11 bookkeeping skills and how to assess them when hiring a bookkeeper

As the financial backbone of a business, bookkeeping is a vital aspect of successful operations.

Bookkeepers document all your business transactions and are often entrenched in the details of finance, so evaluating bookkeeping skills can be a tough nut to crack – especially for hiring managers and recruiters unfamiliar with the intricacies of financial jargon, processes, and certifications.

In this article, we discuss the main bookkeeping skills you need as well as how to assess them with TestGorilla assessments that make it easier to evaluate candidates’ skills in an objective, bias-free manner.

What skills and traits are important for bookkeepers?

All bookkeepers must have certain hard and soft skills to succeed in their jobs.

For example, they need to have a strong understanding of numbers and math, but they also have to be good problem-solvers with strong ethics to ensure the company doesn’t run afoul of regulations.

Here’s an in-depth look at the hard and soft skills this position needs and what you should include in your bookkeeper job description when looking to hire a top bookkeeper.

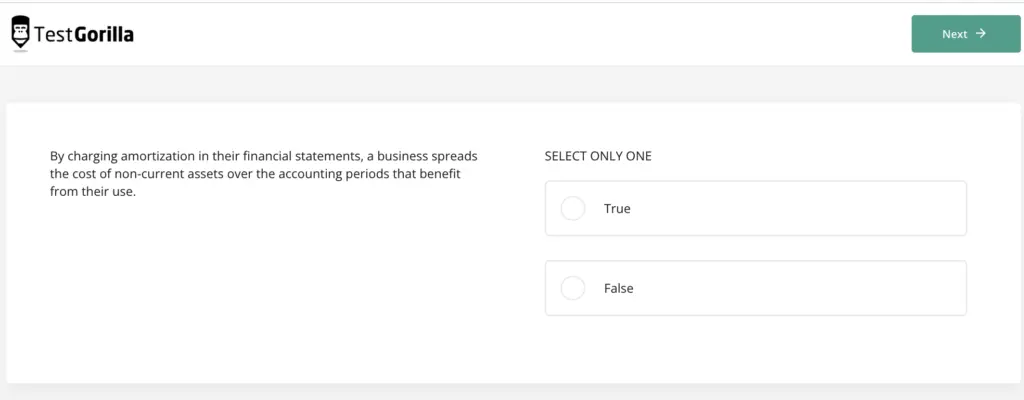

1. Understanding of accounting principles bookkeeping skills: Accounts payable and accounts receivable

Bookkeepers are the hands-on operators who apply accounting principles to a business’s day-to-day financial transactions, including an understanding of the fundamentals of double-entry bookkeeping, recognizing when to debit or credit an account, and correctly categorizing expenses.

This work provides the raw data off of which they build financial reports and forecasts.

Therefore, bookkeepers need to have a solid understanding of basic accounting principles to ensure accurate entries and calculations.

The candidate you finally hire must have the most basic bookkeeping skills – accounts payable and accounts receivable, including an ability to:

Understand accounting concepts and terms

Calculate accounting figures

Competently manage accounting figures

2. Computer literacy

In the modern digital era, bookkeepers execute most tasks using accounting software and spreadsheets. These tools automate many processes, minimize errors, and provide more detailed financial analysis.

Thus, computer skills are a must for modern bookkeepers, and you should be evaluating the computer literacy of any new hire.

They should be comfortable working with spreadsheets such as Microsoft Excel, adapting to new digital advances as they emerge, and using various accounting software, such as:

Freshbooks

Wave

Intuit QuickBooks Online

Sage 50 Accounting

Research has found that 49% of accounting professionals see knowing and adapting to digital technology as their biggest challenge.

3. Data-entry skills

Data entry is crucial for bookkeeping tasks, from calculating accounting figures to recording financial data in general ledgers.

The task involves the efficient and precise entry of data, such as numbers, dates, and text, to create accurate records and balance sheets.

Data-entry skills involve:

Accuracy

The ability to handle different formats and sources

Validating the data to ensure it adheres to the company’s standards

Cleaning the data to eliminate mistakes such as duplicates

A study from Sage found that 45% of accounting professionals expressed an intention to automate data entry, so the data-entry skills required by bookkeepers are likely to change in the near future.

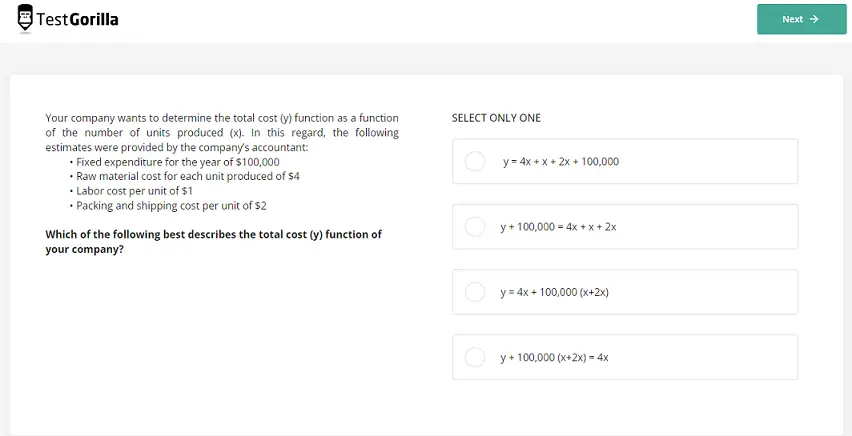

4. Math and numerical skills

Whether calculating totals, balancing accounts, or analyzing financial data, numerical aptitude and math are fundamental skills for bookkeepers.

Strong numerical skills ensure that entries and calculations are accurate and that economic reports are reliable. They enable bookkeepers to spot anomalies and potential issues.

Mathematical skills form the cornerstone of any bookkeeper’s entire skill set, as they must:

Perform financial calculations, including working with income statements and tax returns

Easily balance a company’s financial books

Use numerical skills to calculate the sum of various business transactions

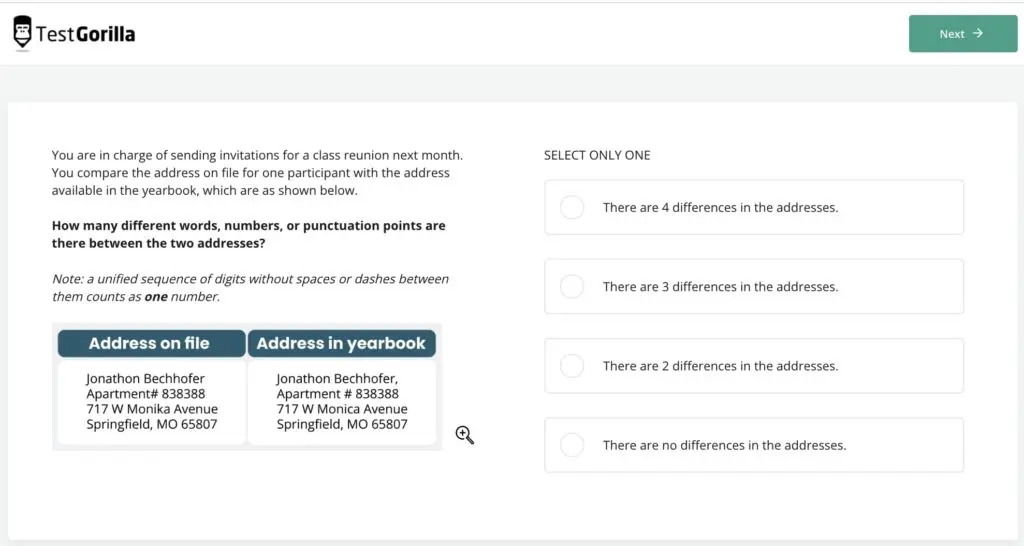

5. Attention to detail

Bookkeepers manage an array of financial data that requires absolute accuracy. Even minor errors can lead to significant discrepancies in the business’s financial picture, potentially causing legal complications and poor financial decisions.

Good bookkeepers possess an eye for detail, ensuring that they correctly record every financial transaction. They must use their bookkeeping skills to identify and promptly resolve any discrepancies.

All bookkeepers, whether full- or part-time, should be able to:

Reconcile accounts

Ensure they don’t miss or miscalculate even the smallest financial details

Keep highly accurate details of all financial transactions

Stay on top of company information

6. Organizational skills

Bookkeepers often juggle multiple tasks, such as managing accounts payable and receivable, recording transactions, reconciling accounts, and preparing financial reports.

Practical organizational skills are thus crucial for prioritizing tasks, managing time efficiently, and maintaining clear, accessible financial records.

A certified bookkeeper is also knowledgeable of the standards that govern bookkeeping activities, like the US GAAP, the Generally Accepted Accounting Principles. For those roles requiring a deeper, advanced understanding of these principles, the Accounting (Advanced) test (US GAAP) offers a comprehensive assessment.

Other organizational skills that are useful for bookkeepers include:

Integrating software programs

Establishing a bookkeeping system

Developing streamlined workflows

Scheduling their day ahead of time

7. Integrity and transparency

Bookkeepers handle sensitive financial data, often involving access to confidential business information. Trustworthiness is a critical trait in this profession.

Bookkeepers must act with integrity and handle confidential information responsibly and ethically to protect the organization’s financial data and create a culture of trust and openness.

Moreover, showing integrity while keeping up with regulatory change is one of the primary challenges for 51% of firms.

A successful bookkeeper must be honest, open, and trustworthy.

8. Communication skills

Most of a bookkeeper’s work may be with numbers, but they must also communicate effectively and translate financial data into clear, understandable information for non-financial individuals.

Communicating complex financial information in an accessible manner is crucial for informed decision-making and helps promote a broader understanding of the business’s financial health within the team.

Full-time bookkeepers must work well with colleagues and clients to communicate workflows, clear roadblocks, and manage expectations. Communication skills in a bookkeeping career include the ability to:

Explain technical/financial matters clearly and simply

Understand the different stakeholders and audiences they communicate with

Provide clear reports on financial performance and any issues that arise

9. Critical-thinking skills

Bookkeepers often need critical-thinking skills to help interpret the story behind the numbers.

Critical-thinking skills are soft skills that enable bookkeepers to analyze data objectively and understand all facets of a financial issue.

When anomalies or issues occur, bookkeepers can identify them and determine the reasons behind them using relevant information and asking the right questions.

Examples of critical-thinking skills include:

Analytical thinking

Being observant

Asking structural, outcome-based, and open-ended questions depending on circumstances

10. Problem-solving skills

Problem-solving refers to using critical thinking to come up with solutions. In bookkeeping, problem-solving can pinpoint inefficiencies and mistakes and anticipate potential issues.

According to a study by Robert Half, 41% of accounting professionals find problem-solving the most satisfying part of their career path.

Bookkeepers are often problem-solvers by default. Candidates with great bookkeeping skills should be able to:

Identify potential financial inconsistencies

Determine the cause of financial anomalies

Solve financial anomalies and irregularities

11. Time-management skills

Bookkeepers often have to deal with many tasks with competing deadlines, so they must have time-management abilities.

Time management greatly benefits from automating manual processes such as invoicing, payroll, inventory, and accounting with bookkeeping software.

Nevertheless, your new bookkeeper should be able to:

Meet deadlines

Prioritize tasks and handle multiple projects

Maximize productivity by managing their time effectively

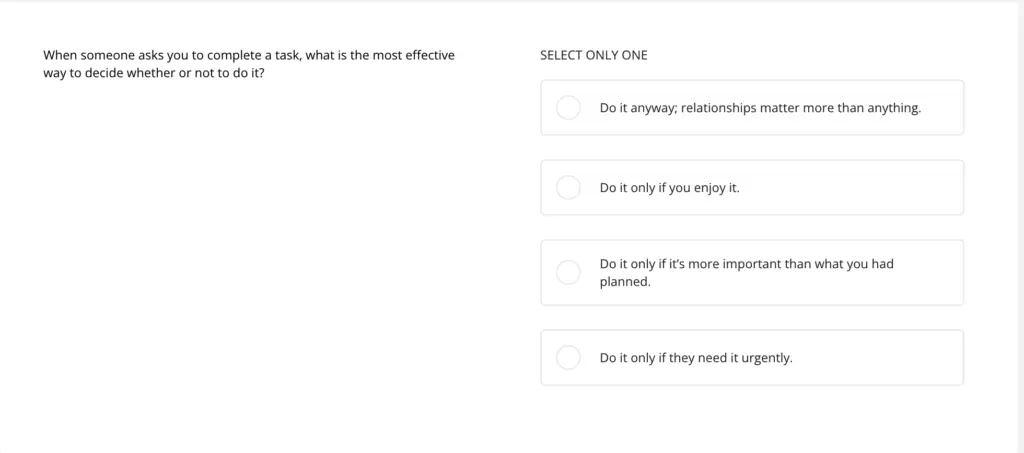

How to assess bookkeeping skills and traits

Having understood the main skills bookkeepers need to do their job at the highest level, we can now look at 15 TestGorilla talent assessments you can use to evaluate these skills before your bookkeeping interview.

Here’s a quick summary of the tests we cover below:

Accounts Receivable test

Accounts Payable test

Quickbooks Online test

Computer Literacy test

Advanced Accounting test

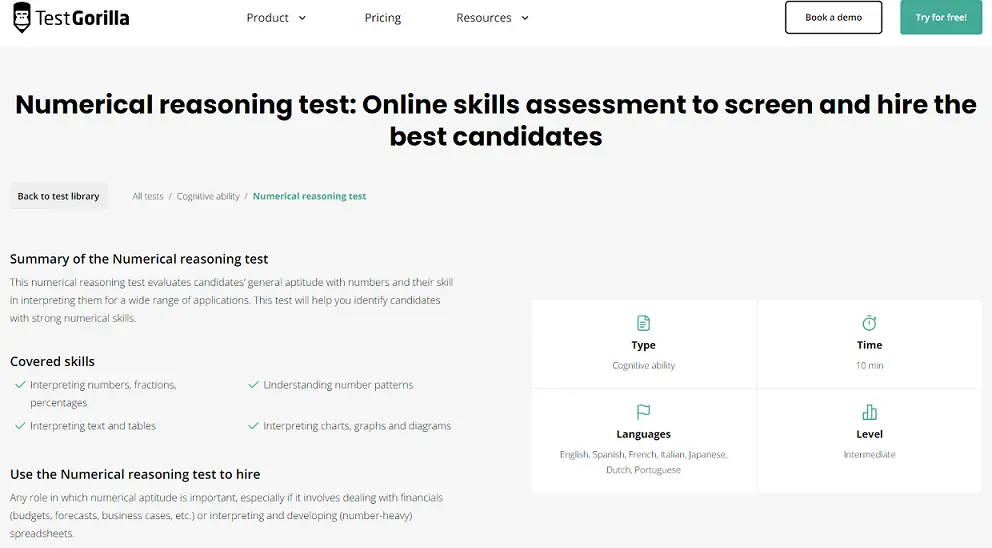

Numerical Reasoning test

Financial Math test

Financial Management test

Attention to Detail test

US GAAP test

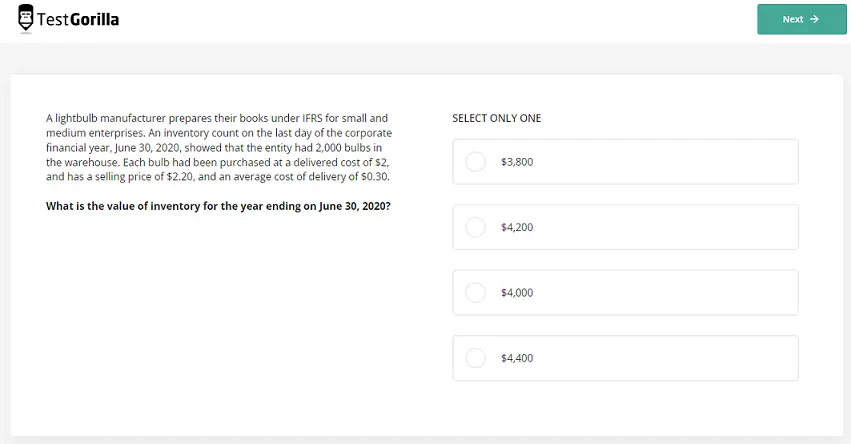

IFRS test

Culture Add test

Communication test

Critical Thinking test

Problem Solving test,

Time Management test

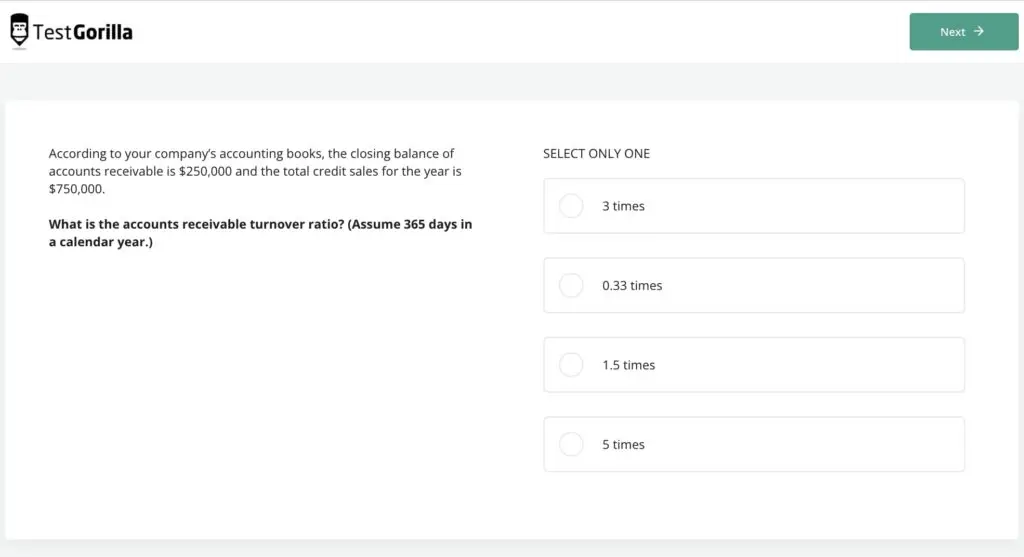

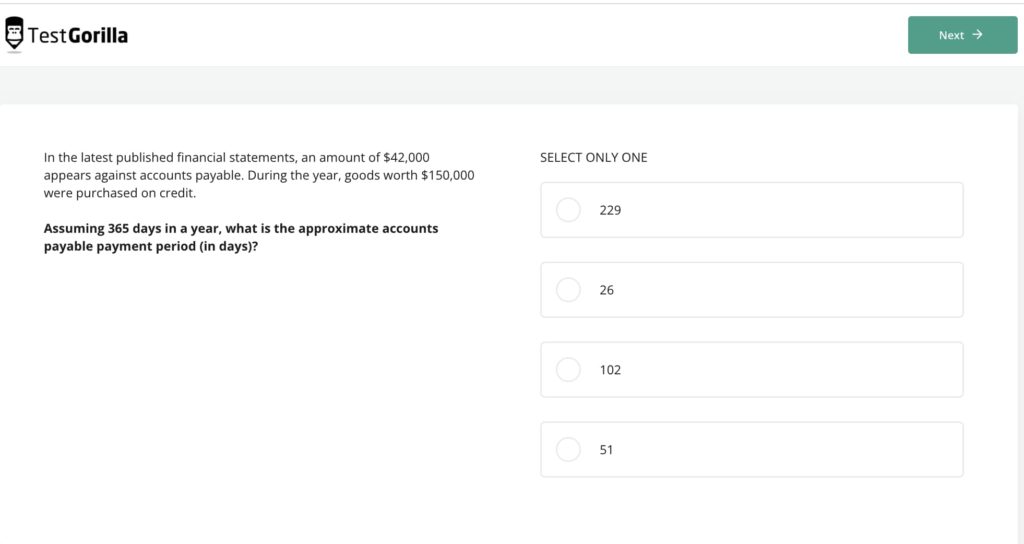

How to test bookkeepers’ accounts payable and accounts receivable skills

The Accounts Receivable test helps you assess candidates’ skills in identifying, recording, and managing accounts receivable.

Likewise, the Accounts Payable test asks them to solve specific calculations pertaining to accounts payable.

The two tests evaluate how well a candidate can manage outstanding invoices, track monies owed by customers, and handle debts owed to suppliers. These are all critical for maintaining healthy cash flow and strong vendor relationships.

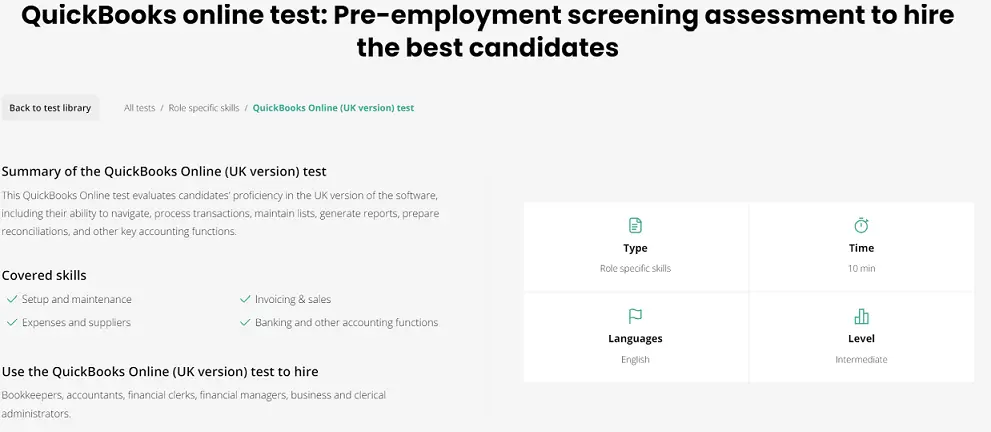

QuickBooks is a widely used bookkeeping software solution, and proficiency in it is a valuable skill for bookkeepers.

If your company uses Quickbooks for bookkeeping, you can assess candidates’ proficiency with this test.

Give your candidates a Quickbooks Online test to evaluate a candidate’s ability to navigate the software, process transactions, prepare reconciliations, and perform other essential functions of the accounting cycle.

A QuickBooks Online (US Version) test for US bookkeepers is also available.

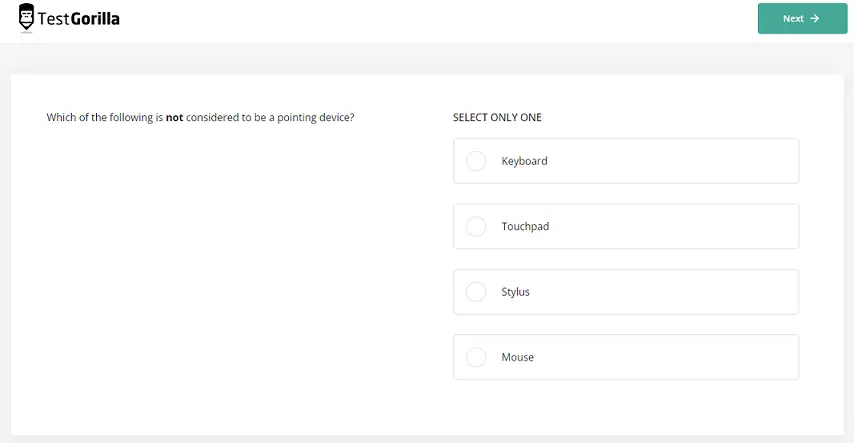

How to test bookkeepers’ computer literacy skills

Companies expect all employees, not just bookkeepers, to have computer literacy skills.

It’s easy to test your candidates’ literacy with our computer literacy tests. The Computer Literacy (PC) test applies to all your bookkeepers who are going to use PCs in the course of their jobs.

If your company uses Apple computers for bookkeepers, you can test their proficiency with the Computer Literacy (MAC) test.

How to test bookkeepers’ data-entry skills

The Advanced Accounting test helps you identify candidates with great data-entry skills by measuring their knowledge of accounting concepts and ability to calculate accounting figures and manage financial records.

Understanding the terminology of an accounting system is fundamental for effective bookkeeping.

Our Accounting Terminology (US) test evaluates candidates’ understanding of various accounting terms related to financial statements, books of accounts, and other aspects of financial transactions.

How to test bookkeepers’ numerical and math skills

TestGorilla’s Numerical Reasoning test measures a candidate’s ability to interpret and work with numbers.

The test presents candidates with questions involving sequences, fractions, ratios, and percentages. It assesses their ability to:

Interpret numbers, fractions, and percentages

Identify number patterns

Understand text and tables

Comprehend charts, graphs, and diagrams

The Financial Math test assesses a candidate’s ability to perform essential mathematical computations efficiently and accurately.

It enables you to identify candidates with the practical skills to handle the financial side of your large, medium, or small business effectively.

How to test bookkeepers’ attention to detail skills

Bookkeepers must be extremely detail-oriented to process financial information and prevent liabilities.

The Attention to Detail test enables you to assess a candidate’s ability to:

Compare statements for differences

Match and filter information

Check the consistency of information

Hire the best bookkeepers on the market

Curious to see how you can use TestGorilla’s talent assessments to hire the best bookkeepers on the market?

How to test bookkeepers’ organizational skills

Organizational skills refer to the best way bookkeepers can organize their workflow and the information they require to function effectively. Here are some talent assessments you can use to assess these skills.

The US GAAP test evaluates a candidate’s ability to perform accounting transactions.

The US GAAP is a widely accepted set of accounting standards and practices in the United States that ensure consistency and transparency in financial reporting.

The IFRS test measures a candidate’s ability to work according to International Financial Reporting Standards.

Knowledge of these standards goes a long way to keep bookkeepers organized and focused on the minutiae of their tasks.

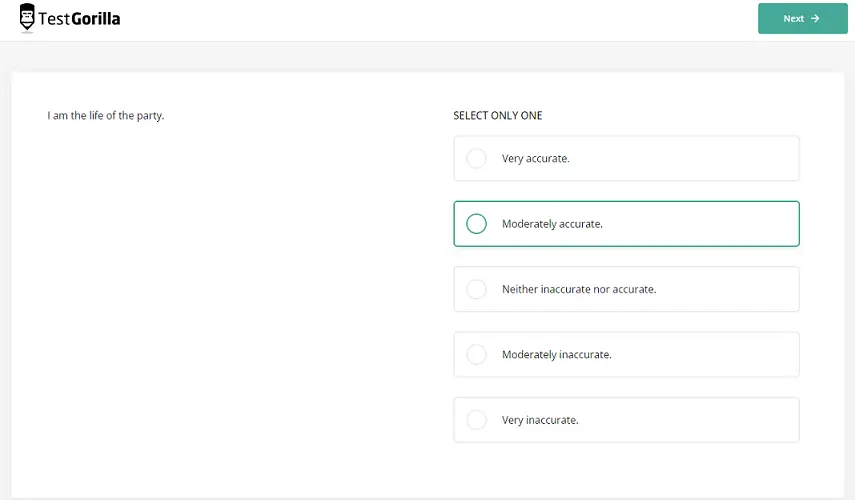

How to test bookkeepers’ integrity and transparency

It can be difficult to assess how well a candidate’s values align with your company’s.

Our Culture Add test enables you to customize your assessments to determine whether your candidates align well with the rest of your company.

Another option to test for transparency is the Big 5 (OCEAN) test, which can give you insights into your candidate’s personality and how likely they are to be open and transparent at all times.

Using these tests in conjunction with an in-person interview can give you a holistic view of your bookkeeping candidate.

How to test bookkeepers’ communication skills

Communication is paramount for companies that expand rapidly and cover multiple sectors like finance, technology, and travel under the same roof.

For example, Dyninno Group, a group of companies covering five sectors under one umbrella, used communication and other tests to improve its recruitment productivity by 400%.

As a soft skill, communication ability can be tricky to test.

TestGorilla’s Communication test helps you assess how well a candidate:

Comprehends and interprets written communications

Interprets non-verbal cues

Understands a task and derives related tasks

Can maintain professionalism throughout all communications

If you’re interested in sample questions, check out the Communication test preview.

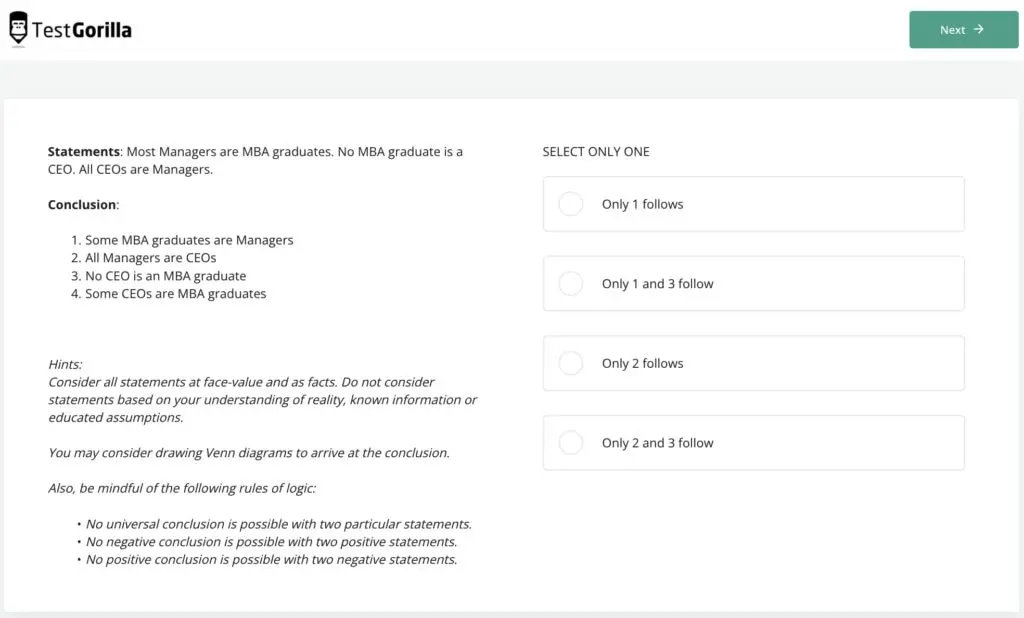

How to test bookkeepers’ critical-thinking skills

The ability to logically analyze and evaluate information is a key bookkeeping skill.

Our Critical Thinking test measures candidates’ critical-thinking skills by presenting them with numerical and written data and asking them to:

Solve syllogisms using deductive reasoning

Evaluate cause-and-effect relationships

Interpret sequences and arrangements

Recognize assumptions

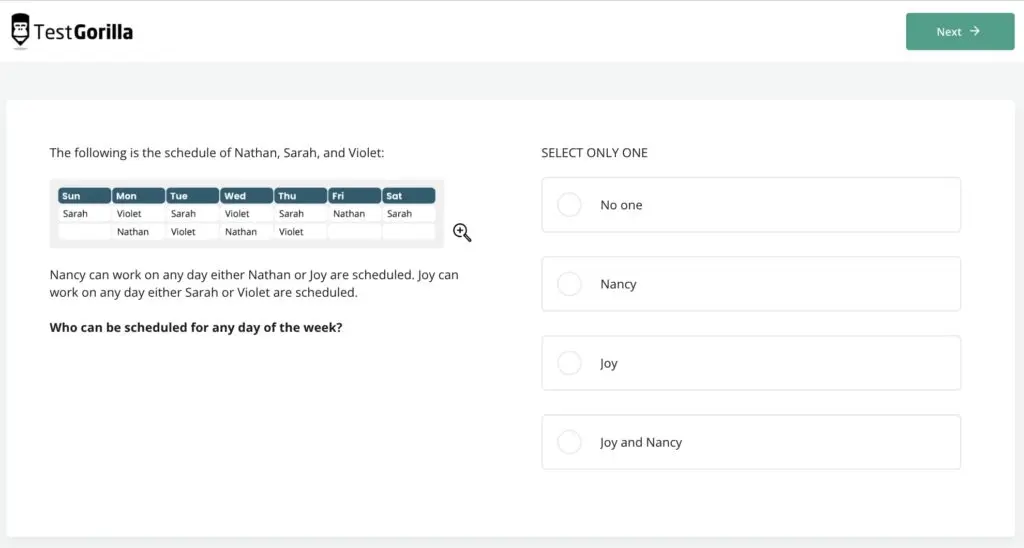

How to test bookkeepers’ problem-solving skills

The Problem Solving test presents candidates with different scenarios and asks them to analyze data and textual information and produce the most appropriate and effective solution. The test covers a candidate’s ability to:

Create and adjust schedules

Interpret data and apply logic to make decisions

Prioritize and apply order based on a given set of rules

Analyze textual and numerical information to draw conclusions

How to test bookkeepers’ time-management skills

TestGorilla’s Time Management test presents bookkeeping candidates with typical workplace scenarios and assesses their ability to manage their time and prioritize, plan, and execute tasks.

Candidates who excel in time management demonstrate strong organizational skills, an ability to set realistic goals, and discipline to adhere to schedules.

Hire a candidate with the best bookkeeping skills

Are you ready to hire a candidate with the best bookkeeping skills using TestGorilla’s talent assessments?

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

The 11 bookkeeping skills and how to test for them: A summary

Bookkeeper skills | How to assess them |

Hard skills | |

1. Accounting principles | Evaluate whether the candidate is fluent in accounts payable and accounts receivable |

2. Computer literacy | Assess if the candidate is comfortable using a computer to do their tasks |

3. Data-entry skills | Gauge the candidate’s proficiency in entering, double-checking, and verifying data from various sources |

4. Math and numerical skills | Look at a candidate’s ability to work with numbers, finances, and financial math |

Soft skills | |

1. Attention to detail | Assess a candidate’s ability to focus on what’s important |

2. Organizational skills | See if the candidate has the knowledge and practical skills to stay organized |

3. Integrity and transparency | Evaluate the candidate’s openness, ethics, and likelihood of abiding by rules and regulations |

4. Communication skills | Look at a candidate’s ability to work well and communicate with peers and third parties |

5. Critical thinking skills | Check the candidate’s ability to use reasoning to assess each situation and come up with the best way to deal with it |

6. Problem-solving skills | Verify that the candidate has an innovative approach to figuring out solutions |

7. Time-management skills | Gauge the candidate’s ability to organize their workflow and not fall behind on their tasks |

Assess and hire the best bookkeepers with TestGorilla

Finding the best bookkeeper isn’t easy without testing the right skills for a bookkeeper. Resumes don’t offer the best glimpse into the hard and soft skills of bookkeeping positions.

TestGorilla simplifies the hiring process. You can create a custom bookkeeping skills assessment to evaluate your candidates’ understanding of fundamental accounting principles and test proficiency in popular bookkeeping software.

By integrating these tests into your hiring process, you can identify candidates with the necessary bookkeeping knowledge and traits like attention to detail, integrity, and strong numerical and math skills.

Start with our demo – it’s the best way to see what our tests can do for your hiring process.

You can also try a product tour to understand the scope of what we’re offering before you make an account.

Finally, register for a free forever plan and get started on your own terms.

Bookkeeping skills FAQs

Now that you discovered the most important bookkeeping skills and how to assess them, let’s close this article with a few frequently asked questions.

What is a bookkeeping skills test?

A bookkeeping skills assessment measures a prospective employee’s financial prowess, precision, and attention to detail. The tests in a bookkeeping assessment often take the form of problem-solving tasks that require candidates to demonstrate their competency in handling realistic financial situations.

TestGorilla’s pre-employment tests, for example, include a variety of scenarios that mirror real-life bookkeeping duties.

Why are bookkeeping skills important?

Bookkeeping skills are important because they facilitate financial control and compliance, enable effective auditing, and assist budget preparation, analysis, and management. These skills support overall business planning and can enhance an organization’s reputation by ensuring accuracy.

What are the skills of a bookkeeper?

Numerical and math skills

Computer literacy

Attention to detail

Organizational skills

Integrity and transparency

Learn more about these and other key bookkeeping skills above.

What are the qualities of a bookkeeper?

Attention to detail

Communication

Ethical integrity

Problem-solving skills

You need a specific bookkeeping assessment test to gauge each of these qualities.

Is bookkeeping a skill for resumes?

Yes, you can include bookkeeping in resumes if you’re applying for a job that requires basic bookkeeping skills.

However, if you’re looking to hire a bookkeeper, you’re better off testing for skills than parsing resumes or looking for a bachelor's degree because candidates can achieve these skills through alternative means, such as bookkeeping courses and certifications.

How do bookkeepers differ from accountants?

Bookkeepers and accountants usually do similar types of work and have interchangeable skills. A bookkeeper records transactions and organizes the finances of a company. On the other hand, an accountant is more focused on providing financial analysis and consultation for a firm.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.