When it comes to financial analysts, telling the difference between a real pro and someone who’s just winging it can be tough. That's why it’s key to know the skills a truly great financial analyst has.

This way, you can write job ads that grab the attention of the best candidates and make smarter hiring choices. After all, picking the wrong person to handle your business’s financial decisions can be costly and risky.

Don't stress, though. We've put together a simple guide to show you the essential skills financial analysts have – plus tips on how to test if your candidates really measure up.

What is a financial analyst?

A financial analyst digs deep into financial data to help businesses and individuals make savvy financial choices (including investment decisions). Their daily job duties involve predicting trends, analyzing market risks, and evaluating an organization's financial well-being.

So, exactly what does a financial analyst do? Picture this:

Building financial models: They whip up models to forecast how things might play out financially down the road.

Analyzing financial statements: They comb through data, looking for trends and anything that seems off.

Conducting research: They keep their finger on the pulse of market trends, economic indicators, and industry-specific news.

Collaborating with stakeholders: They work with different departments to provide valuable financial insights and recommendations.

Preparing reports: They present their findings in a way that's clear, concise, and easy to understand.

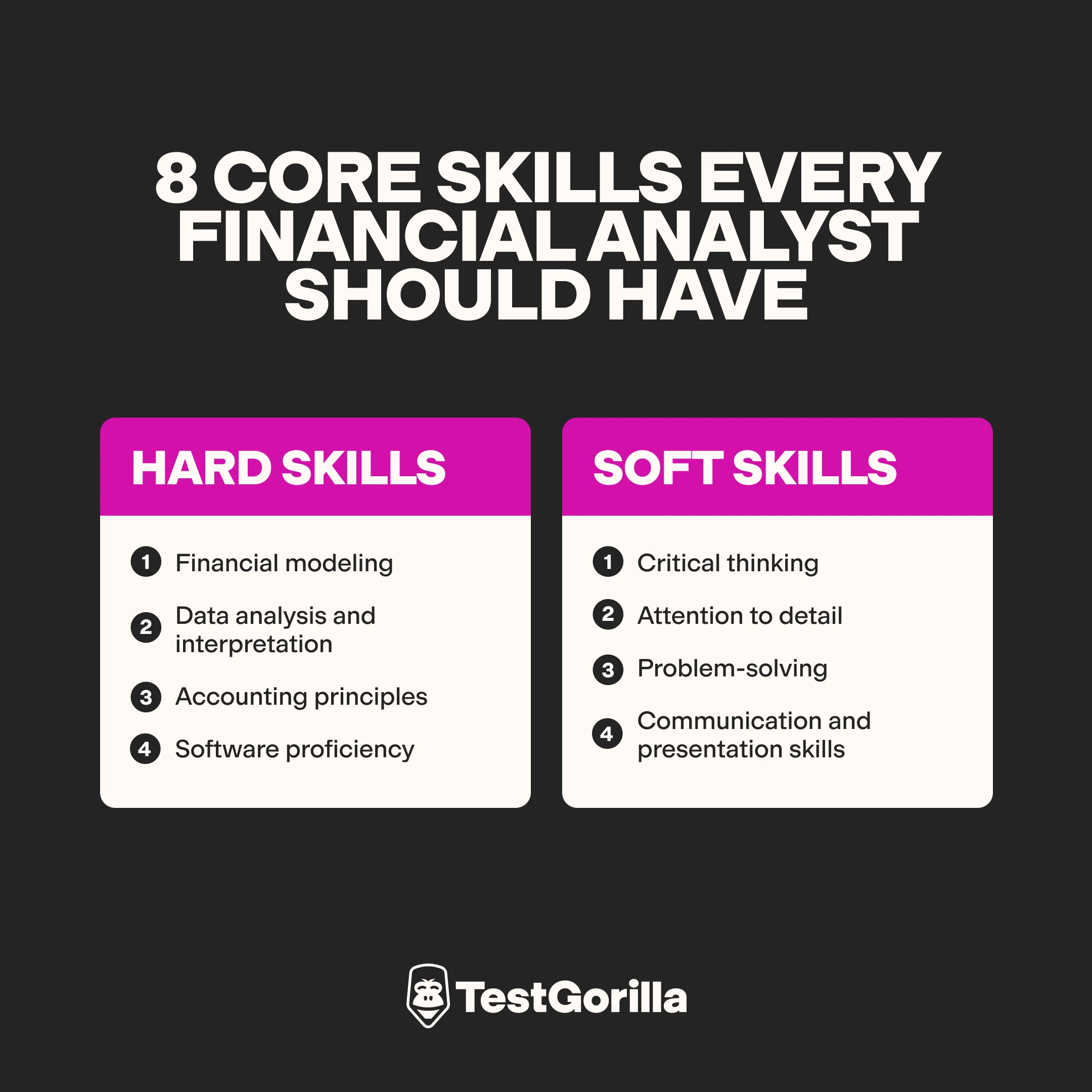

8 core skills every financial analyst should have

Now, let’s talk about the core skills every financial analyst should have in their toolkit. They need a unique combination of hard and soft skills to really shine.

The hard skills give them the technical know-how to tackle their main responsibilities, while the soft skills ensure they can put their knowledge to work effectively, work well with others, and come up with strategic recommendations that hit the mark.

Let's start with the hard skills:

Financial modeling. This is the bread and butter of any analyst's job. They need to be able to build and tinker with financial models. These models are key to making accurate forecasts, running scenario analyses, and coming up with solid financial projections.

Data analysis and interpretation. Financial analysts have to be able to dig through complex datasets and uncover hidden insights. They need a keen eye for spotting trends, connecting the dots, and identifying anything that seems out of place.

Accounting principles. A rock-solid understanding of accounting fundamentals, like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), is a must. This knowledge enables analysts to make sense of financial statements and get a clear picture of a company’s financial health.

Software proficiency. Financial analysts spend a ton of time working with tools like Excel and specialized accounting or financial modeling software. Being an expert with these tools makes analyzing data, manipulating it, and generating reports a breeze.

Now, let's move on to the soft skills:

Critical thinking. Financial analysts don’t just crunch numbers all day. They need to be able to think critically about the data they're analyzing, connect the dots, and draw meaningful conclusions that can guide strategic decisions.

Attention to detail. Mistakes in financial analysis can spell disaster. Top-notch financial analysts have an eagle eye for detail to ensure their models, reports, and recommendations are spot on. Legendary investor Warren Buffet agrees: “A good financial analyst must have an unwavering eye for detail. The difference between a successful investment and a poor one can often hinge on a single data point.”

Problem-solving. Financial analysts tackle complex problems head-on and come up with solutions based on their analysis. This could mean finding creative ways to boost profits, cut costs, or fine-tune investment strategies.

Communication and presentation skills. Barbara Minto, the author of The Pyramid Principle hit the nail on the head when she said, “The most brilliant financial analysis is useless if it can't be understood. Good analysts are also effective storytellers, transforming complex data into clear narratives.”

Analysts need to be able to explain their findings and recommendations to colleagues and stakeholders – some who might not have a deep financial background. They have to break down complex financial concepts into simple terms – using reports, visuals, and presentations to get their point across.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How to assess financial analyst candidates

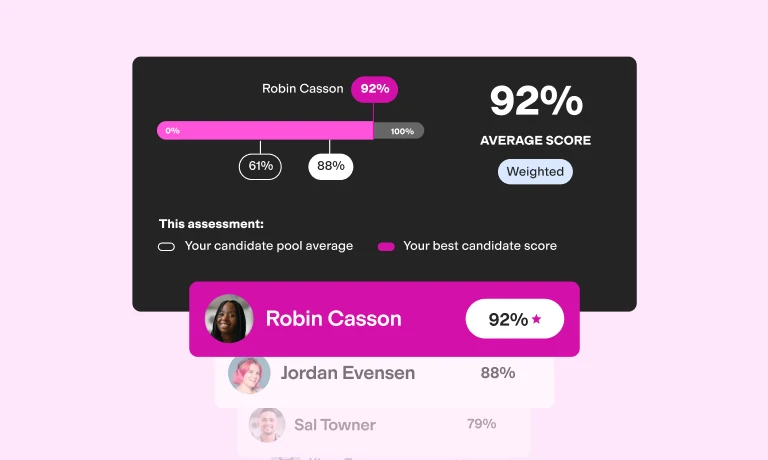

Hiring the right financial analyst is more than just skimming through resumes and having an interview. To really get a sense of whether a candidate is the perfect fit for the role, you’ve got to test their capabilities with multi-measure talent assessments.

TestGorilla is a talent assessment platform with “350+” tests – including ones great for evaluating financial analysts.

With our platform, you can even throw in some custom questions to tailor the tests to your specific needs. You can also mix and match up to five tests to create a single assessment for your candidates. This way, get a comprehensive look at each candidate's technical abilities.

The great thing about testing? It lets you compare candidates objectively and make decisions based on cold, hard data.

How to assess hard skills

TestGorilla has a range of tests that can help you measure the technical skills financial analysts need:

Financial Modeling in Excel test. This one will help you see if they can build complex models and run scenario analyses in Microsoft’s spreadsheet program.

Microsoft Excel (Advanced) test. This test will help you make sure a candidate is a spreadsheet wizard – able to manipulate and analyze data with ease.

Accounting (Intermediate) and more advanced accounting tests (GAAP

or IFRS). These tests will show you if they’ve got a solid grasp of accounting principles and can analyze financial statements.

Data Analytics in Excel and Working with Data tests. These will give you a sense of how well they can get insights from huge datasets.

How to assess soft skills

Technical know-how is important, but soft skills can make financial analysts really stand out. Take a look at these TestGorilla assessments for financial analysts:

Critical Thinking test. This test checks if a candidate can think logically and make smart decisions. It’s essential for financial analysts who need to understand tricky financial info and provide insights that actually mean something.

Problem Solving test. This test will show you how candidates tackle problems. Financial analysts often face unique financial issues, so it’s key to see if they can think creatively to find solutions.

Big 5 (OCEAN) or other personality tests. These assessments can tell you a lot about a candidate’s personality, how they work, and their likely behavior. Knowing all this can help you see if a candidate will mesh well with your team and handle the job’s demands.

Don't underestimate the importance of culture add assessments

Financial analysts often work in fast-paced, high-pressure environments. With TestGorilla's Culture Add test, you get to define the qualities that matter most for your company's unique work culture. Here's how it works:

You rank your values: Rate a list of values according to their importance for your culture.

You define desired behaviors: Tell us which behaviors (for example, analytical or helpful) are important to your financial analysis position.

Then, candidates will receive a survey asking them to choose which values and behaviors matter most to them.

This approach helps you identify candidates whose priorities vibe with your company's. It’s great for fostering a positive and productive work environment, especially in demanding roles like financial analysis.

Behavioral interviews can give you even more insights

Behavioral interviews are great for seeing how a financial analyst tackles problems and handles the kinds of situations they'll face on the job. Here are a couple of questions to get you started:

"Can you tell me about a time you explained a complex financial idea to someone who wasn't a finance expert? How did you make it easy to understand?"

This checks how well they can break down complicated financial analysis for others.

"Have you ever spotted a financial risk or opportunity that other people missed? What did you do, and how did things turn out?"

This shows you if they're good at analysis, strategic thinking, and taking the lead.

By asking about things they've actually done, you'll learn a lot about how they think and solve problems.

Need more question ideas? Check out our article on the top 30 financial analyst interview questions to evaluate applicants’ skills.

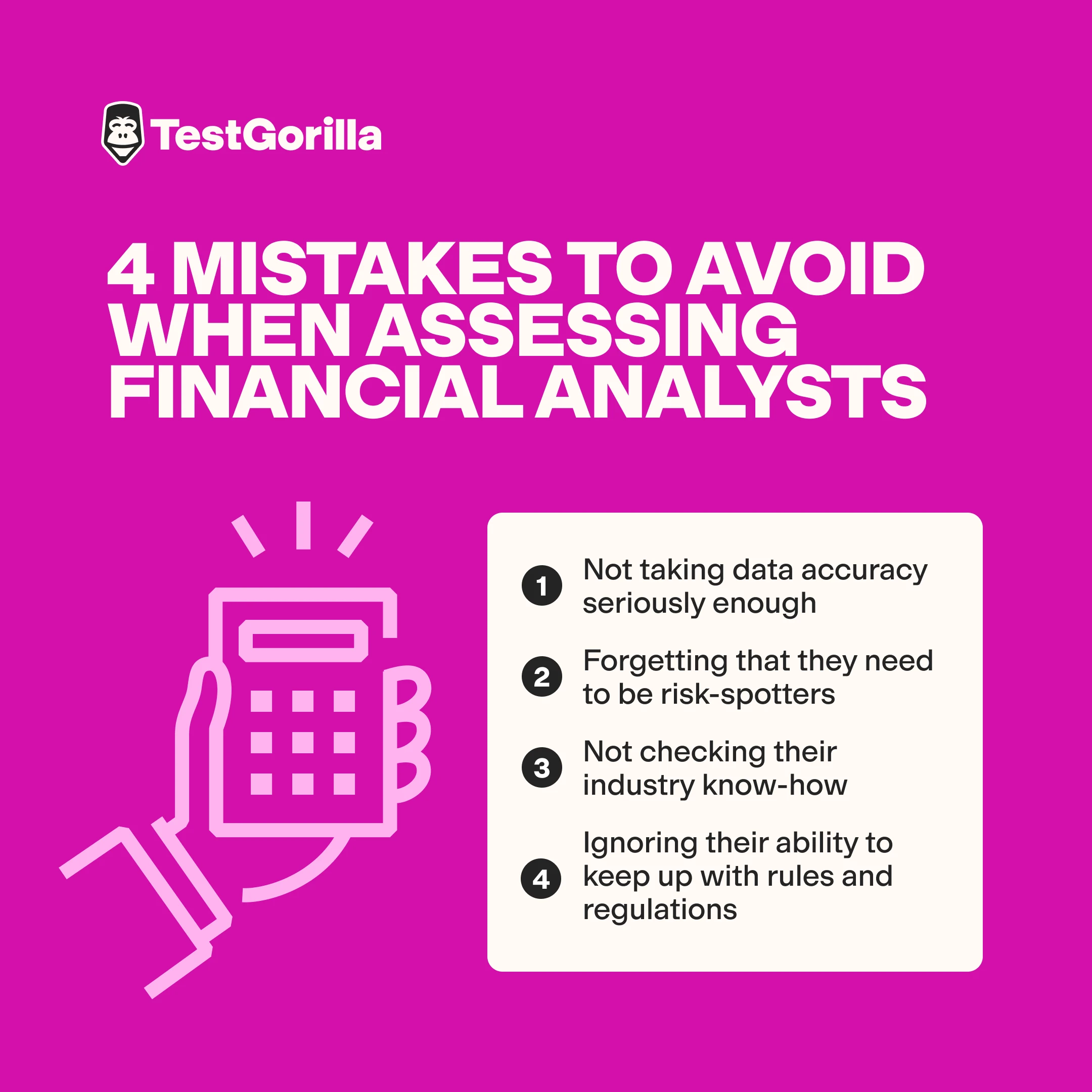

4 mistakes to avoid when assessing financial analysts

Be sure to steer clear of these common pitfalls in your search for the perfect financial analyst.

1. Not taking data accuracy seriously enough

Financial analysts work with sensitive data. One tiny mistake with a number or formula can blow up in your face. Imagine making a decision based on incorrect data because your analyst didn’t double check the accuracy of their work. This could end up costing your company a lot of money – or even damage your reputation.

2. Forgetting that they need to be risk-spotters

Financial analysts must be able to spot risks in the data and in the markets. Fail to assess their risk-spotting skills completely, and you might end up with someone who misses critical risks. This can lead to financial problems that could’ve been avoided.

3. Not checking their industry know-how

Financial analysts often need a good grasp of the specific industry they're working in. If you don’t check whether a candidate knows the ins and outs of your industry – like tech, healthcare, or finance – you could bring in someone who might take too long to catch up or miss critical industry-specific insights.

4. Ignoring their ability to keep up with rules and regulations

Financial markets are often ruled by strict regulations, and these can change. Your candidate shouldn’t just be aware of the current rules – they must also have a knack for adapting to new ones quickly. Not checking this can lead to compliance issues or overlooked opportunities when regulations change.

FAQs

What are some red flags to watch out for when assessing financial analysts?

Keep an eye out for candidates who give overly simplistic answers to complex questions or seem to brush off other points of view. A top analyst should be able to explain their findings in a way that’s crystal clear and consider other viewpoints. If they’re rambling on, getting way too technical, or ignoring others’ ideas, that's a red flag.

What makes a financial analyst good?

Stellar financial analysts are a triple threat: They've got the technical skills, the analytical thinking, and the ability to communicate clearly. They also have an eagle eye for detail, a knack for problem-solving, and a hunger to stay on top of market trends.

How can a financial analyst help a business?

Financial analysts can uncover ways to save money, fine-tune investment strategies, predict financial performance, provide insights for growth decisions, and make sure the company is playing by the financial rulebook.

Upgrade your financial analyst hiring with TestGorilla

Hiring the right financial analyst is an investment in your business’s future. Once you know the core skills that make a financial analyst great, you can revamp your hiring process and make smarter decisions based on cold, hard data.

TestGorilla takes the guesswork out of hiring. We’ve got a library of expert-backed tests that assess both technical expertise and those crucial soft skills. Want to really dig in? Check out our library of more than “350+” tests!

Ready to get started now? Sign up for free here – or book a live demo to see what we’re all about.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.