One of the major roles of a financial accountant is recording the financial growth of an organization. They understand when the business is running at a loss or when it’s in profit. Hence, they offer crucial financial advice that feeds into key decision-making in the organization.

Such a critical role requires a solid recruitment strategy. You want to avoid the risk of mis-hiring, and to do so you need to be aware of the core skills needed to be an effective financial accountant.

Not only does understanding financial accounting skills help you employ talented accountants, but it also saves you from the extra cost that underqualified employees could cause for your organization.

In this article, we will describe the importance of financial accountants and explore the 10 fundamental accounting skills you should look out for when hiring.

What is a financial accountant?

A financial accountant is someone who documents the financial transactions of an organization. They analyze and record the economic condition of the organization and share financial information with other departments in the company.

Additionally, financial accountants obtain and interpret financial data, drawing accurate conclusions and helping business managers make decisions concerning the organization.

With the information they gather, financial accountants ensure that you are timely with your taxes and that your business is operating at its best. They can also make helpful suggestions on project funding and budgeting.

A top financial accountant ensures a timely analysis of the company’s profit and loss and balance sheet reports. They have in-depth knowledge of accounting practices and provide essential information on ways to boost an organization’s financial situation.

Why do you need a financial accountant?

The basic importance of a financial accountant is to record an organization’s transactions and provide insights into financial information. It’s essential for successful companies to employ a financial accountant to understand how your company is performing.

Moreover, with an accountant, you don’t have to worry about encroaching on your capital or overspending on projects. This is because accountants differentiate your capital from the spendable profit.

Financial accountants also help you deal with taxes and budgets. They take measures to ensure that your business is in good legal standing and thus improve your company’s image.

Any organization with a steady cash flow needs a capable financial accountant to track the movement of money in and out of the organization. This way, you can monitor your company’s growth and success.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

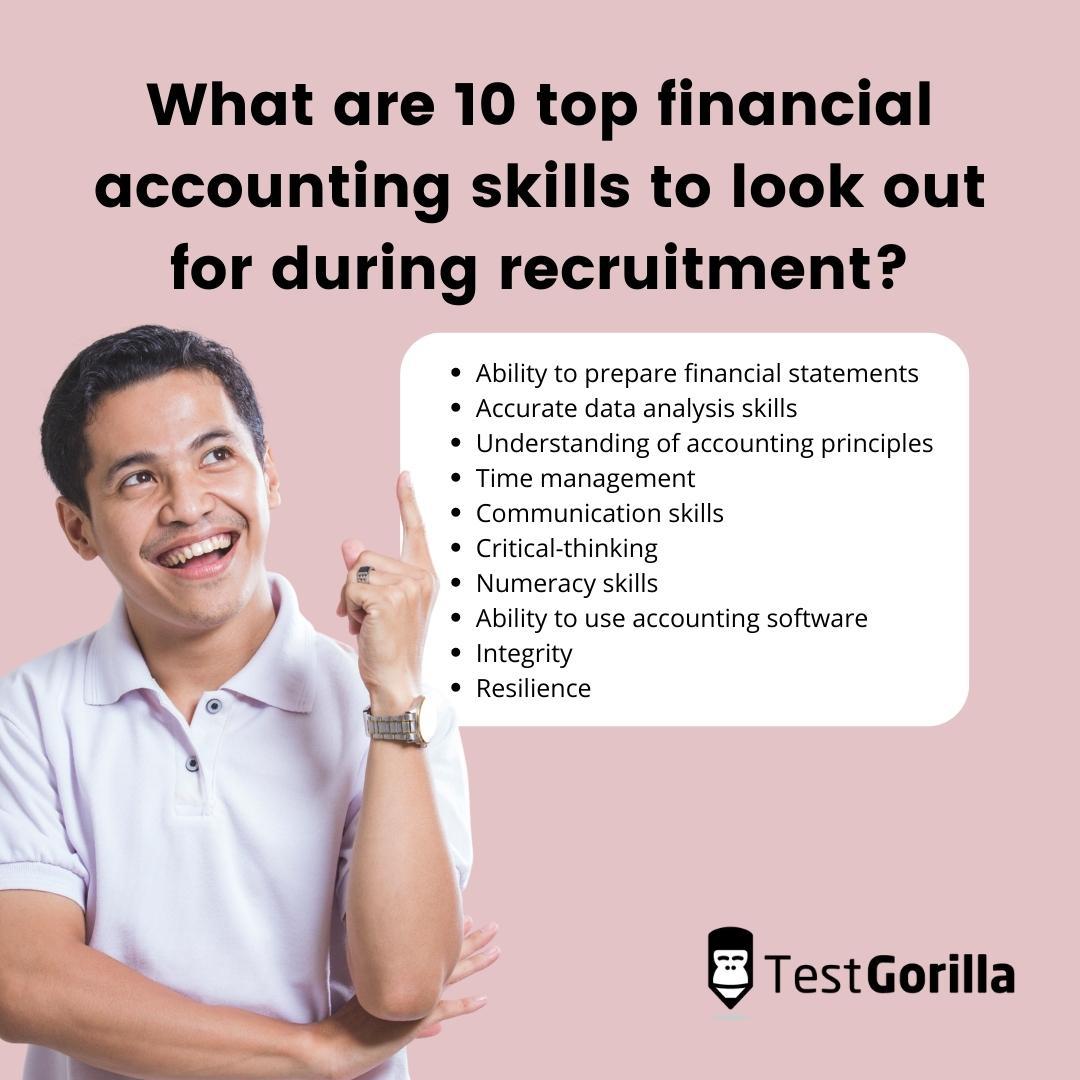

What are 10 top financial accounting skills to look out for during recruitment?

By identifying and recruiting candidates with top financial accounting skills, you ensure that your organization only hires the best for the role.

Below are 10 skills to review when hiring financial accountants:

1. Ability to prepare financial statements

Financial statements specify the organization’s transactions and economic position. The three basic financial statements are income statements, cash flow statements, and balance sheets.

Top financial accountants prepare accurate records to help organize an organization’s financial information and feed into business decisions. To do this, accountants need to be able to interpret financial data and present clear financial analyses.

2. Accurate data analysis skills

An organization’s financial data is critical for enhancing operations. Effective accountants work with data to contribute to an organization’s decision-making process and ensure its success.

Accountants who accurately analyze financial data can extract relevant and useful information. They can understand, classify, and summarize information to make it easily accessible to others.

Data-analysis skills also help accountants observe patterns in the records, as well as possible errors that require attention.

3. Understanding of accounting principles

Talented financial accountants are conversant with the generally accepted accounting principles (GAAP), which govern how accountants record information. These principles include objectivity, materiality, prudence, and consistency.

While recruiting accountants, it’s crucial to ensure that they have a strong grasp of these principles and how to apply them to work scenarios.

4. Time management

While hiring, it is vital to check their time-management skills. The best financial accountants understand the importance of managing time effectively. They keep to deadlines and deliver their best within defined periods.

Being time conscious makes financial accountants reliable, flexible, innovative, and dedicated to maintaining your organization’s financial stability.

5. Communication skills

Deficient communication skills negatively affect an accountant’s ability to turn data into information. A great financial accountant needs communication skills to take in complex information and relate it to others as required.

Accountants must be able to break down complex information into simple forms that other employees can understand. Consequently, communication skills help them carry out their functions properly.

6. Critical-thinking

An accountant will have to face a variety of challenging conditions in the course of their work. Critical thinking is the ability to consider such problems from different points of view and come up with effective solutions.

Accountants with critical-thinking skills pay close attention to details and cross check their work thoroughly to ensure accuracy. As a result, they save your organization from the extra cost incurred due to frequent errors.

7. Numeracy skills

Financial accountants work closely with numbers and numerical functions. As a result, accountants must have in-depth knowledge of numerical operations like multiplication, subtraction, addition, and division.

Numerical-reasoning skills are vital for the accurate representation of information. Meticulous accountants apply their numeracy skills to ensure an organization is informed of its financial standing with accurate data.

8. Ability to use accounting software

Aside from book records, modern organizations use accounting software to present their financial data. These programs make it easier to understand the information and reach an accurate conclusion.

Hiring accountants with the ability to use accounting software helps conserve resources and time spent sorting through books each time you require information.

9. Integrity

Financial accountants must be trustworthy enough to handle financial information efficiently. This is because financial information is the foundation for an organization’s success.

Employing financial accountants with integrity ensures that the information your organization receives is high quality and has undergone proper scrutiny.

10. Resilience

A passion for performing at their best is another quality of top financial accountants. They are willing to spend the necessary time to ensure that their reports are of a professional standard and free from errors.

Resilience and hard work make accountants more efficient, versatile, and trustworthy. With this skill, they can handle delicate information according to your standards.

Enjoy stress-free recruitment with TestGorilla’s pre-employment tests

Identifying top financial accountants might not be as easy as it sounds. It isn’t enough to scan applicants’ CVs because they don’t tell you much about the candidates’ skills and expertise. Besides, poring over resumes takes time and effort.

Thankfully, good pre-employment tests remove the stress of recruitment.

TestGorilla’s Financial Accounting test assesses candidates’ skills and knowledge and presents the results in an accessible way, ranking your candidates to point you towards the strongest.

Our bias-proof tests create fair conditions for all candidates, so you can be sure of hiring experts with the skills you’re searching for. To get started, sign up for free today.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.