More than 60 federal employment laws may apply to your organization, shaping your policies and procedures around recruitment, fair hiring practices, employee relations, termination, and more. These laws are often complex and frequently updated. Plus, they can put strict and burdensome obligations on you.

For these reasons, ensuring compliance can feel like an overwhelming task. This is especially true when the risk of noncompliance carries heavy consequences, including audits, fines, and even criminal prosecution.

In this article, we look at some key federal employment laws that may impact your organization and its obligations to employees. We also explore how your HR team can comply with these laws.

Key federal employment laws

In this article, we take a look at several federal employment laws across seven categories:

Wage and hour

Anti-discrimination and anti-harassment

Employee benefits

Immigration

Tax

Workplace health and safety

Miscellaneous

The laws discussed below provide an overview of employment laws that may apply to your organization. This list isn’t exhaustive, and you should seek advice from an employment law attorney to understand which laws apply to your business and how you can support compliance in your role.

Keep in mind that this article discusses employment laws at the federal level. It’s also important to be aware of the various state and local regulations that apply to your organization.

Wage and hour

Wage and hour laws address how employers must pay employees and other working conditions.

Fair Labor Standards Act (FLSA)

The FLSA is a crucial labor law that applies to most employers. It details your organization’s obligations as an employer, including:

Paying employees at least the federal minimum wage

Compensating employees for overtime (any time worked over 40 hours in a week)

Employing children only under certain conditions (conditions include the minimum age for employment)

Deducting only certain items from employee wages

Providing breastfeeding employees with a private place to express milk

If the FLSA applies to your business, you must keep certain records, including:

Employees’ full names and social security numbers

The times and days employees’ work weeks start

The number of hours each employee works in a day and work week

Hourly pay rates

Total daily or weekly earnings

The FLSA only covers certain employees and is administered by the Department of Labor (DOL).

Consumer Credit Protection Act (CCPA)

The CCPA concerns payroll. It includes provisions that cap how much your business can garnish from employees’ weekly pay. Wage garnishment is a legal process where an employer deducts part of an employee’s wages to pay back that employee’s debt – including unpaid taxes or child support – under a court order.

Under these rules, you can’t fire a worker due to wage garnishment for one specific debt.

National Labor Relations Act (NLRA)

Most private sector employees are covered by the NLRA, which addresses union relationships and employees' collective bargaining rights. The NLRA prohibits your organization from interfering with employees’ rights to join (or not join) a union and participate in collective bargaining. Collective bargaining is the process where unions advocate for better working conditions on workers’ behalf.

The National Labor Relations Board enforces the NLRA.

Anti-discrimination and anti-harassment

These laws protect candidates and employees from discrimination or harassment by employers and other employees.

Title VII of the Civil Rights Act

Title VII is the primary US law prohibiting employers from discriminating against workers. It makes discriminating against a candidate or employee based on a protected characteristic illegal. These characteristics include race, color, religion, sex, and national origin.

The Equal Employment Opportunities Commission (EEOC) enforces Title VII and other anti-discrimination laws, including the following:

Equal Pay Act (EPA): Requires your organization to give equal pay to men and women for equal work

Pregnancy Discrimination Act (PDA): Amends Title VII of the Civil Rights Act to prohibit your organization from discriminating against employees based on pregnancy – including past or current pregnancies, birth control, and decisions regarding abortion (if your organization has 15 or more employees)

Pregnant Workers Fairness Act (PWFA): Requires your organization to make reasonable workplace accommodations for individuals with pregnancy-related limitations, such as medical complications (if your organization has 15 or more employees)

Age Discrimination in Employment Act (ADEA): Prohibits your organization from discriminating against candidates or employees 40 years or older based on their age (if your organization has 20 or more employees)

Americans With Disabilities Act (ADA): Bans your organization from discriminating against candidates and employees with disabilities (if your organization has 15 or more employees)

Genetic Information Nondiscrimination Act (GINA): Protects candidates and employees against employer discrimination based on their genetic information, such as their genetic tests or information about a family member’s genetic disease or disorder (if your organization has 15 or more employees)

Uniformed Services Employment and Reemployment Rights Act (USERRA)

USERRA prohibits your organization from discriminating against candidates or employees who are or were uniformed service members. Discrimination under this act includes denying them employment, promotion, or re-employment after their return from uniformed service.

Armed service employees also have a right to continued access to health insurance during their leave and reinstatement on their return.

The DOL’s Veterans’ Employment and Training Service handles USERRA complaints.

Employee benefits

These laws govern benefits that certain employers must offer employees.

Affordable Care Act (ACA)

The ACA requires organizations with 50 or more full-time employees to make affordable healthcare coverage available to employees and their children.

The act sets out the criteria for affordable coverage and the minimum value the healthcare plan must provide.

Family and Medical Leave Act (FMLA)

Organizations with 50 or more full-time employees must comply with the FMLA. Under the FMLA, your business must give employees up to 12 weeks of unpaid leave each year for family or medical reasons. These include birth or adoption, the employee’s or one of their family member’s serious illness or injury, and reasons relating to a family member’s active service.

Employees requiring time off to care for a family member who was injured or became ill during active service can access up to 26 weeks of FMLA leave.

Your organization must continue group health benefits for employees on FMLA leave and allow them to return to their jobs or equivalent roles upon their returns to work.

Employees must have worked at your organization for at least 1,250 hours and 12 months to access FMLA.

The Wage and Hour Division enforces the FMLA.

Employee Retirement Income Security Act (ERISA)

If your organization chooses to offer an employee benefit plan to employees – like a retirement plan – it must provide the promised plan. In addition, these plans must meet the minimum standards required by the ERISA. These include the time employees must work before they’re eligible for a plan and specific notices you must give employees.

The Employee Benefits Security Administration (EBSA) oversees the ERISA.

Consolidated Omnibus Budget Reconciliation Act (COBRA)

The COBRA provides for the continuation of health benefits after workers lose their jobs or have their hours significantly reduced. It applies to your organization if you hire 20 or more employees and covers various types of benefit plans, including health care plans, dental plans, and medical spending accounts.

COBRA extends health benefits by 18 or 36 months depending on the situation. It may also apply to employees’ spouses and children.

The DOL provides extensive information on COBRA and employers' obligations under it.

Immigration

Immigration laws affect how employers hire immigrants and foreign workers.

Immigration and Nationality Act (INA)

INA applies to all employers. Under INA, your organization can hire only authorized employees authorized to work in the US and must file an Employment Eligibility Verification Form (I-9) for each employee. Your organization also can’t discriminate against candidates or employees based on their citizenship status or national origin.

INA’s anti-discrimination provisions are enforced by the Immigrant and Employee Rights Section under the Department of Justice, while the Department of Homeland Security oversees employment eligibility verification.

Tax

These laws set out employers’ federal tax obligations.

Federal Insurance Contribution Act (FICA)

FICA requires your organization to deduct employees’ Social Security and Medicare taxes from their wages and send them to the Internal Revenue Service (IRS). FICA sets out crucial information for your payroll calculations, including relevant tax rates and the portion of wages subject to social security tax.

Federal Unemployment Tax Act (FUTA)

Under FUTA, your organization must also pay unemployment benefits taxes according to set rates. FUTA applies if your business paid $1,500 or more in wages in a quarter or employed at least one person during any 20 weeks of the calendar year.

Workplace safety

Workplace safety laws aim to protect employees from work-related injuries and illnesses.

Occupational Safety and Health (OSH) Act

The OSH Act aims to ensure safe workplace conditions free from hazards. It addresses employees’ and employers’ rights and obligations. Employer obligations include providing employees with safe tools and equipment, delivering safety training, and keeping records of any work-related injuries or illnesses.

Notably, the OSH Act sets out strict reporting requirements when a serious injury or fatality occurs in your workplace.

The Occupational Safety and Health Administration (OSHA) oversees the OSH Act.

Miscellaneous

There are various other federal employment laws that may apply to your business. Two are below.

Worker Adjustment and Retraining Notification Act (WARN Act)

Under the WARN Act, organizations with 100 or more employees must give workers at least 60 days written notice of a planned closure or mass layoff involving at least 50 employees at a single worksite.

The act provides several exceptions to this requirement.

Employee Polygraph Protection Act (EPPA)

The EPPA prohibits you from requiring candidates or employees to take polygraph tests or retaliating against them for refusing.

There are some exceptions to this, including when an employee is reasonably suspected of committing an offense that caused economic loss to the employer, such as theft or misappropriation. In these cases, the EPPA sets out strict conditions for conducting a test.

The DOL’s Wage and Hour Division enforces the EPPA.

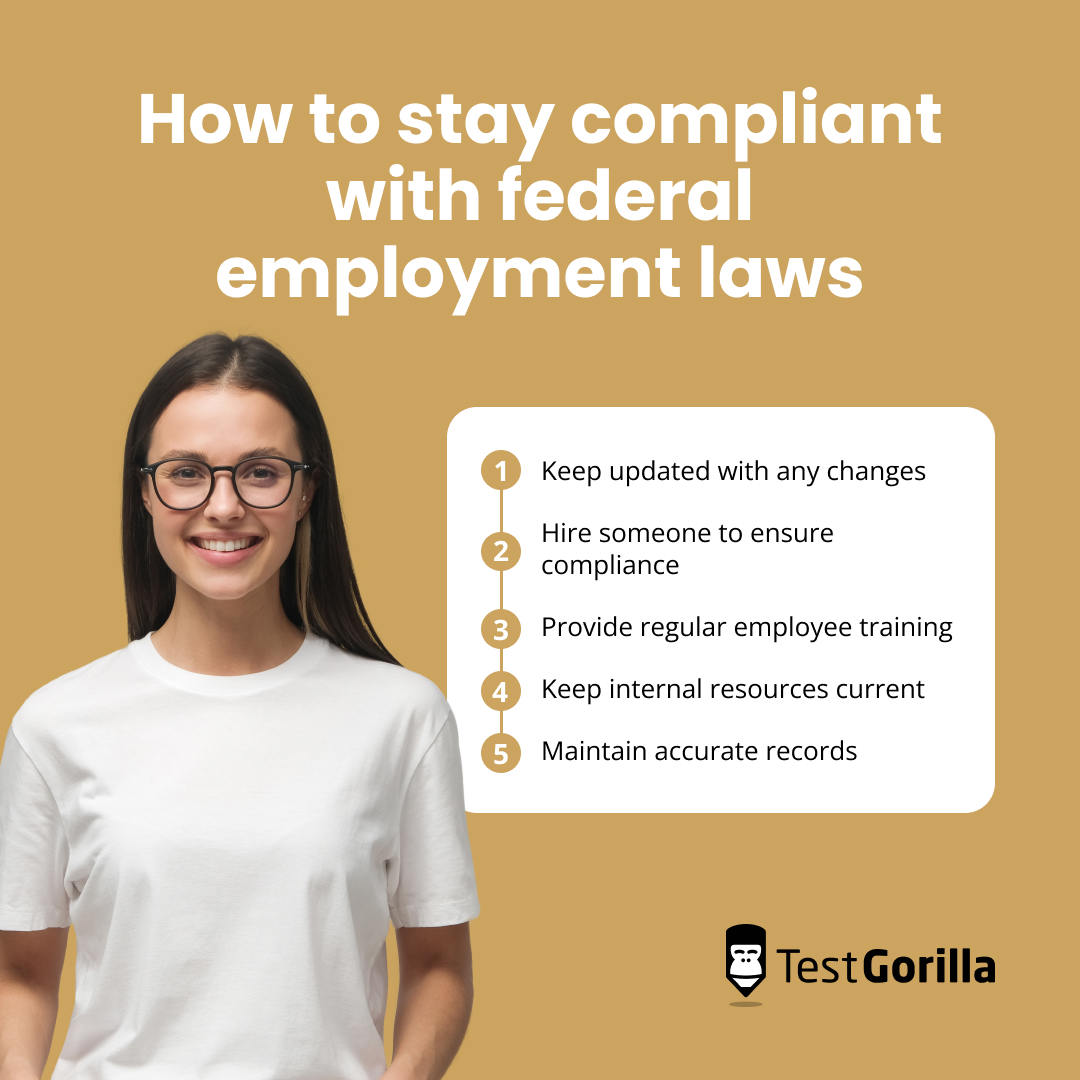

How to stay compliant with federal employment laws

Ensuring your organization complies with relevant federal employment laws is more than a one-person job. Here are five ways to foster a culture of compliance across your organization.

1. Keep updated with any changes

Federal employment law is constantly evolving. An excellent way to stay on top of any developments is to regularly check the websites of the agencies that enforce them, such as the DOL, EEOC, and OSHA. We’ve included links to these agencies throughout the article for your benefit.

Signing up for HR updates through a platform like the Society for Human Resource Management is another good way to stay informed.

2. Hire someone to ensure compliance

Your organization could also consider hiring someone solely responsible for compliance, such as a compliance officer, employment lawyer, or someone else with a deep understanding of employment law.

3. Provide regular employee training

Even if you understand federal employment law inside-out, remaining compliant is challenging – especially if all employees don’t understand their obligations.

Thus, it’s especially important for your HR team to understand these obligations. HR plays a key role in applying many of these laws during recruitment and in the management of employees.

Employment law training is a great way to deliver employment law information to employees.

To deliver this training, consider using skills assessments to identify employee knowledge gaps. For instance, test employees’ knowledge of employment law. Then, you can tailor your training to address these gaps. Delegate the training to a knowledgeable employee, engage external training providers, or buy and adapt pre-prepared training materials.

4. Keep internal resources current

Your internal policies, procedures, and employee handbooks are another way to inform employees about crucial employment laws that apply to them and your business. They also help guide compliant decision-making in your organization.

Update your internal resources to reflect any changes in the law. Doing this ensures employees always have access to the most current information and aren’t unintentionally violating employment laws with outdated practices.

5. Maintain accurate records

Accurate recordkeeping is a requirement of several federal employment laws. For example, under the FLSA, you must retain employee records for at least three years. If your organization has 10 or more employees, the OSH Act requires it to keep records of serious workplace injuries and illnesses for five years.

So, create a reliable recordkeeping system to maintain these records.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Compliance starts during the hiring process

Understanding the federal employment laws that apply to your organization and supporting compliance is no small undertaking. However, by staying informed of any developments in the law, training your employees, and keeping accurate records, you can reduce the risk of noncompliance and its potentially serious consequences.

Federal employment laws can apply to all stages of the employee lifecycle, including recruitment. If you take a skills-based approach to hiring by using talent assessments, finding a compliant testing provider is crucial.

TestGorilla reduces the risk of discrimination in hiring by offering legally defensible, unbiased insights into candidates’ job-related skills, personalities, and more. With hundreds of tests developed by psychometric, psychology, and data science experts, TestGorilla’s results can help you find the right person for your next vacancy.

To learn more about how TestGorilla can help your HR team with compliant hiring practices, check out our product tour or sign up for a free account today.

Disclaimer

The information in this article is a general summary for informational purposes and is not intended to be legal advice. Laws are subject to constant change, and their applications vary based on your individual circumstances. You should always seek legal advice from a qualified attorney about your legal obligations as a hiring manager. While this summary is intended to be informative, we cannot guarantee its accuracy or applicability to your situation.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.