20+ interview questions for a director of finance

New skillsets are changing finance recruitment

80% of finance employees prefer a skills-based hiring process (12 percentage points higher than the industry-wide average). Read the report to learn more.

Are you looking to hire a new director of finance but aren’t sure what to ask them during an interview? In a role with so much responsibility, hiring the wrong person can be disastrous for the business.

The right interview questions, alongside a relevant skills test in areas like financial management or accounting, can help you avoid this.

Below, you’ll find 20+ questions that can help you get to know candidates better. Using these questions can be beneficial to understanding their experience, skills, and personality.

Table of contents

We’ve also included our comments and sample answers to help you evaluate each applicant you interview.

Twenty+ interview questions for a director of finance

1. Can you tell me a bit about yourself?

When considering candidates for the director-of-finance role, asking an open question about their character can be helpful. Their answers to this question can reveal their values and personal interests.

For example, some candidates could emphasize their work ethic or most prominent professional skills, such as mathematical ability, while others might share more personal details about themselves, like their hobbies or talents.

Your applicant’s answer could play a crucial role in setting the tone for the interview, as a response focused on professional skills may show the candidate is prepared for a formal interview, whereas a character-focused response could set a more informal tone. Topics this question could lead to include:

Work experience

Home life

Their family

Where they live

What they enjoy doing in their free time

2. How would your previous employer describe you?

The best candidate should be open and transparent and shouldn’t use this question as an opportunity to say anything negative about their boss or contest their opinion.

Instead, look at how they approach the question. Does it feel like they are choosing to omit anything unfavorable? Are they quick to change the topic? These are things you should be mindful of when evaluating candidates’ responses.

Answers can vary, but asking this should give you a better understanding of their work history and how they may interact with senior management.

3. What makes you interested in the role of a director of finance?

Asking a candidate why they’re interested in the director of finance role can help you understand their motivations, such as career progression or financial incentives, and enable you to investigate their experience and skills further.

An applicant can mention how their education in mathematics or accounting motivated them to become a director of finance one day or how working in junior-level financial roles provided them with beneficial experience that makes them strong finance director candidates.

Look for answers that explain how their skills, such as leadership and project management, make them the best candidate for the role.

4. What do you know about our company?

Candidates should know enough details about the role they are applying for and should show that they’ve conducted some initial research into the company. This question allows you to assess their knowledge of your history, ethos, values, and plans for the future.

It’s a positive sign if candidates have a good knowledge of the company. However, if they don’t understand the business or its direction, this could indicate that they are interviewing for many other roles or aren’t invested in your business’ progression.

5. What made you choose a career in finance?

If someone is applying for a director of finance role, they’re typically passionate about the field and their career choice. This question will bring up different responses, varying from their academic background in accounting to personal career goals.

The best candidates will show their passion for the field and why they love doing what they do, with reference to their goals for the role and how it fulfills their career ambitions.

6. What do you want to achieve in the next five years?

Recruiters should ask this question to determine whether the candidate’s vision for the role, what they want to achieve, and their plans for progression align with the company’s own vision. This can also help you see how long they might stay in this role.

You don’t want to hire another director of finance in a year or two, so getting an idea of their plans can tell you if they want to stay in the role for a reasonable amount of time.

7. How do you keep up with industry news?

Finance has a significant impact on everything around us, from businesses to worldwide economies. It’s a rapidly evolving field, with new investments in businesses, technologies to automate processes, and global events shaping markets.

For a director of finance, being in the know about industry changes and updates is crucial.

The best answer should explain the types of sources they use to stay up to date, such as news sites or social media platforms like Linkedin. Other positive signs to look out for in candidates’ responses would be details on which current financial events are shaping the field and how those are likely to impact their role if they’re successful.

8. What are the factors that make you feel you are ready for this position?

This can be an invaluable question for those who have worked in finance but never as a director. Knowing why they feel ready for a leadership position can give you valuable insight into both their technical expertise and people-management skills.

Most answers will likely revolve around candidates’ experience. For example, they may state that their experience as an accountant or in a financial controller role has provided them with a technical understanding of tax and business finance to manage overall financial operations.

Look out for candidates who are able to explain how their previous role impacted business performance; their accounting experience may be invaluable to your development targets. Accountants now run a number of FTSE100 companies, so extensive experience can be very beneficial for the role of a financial director.

9. What has been your greatest professional achievement?

Professional achievements can range from mentoring someone to success to major financial wins for the business.

Asking a candidate this question can be eye-opening. They may tell you how they transformed a business budget – something your company may need – or how they gained a new qualification while working.

The best candidates should also explain what they learned from their achievements and how they plan to use this experience to benefit their new employer.

10. What makes a successful budget?

A director of finance will oversee and manage the budget of the business they work for, meaning that the success of that budget relies almost solely on them. Candidates should be able to explain what makes a successful budget, such as flexibility and room for risks.

Their answer will likely focus on a business budget overall, but you should ask any follow-up questions where you need more detail on their budget-management techniques, risk-assessment strategies, and contingency plans.

11. What is the approximate size of the budgets you have managed in the past?

This follow-up question about budgets can help you distinguish the candidate’s education from their experience. Though they may have a solid understanding of what makes a good business budget, they may have only dealt with smaller budgets than the one of your company.

It doesn’t have to be a dealbreaker if that’s the case. Instead, you should look for answers that go into the details of how they managed and improved budgets in the past, no matter how small.

The best candidates should know how to scale a budget according to the business’ needs, so consider asking follow-up questions about how they would adapt a budget to a changing financial climate.

12. How do you measure financial performance?

As an experienced financial professional, your candidate should clearly understand how to measure financial performance to help sales directors and marketing teams build strategies to support performance.

Your candidate should mention their technical expertise in reading graphs and in using financial performance indicators like return on sales, gross profit margins, and current sales ratios.

13. Tell me about a major challenge you’ve had to overcome.

There are many ways to assess problem-solving skills, but this is a great question for all candidates.

Expect the discussion might branch in a different direction with each person. Some interviewees may discuss a challenge that they overcame in their personal life; others might focus heavily on their career in finance.

Neither type of answer is preferable to the other as long as their response gives you more information about them as a person and how they overcome difficult situations.

The best candidates will talk about the lessons they learned from this challenge and explain how it allowed them to refine their skills.

14. Can you tell me about a time you worked with a difficult client?

One challenge most people have had to overcome in their work, regardless of the specific role, is dealing with a difficult client. For a director of finance, this would most often be other businesses, and they might also need to negotiate with difficult partners, suppliers, or even competitors.

Finding out how a candidate handled working with a difficult client can tell you more about their communication skills, negotiation skills, and whether they can stay level-headed in challenging situations.

Approaches will likely vary: Some might use empathy to understand and resolve issues, while others might use a different strategy to appease the client after talking to them.

15. Can you tell me about a big financial project you worked on?

Finding out what big financial projects your interviewee has worked on will enable you to assess whether they would be able to handle the pressure of the role. The ideal candidate should provide more than one example.

To show their project-management experience and skills, your candidate should focus on:

Challenges they dealt with and the approach they used

Whether the project was successful

What they would do differently

16. What value do you think you can add to our team?

No matter how big your team is, every team member should add value. If you’ve got a great team running effectively at your business, you’ll surely want to know what a new person will bring to it.

Candidates will likely discuss their skills and explain what makes them an asset to a team, but you shouldn’t hesitate to steer the discussion to talking about their personality, interpersonal skills, and values to find out what they can add to the team.

You can also use TestGorilla’s Culture Add test to measure whether your candidate will fit seamlessly into your team.

17. What is your leadership style?

The role of a finance director is a leadership-oriented one, so it’s useful to check whether they’re able to manage and mentor people and delegate tasks effectively.

Understanding their leadership style enables you to see how they would interact with their team, give feedback, and manage concurrent projects.

Leadership styles include:

Autocratic: This refers to the traditional, boss-like style of leadership where one person has control over all decisions

Democratic: Democratic leadership refers to an approach to decision-making that is based on a group or company-wide effort

Laissez-faire: Laissez-faire leadership is more informal and primarily involves people having total control over their decisions in business; this makes it suitable for more experienced teams

Transformational: Transformational leadership involves inspiring a team to work beyond their immediate interests and creating positive change for the entire group

18. What do you hope to achieve in your first month here?

In a fast-paced role, your finance-director candidate should have a good idea of what they plan to do in their first month and, more specifically, what changes they hope to make.

Finance directors should have a strong understanding of your company’s pain points and provide tangible solutions to how they plan to start addressing them as soon as they begin working for you.

As most new employees only work at a 25% capacity in the first month of their new job, it’s a good idea to learn about their plan for those first few weeks during the interview.

The ideal candidate will provide a summary of their priorities for their first month and explain why they believe these to be important.

19. What strategies do you use to prioritize tasks?

Finance directors are likely to juggle many projects simultaneously, meaning they’ll need a comprehensive understanding of prioritizing tasks. Candidates should explain the specific strategies they’ve used to manage a heavy workload in the past and explain why these are effective.

The best candidates will explain that their prioritization strategies are based on assessing and focusing on what is most beneficial to the business, such as large investment deals or ways to increase workplace efficiency.

20. What methods would you use to deliver work within a tight deadline?

Directors of finance will need to work within tight deadlines. For example, to define budgets for urgent projects or sign deals with investors.

Your candidates should be able to explain what time-management strategies they’re using, such as the Pomodoro method or working in time blocks. Time management is an essential soft skill for leadership roles, so asking this question is crucial.

The best candidates will explain why their specific time-management strategies are beneficial and provide examples from challenging projects they’ve had to work on in previous roles. Those can be assessing returns at the end of the financial year, creating annual budgets, or preparing financial reports of the company’s activity.

21. How would you help an employee who is underperforming?

Your next finance director may need to manage an employee who underperforms. The answer to this question will be telling of their leadership style and skills – and their ability to provide support to employees who struggle with their tasks.

Look for answers that feature a clear strategy, like mentoring the employee or providing career advice. Answers may include information about:

How they’d assess the employee’s work in the future

How they’d discuss the reasons behind low performance

What further action they’d take if the problem persisted

22. What strategies would you use if our company was losing money?

Recruiters can ask this question to gauge how the candidate responds to high-pressure situations like losing money.

Your candidates should use this as an opportunity to explain their risk-management processes, why they’re effective, and how they would incorporate contingency plans into their budget and financial plans.

Look for candidates who provide clear solutions and are able to explain their reasoning as to why their methods would be effective.

For example, candidates might explain how they plan to conduct competitor research to identify the core reason why they’re losing customers. Alternatively, they may explain how they’d evaluate current spending on supplies and look for cheaper alternatives.

When to use these interview questions for a director of finance

These questions enable you to get to know each of your candidates better and assess their skills, experience, and suitability for the role.

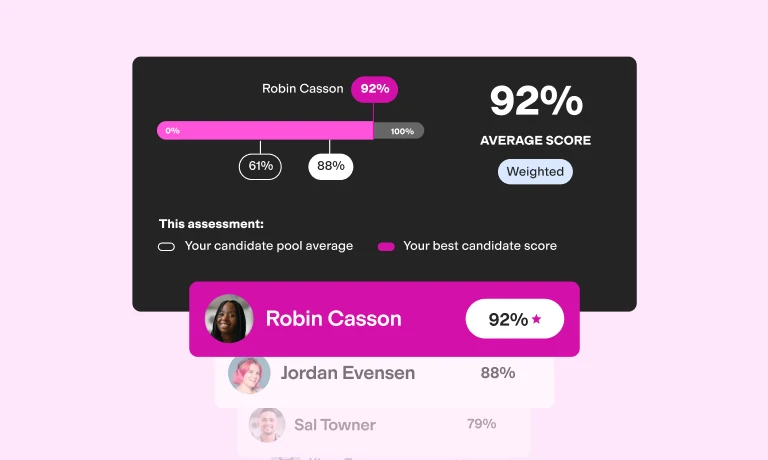

The information you gather during interviews will help you decide who is the best fit for the director-of-finance position at your business. However, skills testing can be very beneficial to gain deeper insights into your applicants’ skills and interview only those who truly have what it takes to be successful.

For example, our Financial Management test can help you narrow down your list of candidates in a way that is objective and bias-free.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Hire the most skilled director of finance with TestGorilla

TestGorilla enables you to simplify your hiring process by providing you with short tests that accurately assess a candidate’s skills and experience. You can combine up to five tests in a single assessment – for this, simply head on to our test library to pick the ones that make the most sense for your open role.

Once applicants complete the tests, simply review their results and decide whom to invite to an interview for a more thorough assessment – and meet your future director of finance in person.

Sign up for a free 30-minute demo to see for yourself why more than 10,000 companies are using TestGorilla to transform their recruitment processes. Alternatively, download The State of Skills-Based Hiring in Finance if you're looking for insights and best practices for finance recruitment.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.