The ability to manage budgets is quickly becoming a necessary skill for workers in many industries. It’s vital for professionals in supervisory and management roles since they often lead any budgeting process that a company adopts.

Creating and monitoring a successful budget will facilitate your organization’s development and enhance its financial position by ensuring that its monetary resources are properly overseen.

To manage a budget correctly, your team needs several important sub-skills.

Therefore, it’s beneficial to give your job candidates a prescreening assessment during the recruitment process. This will enable you to test their skills in budget analysis and related fields like project management.

In this article, we will cover everything you need to know about revamping your organization’s budget management team.

We’ll explore the concept of budgeting and budget management and let you know about the best budgeting test to improve your hiring process.

What is budgeting?

Budgeting is the act of analyzing a company’s total revenue and expenses over a particular accounting period. It provides insights into whether an organization can continue its usual operations with the projected revenues and expenses.

Budgets are typically drafted for a financial year and contain projected sales and business expenditure data for that accounting period. The budgeting data enables companies to compare their expected performance level against their actual performance.

Budgeting is a key aspect of financial management in that it involves planning the use of resources, such as people, cash flow, capital spending, and target setting, to meet financial goals. It’s a good practice to develop and apply financial controls and policies to reinforce a budget.

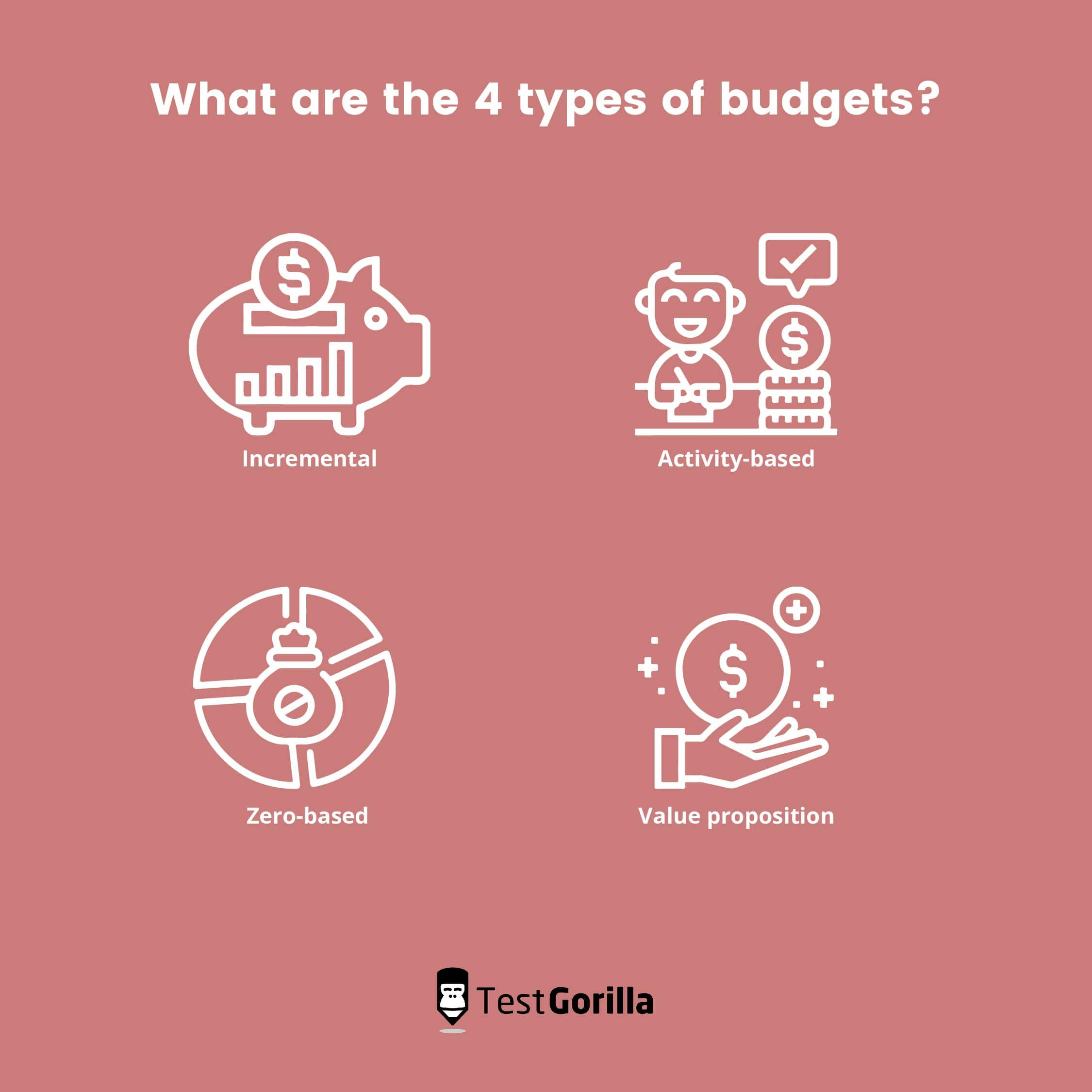

What are the 4 types of budgets?

You can categorize budgets into different types depending on the perspective that you use to view them.

There’s a category for its form (deficit, surplus, and balanced), another for the sectors it operates in (government, business, family), and others.

In this article, we’ll categorize budgeting based on how it calculates business costs.

Learning about each type of budget alongside its benefits and setbacks can help you approach budgeting more creatively in the workplace. Below, we describe the four types of budgets according to their approach.

1. Incremental budget

Incremental budgeting is the most popular budgeting method due to its simplicity and ease of use. It adds or subtracts a specific percentage from the previous year’s numbers to determine the next year’s budget.

It’s ideal for many organizations because of its straightforwardness, especially if business costs are predictable. Incremental budgets are equally useful for companies that change little over time and have relatively stable business costs through the years.

Pros

It’s straightforward and requires minimal calculations since it merely adjusts current numbers to prepare future budgets

It saves time because of its simplicity

It ensures a consistent budget over the years

It helps to stabilize business funds since costs are easily predictable each year

There are few to no internal challenges due to equal budget allocation and adjustment between all departments in the organization

Cons

The incremental budget approach may trigger unnecessary spending since the overall budget typically increases by a set percentage

It can also affect a company’s overall effectiveness since some departments could need more than their budget allocation, while others could have a surplus budget for their activities

It leaves little to no room for innovation because the future budget depends on the previous year’s numbers with only a few adjustments

The budget doesn’t prepare for unexpected changes or external variables

It discourages the company’s management from deeply analyzing costs and savings

2. Activity-based budget

Instead of using numbers from the previous and current years, the activity-based budget approach focuses on the vital goals the organization aims to accomplish in that period.

This method is suitable for companies that lack sufficient data or historical info to prepare their budgets, such as new businesses and startups. It’s also helpful for firms undergoing substantial organizational changes that don’t require past data for future budgets.

For instance, imagine a business that aims to develop a new product that requires a solid marketing strategy. The objective is to make $5m from the product with the help of the production and marketing teams.

Since the company has no past data on this new product, the activity-based budget uses a top-down method of working backward from the revenue goal. The budgeting team will agree on what marketing strategies to adopt, what KPIs and metrics to observe, and the expected sales.

In our example, the budget items may include the costs of email marketing, dynamic remarketing, A/B testing, social media influencing, SEO best practices, and other agreed-upon marketing tactics.

The activity-based budgeting method uses a more strategic approach to budgeting than the other types. It requires companies to spend more time and resources preparing the budget, but it is usually great for innovative businesses due to its flexibility.

Pros

It provides management with reliable insights into where to improve instead of basing a budget on previous ones

It’s easier to recognize areas of the organization that require more or less budget allocation

The approach’s top-down resource allocation strategy enables the business to remain focused on its goals

The budget’s flexibility takes unforeseen events and external factors into account

Cons

It takes longer to analyze and prepare, which could be counterproductive

The approach’s complex budgeting method requires the budget planner to have extensive experience in fiscal planning and budgeting

It could lead the company to consistently pursue short-term goals and lose sight of its long-term objectives

It could result in cash flow problems if the forecasts are wrong

3. Zero-based budget

Zero-based budgeting is a zero starting point or blank slate. It involves creating a budget and justifying each item without respect to previous budgets.

Simply put, an item in past budgets need not be in future budgets unless there’s an actual need or justification for it.

This method takes time because budget owners have to justify every proposed item. However, it’s great for removing irrelevant costs and recognizing expenses that are critical to the core of the business. Companies use this method to improve operational efficiency.

Furthermore, zero-based budgeting enforces careful planning for every dollar the organization aims to spend in the proposed budget. That said, some believe that its many benefits don’t outweigh the time it requires.

Pros

The zero-based budget is great for removing irrelevant costs and inflated budgets

Its strategy makes the company’s management accountable for expenses

It helps to control the organization’s costs and minimize adverse effects on business operations

Cons

It requires a lot of time, resources, and extensive reviews

The zero-based strategy may only have positive short-term effects and cause the company to lose sight of the bigger picture.

Managers can use the zero-based strategy to manipulate the budget to infuse more resources into their departments

4. Value proposition budget

The value proposition budgeting method is somewhat of a hybrid between incremental and zero-based budgeting. It involves examining every budget item and reflecting on the reason for spending and its value to relevant stakeholders.

It’s a strategy for justifying expenses by focusing on their values. Whereas the incremental budgeting method involves minimal budget analysis, the zero-based budgeting approach requires extensive analysis. The value proposition budget, on the other hand, falls in the middle.

This strategy isn’t for every business, but if prepared properly, it can boost profits, add value to the company’s brand, and foster customer loyalty.

Pros

The value proposition approach enables leaders to recognize items that create the most value and eliminate expenses that are irrelevant to the company’s goals

It separates the business from competitors by keeping management focused on the organization’s core values

The method helps the company to remain customer-centered and focus on creating more value for customers

It enables extensive budget examination and cost optimization

It helps the company to channel its marketing efforts toward items and activities that will yield the best results

Cons

It can be hard to quantify “value” in terms of metrics and reports

The method could result in a fixation on short-term considerations instead of long-term effects

An item’s potential value could fluctuate according to external factors

It could be complex to identify the value of some items, causing essential items to be removed because they hold no immediate value

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

What is budget management?

Budget management is the process of handling and monitoring an organization’s income and expenses.

It’s a crucial business practice that’s usually handled by a budget manager and a team that ensures all expenses remain within the budget.

Budget managers are also in charge of adjustment requests, transfer submissions, payment requests, and transaction approval in the company. A well-structured budgeting process lays the foundations for sustainable business growth and development.

Budget management is one of the vital financial practices in an organization. Employees in a budget management role must be adequately skilled to prepare and oversee financial plans over a specific period.

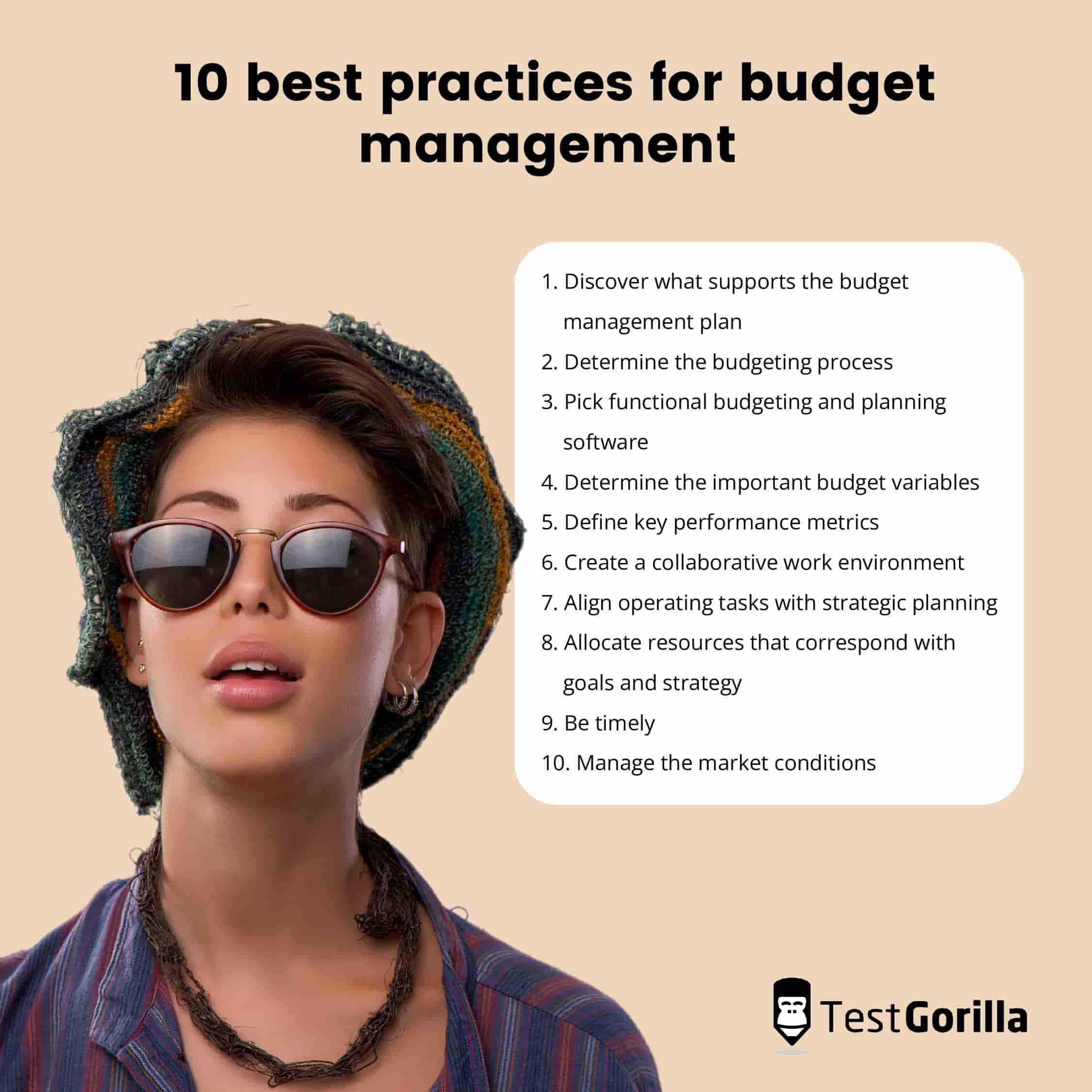

10 best practices for budget management

There are some important procedures and practices to follow when managing a budget. Many successful organizations use these processes to maintain and improve their financial position.

Below are 10 best practices you should follow when managing a budget for your company:

1. Discover what supports the budget management plan

The first step to preparing a good budget is understanding the elements that reinforce your budgeting strategy. You must be attentive to employees and operations and consider how technology can influence the business.

During the interview stage of the hiring process, it’s important to properly examine employees’ skills and delegate duties according to their areas of expertise. By asking the right interview questions, you can identify highly skilled employees with sufficient experience.

After recruiting top employees and assigning them tasks, you should provide them with the tools and procedures they’ll need to carry out their duties efficiently. This will also ensure proper budget documentation, flexibility, and control.

Allocating the right resources enhances the transfer of knowledge across the budgeting team and reduces work dependability. It enables a company’s management to focus on information analysis instead of full-on process management.

2. Determine the budgeting process

Budgeting processes help reveal the essential items and goals for the budget throughout the entire process lifecycle. Creating a strategic budgeting process lays a solid foundation for an effective budget.

However, it requires companies to define the key elements of the process and determine what tools to use for each stage of the project.

Process definition enables businesses to make more informed choices based on data analysis and product or service expense recognition.

3. Pick functional budgeting and planning software

Modern budget management practices involve using budgeting software apps to ensure the entire budgeting process is efficient, consistent, reliable, and accurate. Companies use budgeting programs to handle many of the more complex budgeting tasks.

Invest in a software package that serves as a business performance management and process automation tool since this will support your company’s business intelligence. Some reliable budgeting software packages are Prophix and Hyperion.

Ensure you thoroughly research all the available options to determine the best application for your organization. You can also discuss this decision with the management or conduct more user meetings to further assess and distinguish the best software for your budgeting needs.

4. Determine the important budget variables

Adding excessive details to a budget can have the same adverse effect as including minimal details. Rather than adding irrelevant information to the budgeting process, spend more time determining which elements are vital.

Understanding these crucial variables helps you to differentiate them from the less relevant ones. For instance, preparing a budget for overall office expenses is more relevant than planning a budget for only stationery costs.

Preparing a budget that includes only relevant details also reduces the review time because it provides sufficient details for budgeting assumptions and the flexibility to change business finances when necessary.

5. Define key performance metrics

Key performance indicators (KPIs) are financial and non-financial metrics for quantifying set goals and reflecting the strategic performance of a business or project. KPIs provide data on key business drivers so that companies can allocate resources more effectively.

Budget managers often use KPIs to gauge the organization’s current state. You can find specific KPIs in industry trend reports and company annual reports.

Most industries have distinct metrics for determining an organization’s financial standing. Some popular business KPIs are revenue growth, earnings growth, EBITDA margin, and debt reduction.

Make sure to incorporate KPIs that are relevant to the budget’s goals and the overall business objective. Good KPIs include definition, measurement, and the target goal.

6. Create a collaborative work environment

To further understand the budget’s lifecycle, collaborate with other experts in the organization. A budget management process requires reviewers to provide directions, managers to validate details, and budgeters to collect data.

A good example is a typical budget approval process in which business executives decide on the business strategy to implement, management executes the agreed-upon strategy, and the budgeting team provides the necessary information.

Collaboration creates a more transparent and accountable work atmosphere and a better implementation of the business plan. You can improve collaboration in the company by organizing meetings, feedback forums, and surveys.

7. Align operating tasks with strategic planning

An organization’s daily operations must correspond with its strategic plans to ensure a coordinated planning process across all departments. This alignment helps with monitoring, measuring, and documenting the budgeting process.

This practice also helps companies gain a competitive advantage by formulating a clear objective. It’s commonly used in top businesses as they extend their corporate strategy from the top management hierarchy to other departments.

For instance, when company executives prepare goals, finance shares the goals and expenses across relevant departments. Departmental managers then implement their part of the plan.

8. Allocate resources that correspond with goals and strategy

It’s an undebatable fact that every business activity needs resources – whether they be time, money, or energy – to operate effectively. Whereas some activities receive surplus resources, others experience shortages.

To avoid operational discrepancies and imbalances in budget plans, make sure to sync the company’s required resources with its goals. This practice helps the business make smarter project investments and attain the expected results.

Before you disburse resources, it’s important to remember the budget’s aims and identify KPIs relevant to the corporate plan.

You can use business intelligence tools to discover potential risks and opportunities and properly allocate project resources.

You can also make your budget allocation process easier by using dashboarding, score recording, and what-if scenarios to track results.

Essentially, this practice focuses on finding the best action to take to enhance the company’s budget management processes.

9. Be timely

Many organizations stress the time-consuming part of budget management. Some budget planning spans six months or longer, resulting in immaterial data when the plan takes effect.

After defining clear KPIs, the project plan, and the allocation of resources, you can prepare a successful budget in two months or less. Timeliness ensures that the data you get in that period is recent and useful to the organization.

You can prepare a more timely budget plan using tech tools to develop easy and quick planning cycles, giving your company more time and resources to accomplish other targets.

10. Manage the market conditions

This practice entails planning processes to handle external conditions that may influence budget preparation. Managing market conditions helps organizations remain efficient despite seasonal changes, a transforming business climate, and other factors.

What are budget management skills?

Budget management skills refer to the knowledge and abilities needed to supervise an organization’s financial standing and regulate costs for its budget.

These skills are vital to running the entire budgeting process of short- and long-term projects.

A typical budgeting process involves:

Communicating with stakeholders

Identifying short- and long-term financial goals

Creating charts and displaying financial data during presentations and meetings

Conducting financial analyses

Examining expenses

Budget managers need the skills to boost and maintain the company’s profits. Having the right skill set enables them to help the management plan future expenses and channel resources accordingly.

You can include a budgeting test during recruitment to ensure that you hire highly skilled employees for your organization’s budgeting processes and other administrative or accounting functions involved in their job roles.

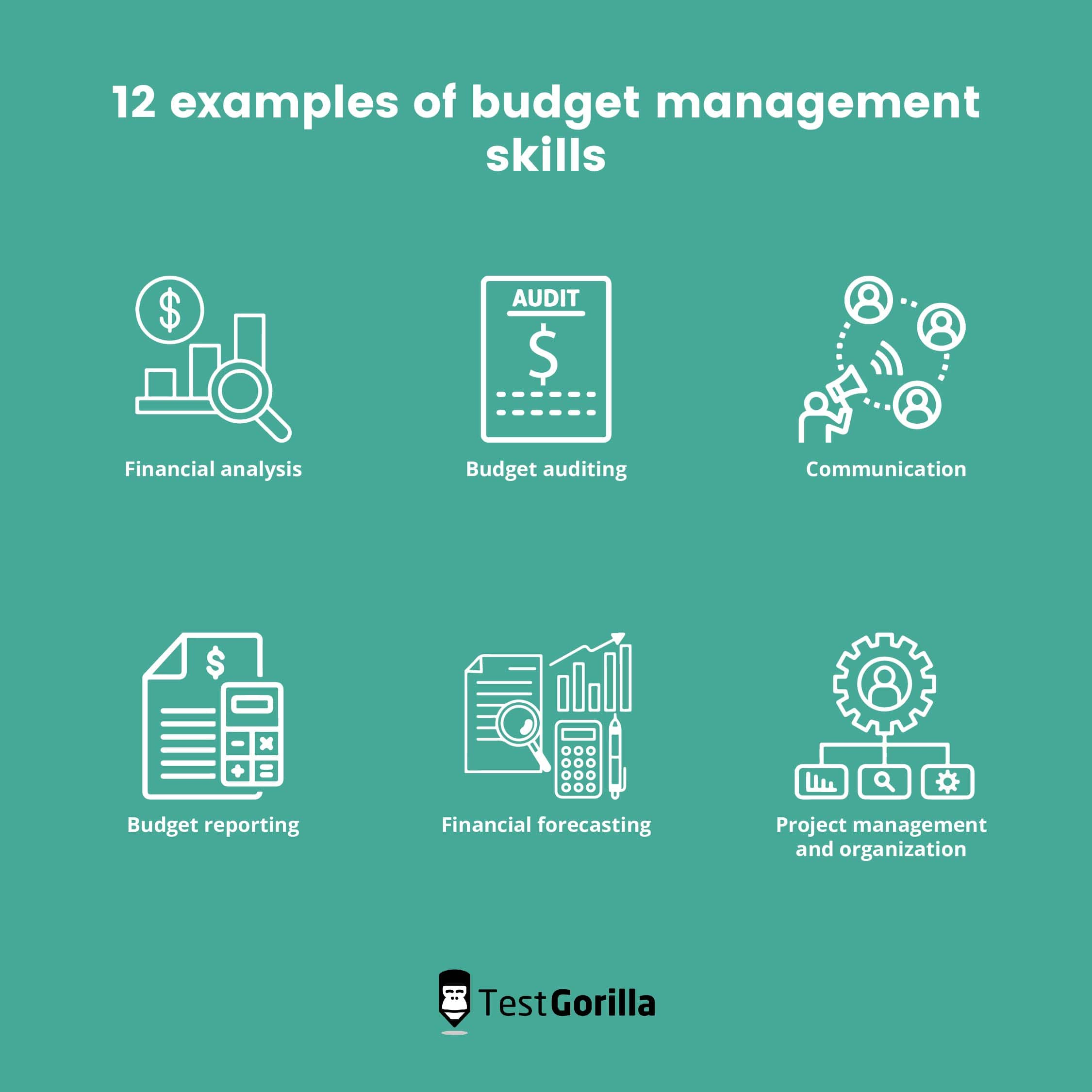

12 examples of budget management skills

You can identify exceptional employees by the quality of their individual achievements and teamwork in different departments.

But suppose you want to recruit new employees for this job role. In that case, you can use a credible assessment like TestGorilla’s Budgeting test, which ensures that you recruit a team of employees with the necessary skills to create and maintain a budget.

This test analyzes a candidate’s ability to read and interpret financial data, estimate the financial resources and requirements for a project, track and manage a budget, and apply financial policies and controls for an organization.

Below are some other vital skills for budget management:

1. Financial analysis skills

Financial analysis is a basic budget management task that involves collecting data from financial statements to prepare a budget and enhance its strategy. A budget review requires strong analytical abilities to examine the organization’s financial standing and performance.

A proper financial analysis facilitates business growth through a well-developed budget and effective financial model. It helps companies recruit new workers, invest, buy equipment, and keep other costs well within the budget.

2. Budget auditing skills

Budget auditing deals with assessing a budget’s dynamics and examining how viable it is for the long term. It involves data collection for budget statements and identifying any misappropriation of funds.

It also requires knowledge of financial compliance policies and how to compare a firm’s use of its finances with industry standards. A skilled budget auditor uses the audit’s results to enlighten the team on best practices and improve subsequent company budgets.

3. Communication skills

Budget management requires clear communication regarding the organization’s goals between all relevant stakeholders, management, and team members. Professional budget managers and other in-field experts should be able to communicate financial trends and forecasts effectively.

They must have proper oral and written communication skills so that colleagues and stakeholders can clearly understand the current budget status and financial standing of the business. This will improve their ability to accomplish their tasks on time.

4. Budget reporting skills

Budget reporting is a useful skill for employees in money management roles because it involves writing and formatting budget reports to predict future financial choices. It enables them to determine and compare the organization’s financial goals with the financial reports after a given period.

After reviewing the reports, they can use the results to manage the company’s budget more effectively in the next accounting period.

5. Financial forecasting skills

Forecasting is the act of developing revenue estimates for the fiscal year based on data from previous financial reporting periods and other projections. Budget managers use forecasting skills to assess business growth and determine how to allocate investment funds.

Forecasting enables the management to discover possible costs and revenue sources that can influence the budget’s accuracy or pose bigger risks to the financial planning process. It also ensures that the budget is properly maintained throughout the entire fiscal year.

6. Project management and organizational skills

Budget creation and management require an extensive understanding of several financial accounts and the skills to monitor various income streams. Organizational skills help identify how much of the budget remains at any time in the accounting period.

It also eases the search for specific transactions in an audit. Budget managers need organizational skills to monitor financial costs and revenue, maintain financial documents, create reports, and organize financial data.

Project management skills enable the team leader or budget manager to create a collaborative work environment. You can use a Project Management test like TestGorilla’s to shortlist the best candidates for the job.

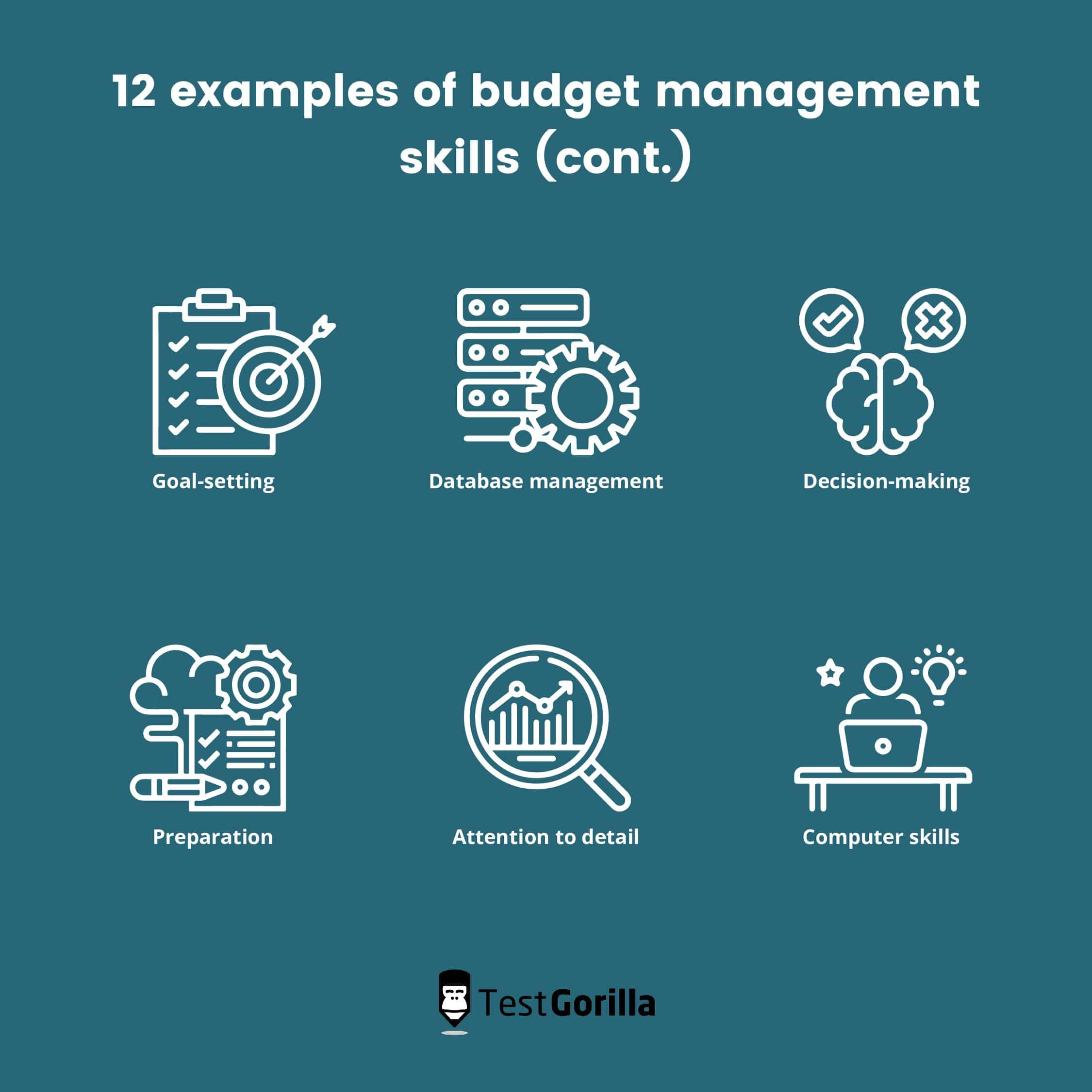

7. Goal-setting skills

A budget can only be effective if the business has a specific goal it aims to achieve in that accounting period. Increasing revenue generation and savings or cutting expenses are achievable financial goals that help guide budget management.

Skilled budget managers use past financial results and budgets to create revenue estimates to set greater goals for the next accounting period. Goal setting helps companies to keep a balanced budget while having sufficient cash flow throughout the fiscal year.

8. Database management skills

Budget management involves using databases for recording and analyzing financial data, creating reports, and identifying patterns. Database management skills enable you to monitor spending and present financial reports to team members, executives, and stakeholders.

They’re also important for managing the entire budgeting process, creating reliable forecasts, saving large data sets, and organizing data in charts and graphs for better presentation.

9. Decision-making skills

The entire budgeting process lifecycle involves decisions on how to spend, how to cut costs, or what to prioritize in future budgets. Decision-making skills enable employees to increase profits, implement budget cuts, and develop realistic financial goals.

They also help create procedures for project expenses – for example, determining how much money a department needs and how the fund distribution system is arranged.

10. Preparation skills

Preparation skills are essential for budgeting since budget managers must determine the company’s objectives and determine the expenses needed to run the organization.

They must be prepared so they can ascertain if the business has sufficient resources to invest in areas that enhance its operational efficiency. Preparedness promotes reliable financial forecasts and projections.

11. Attention to detail

It’s also crucial for budget managers to be attentive to detail when collecting and recording financial data and creating reports. Attentiveness helps them prepare accurate data records for cost monitoring, forecasting, and the overall budget plan.

This skill is also critical when tracking costs to ensure that the budget data matches the company’s available funds.

12. Computer skills

Proficiency in basic computer operations is another major requirement for budget managers. They often use databases and spreadsheets to record expenses and assess financial reports. They also use budgeting software to analyze data accurately.

4 tips for improving budget management skills

Use the tips below to boost budget management skills in your workplace.

1. Include a budgeting course

You can recommend budgeting courses and workshops for employees to expand their budget management skill set. Look out for courses that provide learning materials with new strategies on budget allocation, forecasting, and projections.

Some courses also offer practice sessions for budget creation and analysis. You can find the best budgeting courses online or via recommendations in budgeting symposiums and workshops.

2. Learn to use budgeting software

Database management tools and spreadsheets are essential for making the entire budgeting process easier and faster. New technologies help create a more effective and automated management process.

Good budgeting software can aid you in preparing cost statements, reviewing information, predicting income standings, and using math to ascertain data accuracy.

You should research the best and most affordable budgeting software packages that fit your organization’s needs.

3. Assess budget performance frequently

You can boost budget management skills in your organization by occasionally reviewing the company’s budget performance. Monthly reviews enable you to develop fresh strategies for budget management and income generation.

You can use past budgets in the financial database to examine performance. These previous budgets can inspire you to prepare a new and improved budget that still fits the organization’s management style.

4. Create a documentation system

Ensure you have an appropriate documentation framework to improve the budget requirements for your team and the entire process. You’ll have better documentation if you submit receipts and record purchases.

Join the emerging recruitment wave

Now that we’ve journeyed through the fundamentals of budgeting, described the best prescreening test, and discussed the essential budgeting skills, the next step is to conduct interviews. This stage determines whether or not shortlisted candidates can succeed in the job.

Interviews provide you with an opportunity to test candidates’ confidence, critical-thinking skills, and oral prowess while discussing their skills. You can present a sample budget report for applicants to examine. This short assessment will reveal their practical skills to you in real-time.

Similarly, you can research sample budgeting questions to engage candidates and further examine their skills.

Don’t forget to include a prescreening test like our Project Management test in your recruitment process to bolster your hiring.

Register with TestGorilla today to access the tests you need to revamp your organization’s budgeting team.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.