work and fail to understand the importance of deadlines may not be the best person for the role.

The following questions can give you a deeper understanding of an applicant’s time-management skills:

When have you had to manage multiple reporting deadlines due at the same time? Explain how you prioritized your work and the steps you took to submit the reports on schedule.

Give an example of a time in your previous accounting role when you had to complete a task within a limited timeframe. How did you approach the task to ensure you completed it punctually?

Describe an instance when an unexpected issue or request arose during an accounting task. How did you adjust your work schedule to accommodate it?

Communication

Accountants often deal with clients, colleagues, and other departments from non-accounting backgrounds. Therefore, you want to look for candidates who can demonstrate a good ability to translate technical concepts into easily digestible information.

Applicants who struggle to explain complex financial terms and concepts to others may not be a good fit for your clients or the broader organization.

To identify candidates with the necessary communication skills, you could ask questions like:

When have you had to explain complicated accounting concepts and data to a non-accounting client? How did you ensure the client understood it?

Tell me about a time when you explained a complex accounting issue to a colleague in a non-financial team.

Can you share an experience of working closely with a non-financial department on a project? How did you adapt your communication to ensure everyone understood the accounting aspects of the project?

Business ethics and integrity

Accountants always need to act ethically and comply with applicable financial laws and regulations. Given they are responsible for handling money and reporting to the relevant government departments, they must act with honesty and integrity.

When hiring for an accounting role, you’ll likely want to prioritize candidates who:

Have a solid understanding of accounting principles

Stay on top of any changes to financial laws and regulations

Are prepared to raise their concerns if they notice suspicious financial data or activity

In comparison, candidates who fail to prove that they take their ethical obligations seriously may be a liability for your organization down the track.

Questions to explore an applicant’s honesty and integrity include:

Describe a time when you discovered an error you had made during an accounting project. What steps did you take to address it and how did you address the error with your manager or client?

How do you stay up-to-date on accounting practices, principles, and legislation?

Explain your understanding of the purpose of the Generally Accepted Accounting Practices/International Financial Reporting Standards.

How to roll out behavioral interviews

Behavioral questions are a great way to uncover deeper insights into your applicants, revealing how they may act or make decisions in the role. When used alongside pre-employment testing as a multi-measure approach, these types of questions can paint a clearer picture of a candidate, helping you make better hiring decisions.

At TestGorilla, we offer more than 300 scientifically validated tests that you can use to assess candidates’ potential workplace behaviors, cognitive abilities, and job-specific skills. It’s easy to quickly create and send bespoke TestGorilla assessments when hiring for any role, including accounting positions.

Our assessments are fully customizable, letting you add your own behavioral questions to any test.

By combining these questions with standardized personality assessments like the DISC or 16-Types test, and specific job skills tests like Financial Accounting (IFRS) Advanced Accounting (GAAP), and Accounting (intermediate), you get 360-degree, bias-free insights into candidates that go far beyond the information in their resumes.

With other features like one-way video interviews, multiple question types, and extensive customer support, TestGorilla offers an exceptional and intuitive user experience that helps you avoid expensive mis-hires.

Conclusion

By including behavioral interview questions in your hiring process, you can better understand how candidates may act in a particular role. These insights help you find the right person for the job, avoiding the cost of mis-hires and improving employee retention.

When it comes to putting together your accounting team, TestGorilla helps you uncover top talent by creating assessments specifically tailored to the role. You can gain a full picture of candidates and their potential so you can hire the right person for the job.

To learn more about how TestGorilla’s full set of features can help improve your hiring process, schedule a free 30-minute live demo, or check out our online product tour.

Why not get started with TestGorilla’s Free plan today?

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.