If you’re on the lookout for an accounts payable specialist or manager, or any other role that requires a strong grasp of accounts payable, such as a bookkeeper or an accountant, then this blog post is about to make your recruitment journey a whole lot easier. We’ll take you through the accounts payable process, explain which skills you’ll find in top candidates for accounts payable roles, and show you how to test for them.

What is accounts payable?

Accounts payable is an accounting term that refers to the money a company owes to its creditors and suppliers. It should be documented in the short-term liabilities section of the company’s balance sheet. Its other half, accounts receivable, is the money the company receives from its customers, partners, and investors. For businesses, they are two sides of the same accounting coin.

Almost every big company has an accounts payable department that is responsible for managing and paying these expenses, so it’s an area of business with lots of employment opportunities. Accounts payable can refer to the money owed, the department and its processes, or a job. Accounts payable clerks, specialists, and managers do similar work to bookkeepers and accountants. Some of the responsibilities these kinds of roles share are:

Producing and maintaining financial records

Accurately recording transactions

Managing audits and invoices

Tracking expenses and paying them on time

The accounts-payable process explained

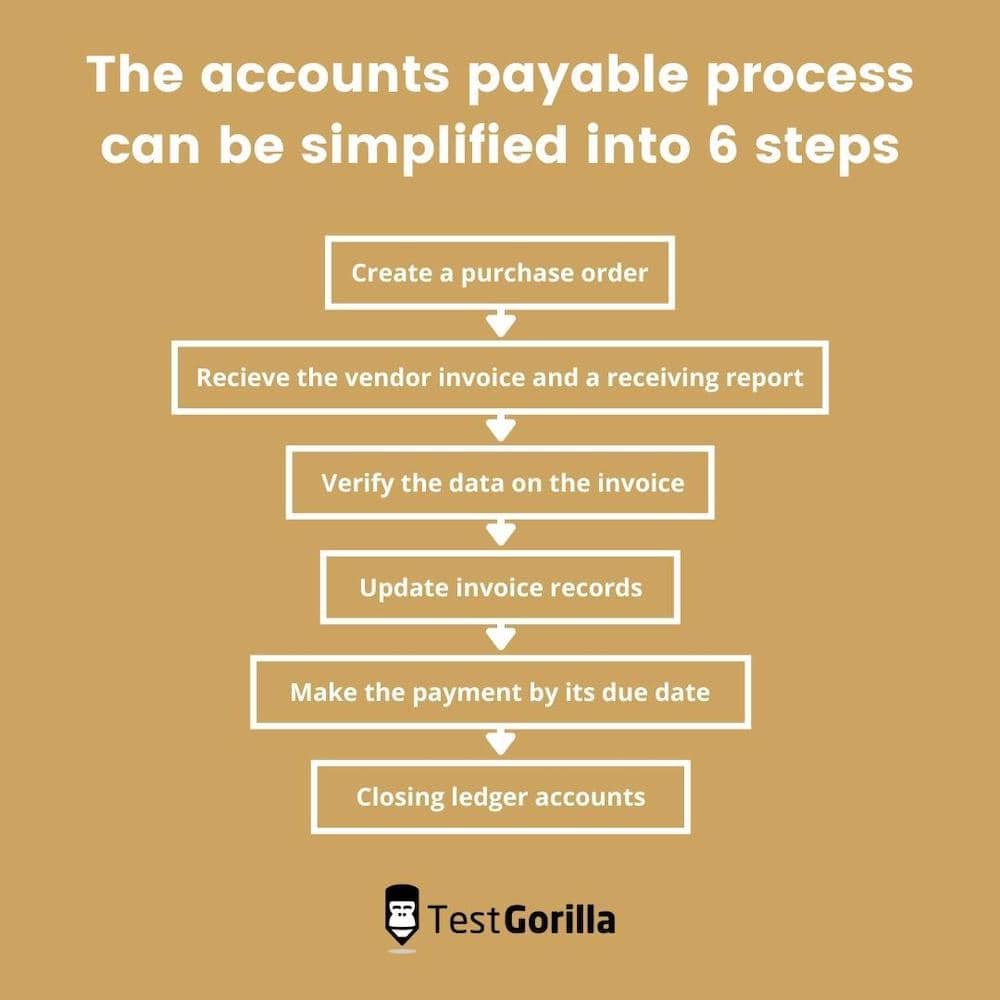

The accounts-payable process follows the journey of an invoice from when it’s received to when it’s been paid. It’s the process that those who work in accounts payable have to follow meticulously to ensure a company’s finances and accounts run smoothly. It can be simplified into six steps:

1. Prepare a purchase order (PO)

The process begins the moment a company submits a purchase order to a vendor. A purchase order should communicate precisely what a company is ordering from a supplier. A copy should be distributed to the accounts payable department, the receiving department and the person requesting the purchase, the supplier, and the person preparing the PO. It should have a PO number, a date, the names of the company and the supplier, a description of the purchase along with quantity and unit prices, and a shipping method.

2. Receive the vendor invoice and a receiving report

A receiving report and a vendor invoice will be delivered to a company, on paper or digitally, once it receives the goods or services it has requested. A receiving report will include a description and quantity relating to what was received, and a vendor invoice will state this information and the sum owed. Each will be routed to accounts payable for approval and processing.

3. Verify the data on the invoice

Accounts-payable departments have a responsibility to pay only bills and invoices that are accurate and legitimate. So, before invoice records are updated with a new entry and its payment is scheduled, invoices should be checked. An invoice must contain accurate information about what the company ordered, what the company received, and the proper unit costs, totals, and terms for the goods/services in question.

A common way of verifying invoices is the three-way match. Here, the PO, the receiving report, and the vendor invoice are compared. If the information on each is in agreement, then the invoice can be entered into accounts-payable records and payment can be scheduled.

4. Update invoice records

If the information on all three forms is in agreement, the invoice can be entered into the liability account for accounts payable. The information that is recorded should include an invoice reference, an amount to be credited to accounts payable, the amounts and accounts that will be debited, and the scheduled date of payment.

One golden rule of accounts payable is that all vendor invoices must be accounted for. This way, companies can avoid paying fraudulent or inaccurate invoices, paying suppliers more than once, or not paying them at all. Records should be updated in a timely manner so that financial statements with accurate information about the company’s financial portrait and performance can be accessed at all times.

5. Make the payment by its due date

Once an invoice has been verified and recorded, accounts payable has to ensure that it’s paid on time and that the payment is recorded. Ensuring suppliers are paid on time maintains good relationships and might result in favorable payment terms and discounts for businesses. How payments are scheduled is important: Accounts payable should plan payments to make sure cash flow is secure at any given time.

Days Payable Outstanding (DPO) is a metric showing how well a company is managing its accounts payable. It measures the average number of days it takes for the company to pay its vendors and it’s calculated by dividing the average accounts payable by the daily cost of sales. The higher a business’s DPO, the higher its cash flow.

6. Closing ledger accounts

For larger organizations that process a large number of transactions, accounts payable will have a separate ledger to keep transactions from cluttering the general ledger. Summarizing information is usually entered into the general ledger at each month’s end. At this point in time, teams should review accounts-payable records so books can be closed properly and spending can be easily analyzed.

Best practices

Although it falls into the category of back-office functions, accounts payable is critical to the effective running of a business. Here are some things you can do to ensure you manage accounts payable well.

Always check and confirm whether or not deliveries match their agreed contractual terms. If they don’t, reach out to the contractor or supplier to fix this.

Issue purchase orders for each order.

Accounts payable teams should communicate with the senior management of a company to maintain a shared and sustainable working-capital culture in the company.

Generate monthly reports to help you understand your company’s cash flow. This will also mean you’re prepared for information requests and audits.

Build strong and long-lasting relationships with your vendors. The better you treat them, the better deals they’ll likely give you.

Use management workflows and a shared environment for accounts-payable processing and reporting. This will help you maintain common practices and standards.

Where it suits your company, use accounting software to optimize accounts-payable processes. Automation can help save time and reduce errors.

Accounts-payable trends in 2022

With all of this in mind, here are some trends to look out for in 2022.

Paperless payments are taking over. Accelerating digital transformation is pushing accounts payable teams even further away from manual processes. Although the majority of teams will already have at least partly automated their processes, there is an even bigger demand for automation in 2022.

Businesses are embracing hyper-automation. This, according to Gartner, is a business-driven, disciplined approach that organizations use to rapidly identify, vet, and automate as many business and IT processes as possible. It’s a quick way for accounts-payable teams to leverage technology and the increasing drive to digitalize.

Cybersecurity matters. This is becoming a big priority for organizations all over the world, especially in light of the cyber threats that have been reported frequently in recent years. Accounts-payable teams are often the targets of fraudsters, so it’s important to stay alert. Luckily, software vendors are improving security controls at the back end of things. On the user side, employees should be more aware than ever of their individual security responsibilities.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

4 core accounts-payable skills

Managing accounts payable

Accounts-payable management is a high-stakes task that a business of any size can’t afford to get wrong. It’s key to maintaining great relationships with vendors and ensuring you don’t have liabilities on your books. It requires accuracy, communication, and patience. Tasks involved include acquiring favorable purchase terms for the business and managing the time and flow of that purchase.

The risks of inefficient accounts payable management are significant: Delayed payments can damage supplier relations, leading to delayed responses, stricter payment terms, and unwillingness to fix issues. More importantly, it’s just bad business. Hiring a team that can reliably manage accounts payable is the best way to avoid these consequences.

Recording transactions

Transactions need to be recorded in a timely and accurate manner, so this skill requires a lot of attention to detail and good time management.

Accounts-payable employees who get it right the first time save their company time, money, and mistakes. If anything is missed or recorded incorrectly, balance sheets won’t be accurate and organizations won’t know the truth of their financial situation. This can be really damaging.

Finding missing information

Because there are multiple parties involved in the information that accounts payable is responsible for recording, discrepancies can also come from elsewhere. Vendors might provide invoices with missing or incorrect information, for example.

If this happens, or if documents get displaced, accounts-payable teams have to make sure the correct information is found as quickly as possible so discrepancies can be corrected and mistakes can be avoided. AP employees should be meticulous and reliable in these cases, communicating with vendors when necessary to locate any missing details.

Reconciling accounts payable

It doesn’t take much to skew a balance, and if the department operates with blind faith in the accuracy of general ledger and accounts-payable balances, then errors are bound to slip through the net. Accounts payable should be frequently reconciled to avoid this and ensure that balances are in fact accurate.

This process involves comparing balances in two or more sets of financial records, or ledgers, and making sure they are identical. AP employees should be able to effectively perform reconciliations to check for consistency.

Other relevant skills for accounts payable

Attention to detail

This soft skill is highly relevant for any detail-oriented role, and accounts payable is no exception. The best accounts-payable clerk, manager, or specialist will have sharp attention-to-detail skills that they can employ to record and check information correctly, and spot and correct mistakes when they do occur.

Time management

Accounts payable is a deadline-driven department. For things to run smoothly, it is essential that vendors and suppliers are paid on time, and that invoices and payments are recorded punctually as well as accurately. Because of this, time-management skills are vital in AP teams.

Communication

Maintaining relationships with vendors and suppliers is also an important responsibility for people working in accounts payable. Although making payments on time is the obvious factor that will bolster this relationship, good, friendly written and verbal communication is important too.

Accounting terminology

The best accounts-payable employees will also have deep knowledge of accounting terms relating to financial statements, transactions, and books of accounts. The world of financial information has an entire vocabulary that simplifies its processes and details down to single statements or words, and AP teams should be familiar with all of it.

How to test for accounts-payable skills

We’ve covered the accounts-payable process and the skills involved. But if you’re recruiting for roles that require a strong grasp of accounts payable, how can you ensure you hire applicants who have these skills?

As they stand, traditional hiring practices seem to orbit around one document: the CV.

The CV provides employers with information about applicants’ education and experience, neither of which accurately indicates whether your candidates have the skills you need them to have. A 2020 ResumeLab survey found that 93% of people know someone who has lied on their CV, and recruiters have few ways of knowing whether applicants are lying or not.

If you’re hiring for accounts-payable skills, CVs can’t help you.

Sending your applicants pre-employment skills assessments is a far more accurate, reliable, and fair way to evaluate their skill sets and decide who will make up your interview shortlist. Skills-based hiring is on the rise, and the fight to reduce hiring bias and discrimination is well under way. Pre-employment testing is progressive on both of these fronts.

The best way to recruit for accounts-payable skills without bias or stress is to send your applicants a skills test.

Use TestGorilla’s Accounts Payable test to hire top candidates

Our Accounts Payable test is an intermediate role-specific skills assessment that measures the following skills:

Managing accounts payable

Recording transactions

Finding missing information

Reconciling accounts payable

Like all of our tests, it’s been crafted with the expert knowledge of a subject-matter specialist. All of our tests are peer-reviewed by a second expert and calibrated using hundreds of test-takers with relevant experience in the subject.

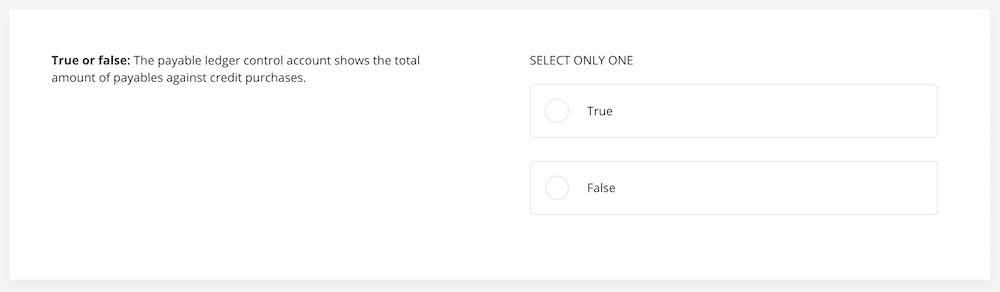

Your candidates will have 10 minutes to answer a selection of questions. To give you a feel for what kinds of questions will appear, here are some examples:

In this true or false question, candidates are tested on their general accounts-payable knowledge.

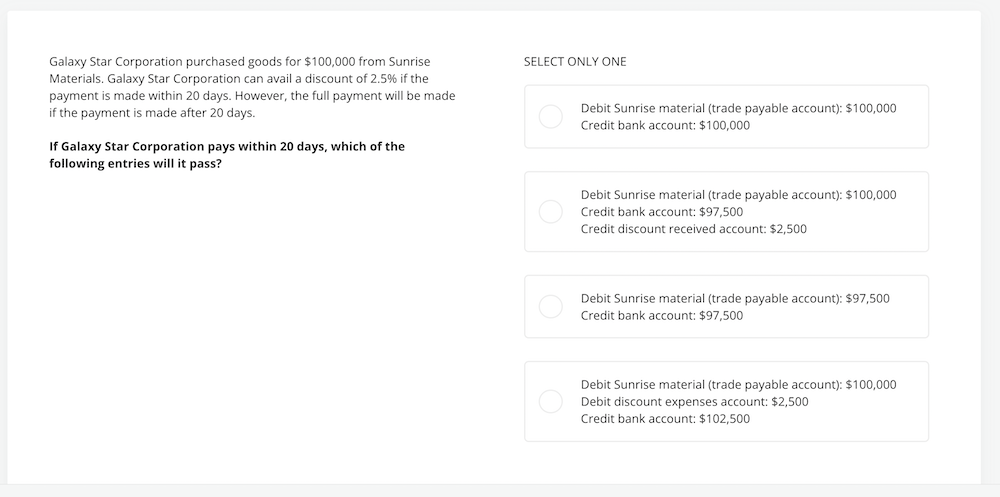

This question assesses candidates’ knowledge of payment processes and their relevant ledger entries.

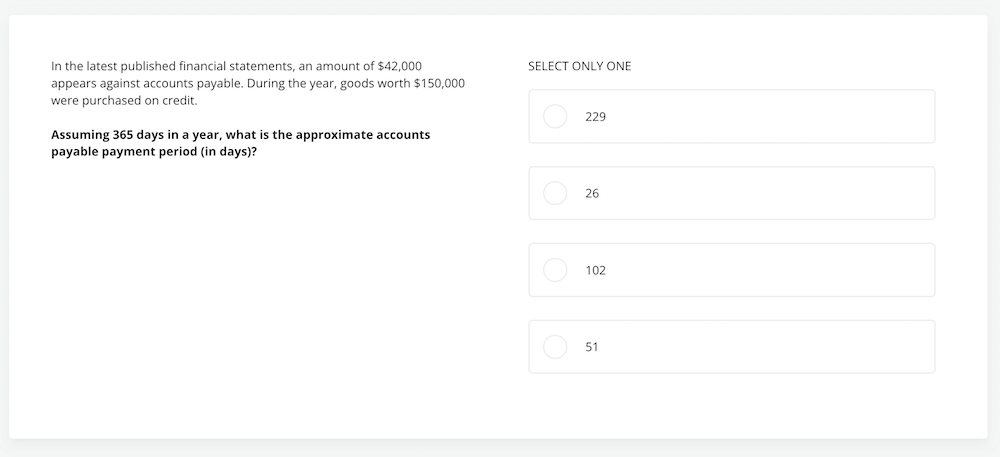

Here applicants are given some information and asked to calculate an approximate accounts payable payment period.

Once all of your applicants have taken the test, you’ll be able to see an accurate evaluation of their accounts-payable skills at a glance. Candidates who perform well on TestGorilla’s Accounts Payable test have a strong grasp of accounting knowledge and will be able to effectively manage accounts payable.

Use the Accounts Payable test as part of a complete skills assessment

It’s important to understand that the Accounts Payable test shouldn’t be used alone to evaluate your candidates. We recommend that you use three to five tests to build a complete skills assessment. This way, you get a well-rounded view of candidates and a better understanding of who they are as people. After all, there’s no use in hiring an accounts payable whiz if they communicate poorly or lack attention-to-detail skills.

We have a selection of personality and culture tests designed to assess candidates’ values, behaviors, and ways of working and seeing the world. These tests are a simple way to open up a new dimension for understanding who applicants are and how they might add to your company culture.

We’ve also got tests that target other soft and knowledge-based skills that are relevant for accounts-payable roles.

Our Attention to Detail (Textual) test will help you identify candidates who pay attention to textual detail while processing information. Applicants who do well can thoroughly and carefully use analytical skills to handle detail-oriented processes.

The Communication test evaluates candidates’ abilities to communicate clearly and effectively, in verbal, non-verbal, and written forms, using professional etiquette. It also tests verbal cues and active listening.

To assess candidates’ time-management skills, you can give them a Time Management test. You can use this test to identify applicants who can effectively prioritize, plan, execute, and reflect on tasks and projects.

Give your candidates an Accounting Terminology (US) test to measure their knowledge of various accounting terms related to financial statements, books of accounts, and other aspects of financial transactions. Note that this test is specific to the US.

Once you’ve built a complete assessment with TestGorilla, you can simply send it to applicants and wait for the results to come in. When all your candidates have completed their assessments, use the results to form a shortlist and host interviews. You can read about how to conduct an interview on our blog using these 25 accounts payable interview questions. We even have a guide to eliminating interviewer bias.

Hiring for accounts-payable skills has never been easier

We’re passionate about putting people in jobs that are right for them. Pre-employment skills testing puts applicants on an even playing field, free of bias-related obstacles, to make this possible. It gives recruiters the best chance of finding the strongest candidates for their job postings without the bias and stress that CV-based hiring entails.

Try TestGorilla for free today or choose a pricing plan that works for you to begin your journey with skills-based hiring.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.