Current employee misclassification penalties to be aware of

Tapping into the contingent workforce can be advantageous for your business as it gives you access to a wider talent pool. However, if the contractors you hire legally qualify as employees, you may face severe consequences for incorrect classification and find yourself running afoul of numerous employment laws.

In addition to the legal implications, misclassifying employees as contractors – and failing to provide entitled protections and benefits – can quickly build a reputation that your business cares more about cutting corners than valuing your people.

From fines and back pay to business reputation damage, we take a look at each of the penalties businesses face when they fail to classify an employee or contractor correctly. We also cover the steps you can take to stay out of the misclassification trap.

Table of contents

What is employee misclassification?

Employee misclassification occurs when a worker has been categorized as an independent contractor but is treated like an employee.

This can often happen by mistake, or because the business doesn’t understand the legal distinctions between employees and independent contractors. However, occasionally, an employee is misclassified because the business wants to avoid paying for benefits afforded to employees or evade collecting employment taxes.

Whether the reason for misclassifying an employee is accidental or intentional, the consequences still apply.

Tests for classifying employees vs contractors

Employee classification is complex. Federal, state, and even local governments can employ their own test for determining whether a worker is an independent contractor or an employee. Criteria will often vary based on where you do business and the type of work performed.

Some states, such as California, have adopted strict tests that leave little room for independent contractor classifications. Meanwhile, at the federal level, there are two different tests employed by different agencies. The Internal Revenue Service (IRS) uses one test, while the Department of Labor uses a different set of criteria.

Given this intricate web of regulations, seeking legal and tax counsel is the best way to navigate the classification of your workers.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Why is employee misclassification unlawful?

Laws prohibiting employee misclassification are designed to protect workers from exploitation and ensure accurate taxation. Some of the areas impacted by employee misclassification include:

Payroll taxes. Misclassifying a worker as an independent contractor enables businesses to avoid their share of payroll taxes. This evasion deprives government agencies of essential revenue.

Accurate pay. Employees are entitled to minimum wages and overtime pay under state and federal labor laws. By misclassifying workers as independent contractors, businesses avoid paying appropriate wages. This deprives workers of fair compensation for their efforts.

Benefits. Employee misclassification also leads to the withholding of employee benefits. This includes health insurance, retirement benefits, paid time off, and other essential perks. Workers erroneously classified as independent contractors miss out on these valuable benefits.

Labor rights protection. When workers are classified as employees, they gain access to crucial labor protections like collective bargaining rights. Misclassification effectively denies workers these important safeguards.

Worker exploitation. Independent contractors often lack the protections and bargaining power that employees have, making them vulnerable. As a result, they may suffer unfair labor practices, substandard working conditions, and inadequate compensation.

What are the current employee misclassification penalties?

The repercussions of employee misclassification are far from trivial. As an employer, you may face substantial penalties, fines, or legal disputes. Let’s take a look at the various types of misclassification and the penalties associated with each type.

Overtime and minimum wage violations

Employee misclassification often leads to violations of the Fair Labor Standards Act (FLSA). For example, the FLSA mandates that non-exempt employees be paid overtime if working beyond 40 hours in a workweek. If misclassified workers are denied overtime pay, even accidentally, it’s a violation of the FLSA.

The same issue arises when the amounts paid to a misclassified employee result in the employee receiving less than the minimum wage. For example, if the misclassified employee is paid a project rate of $100, but spends 14 hours completing the project, then their effective hourly rate is $7.14.

The federal minimum wage is $7.25 per hour. Failing to pay at least minimum wage is a violation of the FLSA.

Any reported violation of the FLSA could spur an audit from the Department of Labor (DOL). A DOL audit will thoroughly review how your workers are classified, and how they have been paid.

FLSA violations can result in back wages to underpaid employees and liquidated damages (equal to the back wages owed). You may also incur costs from the time spent working through the audit and attorney’s fees if you hire a lawyer to represent your business.

Many states have their own overtime and minimum wage laws that can lead to additional liability for back wages or fines.

Unpaid taxes

Employers must pay federal and state taxes and calculate tax deductions from employee pay. The IRS or your state’s tax agency could institute an audit of your employment taxes. Findings that you’ve failed to make required tax payments could lead to orders for back taxes and levied fines for late payments.

Immigration violations (I-9)

Employers are required to document the immigration status of their employees. However, this requirement doesn’t extend to contractors under federal law. Immigration status is documented on Form I-9, a key part of new hire paperwork.

If an employee is misclassified as an independent contractor, then the required Form I-9 won’t be on file. Reports of insufficient documents could spur an audit from the DOL, Immigration and Customs Enforcement, or the Department of Homeland Security.

Findings by any of these organizations that your business has failed to collect and maintain required documents could lead to fines, loss of government contracts, and even criminal penalties.

Unemployment shortfalls

State unemployment insurance plans rely on employer contributions to subsidize its program. The amount each employer contributes is typically based on a quarterly report that details the number of employees and their wages. Independent contractors aren’t counted in this report.

Failing to include misclassified employees can result in orders for back payment of shortfalls and administrative fines. The state then determines the type and amount of penalty for unemployment shortfalls.

Workers’ compensation shortfalls

Workers’ compensation is intended to reimburse employees for injuries that occur in the course of performing their work.

Each state maintains its own workers’ compensation laws, and it’s common for employers to be required to either purchase workers’ compensation insurance or demonstrate financial ability to pay out claims directly.

Misclassifying employees as independent contractors can cause your business to be underinsured and unable to cover costs in the event of worker injuries.

Additionally, workers’ compensation insurance usually won’t cover an injured contractor who should have been designated as an employee. This leaves the financial responsibility on your business to pay the misclassified employee directly.

It’s not uncommon for an injured worker who has been misclassified to file a lawsuit seeking compensation from the employer. This can lead to liability not only through the lawsuit but also for any attention it brings from government entities who discover your business has misclassified employees.

Employee benefits

It’s common for employees to be offered benefits and perks that aren’t offered to independent contractors. For example, your business may offer health insurance to employees, but not to contractors. Retirement plans and paid time off are also examples of benefits that are generally given only to employees.

A misclassified employee may file a lawsuit seeking compensation equivalent to the benefits they were improperly denied. Any employment lawsuit takes time and resources and may result in orders to pay damages to the misclassified employee. Employment lawsuits also have the potential to damage your company’s reputation in the community.

Protected leave

Employees have protected rights that aren’t extended to independent contractors. One of these rights is protected leave of absence. Whether an employee needs time to care for a seriously ill family member or is called to active military service, their job must usually be held for them in these circumstances.

Lawsuits can ensue if a misclassified employee believes you denied them protected leave, failed to reinstate their role, or retaliated against them for taking leave. In addition to the costs associated with fighting an employment lawsuit, you may be forced to offer the misclassified employee job reinstatement or reimburse back pay and damages.

Notice requirements

The Worker Adjustment and Retraining Notification (WARN) Act requires employers to give advance notice to employees when facing mass layoffs or plant closures. It applies to any business with 100 or more full-time workers that lay off 50 or more people at a single employment location. Many states have adopted similar laws that expand on WARN Act requirements.

You can trigger the WARN Act’s requirements if your business miscounts impacted employees because of misclassification, causing inadequate notice to be given. Penalties for non-compliance can include fines and back pay to employees whose employment ended before a full notice period lapsed.

Ways to help avoid employee misclassification as an employer

Employee misclassification can be a costly mistake, but you can take proactive steps to minimize the risk of misclassifying your workers. Here are some essential strategies to follow:

1. Learn about the classification tests in your area

Regulations regarding employee classification can vary significantly based on your location. It's crucial to familiarize yourself with the classification tests and criteria applicable to your specific state or region. State labor departments and government websites often provide detailed guidelines on classification rules.

2. Create a clear independent contractor agreement

A well-crafted independent contractor agreement is your first line of defense against misclassification. Craft a comprehensive contract that clearly defines the working relationship, the scope of work, payment terms, and the level of control the worker will have. Legal counsel can assist in creating a robust agreement that aligns with classification criteria.

3. Consider hiring through an external agency

Hiring contingent workers through a reputable staffing agency or professional employer organization (PEO) can help mitigate the risk of misclassification. These organizations often assume responsibility for certain employment-related tasks, making it more straightforward to maintain proper classifications.

4. Conduct a self-audit or hire a local expert to review your business

Regular self-audits of your worker classifications can identify potential issues before they become costly problems.

You can also consider hiring a local employment law expert or consultant with in-depth knowledge of state and federal regulations. They can assess your current workforce and practices, and provide guidance on compliance and potential areas for improvement.

5. Train your HR and management teams

Ensure that your HR managers and management teams are well-versed in classification rules and the importance of accurate worker categorization. Training programs can help them recognize potential pitfalls and make informed decisions about hiring contractors versus employees.

6. Keep comprehensive records

Accurate and comprehensive record-keeping is a cornerstone of proper worker classification. Maintain detailed records of hours worked, payments made, contracts, and correspondence related to employment arrangements. These records can serve as evidence in the event of an audit or dispute.

7. Regularly review and update agreements

As your business evolves, so may your workforce and its roles. It's essential to periodically review and update independent contractor agreements to ensure they reflect the current working relationship. Changes in job duties, control, or payment structures may necessitate revisions.

8. Consult with legal and tax professionals

When in doubt, seek guidance from legal and tax experts specializing in employment law. They can provide valuable insights, review your employment practices, and offer guidance to ensure you comply with current regulations.

Hire top employees and contractors with TestGorilla

It’s vital that you only bring in independent contractors for services that aren’t intended for traditional employees. Failing to do so can open your business to government audits and lawsuits, draining valuable resources and damaging your company’s reputation.

However, when classified correctly, independent contractors can positively impact your business while maintaining a professional relationship that benefits both parties.

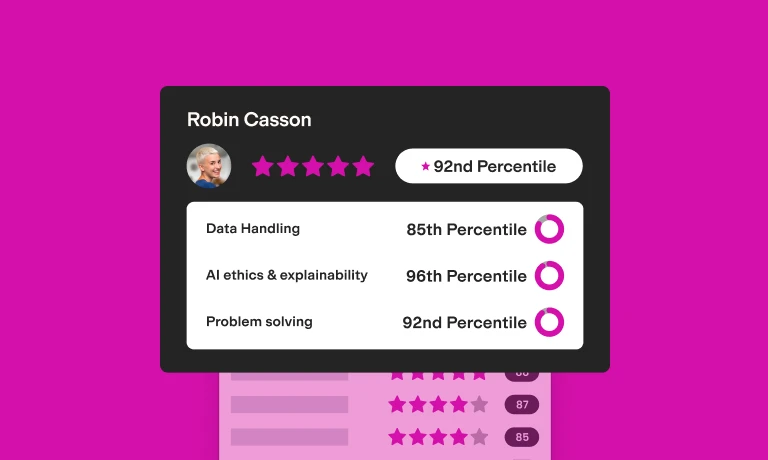

Whether you’re hiring an independent contractor or an employee, it’s important to fully understand the proficiency of the person you’re engaging. TestGorilla’s skills-based approach makes it simple to evaluate role-specific competence for bias-free data-driven hiring decisions.

To find out more take a product tour or sign up for TestGorilla’s Free plan today.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.