55 claims adjuster interview questions (+ sample answers)

Claims adjusters help decide how much should be paid out on insurance claims. But finding someone with the right mix of technical knowledge, problem-solving, and people skills isn’t easy.

A poor hire can lead to bad decisions, legal issues, and unhappy customers – so getting it right really matters.

Luckily, the right interview questions help you get to know candidates beneath the surface. You’ll see their strengths and weaknesses, what makes them tick, and how they might fit into your team.

To help you with this, we've compiled 55 top claims adjuster interview questions so you can hire someone who'll excel in the role.

Table of contents

- General claims adjuster interview questions

- Role-specific claims adjuster interview questions

- Top hard skills interview questions for claims adjusters

- Top soft skills interview questions for claims adjusters

- Questions on managing claim investigations and fraud detection

- Situational interview questions for claims adjusters

- Key qualities of effective claims adjusters

- Hire top claims adjusters with a multi-measure approach

- FAQs

General claims adjuster interview questions

These questions help you get a feel for the candidate’s personality, career goals, and overall experience in the industry. Look for answers that show genuine interest in the role, self-awareness, and a strong work ethic.

For example, a great response to “What drew you to this profession?” might mention a desire to help people during stressful situations or a background as a customer service representative or in investigative work.

Some general questions include:

1. What drew you to the claims adjuster profession?

2. How do you envision your career progressing over the next few years?

3. What is your greatest strength as a claims adjuster?

4. What challenge did you face in your previous role, and how did you overcome it?

5. Do you have any questions about the role or our company?

6. What motivates you to seek a new job at this point in your career?

7. What do you know about our organization, and what makes it appealing to you?

8. What unique skills or perspectives would you bring to our team?

9. What keeps you motivated in your professional life?

10. Do you prefer collaborative projects or working independently?

11. How do you define success in your work?

12. What are you hoping to find in your next role?

13. Describe the type of work environment where you perform best.

Role-specific claims adjuster interview questions

These questions focus on the unique tasks and challenges for candidates applying to a claims adjuster position in your industry and company – whether it’s auto, property, liability claims, or specialized insurance.

Strong candidates will show a solid understanding of policies, claims processes, and regulations and a proactive approach to handling complex cases. This proves they can manage the job, make fair decisions, and prevent issues before they arise. Those who lack this mindset may struggle with compliance and efficiency.

Here are some examples:

14. What strategies do you use to investigate and validate claims?

Example answer: “I begin by reviewing the policy coverage to confirm eligibility. Then, I collect evidence through site inspections, photos, recorded statements, and third-party reports from contractors or medical professionals. If needed, I consult forensic experts to verify the cause of damage. I cross-check findings with policy terms to ensure accurate decisions and document everything thoroughly to support my final assessment.”

15. How do you determine the appropriate settlement amount for a claim?

16. What types of claims are you most experienced with handling?

17. Describe your systematic approach to handling large-scale disaster claims.

18. How do you ensure compliance with company policies and insurance regulations?

19. What is your process for adjusting claims in contentious situations?

20. What's your negotiation process for claims settlement?

21. Have you had experience with claims that involve multiple parties? How do you manage these?

22. What do you find most challenging about the claims adjustment process?

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Top hard skills interview questions for claims adjusters

These questions test a candidate’s technical skills, like understanding insurance laws, using claims processing systems, and estimating damages.

A great claims adjuster pays close attention to detail, thinks analytically, and knows how to use industry-standard software. Strong documentation skills are also important – without them, mistakes can happen, leading to inaccurate claims and delays.

Here are some effective interview questions to test your candidates' hard skills:

23. How do you determine policy coverage for a specific claim?

Example answer: "I start by thoroughly reviewing the claimant's policy and verifying their coverage limits. I look at key terms, exclusions, and endorsements that might impact the claim. If there's any ambiguity, I consult internal guidelines or discuss them with underwriting to ensure a correct interpretation. Clear documentation is crucial, so I always provide a written summary of my findings."

24. What tools and software have you used for claims processing?

25. How do you assess the extent of damage in a property or auto insurance claim?

26. What experience do you have with claims re-inspections?

27. Describe how you use data analytics in your work.

28. Have you implemented any technological solutions to improve claim accuracy?

29. What certifications do you hold that are relevant to claims adjustment?

30. How do you keep your technical skills in claims processing up to date?

31. How do you handle cases where policy language is ambiguous?

Top soft skills interview questions for claims adjusters

The best applicants will be clear communicators who can explain claim decisions in a way that policyholders understand. They should also be skilled negotiators who stay calm and professional in tough situations.

Problem-solving is key, as claims adjusters often need to make quick, effective decisions – especially during challenging times when issues escalate unexpectedly.

Below are some great questions:

32. How do you handle a policyholder upset about a denied claim?

Example answer: "When a policyholder is upset about a denied claim, I listen carefully to their concerns without interrupting. I acknowledge their frustration and explain the denial using simple, non-technical language. I walk them through the specific policy terms and, if applicable, offer alternative solutions like an appeal process or additional coverage options. Keeping the conversation respectful and focused on solutions helps build trust."

33. How do you approach sensitive or emotionally charged claim situations?

34. How do you explain complex insurance concepts to policyholders who don't understand industry terminology?

35. How do you manage a high volume of claims while maintaining accuracy and customer service?

36. Describe a time when you had to persuade a client to accept a difficult decision.

37. What techniques do you use to manage stress in high-pressure situations?

38. How have you handled miscommunication in the past?

39. Describe how you would manage a situation where a client’s expectations aren’t aligned with policy provisions.

Questions on managing claim investigations and fraud detection

Fraud detection is a key part of a claims adjuster’s job. These questions help assess how well a candidate investigates claims and spots red flags.

Look for those who can identify suspicious patterns, follow a clear investigation process, document findings properly, and escalate when needed.

Here are some essential questions to assess fraud detection capabilities:

40. What are some red flags that indicate a potentially fraudulent claim?

Example answer: "Some key fraud indicators include policyholders with a history of frequent claims, vague or changing statements, and lack of supporting documentation. Claims filed immediately after a new policy is purchased or those where the damage doesn't match the reported cause are also concerning. In such cases, I conduct further verification before processing the claim."

41. How do you approach investigating a suspicious insurance claim?

42. Can you describe a time when you uncovered a fraudulent claim? What actions did you take?

43. How do you conduct background checks on claimants?

44. What are the most common types of fraud you have encountered?

45. Describe a complex fraud case you have managed.

46. How do you use technology to aid in fraud detection?

47. What are your strategies for maintaining integrity in the claims process?

Situational interview questions for claims adjusters

These questions help you understand how a candidate would handle real-life situations they might face on the job.

Look for people who stay calm under pressure, follow policy guidelines, and handle tough situations professionally. Avoid candidates who seem unsure or don’t have enough hands-on experience with complex claims.

Here are some questions to assess your candidates' responses to different scenarios:

48. Imagine a claimant disagrees with your settlement offer. How would you handle it?

Example answer: “I would start by listening to the claimant’s concerns to understand their point of view. Then, I would explain the basis for the settlement, referencing policy details and supporting evidence like repair estimates. If they have additional documentation, I would review it to ensure a fair evaluation. If a compromise is possible within policy limits, I would explore that option, but I would also ensure compliance with company policies and industry standards.”

49. A policyholder provides incomplete or conflicting information. What steps do you take?

50. You suspect a third-party contractor is inflating repair costs. What do you do?

51. How would you handle a scenario where new information substantially changes a claim's scope?

52. Describe how you would deal with a situation where two claimants dispute the cause of an accident.

53. How do you ensure timely claims resolution during peak periods?

54. What steps do you take when you suspect an internal error has occurred in claims processing?

55. How do you manage expectations with external adjusters or contractors?

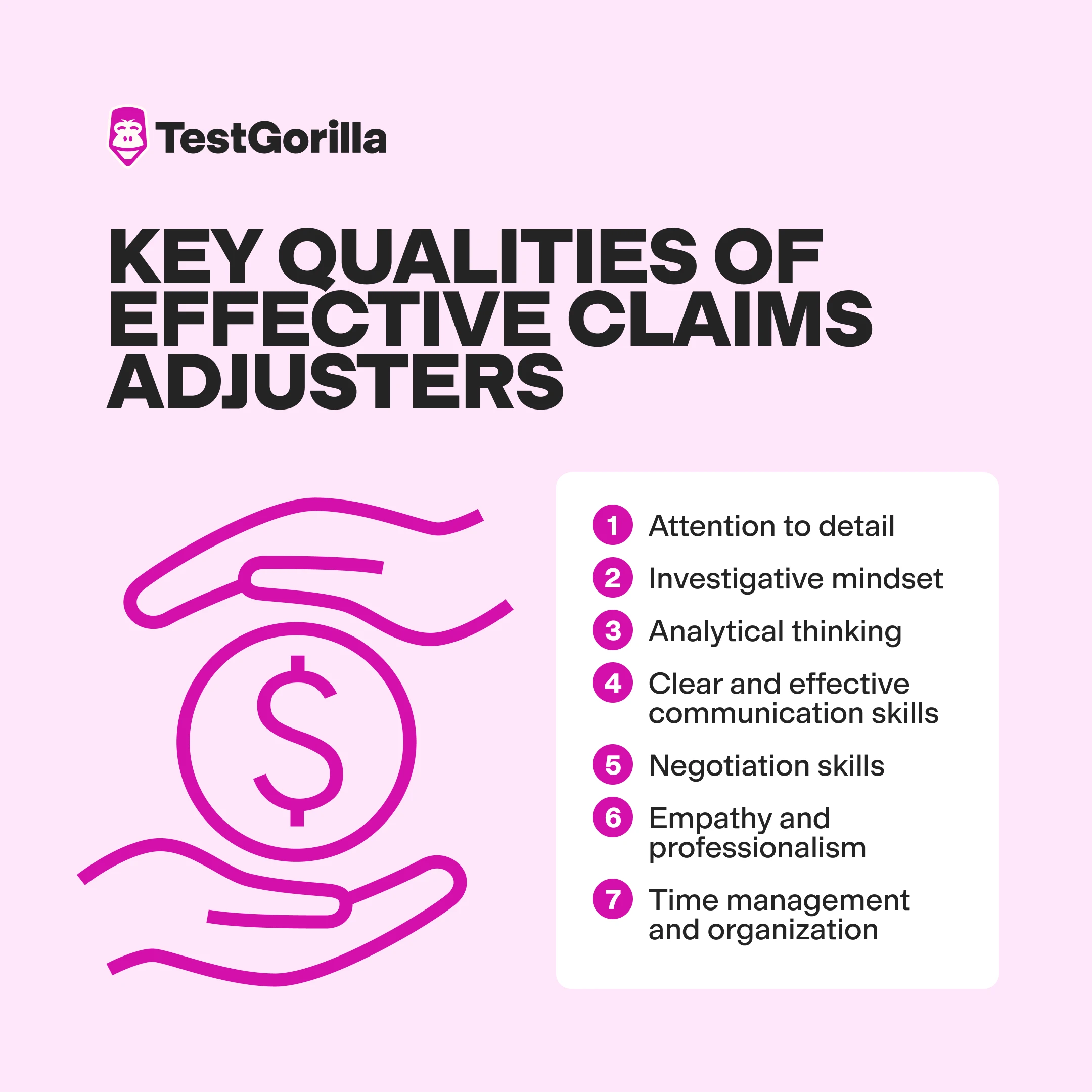

Key qualities of effective claims adjusters

A top claims adjuster needs more than just technical know-how. They must be thorough, fair, and able to handle difficult conversations professionally. Here are the key qualities to look for:

Attention to detail: Small errors can lead to big problems. A sharp eye for inconsistencies in reports, policy details, and damage estimates helps prevent costly mistakes.

Investigative mindset: Digging deeper is part of the job. Good adjusters question discrepancies, verify facts, and seek supporting evidence. For example, noticing a claimant’s damaged photos don’t match the weather conditions reported on the date of the loss.

Analytical thinking: Every claim involves multiple factors. Skilled adjusters evaluate policy coverage, loss circumstances, and repair costs to reach fair conclusions. For example, comparing three different contractor estimates to ensure a reasonable payout.

Clear and effective communication skills: Policyholders need guidance, not jargon. Great adjusters explain coverage, claim decisions, and next steps in plain language.

Negotiation skills: Finding a fair settlement benefits both the company and the policyholder. Adjusters must balance company policies with customer expectations.

Empathy and professionalism: Many claimants are dealing with stressful situations. Capable adjusters remain patient, listen actively, and offer solutions where possible.

Time management and organization: With multiple claims at different stages, efficiency matters. The best adjusters track deadlines, follow up promptly, and avoid delays. For instance, they may use task management software to ensure urgent claims are processed first.

Hire top claims adjusters with a multi-measure approach

Claims adjusters help protect your company’s bottom line while ensuring that policyholders are treated fairly. However, a bad hire can lead to costly payouts, unhappy customers, and even legal trouble. That’s why having a clear, well-structured hiring process is so important.

Start by crafting a compelling claims adjuster job description to attract strong applicants. Then, use a combination of interview questions and skills-based assessments to evaluate a candidate’s knowledge and interpersonal skills.

Taking a multi-measure approach – like adding pre-employment tests – can reduce bias, give you a clearer picture of each candidate, and help you make more confident, data-backed hiring decisions.

With over 400+ pre-employment tests, TestGorilla allows you to evaluate both technical knowledge and soft skills in a bias-free hiring process.

Get started with TestGorilla today by registering for a free account or booking a live demo.

FAQs

What does "adjuster" mean?

An "adjuster" is a professional who evaluates insurance claims to determine how much insurance companies are responsible for paying. They evaluate the details of each case, inspect damages, and decide on the appropriate amount to be paid out to policyholders, ensuring claims are settled fairly and accurately.

What skills make a good claims adjuster?

A strong claims adjuster needs both technical know-how and people skills. They should be knowledgeable in insurance policies, claims software, and damage estimation and comply with laws. They also need soft skills like transparent communication, negotiation, empathy, time management, and critical thinking.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.