Top 31 bank teller interview questions to hire skilled professionals

Hiring the right bank teller is essential for maintaining the trust and satisfaction of your customers. But, relying solely on resume screening won't work – you could end up hiring a teller who looks great on paper but lacks the skills you need.

Instead, try a combo of skills tests and targeted bank teller interview questions. This skills-first approach to recruitment enables you to evaluate candidates’ true potential and fit for your team quickly and objectively and helps eliminate bias from the hiring process.

Below, we discuss the key skills to look for when hiring bank tellers and provide you with a list of insightful questions to help you evaluate these skills in action, along with guidelines for spotting the best candidates.

How to assess a bank teller’s skills

When hiring a bank teller, you need to make sure they can handle the (often challenging) customer service demands of the job and manage transactions with speed and accuracy.

Writing an accurate job description and reviewing the resumes you receive may not be enough to evaluate a candidate’s true skills as a bank teller. That’s why we suggest using pre-employment skills testing at the top of your recruitment funnel to quickly identify the most promising candidates and decide whom to invite to an interview.

By integrating skills tests early in the recruitment process, you can concentrate only on the most qualified candidates who have the practical skills you need, instead of wasting hours interviewing applicants based on their resume writing skills (because, let’s be honest, that’s what resume screening evaluates).

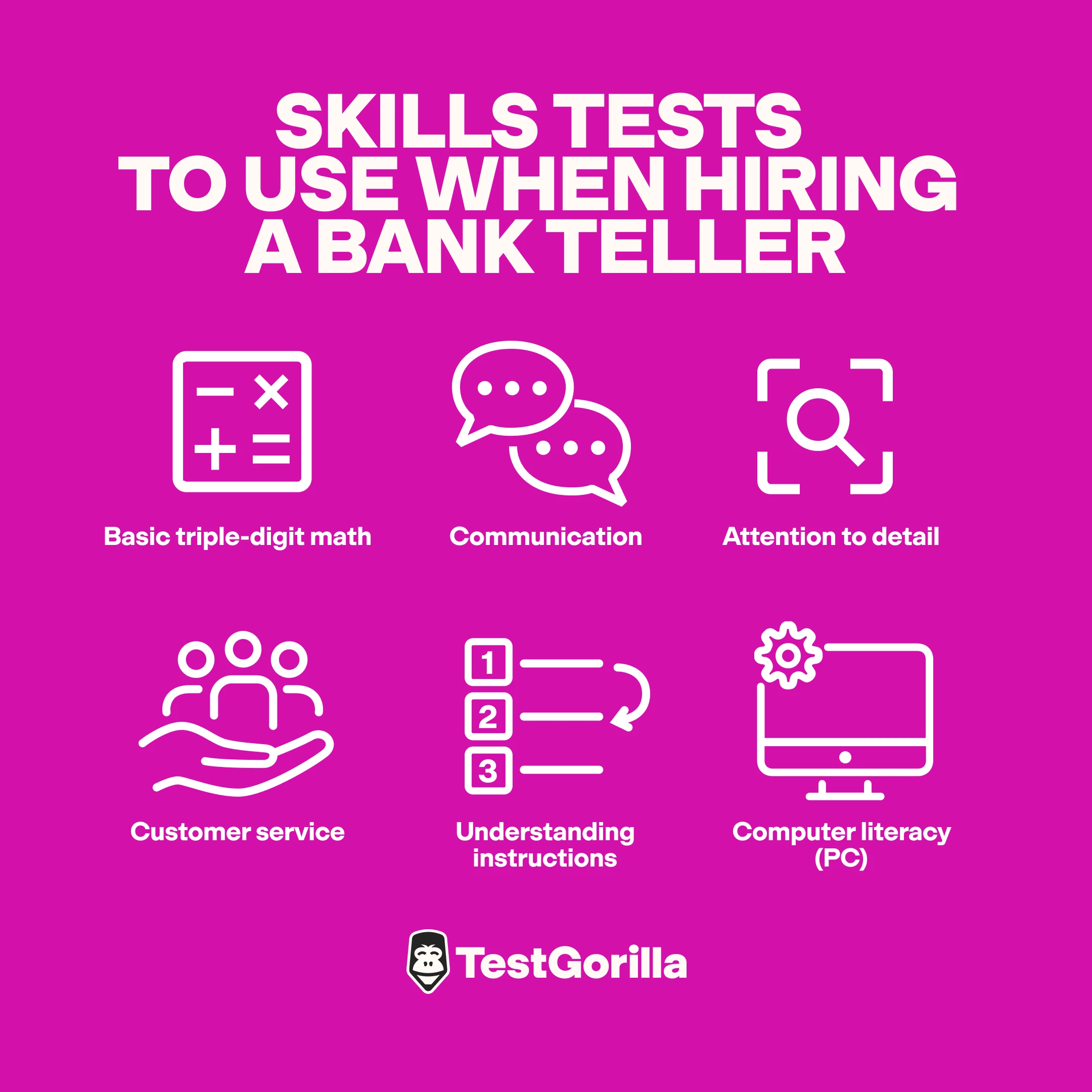

With TestGorilla, you can combine up to five skills tests in a single assessment; most of them take 10 minutes to complete. For the role of a bank teller, consider the following tests:

Basic Triple-Digit Math: Assess candidates' proficiency in handling basic financial transactions to ensure accuracy in the operations they handle.

Communication: Evaluate applicants’ ability to communicate clearly and effectively, a crucial trait for interacting with customers and team members.

Attention to Detail: Determine candidates' capacity to notice errors and inconsistencies, which is key for maintaining accurate financial records.

Customer Service: Make sure applicants can deliver excellent service to your customers, managing their inquiries and resolving issues quickly and efficiently.

Understanding Instructions: Test candidates’ ability to follow procedures and execute tasks accurately.

Computer Literacy (PC): Verify candidates’ computer literacy, which is critical for the bank teller role.

A targeted skills assessment enables you to identify top applicants quickly, ensuring a more efficient selection process. Then, you simply need to conduct interviews with your top talent to find the perfect match.

Top 15 bank teller interview questions to hire the best talent

Below, you’ll find our selection of the best 15 interview questions for bank tellers, which will help you assess applicants’ skills and their preparedness for the role. To help you assess their answers, we’ve also included information on what you should look for.

1. What are the most important qualities of a bank teller, according to you?

Expect applicants to talk about qualities such as accuracy, customer service, integrity, and the ability to work under pressure. Some candidates might also mention adaptability and strong communication skills.

Look for examples of these qualities in past roles, such as:

Personal anecdotes demonstrating their attention to detail and accuracy in transactions

Examples of how they've provided excellent customer service

Instances where integrity was tested and upheld

Their ability to learn new banking software systems quickly

2. What do you believe is the most challenging aspect of working as a bank teller? How do you manage it?

Answers will vary based on each candidate’s own struggles – which is exactly what makes this question so important.

They might mention challenges such as:

Dealing with difficult customers

Maintaining accuracy under pressure

Identifying and reporting potential fraudulent transactions

Expect answers that show an awareness of the potential stressors of the job and a proactive approach to managing them.

3. What's your experience with banking software?

Candidates should discuss their experience with specific banking software platforms, such as Temenos Core Banking, Finastra Fusion Essence, ACI Worldwide's money-laundering detection software, and internal bank systems.

More importantly, however, you need to assess their ability and willingness to learn new technologies, so don’t hesitate to ask follow-up questions as needed. The most skilled candidates might also mention additional training or certifications they have pursued or talk about the ways they ensure they’re using the software correctly.

4. How would you explain a new banking product to a customer who is not very financially savvy?

Look for candidates who are aware of the importance of empathy in customer-facing roles – and who know how to simplify complex information. They should be able to translate financial jargon into easily understandable terms and use relatable examples to explain the benefits and features of the product in question.

The best answers will include details on how they would:

Assess the customer's level of understanding and tailor the explanation accordingly

Use analogies or simple terms to clarify the information they provide

Make sure the customer understands them by using active listening

5. Have you ever noticed a coworker making a mistake while working with a customer? What did you do?

This question tests integrity and teamwork. A great team player will know how to address mistakes constructively and strike a balance between maintaining the bank’s reputation and ensuring the mistake gets corrected to prevent potential issues.

6. What steps do you take to ensure confidentiality when handling customer information?

Candidates should mention specific policies and practices they follow to protect customer information, such as secure document handling, not sharing unnecessary information, using two-factor authentication, and following the bank’s security protocols.

Knowledgeable candidates will also show an understanding of local and national banking regulations and laws related to data protection.

Bank tellers should also be mindful of discussing sensitive information in open areas and immediately report any suspicious activity or security breaches to their managers.

7. How would you handle a situation where a customer's request violates the bank's policy?

Look for bank tellers who understand the importance of adhering to bank policies while also showing empathy and offering alternatives to the customer.

In this situation, they would need to explain the policy to the customer in a way that is clear and respectful and work together to find a solution, evidencing their communication and problem-solving skills. Experienced applicants will also be able to give you examples of how they’ve handled such instances in the past.

8. Describe your process for balancing your cash drawer at the end of the day. Have you ever encountered a discrepancy? How did you resolve it?

Attention to detail and a systematic approach are key here. Candidates should describe their method for counting and reconciling cash, as well as the steps they take if they discover a discrepancy.

Expect answers to include:

A step-by-step description of their end-of-day process

Examples of specific instances where discrepancies occurred and the actions candidates took to resolve them

An emphasis on the importance of accuracy and integrity in handling bank funds

9. How do you ensure you stay focused during repetitive tasks?

Candidates should share techniques that help them maintain their focus and efficiency, even when performing monotonous tasks. Look for answers that show self-awareness, a proactive approach to maintaining their attention to detail, and possibly the use of tools or methods to support their consistency, such as double-checking their work or using checklists to ensure nothing falls between the cracks.

10. What's your approach to cross-selling or recommending additional products to customers?

Strong answers will show applicants’ ability to listen to and understand customer needs and use their knowledge of the bank’s offerings to recommend the right bank products. They should use an approach that is helpful rather than salesy, focusing on building relationships and providing value to customers.

You can use our sales behavioral interview questions to further evaluate candidates’ sales skills.

11. Tell us about a time when you had to learn a new technology at work. How did you tackle this?

Adaptability and a willingness to learn are critical for most roles today – especially in a sector as dynamic as banking. Candidates should provide examples of new technologies that were introduced to their workflows, explain how they approached the learning process, discuss the challenges they faced, and tell you how they overcame them.

The best answers will also include mentions of the impact that the new technology had on candidates’ efficiency or the quality of their service.

12. Can you discuss a time when you identified a potential fraud or security risk? What actions did you take?

Bank tellers need to be vigilant to potential fraud and demonstrate a proactive approach to addressing potential security risks. This question enables you to gain insights into their ability to:

Recognize unusual transactions or behavior

Follow the bank's procedures for reporting and addressing the issue

Get in touch with other departments as needed

13. How do you ensure you are up-to-date with all the bank's products and services?

A commitment to ongoing education and self-improvement is key. Candidates should mention specific strategies they use to stay informed, such as attending training sessions, reading the bank’s internal newsletters, participating in workshops, or using continuous learning resources offered by the bank.

14. How would you react if you made a mistake that negatively impacted a customer? What steps would you take to correct it?

This question tests a candidate's integrity, responsibility, and customer service skills. The ideal response would include an immediate acknowledgment of the mistake, clear communication with the customer and superiors, and prompt action to correct it.

To go deeper, you can use some of our customer service interview questions to evaluate applicants’ skills.

Make sure you also include our Customer Service test in your candidate assessment at the top of your hiring funnel.

15. Can you explain the importance of the Bank Secrecy Act and Anti-Money Laundering regulations in your role as a teller?

Bank tellers need to show a deep understanding of the significance of these regulations in maintaining the integrity of your institution.

Candidates should explain how these laws affect their daily responsibilities, including monitoring transactions, reporting suspicious activity, and maintaining customer confidentiality.

Expect explanations to cover:

The basics of the Bank Secrecy Act and Anti-Money Laundering regulations

How compliance impacts their role and the bank's operations

Examples of how they apply these regulations in their daily tasks, such as identifying suspicious transaction patterns or completing necessary reports

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Additional interview questions you can ask bank tellers

Looking for more ideas? We’ve compiled a list of 16 additional questions for bank tellers, dividing them up into four categories: behavioral, situational, procedural, and customer service. We’ve also included some short, model answers so you know what to look for in candidate responses.

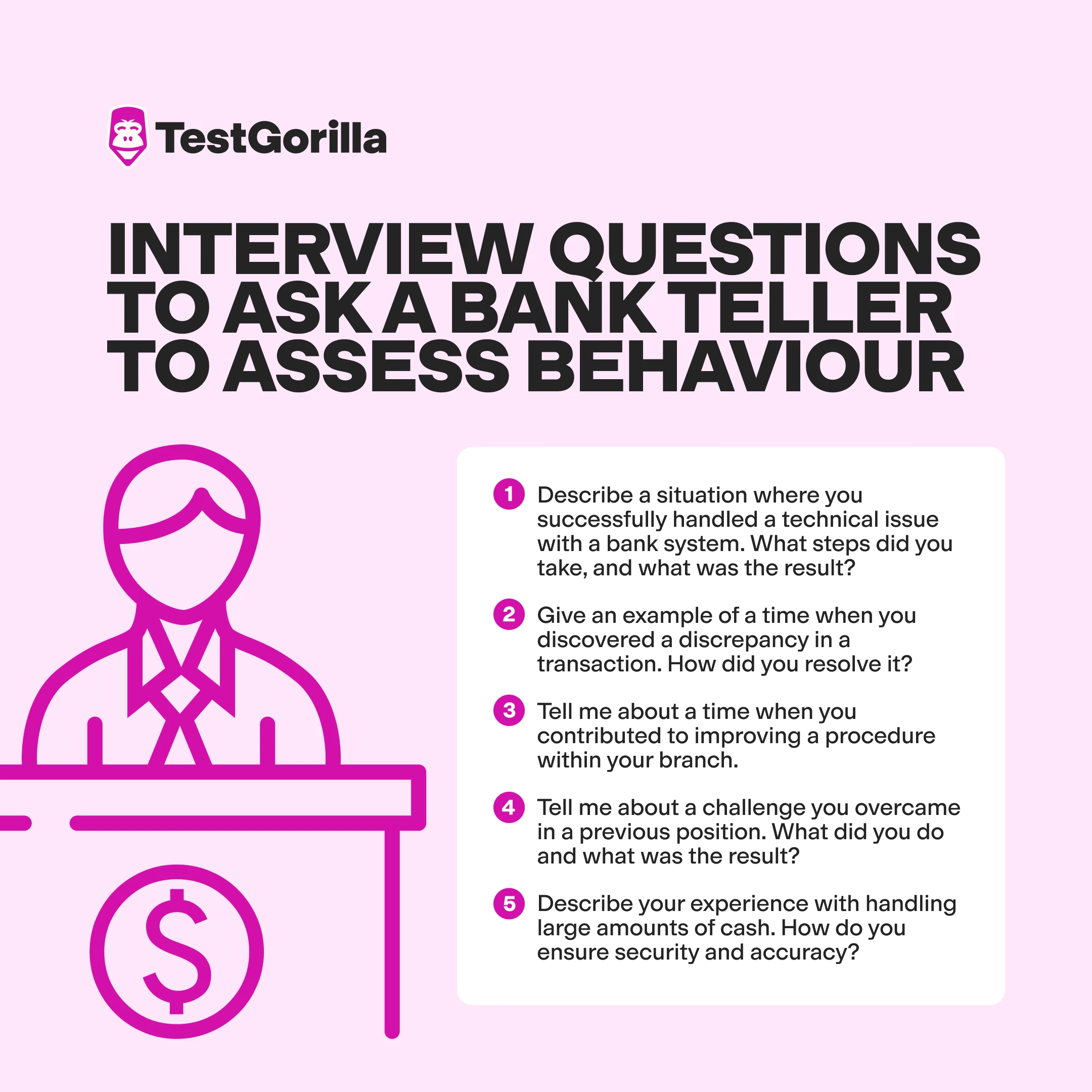

5 behavioral interview questions for bank tellers

These questions ask candidates about their past behaviors in this or other roles. Answers should be detailed, demonstrating specific actions they took and the outcomes of those actions.

1. Describe a situation where you successfully handled a technical issue with a bank system. What steps did you take, and what was the result?

Example answer: I remember a time last November when the bank’s mobile banking app wasn’t working. The technical team was working on the issue, but the time was especially frustrating for customers who relied on the digital approach. Although I had no control over the app, I took control of the situation by supporting those in the bank with their requests.

I reassured customers that we were aware of the issue and doing everything we could to help. I advised customers on alternative ways to complete their transactions, like using telephone banking or visiting an ATM. For urgent cases, I helped escalate their concerns to the right team to make sure they were prioritized.

2. Give an example of a time when you discovered a discrepancy in a transaction. How did you resolve it?

Example answer: I remember spotting a transaction that didn’t add up when a customer was trying to deposit a check. There were discrepancies with the handwriting, the date code, and the amount written versus the amount processed.

Rather than assuming it was an error, I double-checked the system records and verified the details with the customer. Once I confirmed the discrepancy, I escalated it to the fraud prevention team for further investigation while keeping the customer informed.

Thankfully, it turned out to be an innocent mistake rather than anything fraudulent, but it’s better to be safe than sorry.

3. Tell me about a time when you contributed to improving a procedure within your branch.

Example answer: I remember we had an issue when it came to closing banking accounts. All signing members had to be present at the bank to close the account, which wasn’t practical.

But, I proposed a solution whereby we could introduce a remote verification process. This enabled account holders to confirm their identities and authorization via a secure online portal. It made the process much smoother for customers.

4. Tell me about a challenge you overcame in a previous position. What did you do and what was the result?

Example answer: My last role was full of challenges. For example, once I needed to help a customer struggling with their online banking access. After some digging, I found out it was because they’d been reported for potentially fraudulent activity, and their account had been temporarily locked as a precaution.

It was a tricky situation because the customer was understandably upset, but I knew I needed to approach it with sensitivity and professionalism. Ultimately, it wasn’t a problem I could solve, so I had to defer to my colleagues in fraud protection. But, I think an important part of solving a problem is knowing that when something isn't within your jurisdiction, you must refer it to those with the right authority or tools for handling it.

5. Describe your experience with handling large amounts of cash. How do you ensure security and accuracy?

Example answer: When handling large amounts of cash, it helps me to break it down into smaller sections to stay organized and reduce the risk of errors. I always count the cash twice – once when it’s first handed over, and then again after processing it – to ensure accuracy.

Plus, I always make sure to follow the bank’s security protocols to the letter. For instance, my previous bank required any transaction above a certain threshold to be verified by two tellers. No cutting corners on large transactions!

2 situational interview questions for bank tellers

Situational questions pose hypothetical scenarios and ask candidates to envision how they’d act in those scenarios. Strong answers demonstrate problem-solving and decision-making skills, along with good situational judgment – especially when it comes to banking regulations and company policies.

1. What would you do if you noticed a coworker do something that exposes customer data to potential security breaches?

Example answer: Customer confidentiality is non-negotiable in banking. If it was the first time I’d noticed this happen, I’d address it directly but discreetly with my coworker. I’d make sure they were aware of the risk and give them the benefit of the doubt – it could’ve been an honest mistake.

If it seemed like they didn’t take it seriously or if the potential security breach was severe – for instance, if the potential security breach involved leaving a customer's account information visible on a shared computer screen – I’d escalate it to a manager or the appropriate security team.

2. Your manager asks you to do something in a specific way, but you know there’s a better way to accomplish the task. What do you do?

Example answer: I try to be reasonable and find a middle ground. I don’t see a point in doing something in a counterproductive way, but I also appreciate that there can be merits to others’ perspectives.

I’d start by respectfully discussing my thoughts with my manager. I’d explain why I think a different approach could be more efficient or effective, backing it up with examples or past experiences. If they’re open to it, we could discuss the pros and cons of both methods and potentially come to a compromise.

2 procedural interview questions for bank tellers

These questions ask candidates to describe how they typically handle common tasks or challenges in the workplace. Ideal answers should illustrate practical knowledge, effective strategies, and a clear understanding of procedural norms.

1. How do you manage your workload during busy periods at the bank?

Example answer: Staying organized with my tasks is the key during busy periods. I like to take time in the morning to set myself up properly and prioritize tasks based on urgency. I make a to-do list using our bank’s task management software, focusing on the most time-sensitive tasks first while also keeping an eye on things that need follow-up.

2. How do you handle receiving negative feedback from a supervisor?

Example answer: Negative feedback is never nice to hear, but so long as it’s delivered calmly and sensitively, I try to view it as an opportunity to improve. I listen carefully to the feedback, making sure I fully understand the concern before responding.

I also ask for specific examples or suggestions on how I can improve, as this helps me focus on concrete steps to grow. I make a conscious effort not to take it personally, as I know the feedback is meant to help me do my job better.

7 customer-service interview questions

You should also include some customer-service questions, and these can be a mix of behavioral, situational, and procedural questions – including questions that ask about specific customer-service scenarios. The best answers show empathy, patience, and adaptability – along with a strong adherence to banking regulations and internal policies.

1. How would you handle a situation where you are unable to immediately resolve a customer's issue?

Example answer: I’d start by speaking with the customer. I’d want to let them know I understood their frustration and want to get this resolved as quickly as possible for them. I’d be upfront if I couldn’t fix the issue right away but would reassure them that I’m on it. I’d gather any relevant details, let them know the next steps, and give them a realistic timeline for when they can expect a resolution.

If it was out of my hands, I’d escalate it to the right person and follow up to make sure it didn’t fall through the cracks.

2. What methods do you use to build and maintain good relationships with regular customers?

Example answer: I like to use the personal approach. I try to remember small details like customer names, their children's names, and their hobbies. Even small actions – like asking about their last transaction or checking in on something they mentioned before – can go a long way in making them feel valued.

3. Tell us about a time when you dealt with a difficult customer. How did you handle the situation?

Example answer: We had a regular customer who was known to be difficult. They came in frustrated that a transaction hadn’t been processed as they were expecting.

Rather than brush them off, I took the time to listen to their concerns, allowing them to vent their frustrations. Then, I calmly reassured them that I understood their frustration and would do everything I could to help. I walked them through the next steps, offering a solution that would get things sorted as quickly as possible.

By the end of the conversation, they were calmer and expressed appreciation for the help.

4. A regular customer is unhappy with your service and threatens to take their business elsewhere. What do you do?

Example answer: First and foremost, I’d apologize for their experience. Bank tellers are human, and we don’t always get it right. I’d ask open-ended questions to get to the root of their frustration and reassure them that I value their business.

If there was something I could do to fix the issue immediately, I’d take action there and then. If it was something more complex, I’d explain the steps I’d take to resolve it and make sure to follow up.

5. Tell us about an instance where you had to collaborate with another department to solve a customer's problem.

Example answer: There was a time when I needed to collaborate with our company's marketing department, which was completely out of my comfort zone. We were working together to produce in-bank collateral for an upcoming promotion, but a customer flagged that some of the information on the promotional materials didn’t match what they’d been told online.

Rather than dismissing their concern, I reached out to the marketing team to clarify the details. It turned out there’d been a slight miscommunication in the wording, which could’ve led to confusion for other customers, as well. I worked closely with them to get the correct information updated and made sure our frontline staff were briefed so they could provide clear and consistent messaging.

6. How do you approach explaining banking terms or procedures to customers who are unfamiliar with them?

Example answer: I think the most important thing is to speak to your customers in a language that makes sense to them. There’s no point in using banking jargon or technical terms. Instead, I break things down into simple, everyday language and use examples that relate to their situation.

I also like to use analogies, like comparing a standing order to a “subscription for payments”’ for example.

7. How do you handle situations where a customer's needs can’t be met with the bank's current offerings?

Answer: It’s important to be upfront and honest about the bank’s limitations. If a customer's needs can't be met with our current offerings, I’d be honest about it. I’d explain what we can offer, and try to make that work for the customer. But, ultimately, if it’s clear that our services can’t fully meet their needs, I'd rather them go elsewhere than be disappointed.

Hire the best bank tellers with a skills-first approach

With the right skills tests and interview questions, you can gain invaluable insights into how candidates handle real-world situations, from addressing customer concerns to learning new banking software.

Plus, skills-based hiring is not only more efficient, it’s also cheaper: 78% of the employers we surveyed reduced the cost-to-hire when using a skills-first approach to recruitment.

To see whether TestGorilla is the right platform for you, sign up for a free 30-minute live demo with one of our team members – or create a free account to start evaluating your candidates’ skills today.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.