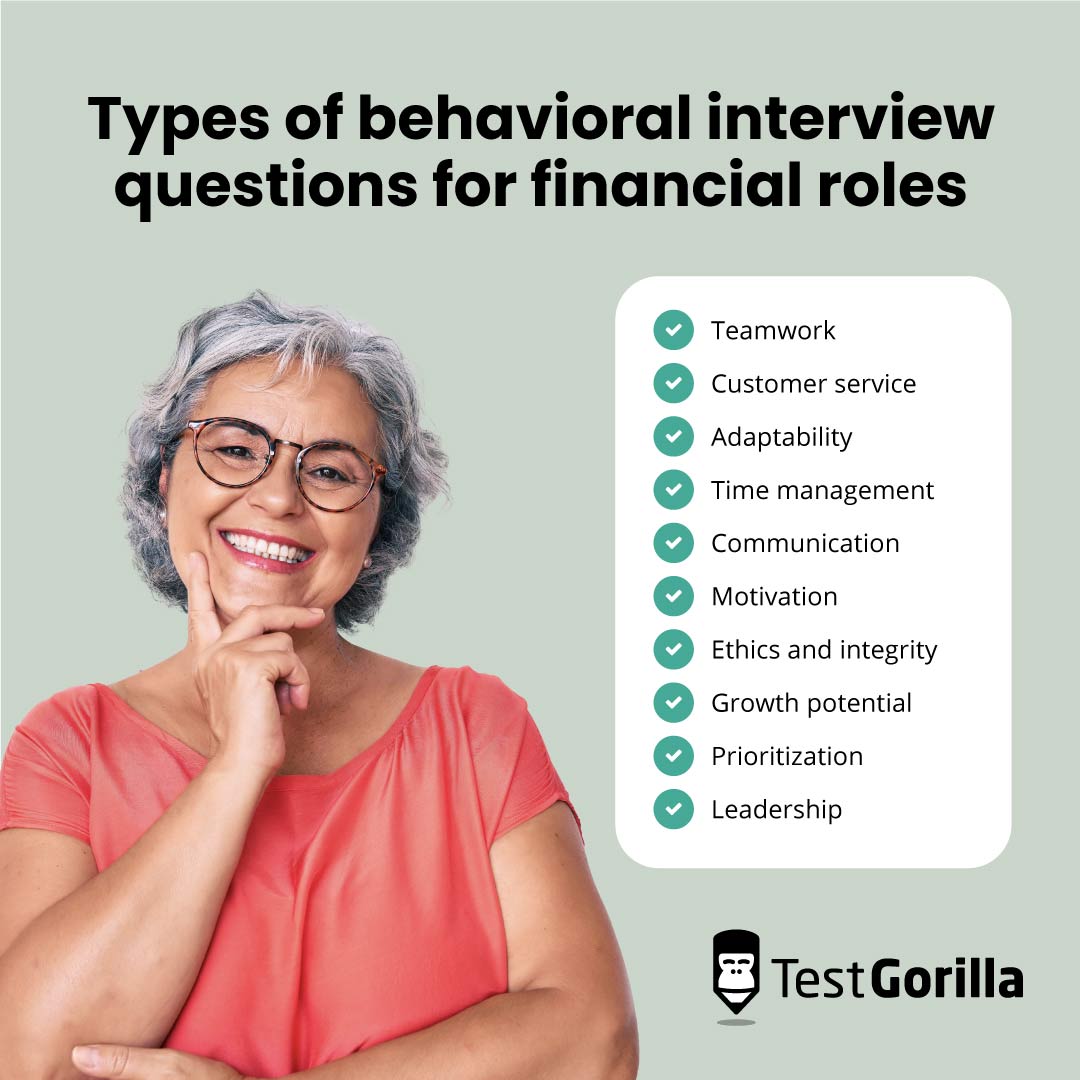

51 behavioral interview questions for roles in finance (+ answers to look for)

New skillsets are changing finance recruitment

80% of finance employees prefer a skills-based hiring process (12 percentage points higher than the industry-wide average). Read the report to learn more.

When hiring for a role in finance, it’s important to consider applicants from all angles. Their skills in accounting, budgeting and forecasting are important—but so too is their ability to work well with others, solve problems, adapt to changes, and approach their work with diligence and integrity.

Poor communication, for example, can lead to friction within teams and declining productivity. A mismatch between company values and their own can lead to improper, even risky financial behavior.

Behavioral interview questions allow you to go beyond how well someone handles numbers and figures. They offer insights into an applicant’s past experiences and how they’ve handled difficult or stressful situations. This allows you to better predict how well someone will fit in an open position.

Below, you’ll find 51 finance behavioral interview questions you can use to determine which applicants possess the interpersonal and other soft skills crucial for success in financial roles.

We also offer tips on how to incorporate these questions into your hiring process, and what to look for in applicants’ answers.

Table of contents

- What are behavioral interview questions?

- Why ask behavioral interview questions during an interview?

- 51 behavioral interview questions for finance professionals and what to look for in answers

- How to roll out behavioral interviews for finance roles

- Combine these questions with skills testing to hire the best

What are behavioral interview questions?

Behavioral interview questions are a strategic approach to hiring that allow you to go beyond an applicant’s accounting, forecasting and budgeting skills. These questions ask about a candidate's past experiences, approaches, and actions, which can help predict their performance in the future.

TestGorilla has a list of 51 behavioral interview questions so you can see how they differ from traditional interview questions. In this article, we focus on behavioral interview questions for financial professionals, specifically.

For example, as you interview a financial professional, you might ask the candidate how they handled past financial crises at an organization or what they did when financial goals were misaligned with company values.

The applicant’s answers offer a sense of their ability to adapt to changing financial landscapes, communicate effectively, and demonstrate leadership.

Why ask behavioral interview questions during an interview?

Finance professionals don't work in isolation; their roles often involve collaboration, decision-making, and adaptability. Behavioral interview questions let you examine these qualities by asking applicants about their specific past experiences and choices.

Behavioral interview questions have other benefits, too. They cut past rehearsed answers and help you to evaluate situational judgment and key soft skills in addition to expertise in finance.

Curious to know more? TestGorilla has a guide to behavioral interviews to help you learn the ropes.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

51 behavioral interview questions for finance professionals and what to look for in answers

5 teamwork behavioral questions for finance roles

Teamwork is integral for any finance team, as everyone has to work together to reach financial objectives.

Look for interview responses that showcase a track record of:

Strong communication;

Conflict resolution;

Accountability; and

Willingness to support colleagues.

Conversely, be cautious of candidates who struggle to provide concrete examples of successfully collaborating with others or who exhibit a lack of accountability.

Here are questions you can ask to uncover teamwork traits:

Describe a project where you collaborated with colleagues and different departments for a common financial goal. How did you ensure team members pulled together?

When have you encountered conflict with a team member? How did you resolve the issue?

In high-pressure situations, how do you keep your team motivated and focused?

Discuss a time when you had to delegate tasks. How did you choose to assign responsibilities?

Tell us about a time when you supported a teammate who was facing a challenge. What steps did you take and why?

5 customer service behavioral questions for finance roles

Customer service in the financial sector requires a good understanding of clients' needs and the capacity to build lasting relationships.

Look for candidates who display empathy, patience, and the ability to offer financial guidance in a clear and understandable manner—even to those who don’t understand financial concepts.

On the flip side, beware of candidates who seem indifferent to customer satisfaction or who struggle with understanding client needs.

Here are five questions that can help you uncover customer service abilities:

How do you ensure that you understand a client's financial objectives and can adapt your services to meet their specific needs?

Describe a situation where you had to handle an unhappy client. How did you address their concerns and work to turn the situation around?

Can you share an example of how you've gone the extra mile to deliver exceptional financial services to a client?

How do you build trust with clients while adhering to financial regulations? Can you give examples of how you’ve done this in the past?

Can you describe a time when you’ve had to explain a complex financial concept to someone who didn’t understand it? How were you able to get on the same page?

5 adaptability behavioral questions for finance roles

The finance world is constantly evolving. Those who can adapt to change and are skilled at innovation are highly valuable.

You will want to ask questions and look for answers that demonstrate:

A growth mindset;

Flexibility; and

Curiosity and a willingness to learn.

Be cautious of candidates who seem resistant to change or uninterested in how the financial landscape is changing.

Here are five adaptability behavioral questions you can use:

How do you stay informed about industry trends and changes in financial regulation?

Can you share an instance of a time when you had to adapt your financial strategies due to market fluctuations, regulation changes, or economic shifts?

What changes are you anticipating in the financial sector with regards to our industry, and how are you preparing?

Share an experience where you successfully introduced new software or technology to your team.

Describe a situation where you were required to change your financial approach midway through a project because of regulatory or market changes. How did you facilitate this change and what was the outcome?

5 time management behavioral questions for finance roles

Tax deadlines and other financial deadlines are crucial. You will want to target applicants who can meet deadlines while maintaining a high quality of work.

You may want to steer clear of candidates who struggle to explain how they manage their time and who can’t offer examples of ways they’ve met tight deadlines.

Here are five questions to make sure your new hire keeps projects on schedule:

How do you ensure that you can meet multiple financial deadlines without compromising work quality?

Describe a time when you had to handle urgent tasks while managing your regular schedule. How did you get important work done and how did you decide what to focus on?

Can you share an example of how you've used time management techniques or technology to improve your efficiency?

Can you explain a time when an original timeline needed adjustment? How did you decide you needed to adjust and how did you address the issue?

Tell us about how you organize your time now. How has your method of delegating tasks, prioritizing, and focusing changed over the years?

5 communication behavioral questions for finance roles

Financial professionals often need to explain money matters to those outside the finance industry, so that organizations and leaders can make informed decisions.

Listen for replies that show candidates can communicate with clarity, listen actively, and adapt their communication style to different audiences. Beware of candidates who show a lack of patience in explaining financial matters.

Here are questions to help you evaluate applicants’ communications styles:

How do you make your financial reports and presentations clear and understandable for non-financial stakeholders?

What is the most complex financial concept you’ve had to explain to non-financial stakeholders? How did you approach the task?

Describe an instance when you had to address a misunderstanding about a financial situation. How did you resolve the situation and ensure better communication moving forward?

How have you handled challenging financial conversations with clients?

Tell us about a time when you had to address financial discrepancies. How did you address the issue and avoid misunderstandings?

5 behavioral questions on motivation for finance roles

Understanding a candidate's motivations will help you find the right fit for your company values and culture.

As you ask behavioral questions, stay alert for candidates who demonstrate passion for the field, enjoy seeing things through or taking on challenges, and are success- or growth-oriented. On the flipside, be cautious of candidates whose motivations seem primarily focused on personal gain.

Here are finance behavioral questions you can ask about motivation and values:

What motivated you to pursue a career in finance?

How would you define your main drivers today, and how are these reflected in your work and career so far?

Can you share a time when you faced burnout or a period of questioning at your job? How did you reconnect with your love of work?

Describe a situation when the motivations of clients and the potential financial gains for your organization clashed. How did you navigate this?

Tell us about a time when you had to make a financial decision that you felt unmotivated to make because you knew it would be unpopular. How did you make this decision? What happened?

5 behavioral questions on business ethics and integrity for finance roles

Employees who handle sensitive financial information and make money-related decisions need to have a strong code of ethics.

Look for candidates who exemplify the following traits in their interview questions:

Honesty;

Trustworthiness;

Transparency;

Awareness of and adherence to regulations and other standards; and

Conversely, look out for applicants whose answers suggest a history of unethical conduct or who could easily give into external pressure or a desire for personal gain.

The following finance behavioral interview questions help you select the right talent:

How do you ensure that your financial decisions comply with all relevant laws and meet high standards of integrity?

Can you share a time when there was a potential conflict of interest in your financial role? What did you do?

Describe a time when you discovered a financial discrepancy. How did you ensure transparency and build trust as you addressed the error?

Tell us about a time you’re proud of—when you showed exemplary integrity in a financial matter.

Describe a situation you encountered when there was a conflict between meeting financial objectives and following ethical practices. How did you handle the decision-making process?

5 behavioral questions on growth potential for finance roles

Personal and professional development keeps financial professionals resilient and well-rounded. When these employees focus on growth, they may feel happier at work and more able to make a contribution—one that goes beyond money knowledge.

As you ask pre-employment assessment questions, seek out applicants who demonstrate a thirst for knowledge and a willingness to embrace new challenges and constructive criticism.

On the other hand, proceed with caution if applicants are complacent in their professional development or show resistance to feedback.

Here are 5 questions that can help you uncover growth potential:

How do you pursue new knowledge and skills? Can you share an example of how learning has positively impacted your career?

Describe a time when you developed a new skill or competency, even if it wasn't required for your current role.

How do you handle criticism? Can you provide an example of feedback you received that was hard to hear but that helped you improve as a financial professional?

Tell me about a time when you needed to step outside your comfort zone at work. What did you learn?

Discuss your long-term career goals and your plans to achieve them. How do you see your goals aligning with our organization?

5 prioritization behavioral questions for finance roles

In the fast-paced finance industry, prioritization is key to meeting deadlines.

As candidates answer behavioral questions, look for replies that show applicants can:

Manage multiple financial tasks;

Use resources and technology to make good decisions; and

Allocate their time wisely.

You may not want to move further with candidates who seem unable to correctly evaluate the importance of different tasks and what that means for their work.

The following five questions delve deeper into an applicant’s prioritization skills:

How do you determine the priority of tasks and projects?

Can you share an example of a situation where you had to handle conflicting priorities? What was the outcome?

Describe a time when you had to adjust your priorities due to unexpected events. How did you decide what was most important?

How do you balance long-term projects with immediate tasks that require your attention?

Tell me about a time when you had unreasonable demands on your time. What steps did you take to ensure tasks were completed in the correct order?

5 leadership behavioral questions for finance positions

Financial professionals in leadership roles make decisions that can have a big impact on a company’s success. For this reason, strong leadership skills are especially important when hiring for a management position in finance or when seeking out candidates with potential for vertical movement within the company.

Look for candidates who can communicate clearly, delegate with confidence, and motivate others to do their best work.

On the flip side, if you’re hiring for a leadership role, you might want to think twice about applicants who don’t have a history of guiding teams effectively or who seem hesitant in their decision-making skills.

The following questions help you uncover a financial professional’s leadership abilities:

How do you inspire your team to achieve its objectives together?

Describe a time when you successfully led a team through a challenging project. How did you keep everyone aligned and committed?

Can you share an example of how you’ve chosen to delegate responsibilities in the past?

Tell us about a time when you provided constructive feedback to a team member. How did you support them afterward?

What leaders do you most admire? How have you used their leadership style in your own work and what has been the outcome?

What is the most difficult lesson you've had to learn as a leader? How did you learn this lesson and how have you applied it in your career?

How to roll out behavioral interviews for finance roles

Behavioral interview questions are a powerful tool to help you find financial professionals, but they’re only one part of the equation.

TestGorilla’s multi-measure testing technique allows you to get a fuller picture of all your applicants. It’s easy to create full assessments, thanks to an extensive library of more than 300 scientifically validated tests.

TestGorilla will offer recommendations based on the financial position you’re hiring for, whether it’s an internal auditor or a chief financial officer. Select those that seem most relevant to the role and your company. Then, you can add in any number of behavioral interview questions from this article. You can even ask candidates to reply by video, if you prefer, or by text.

Tests that would work well for a financial position include:

The Financial Due Diligence test and other finance-specific tests to evaluate financial skills;

The DISC and Motivation test to evaluate motivation;

The Enneagram, and 16-type personality test to measure personality;

The Culture Add test to make sure your new financial professional aligns with your company;

and other personality and culture tests.

Combined with behavioral interview questions, these are a great, objective way to measure how a financial professional will fit with your organization.

Combine these questions with skills testing to hire the best

Behavioral interview questions offer you insight into a candidate’s abilities, motivations, and values.

As you evaluate candidates' responses, look for authenticity, adaptability, and alignment with your company's culture and values. This ensures your organization will be well-positioned to thrive, with financial talent you can count on.

Are you ready to learn more about how you can evaluate candidates for roles such as financial controllers, financial managers, CFOs, and more, while removing bias and getting more actionable insights that can help you make hiring decisions?

Take TestGorilla’s product tour to check out all the features TestGorilla pre-employment assessments have that can make hiring a breeze. Or sign up for a free demo to see how TestGorilla can help you with your next hire. Alternatively, read The State of Skills-Based Hiring in Finance to discover insights and best practices for hiring finance talent.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.