Are you looking to hire an actuary? You’re not alone. Actuaries are in high demand. According to the US Bureau of Labor Statistics, actuary recruitment will grow by 21% between 2021 and 2031.[1] That’s a whopping 16% faster than the average for all professions.

That said, actuarial talent acquisition can be tricky because the talent pool is small, and candidates need highly specialized skills, such as proficiency with programming languages like SQL. We’ve created a nifty guide to help you identify and interview actuary candidates suited to your hiring needs using an unbiased skills-based approach.

We’ll show you how to hire an actuary by diving into various aspects of the actuary hiring process, including which skills to look for in an actuary (and how to assess them), a customizable job description template, typical salary ranges, where to find quality actuarial talent, and some sample interview questions to get you started.

What is an actuary?

The actuary hiring process begins with understanding what actuaries do. In a nutshell, actuaries are risk management experts and financial forecasters. They have strong analytical skills, business knowledge, and a keen understanding of human behavior.

Their job is to measure the monetary consequences of risk for a business. They do this by analyzing large amounts of data using mathematics, economics, statistics, and financial theory. Actuaries then use their findings to help companies make decisions that will minimize or eliminate the cost of risk.

There are different types of actuaries. Life insurance actuaries are probably the most common, but they can practice in other financially focused businesses, such as banks and investment firms. They are also increasingly becoming involved in sectors like government, energy, e-commerce, marketing, startups, education, predictive analytics, consulting, and more.

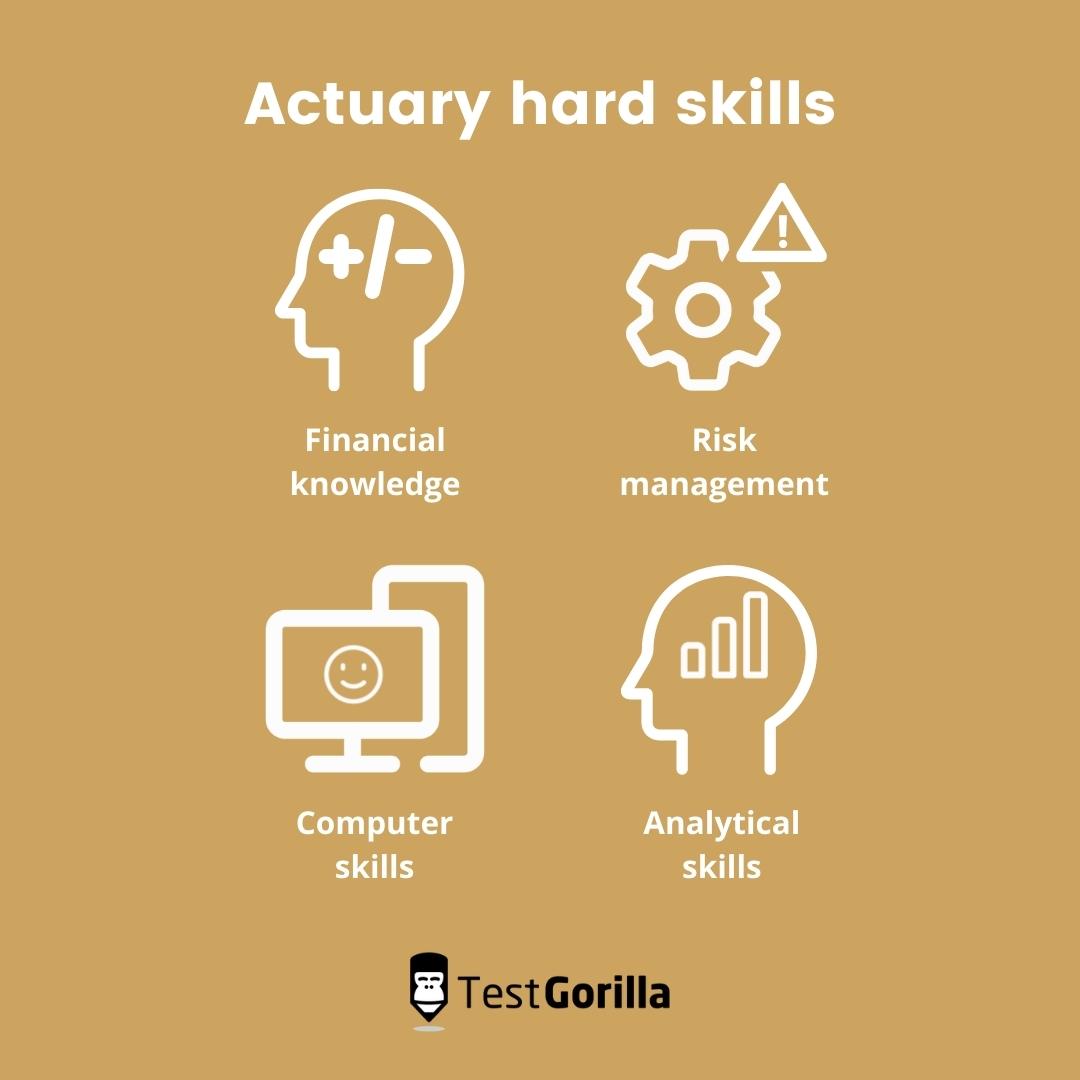

Actuary hard skills

Although numerical aptitude is a given, good actuarial candidates are proficient in several hard skills. They use a blend of expert technical abilities to make sense of uncertainty and quantify risk. Here are a few hard skills you should look for during the actuary hiring process.

Financial knowledge

Given the highly quantitative nature of their work, actuaries should have a knack for all things financial, like mathematics, economics, and statistics.

Risk management

Actuaries analyze large sets of data to quantify risk. Using their innate risk management skills, they help companies determine if they need to avoid, mitigate, or even take on more risk if they have the resources to do so.

Computer skills

Technology plays a vital role in the actuarial profession, so proficiency with computers and programs like Excel and Access is essential. Top candidates usually understand at least one programming language, with SAS, VBA, R, Python, and SQL being the most common.

Analytical skills

In actuary recruitment, it’s critical to find candidates with strong analytical abilities. A large part of an actuary’s role involves analyzing data and information. They need strong analytical skills to forecast, research, interpret, and present their findings.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Actuary soft skills

We’ve touched on which hard skills actuaries should possess, but did you know that the best actuarial candidates are just as proficient when it comes to soft interpersonal skills?

Most successful actuaries are strong communicators, problem-solvers, self-motivated, creative, and able to work well with others. Below are some of the top soft skills to look for in the actuary hiring process.

Communication

Actuaries typically work on teams with individuals who are not actuaries. As a result, they often need to explain highly technical information to people with little or no actuarial background.

Hiring an actuary with poor communication skills could lead to inefficiencies, mistakes, lost clients, and decreased revenue – so it’s vital to find a candidate who can communicate complex information in simple terms.

Self-motivation

Self-motivation is an internal drive to achieve, produce, develop, and keep progressing. Research has shown that it helps employees overcome workplace barriers like inner conflict and a lack of self-confidence.

Actuaries work with risk and are constantly under pressure to deliver meaningful risk insights. A good actuary has the drive to keep moving forward despite facing setbacks.

Creative problem-solving

An aptitude for creativity is probably not one of the core skills that come to mind when hiring an actuary, but great actuaries need to get creative to strategically solve business problems associated with risk.

Teamwork

Finally, it’s crucial to look for applicants who are team players in the actuary recruitment process. Rarely does an actuary work in isolation. Many of the problems they need to solve are complex and inevitably need the input of multiple people.

A good actuary has a collaborative spirit that cultivates solid relationships and partners effectively with others to accomplish goals.

How to test actuary skills

Now that you know which skills to look for, you can use TestGorilla’s pre-employment testing software in your actuary hiring process to evaluate a candidate’s ability to meet those requirements. It’s an unbiased and stress-free way to reduce onboarding costs, and you can get to know your applicants better.

With access to our ever-growing test library, you can add up to five tests to your assessment. We recommend blending hard- and soft-skills tests for a well-rounded evaluation like the one below:

Communication test: assesses your candidates’ skills in communicating clearly and effectively using professional etiquette

Critical Thinking test: identifies applicants who can evaluate information and make sound judgments using analytical skills

Visual Basic for Applications (VBA) test: focuses on core VBA skills and using VBA with Microsoft Excel

Problem-Solving test: evaluates a candidate’s ability to define problems and analyze data and textual information to make correct decisions

Culture Add test: assesses how a candidate’s values and behaviors align with the organization’s values and the behaviors that would make your ideal hire successful in a specific role based on a customized survey you fill out

Where to find actuaries

Luckily, there are several places to find great actuarial candidates, including actuary associations, actuary programs at nearby colleges, and actuary conferences and events.

Alternatively, let candidates come to you by posting the job opening online on social platforms like LinkedIn or job portals like Indeed. Before you start looking, it’s best to determine whether you need someone part-time or in-house.

In-house actuaries

Most actuaries work full-time for large, financially focused companies during business hours. High-risk organizations usually employ dedicated actuaries full-time.

The benefit is that they have a person or team solely focused on the organization and its clients. They can also build strong relationships with their colleagues and develop insights into the business that a consultant may have yet to gain.

Though it’s easier to assign employees to specific tasks than to hire consultants and make frequent changes to teams, in-house actuaries may fall prey to the monotony of a business since their roles are relatively routine. This means companies could lose out on the creative side of problem-solving that a freelance actuary may have to offer.

Freelance actuaries

Businesses are increasingly operating in an age of high risk and uncertainty, regardless of whether they operate in the finance sector. Organizations will always have a place for actuaries who can help monitor and mitigate risk, even if it’s only on a consulting basis.

If you are hiring a freelance actuary for a project to complement your management team or someone to consult on an ad-hoc basis, remember that consultants usually come with a high price tag.

On the upside, their experience, creativity, and knowledge may justify this expense. Independent actuaries have vast experience in their particular fields, but this usually comes at a cost.

Actuary job description template

Top-quality actuaries are looking for employers that meet their personal and professional needs. A clear and compelling actuary job description is the best way to attract top-notch candidates.

We’ve compiled a comprehensive guide outlining the key components of a great job description. These include an appropriate title with associated keywords, a synopsis of the company, a concise overview of the role, required knowledge, skills, or competencies, working conditions, and company benefits.

Below is an actuary job description template you can easily tweak to suit your hiring needs.

Job title: Insert the job title you are hiring for using keywords.

Example: Senior Actuary

Reports to: State the reporting line.

Example: The senior actuary reports to the chief actuary.

Job overview: Contextualize the role by giving a company overview, touching on the working environment, outlining key responsibilities and duties, and summarizing how these all tie in with the overall organizational structure.

Example:

XXX Insurance is looking for a senior actuary to join our innovative, energetic, and flexible team. If you have a solid knowledge of insurance concepts and rating data, strong communication skills, and an ability to work independently and within a group, look no further.

This hybrid role involves tasks such as developing various actuarial and statistical models, reviewing data irregularities, performing financial forecasting and trend analyses, developing rate formula valuations, and preparing regulatory reporting requirements, to name a few.

The senior actuary also assists organizational planning by identifying trends in premiums and losses, recommending rate levels, and maintaining and updating predictive models.

Responsibilities and duties: Write complete sentences starting with verbs to list the role’s essential responsibilities. List these duties in order of importance using gender-neutral language.

Example:

Complete rate analyses and rate filing submission

Perform loss development analyses for pricing, reserving, and forecasting purposes

Ensure that the internal system rating is consistent with rates on file with the Department of Insurance

Lead and mentor junior actuarial staff

Perform financial forecasting and trend analyses

Build routine reports

Present findings and recommend solutions

Qualifications: List your required and then your preferred education levels and experience. Actuaries typically require a bachelor’s degree in actuarial science or a related field and an accredited actuarial designation with the relevant society.

In addition, the best candidates will have additional qualifications, like more industry experience and an understanding of one or more programming languages.

Benefits: You’re looking to attract the best talent in a highly specialized field. That means selling the organization’s perks. Do you have a rewards or compensation program? Are there health and welfare benefits? Are salaries competitive and performance-based? If the company offers any of these incentives or more, then emphasize them here.

What is an actuary’s salary?

According to Indeed, the average salary of an actuary is around $111,080 per year.

However, a candidate’s earning potential depends on their qualifications and experience. On top of having a bachelor’s degree, actuaries are required to pass up to 10 additional professional exams to achieve full certification. Therefore, the number of exams they have passed and their experience will impact their salary.

An entry-level actuary who has passed two exams can earn between $48,000 and $92,000. This range bumps up to between $125,000 and $190,000 for those who have passed all required exams and have more than 10 years of experience. Actuaries with more than 20 years of experience can expect to earn around $500,000 annually.

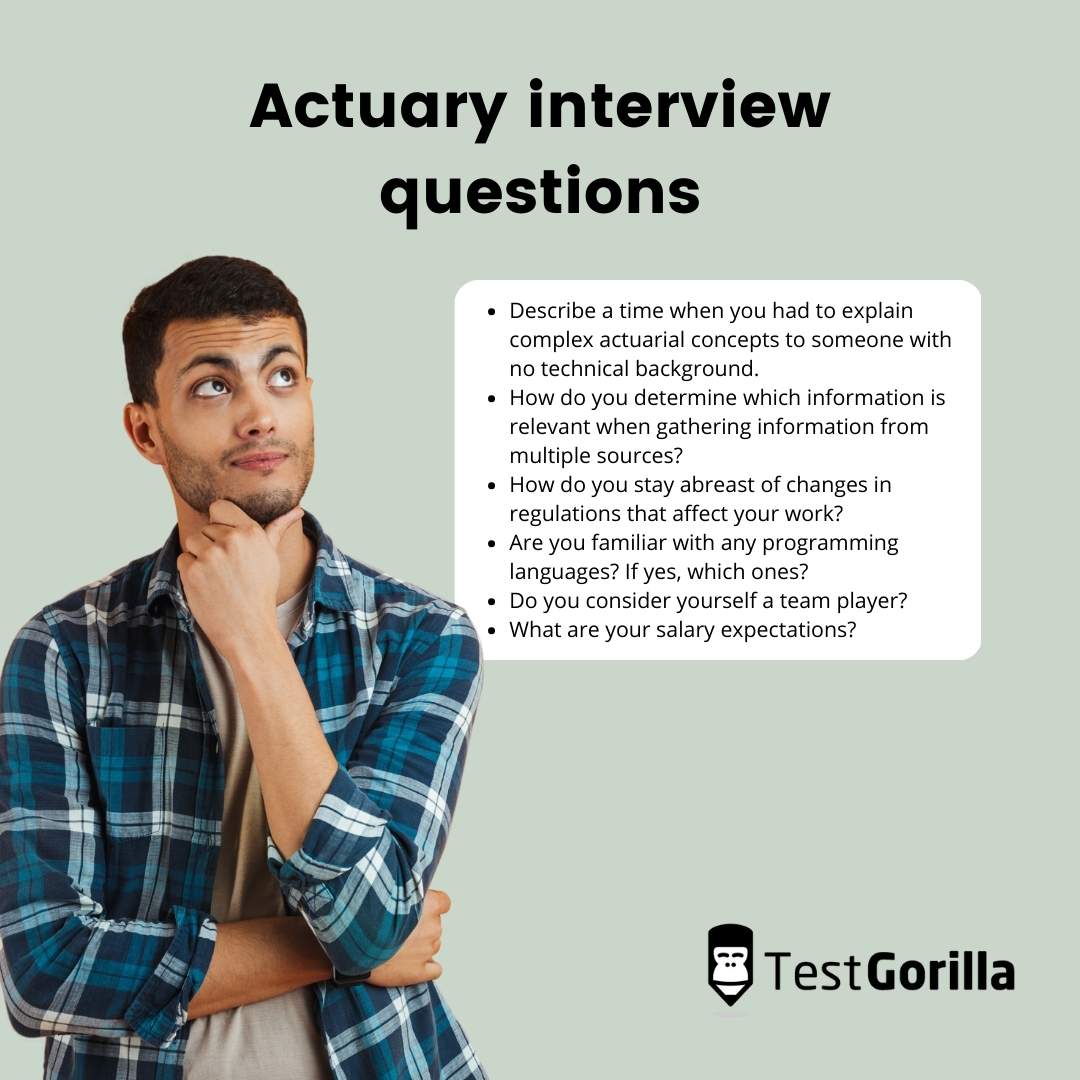

Actuary interview questions

Once candidates complete your skills-based assessment, you can screen and select the actuary candidates most suited to the role you are hiring for. Here are a few sample questions to help get you started.

Describe a time when you had to explain complex actuarial concepts to someone with no technical background. This question can help you understand if the candidate can explain technical information clearly and concisely in layperson’s terms.

How do you determine which information is relevant when gathering information from multiple sources? This is a great question to ask when assessing a candidate’s ability to compare and contrast overlapping data. They often work with large datasets and need to be able to identify what is essential versus what’s not.

How do you stay abreast of changes in regulations that affect your work? Being clued up on all things regulatory is critical to an actuary’s role. You’re looking for someone who keeps up with changes and can apply them meaningfully to their work.

Are you familiar with any programming languages? If yes, which ones? As mentioned, the ability to use programming languages is becoming more prominent in the actuarial field. You’ll want to find someone proficient in at least one of these languages.

Do you consider yourself a team player? This question speaks to the cooperative nature of an actuary’s role in the business. You will need someone who can work well with others.

What are your salary expectations? Although most candidates aren’t in this for the money alone, you still need to understand what they are looking for in terms of salary. If you decide to make an offer of employment, you’ll need to meet their expectations to ensure your proposal stands out.

Take your actuary hiring process to the next level with TestGorilla

Actuary recruitment can be more challenging than hiring for other occupations because the skills required are so specialized. Combing through hundreds of resumes is time-consuming, may lead to bias, and can mean passing over the perfect candidate.

By following the steps mentioned above and using our pre-employment skills-testing resources as your starting point, you can narrow down the talent pool and simplify the actuary hiring process to ensure you hire the right person for the job. Sign up for your free account with TestGorilla today to help get you started.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.