Financial analyst job description template: Everything you need to include

The job market for financial analysts is growing fast – it's expected to increase by 9% from 2023 to 2033. [1] Hiring for this role? Your job descriptions must be more comprehensive and attractive than your competition’s.

A poorly worded job description can push away candidates who’d otherwise excel. Plus, it can draw in candidates lacking the financial know-how, analytical chops, and strong communication skills you need – not something you want for a high-stakes role like this.

This is where we come in. We’ve created a financial analyst job description template with everything it should include. Plus, we suggest skills assessments to pair with this job description so you can discover the best of the best.

Let’s get started!

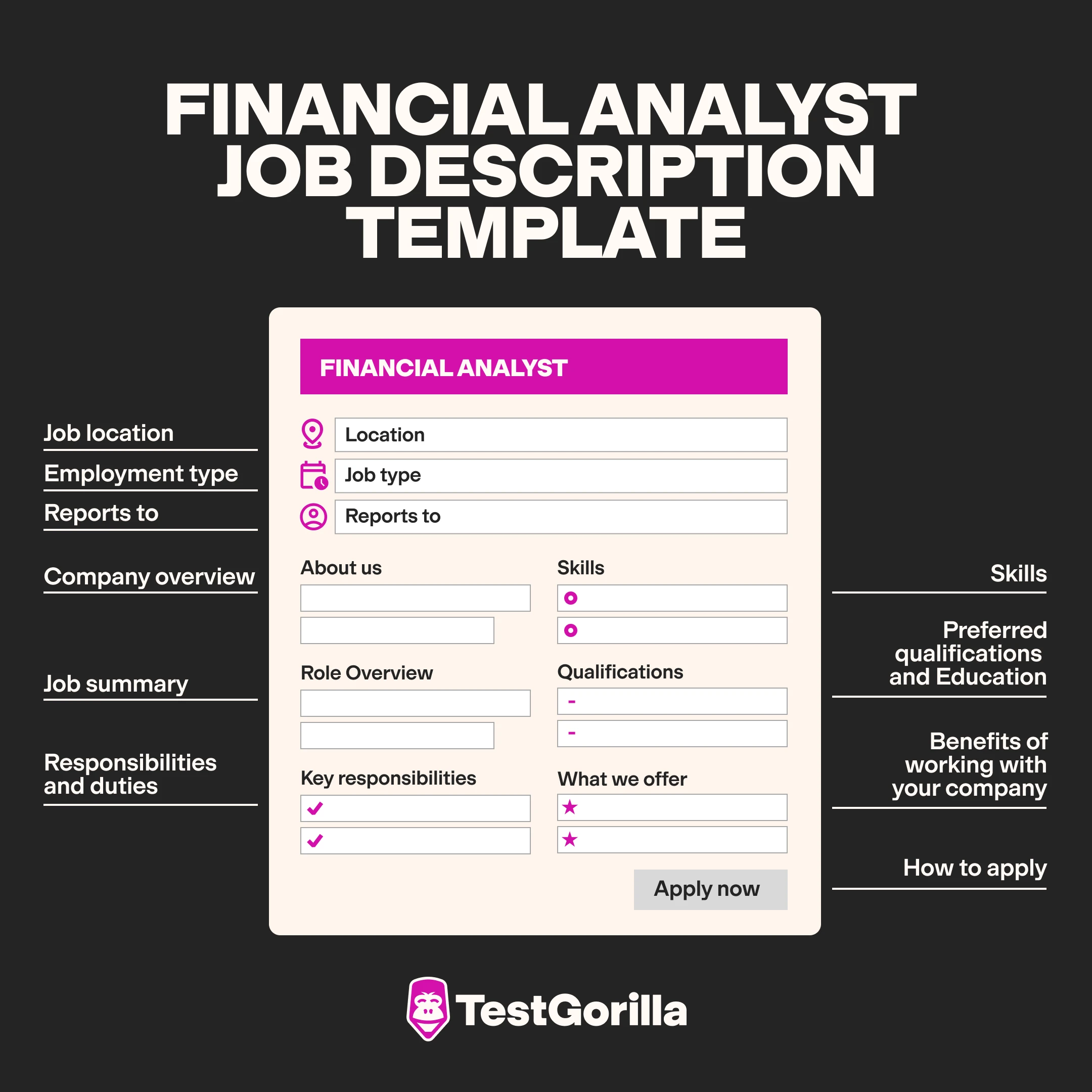

Financial analyst job description template

Job Title: Financial Analyst

Location: [Insert Location]

Reports To: [Insert Line Manager]

Job Type: [Full-time/Part-time/Contract]

About Us

[Company Name] is a leading [industry] company dedicated to delivering exceptional services and products to our clients. Our team is committed to fostering a collaborative environment that encourages growth, innovation, and professional development. We value integrity, excellence, and continuous improvement, and we are looking for motivated individuals to join us on our journey to success.

Job Overview

We are seeking a skilled Financial Analyst with a strong eye for detail to join our finance team. In this role, you will play a key role in analyzing financial data, preparing reports, and making recommendations to support the company’s financial planning and decision-making. Our ideal candidate will deeply understand financial principles and have excellent problem-solving skills and the ability to communicate complex financial information clearly and effectively.

Key Responsibilities

Conduct detailed financial analysis to support business decision-making.

Prepare and analyze monthly, quarterly, and annual financial reports, forecasts, and budgets.

Monitor financial performance against budgets and forecasts, identifying trends and variances.

Develop financial models and provide data-driven insights to improve profitability and operational efficiency.

Collaborate with cross-functional teams to gather and analyze data for financial planning.

Assist in developing and implementing financial policies, procedures, and controls.

Support the finance team with ad-hoc analysis, presentations, and special projects as required.

Skills

Strong problem-solving and analytical abilities.

Excellent attention to detail and accuracy.

Proficiency in financial modeling and forecasting.

Advanced Excel skills; experience with [financial software or tools, e.g., SAP, QuickBooks, Oracle, etc.] is preferred.

Ability to interpret and present complex financial information clearly.

Strong verbal and written communication skills.

Ability to manage multiple priorities and meet deadlines in a fast-paced environment.

Preferred Qualifications

Bachelor’s degree in Finance, Accounting, Economics, or related field.

[X] years’ experience in financial analysis, accounting, or a related role.

Experience with budgeting, forecasting, and financial reporting.

Professional certification (e.g., CFA, CPA) is a plus.

Benefits

Competitive salary and performance-based bonuses.

Comprehensive health insurance package.

401(k) plan with company match.

Paid time off and holidays.

Professional development and continuing education opportunities.

[Any additional benefits specific to your company, e.g., wellness programs, remote work options, company events.]

Application Instructions

To apply, please submit [application materials] to [email address or application portal link]. Please include “Financial Analyst Application – [Your Name]” in the subject line.

Why this financial analyst job description template works

This job description uses the keyword phrase “financial analyst” in the Job Title to grab your target audience’s attention and give your post a better chance of showing up in job seekers’ internet searches.

Next up are the Location, Reports To, and Job Type sections. These first four elements help your candidate decide whether this role fits what they’re looking for.

Immediately after is the About Us section, which describes the company culture and values. You should highlight values that appeal to financial analysts – like integrity and continuous improvement. This section draws in candidates who line up with your organization’s values and culture.

The Job Overview is a TL;DR of the main requirements of the financial analyst's role. It tells candidates who you expect them to work with, what you expect them to do, and which competencies you expect them to possess. Candidates who can’t picture themselves collaborating with the finance team or making expert recommendations are less likely to apply.

Next is the Key Responsibilities section, which outlines specific deliverables like monthly financial reports and financial modeling. The Skills section then lists the tools (for example, QuickBooks) and the hard and soft financial analyst skills they’ll use in this role. These sections help candidates determine if they can handle the workload and have the right combo of skills for success.

Then we tell candidates which certifications, finance-related education, and work experience we’re looking for in the Preferred Qualifications section. By labeling qualifications as “preferred,” you let candidates know you’d like certain education and experience but that applicants who don’t tick all these boxes are still welcome to apply. This expands your candidate pool – and you might discover that a candidate without a finance or related degree still has all the skills you need and more.

The Benefits section highlights all the advantages of the job that might appeal to financial analysts – like performance-based bonuses and paid vacation, which are great perks for high-stakes roles.

Finally, the Application Process gives applicants specific instructions on how to apply for the role. This doubles as a test of the candidate's attention to detail and verbal and written communication skills.

✨ Recommended reading: What does a financial analyst do?

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Next steps: Attracting and assessing financial analyst candidates

Now that you have a compelling financial analyst job description template in hand, post job ads to reel in those stellar candidates. You can use popular or finance-specific job boards. Hiring remotely? Our remote jobs board is a great choice. As the applications roll in, start screening candidates.

A skills-based approach tells you more about your candidate’s capabilities than a resume and cover letter. This is why you should use skills tests right away. This way, you can see how applicants’ skills stack up from the get-go and shortlist the best ones for the next stages of your hiring process.

TestGorilla is a talent discovery platform with tons of skills tests. Here’s a list of tests you might use to evaluate your financial analyst candidates:

Role-specific

Cognitive abilities

Situational judgment / soft skills

Personality and culture

Don’t see what you’re looking for? Check out our other tests for financial analysts or our full test library. We have lots of tests you might find useful – including specific software skills tests, like our QuickBooks Online (US Version) test.

When vetting your ideal financial analyst, don’t forget to ask them financial analyst interview questions to cover any bases the tests might miss.

Ready to start screening candidates with TestGorilla? You can combine up to five customizable tests to create the ideal assessment tailored to your needs.

Sign up for a free account to get started. Need a little guidance? Schedule a free demo.

FAQs

What information do financial analysts need to do their job?

Financial analysts need access to financial statements, market trends, economic data, and company performance reports to make informed recommendations. They also rely on industry-specific data and any relevant forecasts or projections.

Which degree is best for a financial analyst?

Degrees in finance, economics, accounting, or business administration are commonly the best choices for a financial analyst role. But degrees aren’t always necessary – in some cases, strong certifications like the CFA (Chartered Financial Analyst) or experience in financial analysis can be enough to qualify someone for the role, especially if they have relevant skills.

What is the entry-level position for a financial analyst?

The entry-level position for a financial analyst is often called a "junior financial analyst" or simply "financial analyst."

What is a financial analyst not responsible for?

A financial analyst isn’t typically responsible for making final business decisions. They provide insights and recommendations based on data, but key decision-making is usually left to senior management.

Sources

1. US Bureau of Labor Statistics. “Financial Analysts,” Occupational Outlook Handbook. https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.