Hire the right accountant for your mid-sized business in 6 easy steps

Table of contents

If you’re looking to hire an accountant for your medium-sized business, then you’re in the right place.

Accountants play a crucial role in keeping businesses afloat and running smoothly, especially ones that are growing. When a business is new, the financial admin tends to be taken up by the founder until money starts to circulate. Because accounting errors can be costly, it is worth delegating to an expert accountant as soon as you can.

Hiring the right fit can seem daunting to any business, and the consequences of a mis-hire are larger and more damaging for small and medium-sized businesses that might not have the funding or resources to recover. Fear not – this article is here to tell you how to hire the best accountant for you.

In this blog post:

What kinds of accountant are there?

What if I can’t afford an accountant?

✅ Sign up for free and use our accounting test to hire the best

Why hire an accountant?

As your business grows, its financial structure increases in complexity. Unless it’s an accounting business, the chances of its financial portrait expanding beyond its founding team’s capabilities will quickly increase.

Without an expert at hand, accounting tasks will take up more time and you will be faced with a higher chance of accounting errors.

Accounting is a big job. It involves sound record-keeping, sharp analysis, astute financial planning as well as continuous research into the latest state of tax laws and regulations. Tax codes are constantly changing, and a qualified accountant will have the know-how and resources to keep on top of these that people outside the profession simply won’t.

Hiring an accountant is one of the best things you can do to improve the financial well-being of your business. The services and expertise that accountants can offer often make their role advisory, too, as well as practical and strategic.

Entrepreneurs’ most-trusted advisors for business questions are most commonly their accountants

From Onpay’s Small Business Finance and HR Report (2019)

Is hiring an accountant worth it?

With an abundance of accounting software out there, all of which are considerably cheaper than hiring an accountant, it is worth considering at length if this investment is right for your business at this point in time.

Truthfully, we can’t offer a clear or correct answer to the question: Which is the better option for my business? This can only be judged on a case-by-case basis since every medium-sized business has different needs.

We can, however, take you through some of the pros and cons of hiring an accountant and using accounting software.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Accountants vs. accounting software: Pros and cons for mid-sized businesses

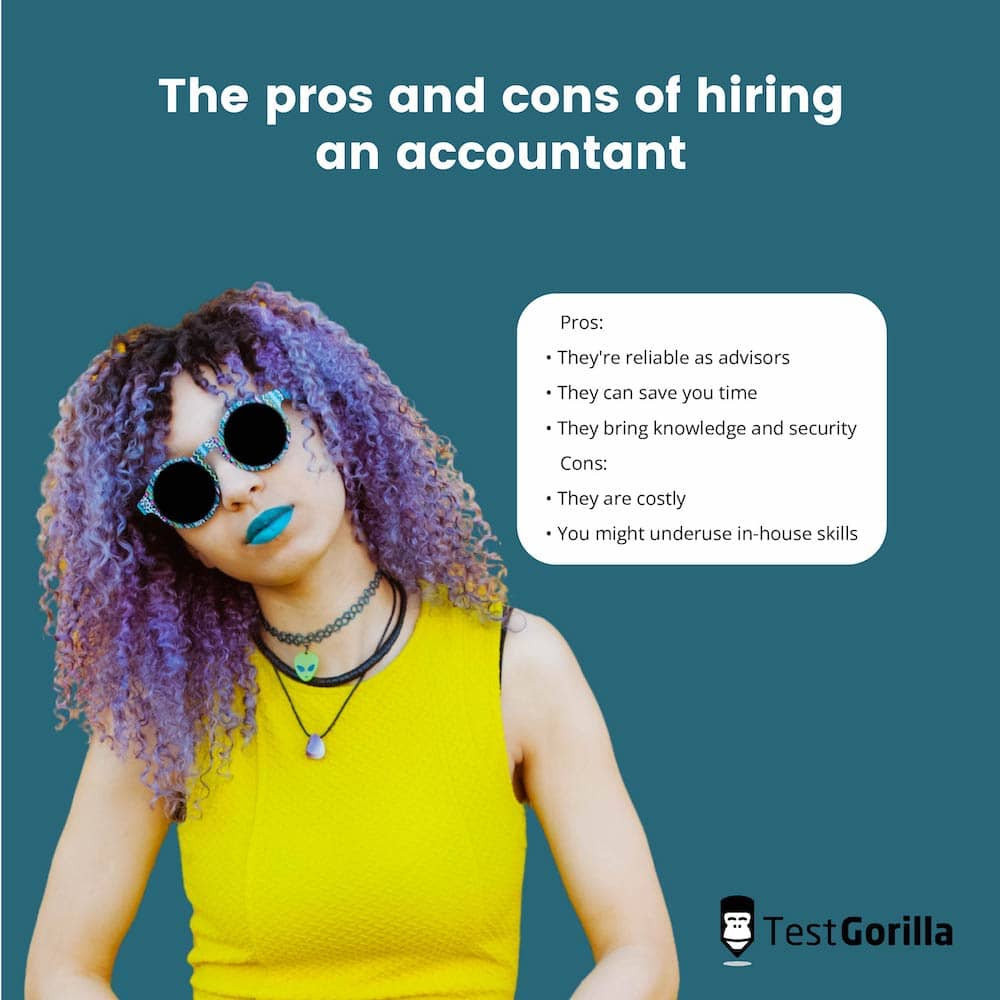

Accountant: Pros

Hiring an accountant will bring security to your business. Business accounting can be complex and scary. By employing a reliable accountant you can ensure that you are getting the legal stuff correct, while avoiding accidental financial issues.

Employing someone to manage your accounts will give you, or whoever has been managing the finances so far, more time to focus on other business matters. A delegated expert will undoubtedly manage things faster and more effectively.

Accountants will often be in a position to advise on all things financial. Software can’t give you the crucial financial advice that an expert can. This being said, breadth of services will differ, so it’s important to determine and communicate what you want from an accountant before recruiting.

Accountant: Cons

The main con is the cost. As with accounting technology, the cost of hiring an accountant will vary. It will depend on experience, location, job requirements and workload, so it’s important to do some research.

Typically, accountants nationwide in the U.S cost between $30 and $300 per hour

Employing an accountant could lead to an underuse of the skills you have in-house. Chances are you already employ someone who has the skills to make effective use of accounting software and keep the finances in order. If so, giving them the time and resources to handle things might be a sustainable alternative.

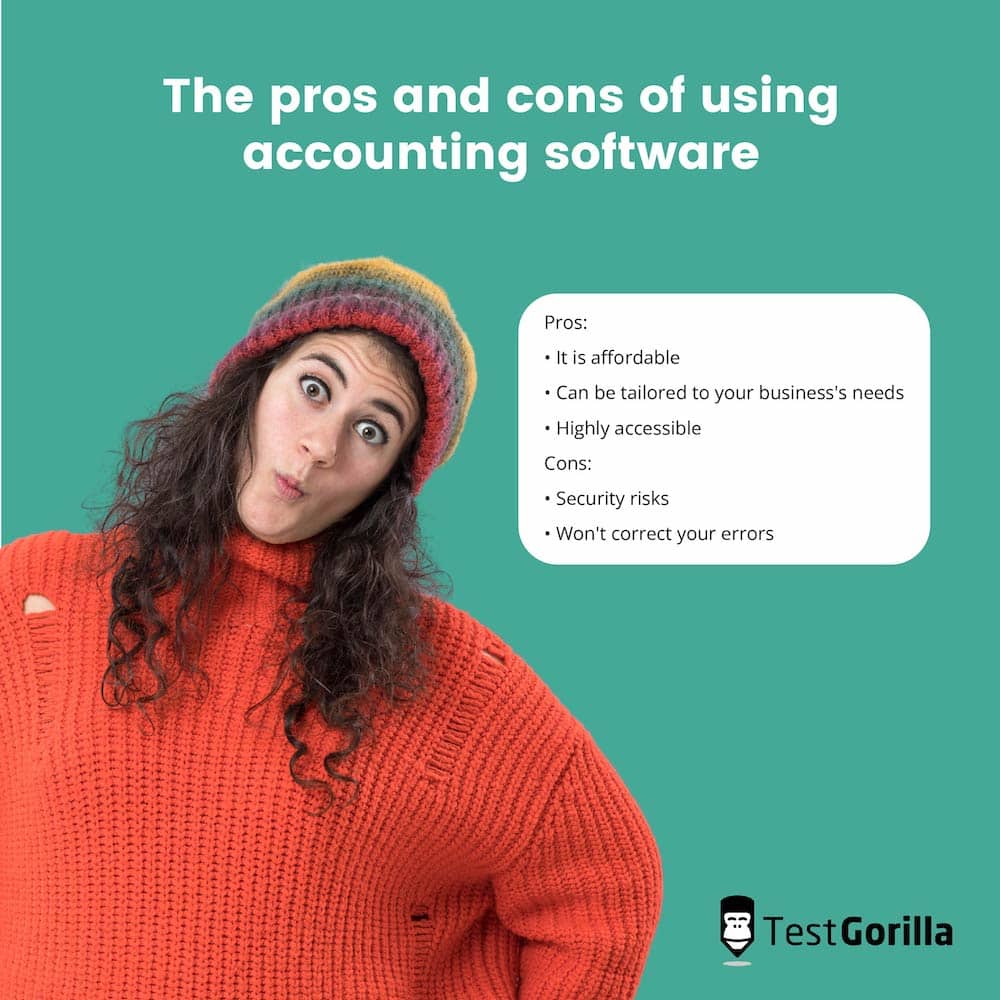

Accounting software: Pros

Though prices vary across software options, usually depending on the number of users you require, this is an affordable and cost-efficient option for managing the finances of your business.

Accounting software can start as low as $9 and run as high as $999 per user, per month while one-time license fees start around $96. For advanced accounting systems with more users, you can expect to pay closer to $375 per user, per month or $1,000+ for a license.

softwareadvice.com (2020)

There is a huge variety of software to use and an opportunity to find something that is tailored to the needs of your business. Whatever your business’s needs, there will be software to match them.

Accounting software has accessibility benefits. Files and information can be accessed, preserved and navigated with ease on multiple platforms, and managing accounts is made easier and more efficient by certain features and functions.

Accounting software: Cons

Relying on computerized accounting, where data is increasingly being hosted on the cloud, leaves businesses open to potential fraud. Using cloud accounting software means that no data is stored on devices, so information is safe if a laptop is stolen. However, storage server security is not infallible, as recent LinkedIn data breaches have shown.

Software can’t correct information. The data you get is only as accurate as what you put into the system, and accounting technology can’t tell you what might be amiss in the same way that a trained accountant can.

All things considered – for mid-sized businesses – the most sensible option is often to use a combination of both: Hiring an accountant and using accounting software. If you have the budget for it, this combination is definitely worth the benefits you’ll reap as your business continues to grow.

As you can see above, the pros of each accounting option complement one another. If you recruit the right expert accountant then they will know better how to use accounting software to its full potential.

In fact, most accounting software programs are geared towards this kind of collaboration: Business owners can allow access to accountants and bookkeepers, and data can be easily synced in seconds.

Accountant recruitment Q&A

What types of accountants are there?

There are 10 different types of accountants that you should know about.

Certified Public Accountants or CPAs are experienced accountants and usually operate as an organization’s financial advisor, though they will specialize in certain fields.

Staff Accountants are less experienced, though they do a variety of work (such as ensuring legal compliance and managing accounts payable and receivable) and generally report to CPAs.

Investment Accountants are knowledgeable about everything investment-related on top of their basic accounting knowledge. They can help organizations improve their financial strategies.

Project Accountants are versatile since they are employed to work on specific projects. They will often be brought in as contractors to ensure the cost-effectiveness of a project.

Cost Accountants have a similar role but don’t work on a project-by-project basis. They are hired by companies for general assistance in managing finances.

Management Accountants will analyze financial portraits for organizations in order to understand their impact and provide specific advice.

Forensic Accountants will analyze a company’s finances to spot errors, oversights, or fraud, and ensure compliance. Their skillset is specialized and so they’re in high demand.

Auditors ensure records are correct and conduct reviews to confirm a business’s compliance with regulations.

Financial Advisors offer financial planning and investment services to individuals and businesses with the goal of improving financial standing.

Financial Consultants are super knowledgeable about finance and help make sure sound financial decisions are made. They will often specialize and offer consulting services for specific industries.

What if I can’t afford an accountant?

If you need expertise but don’t have the money to hire an accountant for your mid-size business, there are a few things you can do instead.

Hire a bookkeeper. A good bookkeeper can handle a lot of similar responsibilities to an accountant – daily tasks such as keeping records up to date and tracking invoices and transactions – and will cost less than an accountant.

Hire an accountant internally. If you already employ somebody whose skill set and knowledge overlap with that of an accountant, invest in them (with their permission, of course). This could be a great opportunity but isn’t an ideal solution if you need accounting help fast.

Take advantage of accounting software. Finding software that complements your accounting needs will do wonders for whoever is managing your accounts and finance in the meantime.

6 easy steps to hire an accountant

Once you’ve decided to go ahead with recruitment, here are six steps we suggest you follow.

1. Determine the needs of your business

As is evident from the information above, employing the right person will require a lot of consideration into the nature of your medium-sized business and what that might demand from an accountant. There are many factors to consider, and you should ask yourself the following questions:

What level of financial help do you need? Are you having serious financial problems, or do you just need a hand getting your taxes in order? Are there any big sales or overhauls lined up for your business?

Does your industry require specific financial knowledge? If you are having industry-related issues with your business, hiring an accountant with specific industry experience might help.

Do you need a full-time or part-time accountant? This will depend on how much help you need and how much you can afford to invest in an expert. Lots of mid-size businesses survive with only a part-time accountant, calling on their skills when needed, e.g. during tax season.

2. Identify a skillset

Look at how your business is operating and determine which skills are a must-have if you are to hire an accountant.

Many of these requirements will be soft skills. An accountant will need to have excellent organization skills and attention to detail, for example. Good communication skills and proficiency in time management might also be important.

In terms of hard skills, their numerical and accounting skills will need to be up to scratch. Qualified accountants will have this in the bag, but more specifically these skills will need to be compatible with whatever technology and software your company uses.

Think about specific technical skills that will be important, like Excel proficiency. If your company uses bookkeeping software (QuickBooks, for example) then you’ll want to include this in your identified skillset, too. It’s also worth asking yourself how many years of experience you might require.

Does this experience need to be industry-specific? If your business would benefit from extensive knowledge about special taxes or legal processes, add those to the required skillset.

3. Advertise accurately

It’s key to create a clear and accurate job description for the accounting role you’re hiring for. If done well, it will save you and your candidates a bunch of time and make everything easier.

Using the skillset you’ve identified for the role, construct an on-brand job spec that communicates precisely what you are looking for. Write a list of job responsibilities as well as required skills. If you are willing to be flexible about certain things, express this too.

People can take unconventional routes into an accounting career – for example, a candidate might have higher-level qualifications and a huge amount of experience but no degree. ‘Or equivalent’ is a good phrase to use when listing education and experience-related requirements, and you can leave it to applicants to decide if they think they have the skills to apply.

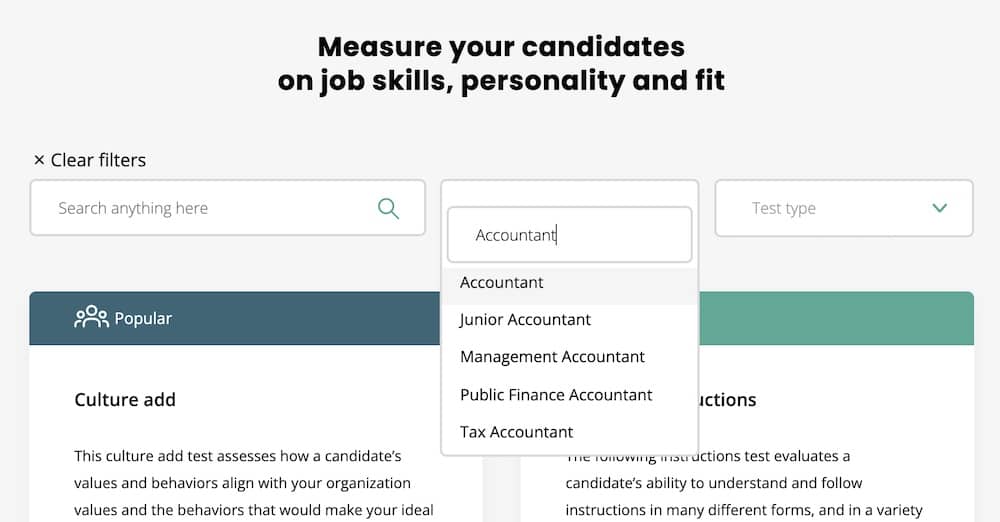

4. Conduct a complete pre-employment skills assessment

Once applicants start applying to your job ad, you need a way to analyze the skill set of all your candidates before you move the best ones through to the interview stage.

Based on the skillset you have identified for your accountant role, build a complete pre-employment skills assessment for your candidates. If the candidate’s profile differs from the job spec, at this stage it will become clear whether or not their skills are apt for the job you need them to do.

It is important that you use a range of tests to assess their technical and soft skills, their software-specific skills (if relevant), as well as what cultural add they bring to your organization.

Recommended tests for accountants

TestGorilla recommends tests that apply to the skillset all accountant candidates should have. From our recommended selection, you can choose which tests to use to create a complete assessment.

Some of our recommended tests for accountants are:

Financial accounting (US GAAP): tests practical ability to record, classify and summarize data according to US GAAP

Financial accounting (IFRS): tests practical ability to record, classify and summarize data according to IFRS

Accounting (advanced): evaluates knowledge of accounting concepts, ability to calculate accounting figures and handle financial records

Attention to detail (textual): assesses attention to textual details and ability to process and analyze written information

Business ethics & compliance: evaluates awareness, judgement and knowledge of ethical issues in a business context

Culture add: tests how well behaviors and values align with your organization, based on a customized survey

Financial modeling in Excel: assesses finance and valuation skills and ability to develop and maintain financial models in Microsoft Excel

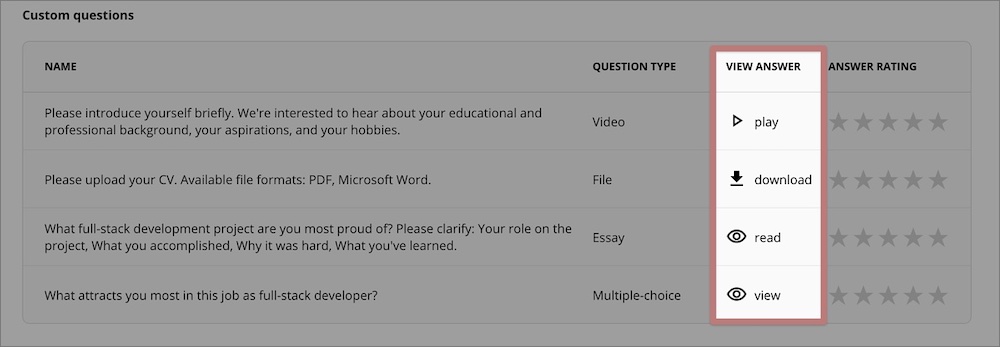

Custom questions

To customize your assessment, you can add a range of custom questions with TestGorilla. These are questions that you choose and design with the aim of filtering through your candidates to employ people that best align with your company.

You can choose from various kinds of questions, including essay, multiple-choice, video-response questions, and more.

5. Interview and hire the best

Once you have created and sent out your assessment, you can go to ‘My assessments’ to access a list of all candidates who have completed it. Click on candidate names to review individual results, and decide who you want to interview

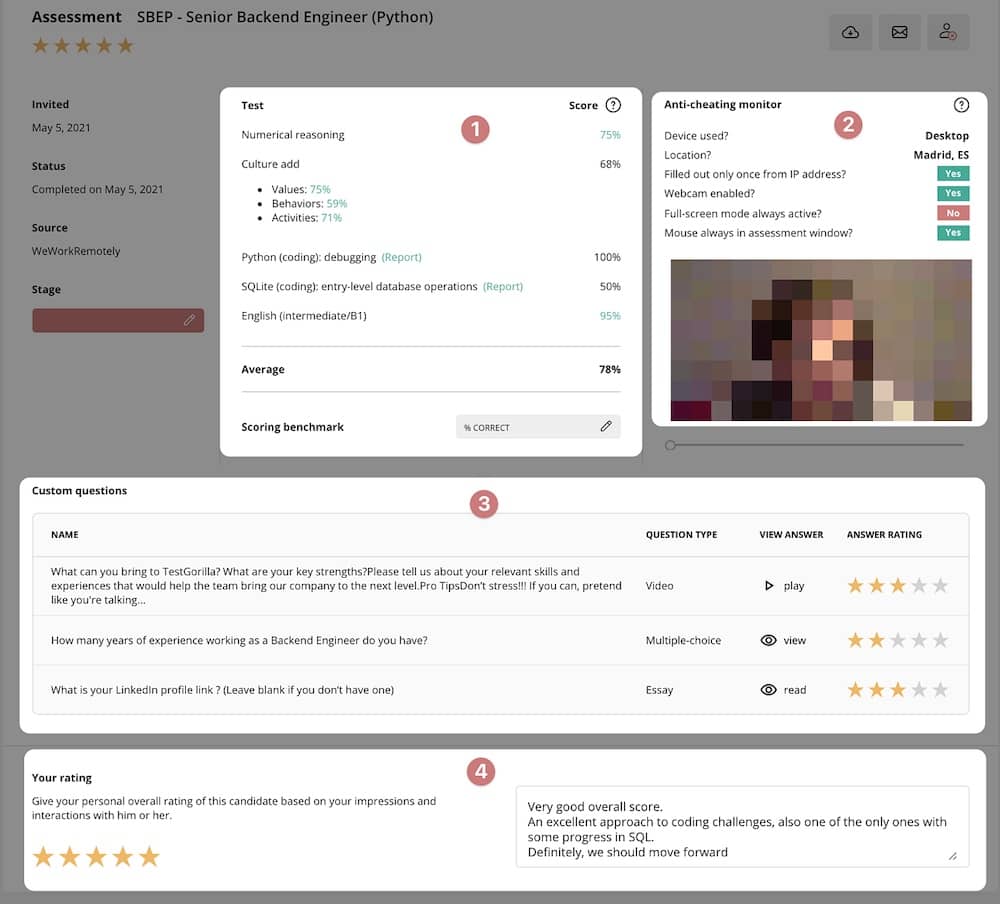

When your candidates have completed their assessments, their results will appear in four categories: A summary of test results, an anti-cheating monitor tab, individual answers to custom questions, and an overall rating at the bottom.

We suggest you evaluate candidates based on all results before you decide who to interview.

Recommended interview questions

The questions you ask when interviewing an accountant will vary depending on your company and needs. Here are 10 common and useful questions we recommend:

Can you describe your previous accounting experience?

Which accounting software are you familiar with? Which is your preference?

How do you make sure you don’t make mistakes?

Tell me about a time you did make a mistake. What did you do once you spotted it?

Do you have experience developing business metrics? Can you tell me about it?

Why did you choose to become an accountant?

(Describe the biggest accounting challenge your company faces). How would you tackle it?

Tell me about a time when you had to work to a tight deadline. How did you make sure everything was delivered on time?

What do you find hardest about accounting?

Why do you want to work for us?

This might be a good opportunity to gauge your candidates on any soft skills not tested in your assessment.

6. Onboard your new accountant

At this stage, you have employed the best accountant for your business from the selection of candidates assessed. But the work isn’t over yet. Onboarding is an essential part of the recruitment process that is often overlooked and doing it well is a huge part of securing your hire.

Organizations with a strong onboarding process improve new hire retention by 82% and productivity by over 70%

Brandon Hall Group (2015)

Perfecting the onboarding process of your medium-sized business will be a crucial investment as your team grows. There are many ways to improve onboarding and integration, so below we have assembled some accountant-specific onboarding procedures that might come in handy:

Have a training plan and share it with them. Structure and immersion will be everything in the initial stages, so try and deliver specific tasks and issue mentors and buddies as you see fit. The plan should include onboarding for company culture as well as the job.

Train them on your accounting software. Even if your new employee is familiar with certain technology, it may have been some time since they’ve used it. If it’s new to them, do what you can to help them master it quickly. Create mock scenarios for the software, ask them to mock audit records, or analyse and interpret pre-existing data.

Question them on the details of company-specific methodologies. Do this to make sure they can slip easily into your processes for things. It is also a good way to flag up any questions or suggestions they might have

Meet regularly to discuss their experience. This way you can measure onoarding success and offer frequent suport.

Finances can be stressful…. Recruitment doesn’t need to be

Fair and effective pre-employment testing leads to secure and bias-free skills-based hires. Join TestGorilla for free today to upgrade your hiring process!

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.