How to effortlessly hire an accounts receivable specialist for your team

Is it your goal to hire accounts receivable specialists for your expanding team?

At first glance, this may seem overwhelming. You have to source applicants, review their skills objectively, and onboard new hires – and these are just a few of your responsibilities when hiring.

Therefore, you may be wondering, “What is the best way to hire accounts receivable specialists and complete all of these tasks efficiently?”

We’ve provided the answers you need in this article.

Spoiler alert: Using our Accounts Receivable skills test is one extremely handy way to easily find the right applicant. Read on to find out about the other methods for hiring accounts receivable specialists for your team.

Table of contents

- What does an accounts receivable specialist do?

- What main responsibilities of accounts receivable specialists should you include in a job description?

- How can you find accounts receivable candidates?

- Which skills are essential for accounts receivable professionals, and how can you assess them?

- Which method should you use to interview accounts receivable candidates?

- The 5 essential steps for managing accounts receivable

- Hire accounts receivable specialists for your company

What does an accounts receivable specialist do?

Accounts receivable specialists are responsible for ensuring a business receives payments from clients and customers for services or products.

Your next accounts receivable specialist will use their project and task management skills to collate payments, record transactions accurately, issue invoices, and handle billing operations.

What main responsibilities of accounts receivable specialists should you include in a job description?

To source applicants for your accounts receivable specialist role, you must write a compelling job description that outlines the main responsibilities of your next hire.

Here’s a sample list of responsibilities for accounts receivable specialists that you may wish to include in your job description:

Accounts receivable specialist duties

Our next accounts receivable specialist will be responsible for completing the following duties with our team:

Preparing and sending invoices

Liaising with clients to resolve payments

Resolving discrepancies in payments

Maintaining accounts

Making required updates to credit policies

You may choose to expand on these duties to explain why they are essential in your organization. Keep in mind that interviews are another excellent opportunity to give your applicants more information about the position.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How can you find accounts receivable candidates?

After writing your accounts receivable job description and listing the duties of the role, you can focus on candidate sourcing.

There are various ways to find qualified accounts receivable candidates for your team. Here’s a list of three valuable strategies you can use to find accounts receivable candidates:

Recruit internally. Review your mid-level accounting team members, and consider whether they are prepared to transition into an accounts receivable specialist role. Interview them to find out if their skills and values match the position.

Network using social media. Reach out to connections on social media, or connect with accounting industry professionals to find top talent keen on joining your organization.

Post your job description on job boards. Post on the right job boards to advertise your job vacancy. You may choose job boards such as LinkedIn, FlexJobs (if you’re advertising a remote or hybrid job), or AccountingCrossing.

Which skills are essential for accounts receivable professionals, and how can you assess them?

Before you hire accounts receivable specialists, it’s critical to understand which skills are indispensable for the role and how to evaluate them.

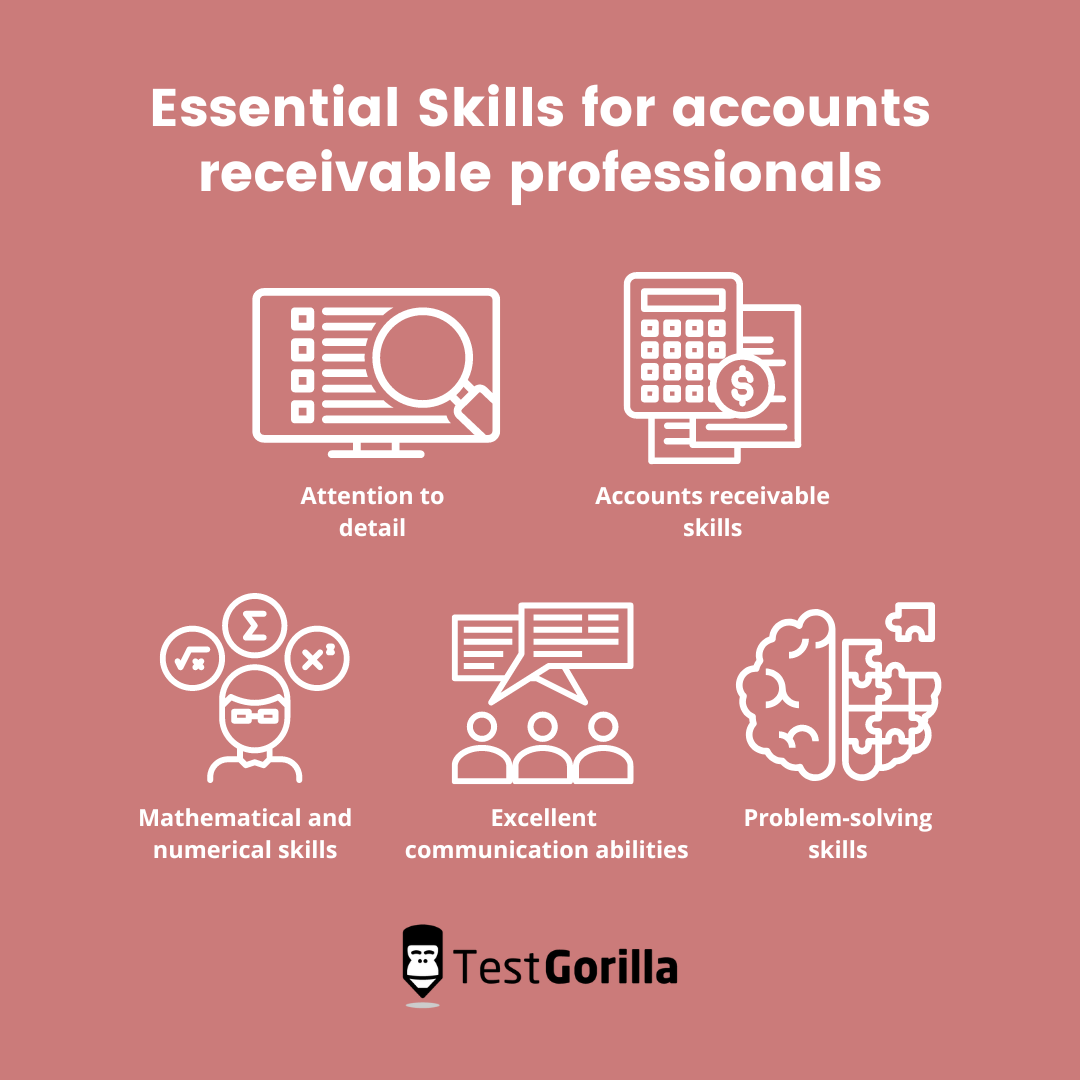

Some of the crucial skills you should consider assessing are:

1. Attention to detail

To spot minor issues or discrepancies in transactions, candidates applying for an accounts receivable role need exceptional attention to detail.

One way to assess this ability and hire the most detail-oriented accounts receivable specialists is with our Attention to Detail test, which will indicate how well candidates can apply their analytical skills to handle intricate tasks.

2. Accounts receivable skills

Applicants require exceptional accounts receivable skills to manage accounts receivable, record transactions, and reconcile accounts. Use our Accounts Receivable test to determine how efficiently your candidates can manage accounts receivable, prepare records, pass them in the required books, and register transactions.

3. Mathematical and numerical skills

To test whether your applicants have the right numerical and mathematical skills to handle accounts receivable tasks, use our Basic Triple-Digit Math test and Intermediate Math test to assess their proficiency.

4. Excellent communication abilities

Communication is an integral part of an accounts receivable role. Before you hire an accounts receivable specialist, evaluate their communication skills with our Communication skills test to find out whether they can use active listening and speak clearly and articulately with team members.

5. Problem-solving skills

How well can your applicants spot discrepancies in transactions and solve complex accounts receivable errors? Use our Problem Solving skills test to learn if your candidates can solve problems with ease.

Which method should you use to interview accounts receivable candidates?

Using the right interview method will enable you to make objective hiring decisions and evaluate applicants’ responses more easily. We recommend using structured interviews in your hiring process. They are a simple way to increase fairness in hiring and predict job performance more accurately than unstructured interviews.

There are different types of structured interviews, including structured interviews that use basic interview questions, situational questions, or behavioral interview questions.

When using the structured interview method, you select a set of accounts receivable specialist interview questions and ask every applicant the same questions in the same order.

You can ask follow-up questions to get more information from candidates. Collate the structured interview results on scoresheets to easily compare candidates, and choose the accounts receivable specialist who best suits your role.

The 5 essential steps for managing accounts receivable

Your new hire will be responsible for handling five crucial steps when managing accounts receivable, so ensure you find out whether your applicants understand the following processes:

1. Determine rules for credit

Applicants should be able to assess potential risks and establish credit rules before they permit clients to receive credit. Understanding the factors that determine client creditworthiness is vital for accounts receivable specialists, so review your candidates’ skills in defining rules for credit.

2. Make documents for terms and conditions

Setting payment expectations and terms is an important responsibility for accounts receivable specialists.

Can your applicants use templates effectively and ensure clients understand the company’s policy? Do they know the importance of issuing contracts and documents?

3. Create an invoice template

Since the ideal time to send invoices for services is the moment your organization renders them, verify that applicants have experience in creating invoices. Ask whether they know how to make an up-to-date, professional-looking invoice with the correct data, including the acceptable payment methods.

4. Produce an accounts receivable report to review liquidity

Reviewing accounts receivable liquidity is a crucial responsibility for accounts receivable specialists. Use our Accounts Receivable test to ensure your candidates can use reports, quantify the worth of your business, and assess accounts receivable instantly.

5. Prepare a plan for collection

Can your applicants produce plans for collecting payments and handling late or missing payments? Do they have a strategy for looking at each client’s situation and determining why the payments were late? Ask the correct accounts receivable interview questions to assess these skills.

Hire accounts receivable specialists for your company

Making sure your accounts receivable is free from discrepancies can be challenging, but with the right accounts receivable specialist, it’s no trouble at all.

Test accounts receivable skills effectively by using our Accounts Receivable skills test and the right interview questions. With these approaches, you’ll find top talent in no time.

Hire the best accounts receivable specialists for your company and start balancing your books. Register with TestGorilla for free today and start making better hiring decisions, faster and bias-free.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.