36 accounts receivable interview questions

Avoid mishires and hire the best accounts receivable professionals with minimal effort

If you’re searching for ways to hire a professional with extensive accounts receivable knowledge, there’s a lot to think about.

We know that hiring the right candidate can be difficult. You need to hire someone who has the right accounts receivable skills and experience – and holds the same values as your organization.

It’s vital that you avoid costly mis-hires, which can be financially damaging to your business, especially for an SME.

To make the right hire, you need the right accounts receivable interview questions, which is what you’ll find in this article, along with sample answers.

So, let’s dive straight into the interview questions so you can build your list and prepare for the interview process.

Table of contents

- 7 general accounts receivable interview questions and answers

- 13 behavioral accounts receivable interview questions and answers

- 16 accounts receivable interview questions related to definitions and terms

- When should you use accounts receivable interview questions?

- 5 tips to help you use accounts receivable interview questions

- Find the right accounts receivable professional for your business

7 general accounts receivable interview questions and answers

Here are seven general accounts receivable interview questions to ask candidates at the beginning of the interview.

Use them to learn about your candidates’ general accounts receivable knowledge.

1. Explain what an accounts receivable role involves.

Some of the main responsibilities of an accounts receivable role include monitoring and processing incoming payments, ensuring the smooth functioning of the billing system, reconciling accounts, checking irregularities and resolving them, and creating statements and invoices.

2. Which accounting software have you used?

Candidates may respond by listing different kinds of accounting software, such as QuickBooks or FreshBooks. Pay special attention to candidates who have experience with the accounting software your organization uses, but check that they have used it recently and understand all the features.

If they haven’t used your software, they should show that they are willing to learn.

3. Which skills do accounts receivable roles require?

Knowledge of accounts receivable, top math skills, record-keeping skills, and management skills are crucial for an accounts receivable role.

4. What is the most important aim of accounts receivable, in your opinion?

One of the most important goals of accounts receivable is to keep a current summary and record of all transactions or debts of each client. This ensures that the enterprise receives its payments in full.

5. Name two helpful rules for managing accounts receivable.

Here are two rules that make it easier to manage accounts receivable:

For real accounts, debit is the money that comes in, and credit is what goes out

For personal accounts, the receiver benefits from debits, and the benefit giver benefits from credits

6. Are accounts receivable important for small businesses?

Candidates should know that accounts receivable can support small businesses by helping them with liquidity in the short term.

7. Which soft skills are required for accounts receivable roles?

Candidates may list some of the following soft skills when responding to this question:

Collaboration skills

Adaptability skills

13 behavioral accounts receivable interview questions and answers

This section contains 13 behavioral accounts receivable interview questions and answers.

Ask your candidates these questions to learn how they behave in a work environment and how they complete accounts receivable tasks.

1. Which preparations do you make for accounts receivable audits?

There are several financial regulations that candidates should know. Additionally, they should be able to explain how they would make sure that accounts receivable complies with them.

They may mention using either a manual or electronic system to manage document aging. They may also explain that they have previous experience with the retention process of records.

2. What do you use accounts receivable aging reports for?

Candidates may respond by saying that they use accounts receivable aging reports for bad debt estimation, making a system for collecting payments, finding out which customers are late payers, and identifying which clients owe the organization the most money.

3. Which process do you use to determine whether a customer is worthy of credit?

Your candidates may explain that they use accounts receivable aging reports to find out which clients are behind with their payments and determine whether they are worthy of credit.

They may identify that a single client is behind many late payments and take action. Answers should also show that your candidate understands the process of credit application.

4. Which process do you use to maintain an organized ledger?

In addition to logging the date and description of the payment, candidates should also include several key categories on a ledger to keep it organized. Candidates may mention key categories they use, such as:

Assets

Liabilities

Owner’s equity

Expenses

Gains and losses

5. Tell me about a time you made an accounting error. How did you correct it?

Each candidate may have a unique response to this question. It’s important to listen to the methods they used to resolve the error, what they learned, and how they avoided making it again in the future.

For instance, they may mention a discrepancy that they failed to reconcile. In this case, you should note what they learned from this error and whether they adopted any proactive methods to prevent such errors in the future, such as working on their attention to detail skills.

6. How would you explain complex accounting information to stakeholders?

Communication is an essential skill that candidates should mention when answering this question.

Are they able to show that they have the ability to discuss complex accounting or financial concepts with stakeholders who lack in-depth accounting knowledge? Can they break down complex financial information into concepts that others can understand?

7. How do you close the accounts receivable phase?

Candidates should be familiar with the many types of balances they should review when closing an accounts receivable period. They should also know how to reconcile accounts receivable transactions and explain the different steps of the process.

8. How frequently do you complete the bank reconciliation process?

Your candidates must know the advantages of regular bank reconciliation, so look for responses that suggest they complete this process frequently, perhaps each month.

They may also mention that doing frequent bank reconciliation makes it easier to check potential errors and notice if there are any extra transactions that went through.

9. What do you do if you find a billing discrepancy in an invoice?

Invoicing mistakes can happen, and candidates should know to resolve them.

Can they explain how they would resolve any potential disputes, e.g., by checking the formal agreement between the business and the client? Can they give examples of different formal agreements they would need to check, such as supply or purchase agreements?

10. Which steps would you take to forecast the payments for the following month?

A crucial part of accounts receivable management is forecasting, and candidates should have a method to forecast payments for the following month.

Can your candidates explain that they would check clients’ payment history to work out the cash flow of your business and forecast payments in the future? Do they know that dividing accounts receivable into different categories and monitoring these categories is important for forecasting payments?

11. What is your experience with analyzing significant amounts of accounting information?

Your candidates should know how to handle significant amounts of accounting information. Ask them this question to determine whether they have analyzed large volumes of transactions, financial reports, bank deposits, and receipts.

Candidates who can show a high level of attention to detail when handling large amounts of accounting information may have the skills you’re looking for.

12. How do you record journal entries?

Candidates should know that they must first make a debit entry in the accounts receivable and then make a credit entry in a sales account to make a journal entry.

13. Do you have experience with creating a bill for services? Which details should it feature?

Service invoices should include the following information:

The company’s contact information

The client’s contact information

The invoice’s date

The due date of the payment

A description of the services

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

16 accounts receivable interview questions related to definitions and terms

Ask your candidates these 16 accounts receivable interview questions related to definitions and terms to learn how comprehensive their knowledge is.

1. Define accounts receivable.

Accounts receivable refers to the payments that a company is owed from their clients. On the balance sheet, accounts receivable count as assets.

Candidates may give examples of payments that count as accounts receivable assets, such as when a client buys a product using credit.

2. Explain what factoring is.

Are candidates aware that factoring is one example of debtor finance that involves selling accounts receivable to other companies? Can they explain that businesses can use accounts receivable factoring to finance their venture and avoid a loan application?

Candidates should also know that the companies who receive the accounts receivable are referred to as “factors” and that they usually ask for a factoring fee as part of the process.

3. What is deferred revenue?

Deferred revenue refers to a prepayment for services or products recorded on a company’s balance sheet. Deferred revenue counts as a liability.

4. What is the difference between accounts receivable and deferred revenue?

Accounts receivable is classified as an asset, while deferred revenue is a liability. The main reason deferred revenue is a liability is that a customer has paid the enterprise, but the enterprise has not yet fulfilled their obligation to the customer.

5. What does goodwill mean?

Goodwill in accounting refers to an intangible asset. It occurs when one enterprise buys another business and spends a higher price for it when compared to the net assets of the company they are buying.

6. Explain what PP&E is.

Candidates should be able to explain that PP&E (short for property, plant, and equipment plants) are critical assets for business operations. The PP&E all count as tangible assets which are difficult to convert into cash.

7. What is bank reconciliation?

Can your candidates give a precise definition of a bank reconciliation? Do they know that the process involves matching unpaid billings from customers to the total recorded in the general ledger for the accounts receivable?

Candidates should also be able to explain why bank reconciliation is important and may mention that it ensures the accounting records and statements are accurate.

They may also mention that bank reconciliation can help enterprises safeguard against fraudulent activity.

8. Explain what working capital is.

Working capital is a term that refers to the difference between an enterprise’s current assets and its liabilities.

In response to this question, candidates may describe a few examples of current assets, such as accounts receivable, and examples of current liabilities, such as accounts payable.

9. Explain what negative working capital is.

Candidates may respond to this question by first explaining what positive working capital is, which is a term that describes the fact that a business can pay off immediate debts thanks to its sufficient liquid assets.

They may then compare this with negative working capital, which is a term that indicates that an enterprise may not be able to pay off immediate debts with its current assets alone.

10. Explain what depreciation is.

Depreciation refers to a transaction that reduces a tangible asset’s cost over its life, considering that its value has declined.

11. Explain what services rendered means.

Services rendered refers to services that a business offers and fulfills before the client pays for the service. Accounts receivable professionals will record the rendered service and produce an invoice when the service agreement has concluded. They will then present the invoice to the client to get paid.

12. Explain what DSO means.

DSO is short for days sales outstanding. It refers to the average number of days it takes for a firm to collect a payment from a client following the completion of a sale.

13. Explain what accounts receivable ratios are.

An accounts receivable ratio refers to the number of collections a company makes throughout an accounting period and how efficiently the enterprise can collect receivables from customers.

Candidates may also mention that accounts receivable ratios measure how frequently an organization converts receivables into cash.

14. Explain what net sales mean.

Candidates should know that “net sales” is a term that defines the gross sales a company makes, minus its discounts or returns. They may explain that if net sales change, this will affect an enterprise’s gross profit margin.

15. What is a BRS?

BRS is an acronym that means “bank reconciliation statement.” Candidates may explain that bank reconciliation statements count as confirmation that a payment has been processed.

16. What is a derivative?

A derivative is a contract that is established between two or more parties. Derivatives derive their value from underlying assets. Candidates may provide examples of common derivatives, such as a contract or a swap.

Roll out tests, track results, and make hiring decisions from an intuitive, unified platform.

When should you use accounts receivable interview questions?

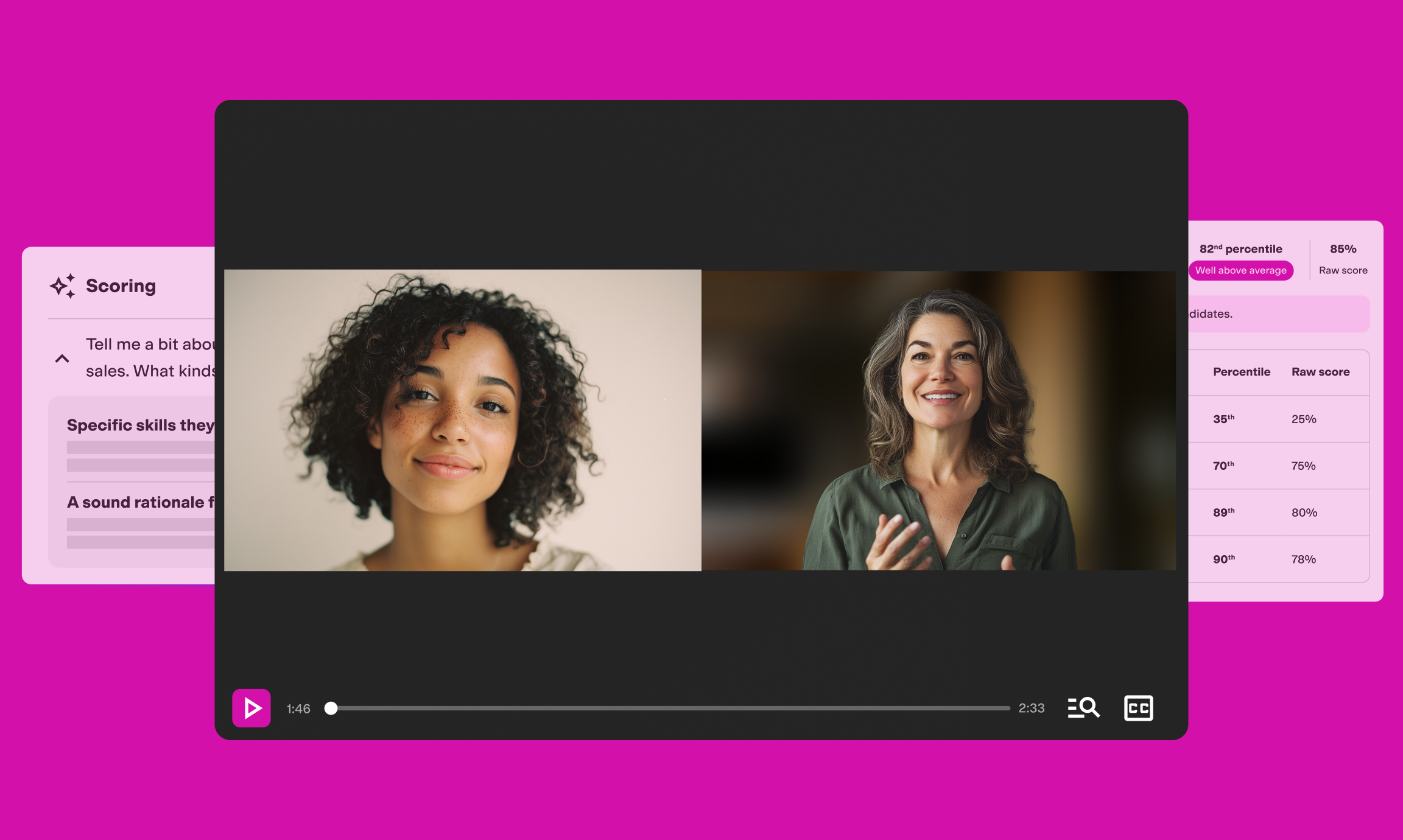

We suggest you use accounts receivable interview questions during the last stages of the recruitment process, after having filtered out unsuitable candidates with the help of skills tests.

Skills testing should always precede interviews, so that you can shortlist your most promising applicants and only invite them to an interview, instead of interviewing everyone. This approach helps you streamline the hiring process and save time and effort.

Skills testing also enables you to minimize unconscious bias during hiring.

Once you receive skills assessments results, you’ll be able to identify the best applicants and invite them to an interview. From there, you can use the accounts receivable questions in this article to gain a deeper understanding of your candidates’ skills and knowledge.

Related posts

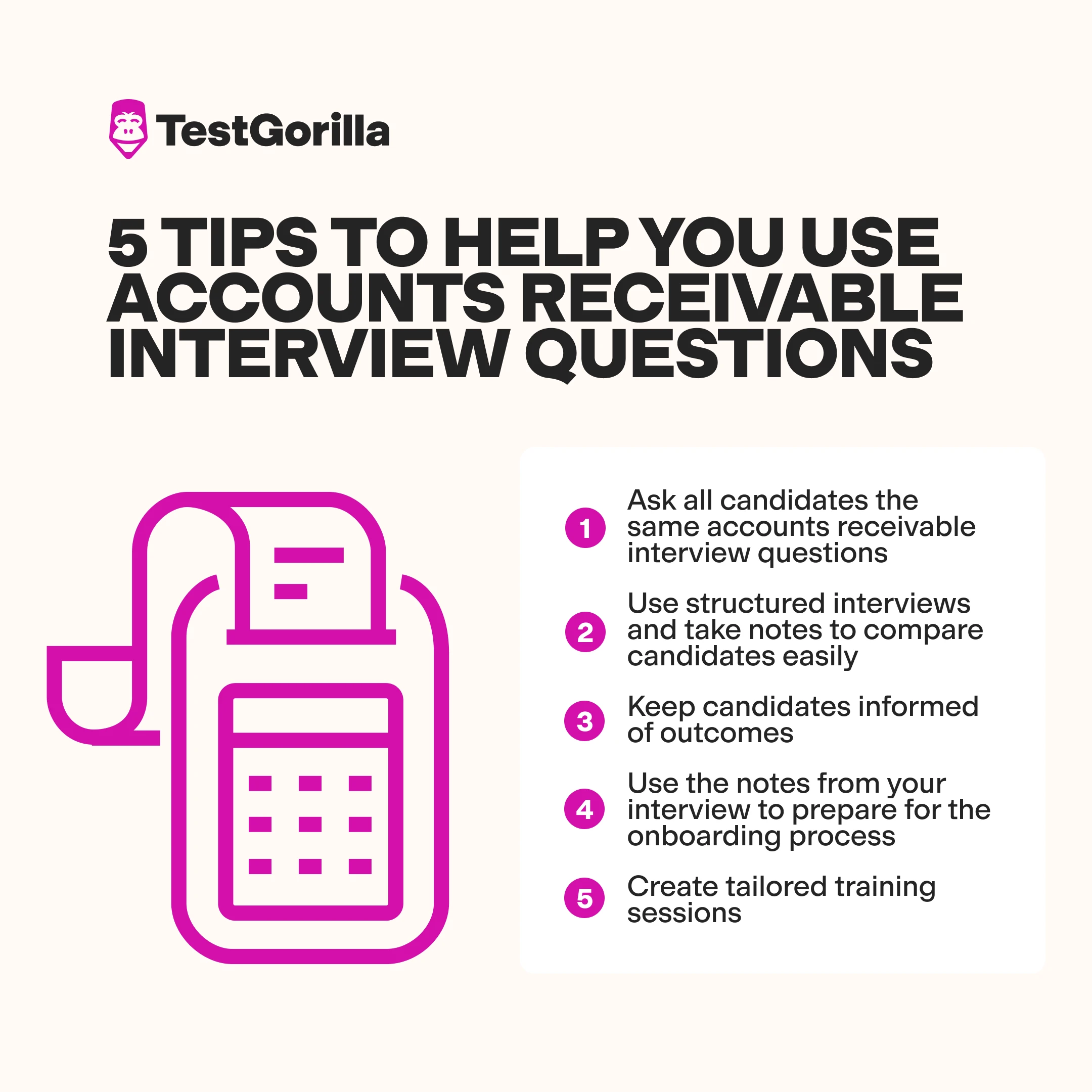

5 tips to help you use accounts receivable interview questions

The five tips in this section will make the interview process easier and help you enhance the candidate experience.

1. Ask all candidates the same accounts receivable interview questions

Ask all candidates the same accounts receivable interview questions to minimize bias. Decide on a comprehensive list of questions and ask them in the same order to enhance the fairness of your interview.

2. Use structured interviews and take notes to compare candidates easily

Avoiding unstructured interviews and sticking to a structured interview process can make your job easier when comparing candidates’ responses. During structured interviews, you can also take notes of your candidates’ answers.

3. Keep candidates informed of outcomes

Consistent communication greatly improves the candidate experience.

Whether you need to ask candidates for additional information or inform them about their progress in the hiring process, make sure that you communicate promptly.

Give feedback to unsuitable candidates when informing them you haven’t retained their application. This will further enhance the candidate experience and help you stand out among all the companies that are skipping this step.

4. Use the notes from your interview to prepare for the onboarding process

Use the notes you have taken during the interview with your new hire to make their onboarding easier for everyone.

For example, you might have learned that your new employee has used your accounting software in the past but not recently. In this case, you should focus your onboarding process on giving them the means to re-learn how to confidently use it.

5. Create tailored training sessions

Use what you learn about candidates in the interview to create tailored training sessions to complete their onboarding.

For example, if your new hire has never worked in a large enterprise like yours, but has experience with accounts receivable in SMEs, focus on teaching them how to handle large amounts of accounting data for big companies.

Find the right accounts receivable professional for your business

Making sure your books are in order is not always easy but it’s crucial for the success of your business. You need the right professional on board – and recruiting them doesn’t have to be stressful.

For this, you need a skills assessment and a comprehensive list of the right accounts receivable interview questions to hire the candidate who fits your team and enterprise like a glove.

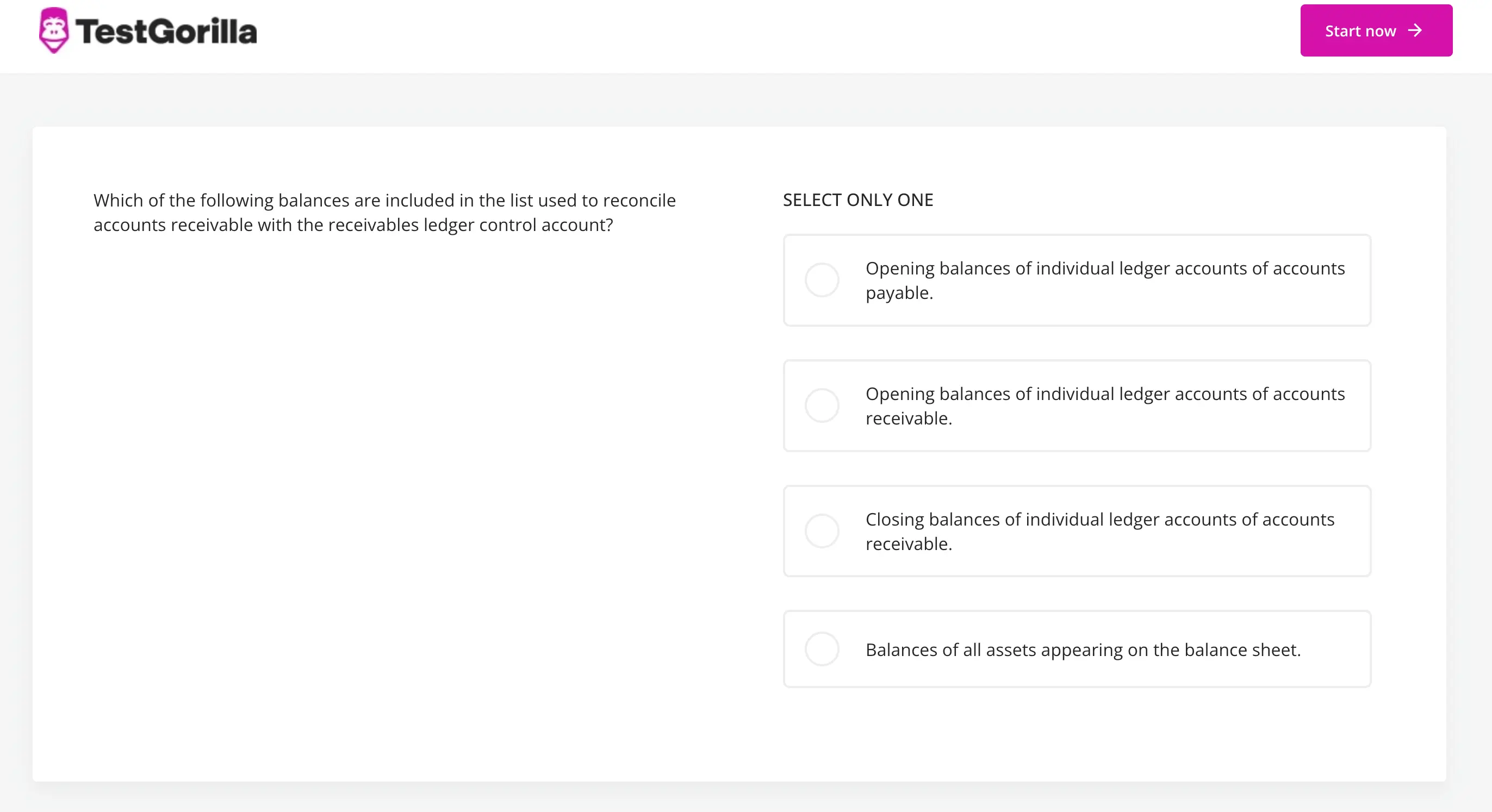

Head to TestGorilla’s test library to find the right skills tests for the role you’re looking to fill and select up to five tests to administer in a skills assessment – and make sure to include our Accounts Receivable test (preview below) to assess candidates’ knowledge.

Once you’ve received your candidates’ test results, invite the best ones to an interview, and use the list of accounts receivable interview questions in this article to further evaluate their skills.

Get your free trial to avoid mis-hires and hire top talent with minimal effort.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.