Employee profit sharing plans: A long-term benefit for your staff

Employee benefits are a great way to distinguish your company from others, offer an attractive compensation package, and make your organization a good place to work.

But you need more than ping-pong tables and free meals to get there.

Profit sharing plans are an excellent benefit option because they tie your company’s performance to your staff’s compensation, creating a sense of ownership and aligning interests.

Profit sharing plans help employees feel like a part of the whole. They see a tangible benefit from their work.

They get back what they put in, which is hugely motivating.

Another reason why profit sharing plans appeal to candidates is they’re not simply buzzwords; the profits are measurable and linked to the company’s overall success.

It’s not like when some companies say they value inclusivity and do nothing to follow up on this claim.

But how does this play out? How exactly do profit sharing plans differ from 401(k) plans and other similar benefits?

We discuss these in the article.

Table of contents

- What is a profit sharing plan?

- How do profit sharing plans work?

- Summary of employee profit sharing plan benefits

- Why are employee profit sharing plans attractive to employers?

- Why are employee profit sharing plans attractive to staff?

- Profit sharing plan examples

- Profit sharing plans help to recruit and retain top talent

- Sources

What is a profit sharing plan?

A profit sharing plan gives employees their share of the company’s overall profits on top of their salary. It’s a way to incentivize them to engage and perform by offering a tangible financial reward in exchange.

They have some similarities with other types of retirement plans or equity plans, but they’re not synonymous.

Here are the differences between these benefit plans side by side:

Benefit plans | Comparison |

Profit sharing plan | Only employers make profit sharing contributions Employees get cash or stock immediately or rewards from a trust fund later (often at retirement) Can be taxed depending on the type of plan Contributions are |

401(k) | Both employer and employee contributions Retirement plan Contributions happen before taxation Contributions are |

Equity | Long-term ownership, not only a share of the profitsStock options and membership shares are common rewardsCan be included in a profit sharing plan, but it’s not required |

These plans can be offered separately and in conjunction or can be combined.

There are different types of profit sharing plans depending on when and how the employees get their rewards, as well as how the amounts are calculated:

Cash plan: Immediate cash or stock rewards that are taxed immediately

Deferred plan: Investment in a trust fund where the employee gets rewards later (usually when they retire), which puts off the taxation

Combination plan: A combination of immediate rewards and deferral trust fund investments

Flat dollar amount: Equal contributions regardless of employee salaries

Pro rata: Each employee receives a percentage of their annual income as a contribution

Age-weighted: The ages of employees are considered, and employees closer to retirement may receive higher contributions

Cross-testing: Employees are separated into groups with separate formulas to calculate their contribution amounts

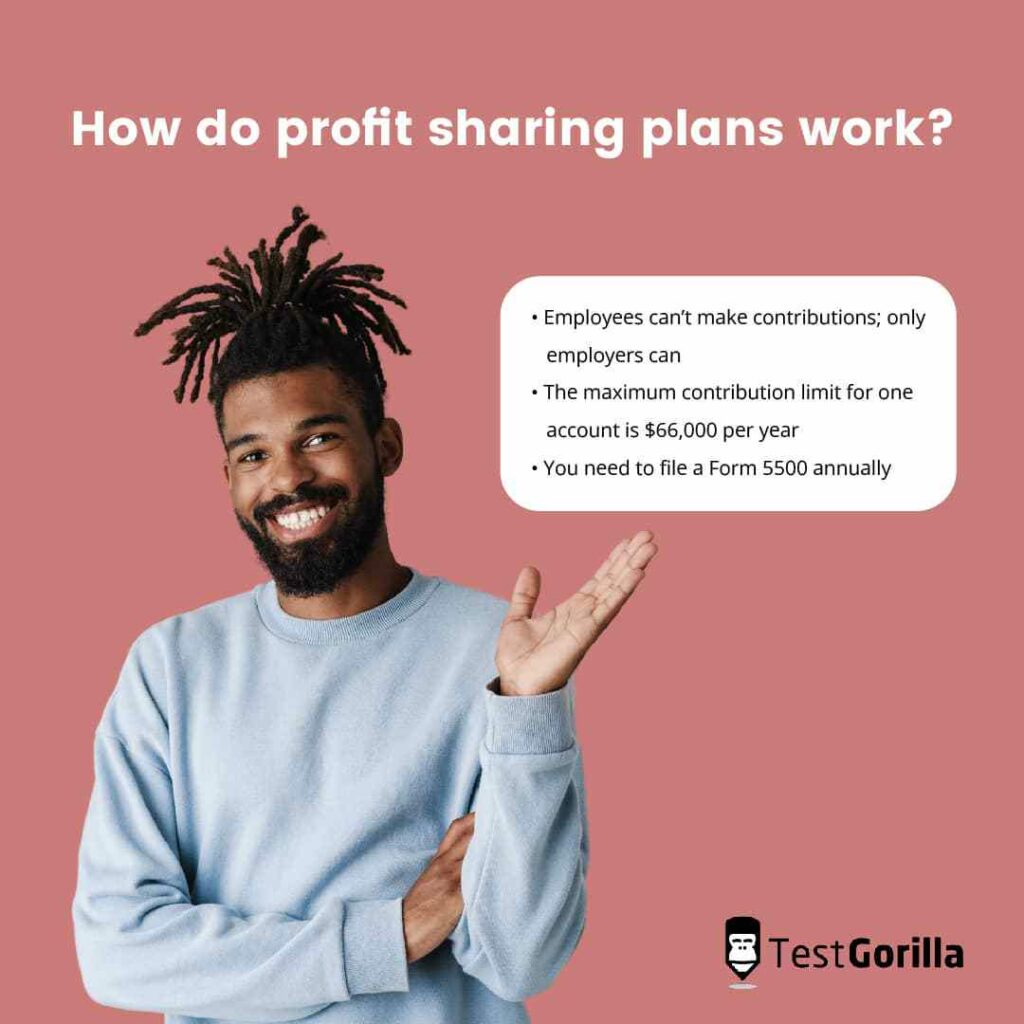

How do profit sharing plans work?

The great thing about employee profit sharing plans is you can customize them to work in your organization in almost any way you’d like.

These are the only ground rules for US-based profit sharing plans:

Employees can’t make contributions; only employers can

The maximum contribution limit for one account is $66,000 per year

You need to file a Form 5500 annually

Everything else – how you pay out the rewards, timing, tax deterring, amounts, and other benefits you offer parallelly – is all up to you and can be specified in your custom contract.

It’s on you to decide whether you want to offer this plan to all or a portion of employees and how to approach each group fairly.

For example, if you simply go by a percentage of annual employee compensation, there’s a risk of perceived unfairness because highly compensated employees will receive much higher employer contributions than others, regardless of their performance.

You may need to do testing before you create a final version of this benefit.

Because of their complexity, the administrative fees of creating a profit sharing plan can be higher than for other, more basic plans.

So why should you explore profit sharing plans for your business?

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Summary of employee profit sharing plan benefits

Here are the reasons that make profit sharing plans attractive both from employers’ and employees’ points of view:

Benefits for employers | Benefits for employees |

Motivated employees; Higher retentionHigher performance and profits; More attractive on the talent marketplace | Sign of a good company culture; Sense of ownership and an alignment of interests; Potential for increased pension; Potential tax advantages |

Let’s dig deeper and look at some real-life examples.

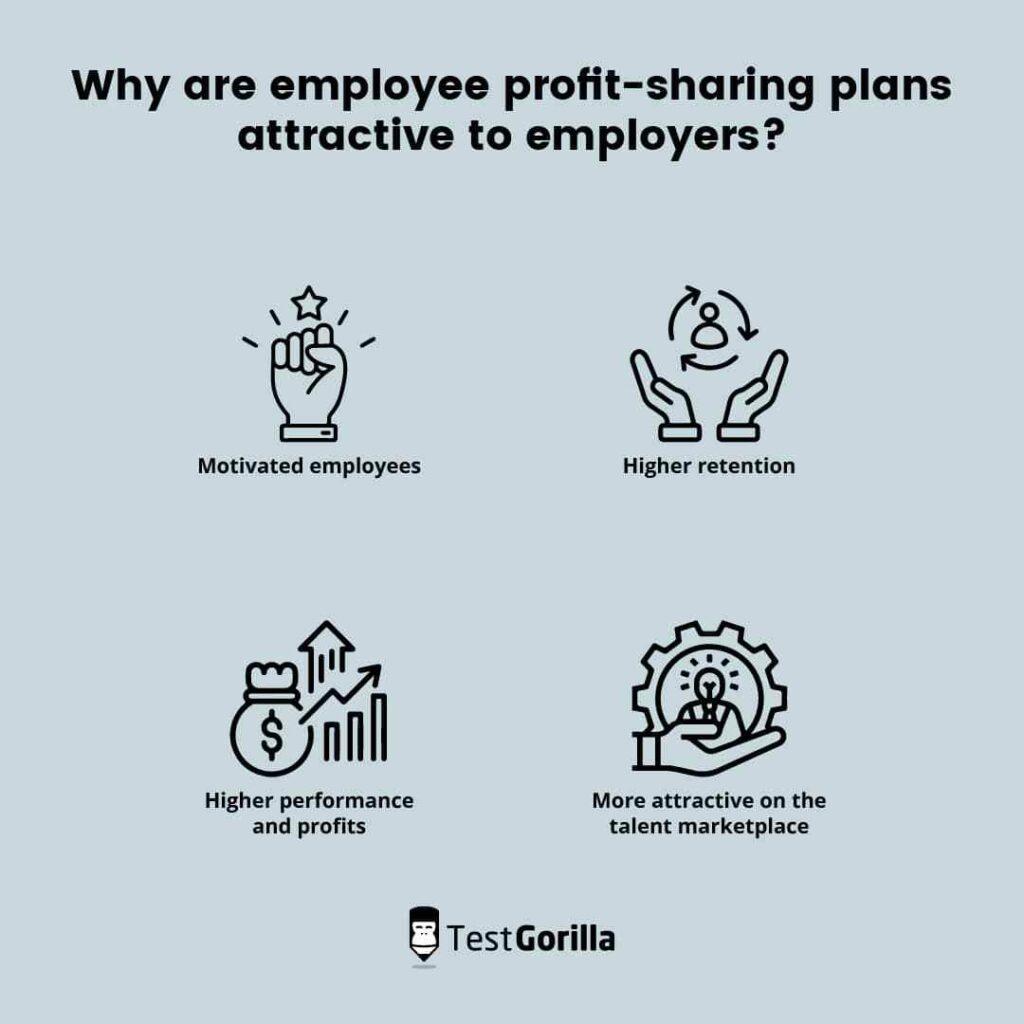

Why are employee profit sharing plans attractive to employers?

You’re the one who has to contribute to employee profit sharing plans, so what’s in it for you?

1. Motivated employees

What better way to incentivize employees than with a share of the company’s profits?

Quiet quitting, where employees get totally disengaged from work, is an issue and something of a social media hot topic these couple of years. It doesn’t look like it’s going anywhere on its own.

Employees don’t feel a reason why they should be pushing themselves to work hard when there are no rewards, and they only get burnt out.

It makes sense, right? You have to give employees a reason to put in the effort.

Well, profit sharing plans are huge, tangible rewards that help employees buy into the company vision and rally them to work cohesively as a team.

After all, it’s much easier to care when you experience the company’s success and growth firsthand.

Profit sharing plans motivate the workforce because they raise the stakes. Hard work directly pays off, and not only for the employers.

2. Higher retention

The Great Resignation is another global-scale problem companies are dealing with, and the main reason behind it is toxic company culture.

Toxic culture can look like many things, including a lack of rewards for high performance, a lack of care for employee wellbeing, and a “grind culture” of overwork and burnout, driving those record turnover rates we all want to stop.

Offering employees tangible rewards makes them want to stick around and helps in a couple of ways:

Provides a clear reward

Shows them you’re thinking about their wellbeing, security, and future

Gives them a reason to work through problems, which helps you transform the company culture

Sharing profits with employees often translates to lower employee turnover and higher retention, saving you money long-term.

3. Higher performance and profits

Simply put, profit is the dangling carrot many people understandably need to get any work done.

If you don’t feel like you earn enough and are appreciated enough, why would you try hard to perform?

With a profit sharing plan, the answer is clear: You’ll reap the rewards and be accountable for your results.

It’s in your employees’ best interest to perform well.

As the employer, the party who has to contribute money for all this to happen, you may feel hesitant.

But think of the long run.

Sharing a part of the profits with your employees today can help you increase profits going forward because your staff will work harder and get more high-quality hours in.

Here’s a real-life example:

Brewdog significantly increased profits by addressing employee complaints and implementing a profit sharing plan. They now sell 80% more beer than they did before the pandemic.

In the long run, employee profit sharing plans are a bargain.

4. More attractive on the talent marketplace

Offering a profit sharing plan shows you’re doing your part in creating an equitable workplace where everyone feels the benefits of overall business success. This sets you apart from too many companies that overpromise and underdeliver.

A profit sharing plan can go hand in hand with other benefits like a 401(k) to form an even more compelling offer and attract the best talent.

These are the rewards for companies that offer competitive and non traditional benefits:

Lower hiring costs and time

More high-quality candidates to fill any role

No settling or hiring mistakes due to being in a rush

Better long-term outcomes

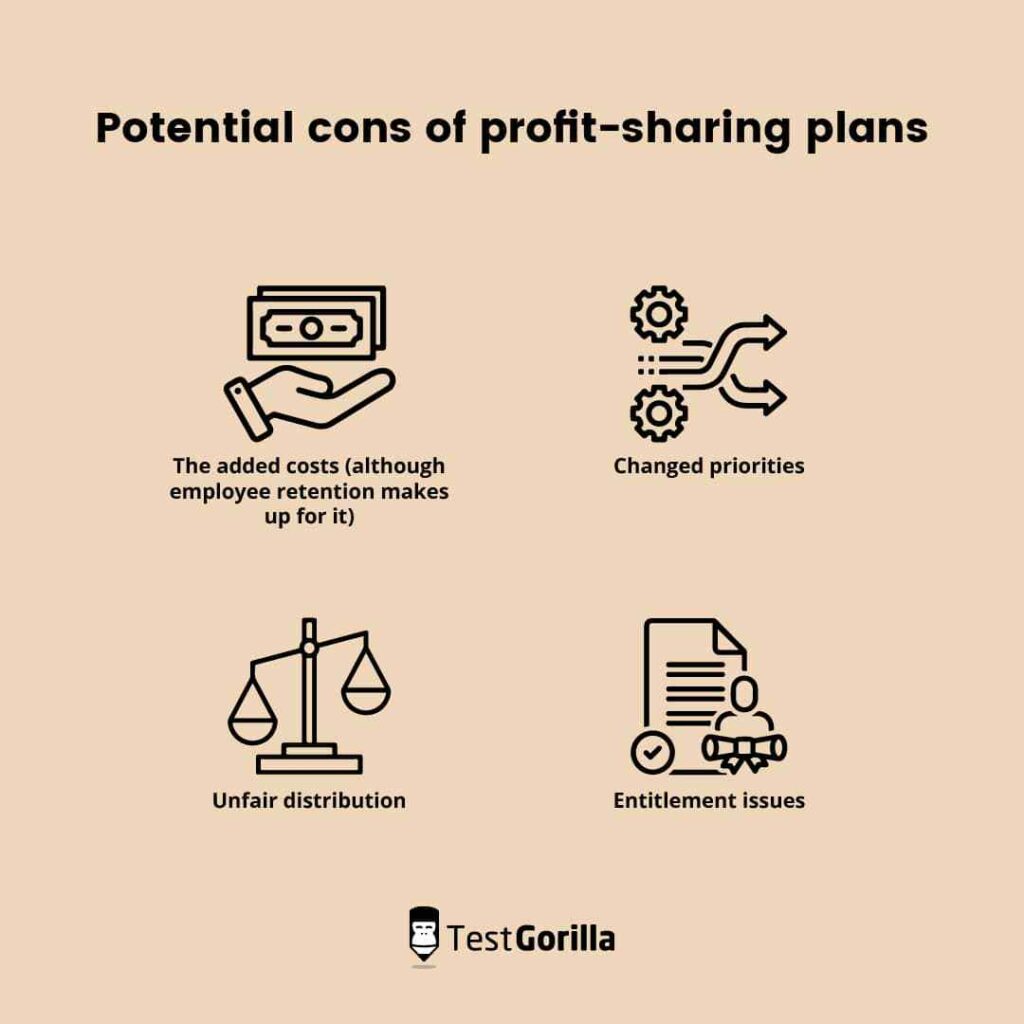

Potential cons of profit sharing plans

But what about the cons?

We need to give you all the information, and there are situations when profit sharing plans can go wrong.

Before you go for a profit sharing plan, you need to consider potential problems so you can avoid them:

The added costs (although employee retention makes up for it): You’re working with a limited budget, so investing here means you have less money for other things

Changed priorities: People may start focusing more on the quantitative aspects of the business

Unfair distribution: Conflicts and issues may arise if the rewards are not fairly distributed among employees

Entitlement issues: There could be conflict when some workers seem to be slacking while others work hard to win those rewards, leading to high performers feeling held back

As the employer, you can do your part to ensure the benefits are fairly distributed to everyone and communicate with your staff regularly.

This helps spot and solve problems early before your top talent decides to leave.

Why are employee profit sharing plans attractive to staff?

Now onto candidates and employees. Why are they more likely to pick a company offering them a profit sharing plan?

1. A sign of a good company culture – employees benefit from the overall success

A profit sharing plan is one of the signs of a healthy workplace, especially alongside other indicators like the company’s commitment to learning, development, and DEI policies.

Compare this to job description red flags like:

“Do you live and breathe code and see breaks as another opportunity to tweak your work?”

“We offer competitive pay and benefits,” with no indication as to what the salary is or which benefits come with the job, leaving candidates suspicious about why the company is hiding such important information

Yikes.

No wonder applicants have higher hopes for a company offering specific and meaningful benefits.

Profit sharing, in particular, is significant because it is not an empty promise. The rewards are expressly tied to company success, which is both a payoff guarantee and an attractive incentive.

Employees are then more motivated in their roles. If candidates do happen to “live and breathe code,” they go where they’ll be fairly compensated for their dedication and skill.

2. Sense of ownership and an alignment of interests

Aligning employees’ interests with the company’s gives staff a sense of purpose and a reason to be invested in the success of the company as a whole.

A profit sharing plan adds accountability and motivates employees to consider the bigger picture in their actions rather than think about their own responsibilities and immediate results in a vacuum.

This encourages good teamwork.

Everyone is getting a slice of the pie, so everyone has a reason to work together to put out the best work they can.

For example, helping another employee learn and grow to become a better worker might not be an average employee’s high priority.

But with a profit sharing plan in place, helping a colleague leads to the company’s continued success, which leads to more profits in the bank for everyone!

Since everybody’s engagement and quality of work play a part, this creates an atmosphere where everyone happily pulls their weight – for their own benefit, but also the benefit of the team.

3. More people are thinking about their pensions

Retirement benefits may increase if contributions increase.

With a deferred plan, you can set it up so the profit from the sharing plan accumulates and then pays out upon the employee’s retirement.

Employees closer to retirement often receive bigger contributions.

A deferred profit sharing plan combined with a 401(k) plan is an attractive offer, especially for older workers. Plus, it’s a good way to retain them until retirement.

4. Potential tax advantages

Depending on the plan employees have, they could be exempt from taxation until the distribution of funds, which maximizes the amount of money that reaches their retirement accounts.

The only real con for employees is that only employers can contribute to their profit sharing plan, which is easily fixable because these schemes can run in parallel to other retirement savings plans.

For example, if they also have a 401(k), employees can still contribute to that plan.

Profit sharing plan examples

Let’s look at some examples to help you understand how profit sharing works.

The founder of On Par, a small business, made his three employees co-owners.

The shared profits gave them a tangible incentive to put in their best work, but it also made running the company and making all the decisions a less lonely experience for the founder.

As a result, the founder owns less of the company, but he makes more money now. He also has a more motivated team.

But what if you didn’t want to include permanent ownership of the company in the deal?

You could still share the profits.

If you decide on a cash plan with a 10% profit sharing plan, 10% of the quarterly or annual profit gets split between the employees.

Here’s another example for good measure.

A manufacturing company implemented a custom profit sharing retirement plan that allowed each owner to contribute:

$61,000 of pre-tax money into their retirement plan

A contribution of 10% of the compensation to a group of employees

Minimum required contributions for everyone else

In a year, this plan resulted in nearly $350,000 in tax-deferred savings and helped the company retain its most valuable employees.[1]

Disclaimer: The information contained on this site is intended for informational purposes only and should not be construed as legal advice. If you have questions about profit sharing plans, please consult a lawyer.

If you want to get more official information on profit sharing plans, like what the deferring limits are if you have multiple plans, or which retirement plan to choose, the IRS is a good place to look.

Profit sharing plans help to recruit and retain top talent

Profit sharing plans provide a sense of ownership in the company, promoting unity, teamwork, and employee performance.

They help employees feel valued and give them a reason to be loyal to the company.

This is also why profit sharing attracts new candidates looking for a healthy company to work for long-term.

So what else can you do once you’ve got their attention?

You can pair employee profit sharing plans with other benefits to blow the competition out of the water and attract all the top talent to your business.

From there, pre-employment tests help qualify and select the best of the best candidates for your next role.

Sources

“Profit Sharing Plan Case Study”. (n.d.). JC Actuarial. Retrieved February 22, 2023. https://www.jc-actuarial.com/case-studies/profit-sharing-plan/

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.