Credit analysts determine whether the people or companies looking to borrow money are capable of repaying their loans, and recommend whether to approve the transaction. For this reason, it’s essential for financial institutions to have skilled and capable credit analysts on their teams — and hiring them is not always easy.

A good credit analyst will possess excellent financial due diligence and critical thinking skills, and must be well-organized to perform their duties.

This article will go over what a credit analyst is, what their job description entails, which skills to look for when hiring, and how to use skills testing to find the top candidate for your organization. You’ll also understand where to look for credit analysts, how much they’ll cost you, and which questions to ask your shortlisted candidates during the interview process.

Table of contents

- What is a credit analyst?

- What does a credit analyst do and why hire one?

- Skills to look for in a credit analyst

- Why use skills testing when hiring a credit analyst?

- Where to find credit analysts to hire?

- Credit analyst job description template

- Credit analyst salary

- Credit analyst interview questions

- Extending an offer and onboarding

- Hire a credit analyst in no time with TestGorilla

What is a credit analyst?

A credit analyst is a finance professional who assesses and evaluates the creditworthiness of individuals or businesses to determine their ability to pay back loans, lines of credit, or other forms of financing.

Credit analysts work for financial institutions like banks, credit card companies, and investment companies. They are responsible for making all the necessary background checks on loan applicants to determine their financial health and whether they’ll be able to repay their loans.

The credit analyst inspects financial statements, credit history, and other relevant data to assess the level of risk associated with lending to a particular individual or company. Based on this assessment, credit analysts recommend approving or denying credit applications and establishing appropriate terms, such as interest rates and payment schedules.

What does a credit analyst do and why hire one?

You need a credit analyst if you have a financial institution that handles money and offers loans.

Credit analysts are often called credit risk analysts because they determine the risk an investment holds and decide how safe it is to lend to a borrower. They research the borrower’s financial identity, including their spending habits, previous loans and history of repaying, and current financial status. Based on this information, the credit analyst extends an affordable loan to the borrower that is deemed safe for the financial institution.

Your credit analyst also extends loans to businesses after evaluating certain risk factors, such as stock market fluctuations, economic downturns and upturns, and the current legislation of the country they practice in.

One of the leading job duties of a credit analyst is to monitor a borrower’s financial health after being given a loan. If the borrower cannot meet their payroll and the agreement becomes too risky, the credit analyst can terminate it, thus protecting the bank’s assets and reputation.

Credit analysts also play an integral role in determining credit scores for individuals and assigning credit ratings to companies. The FICO score is a commonly used credit score for individuals, while companies are given letter grades. Once a company’s debt rating drops below a certain threshold, it is considered below investment grade. Your credit analyst will determine these factors and give you insights on how to proceed.

In short, credit analysts bring their expertise to assess creditworthiness, identify potential risks, and provide businesses with the necessary data to make informed decisions regarding credit and debt management.

If your organization deals with any of the aforementioned practices, you may be looking to hire a credit analyst. Before you do that, however, you need to know what skills to look for in candidates.

The following section will cover the essential skills a credit analyst should possess.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

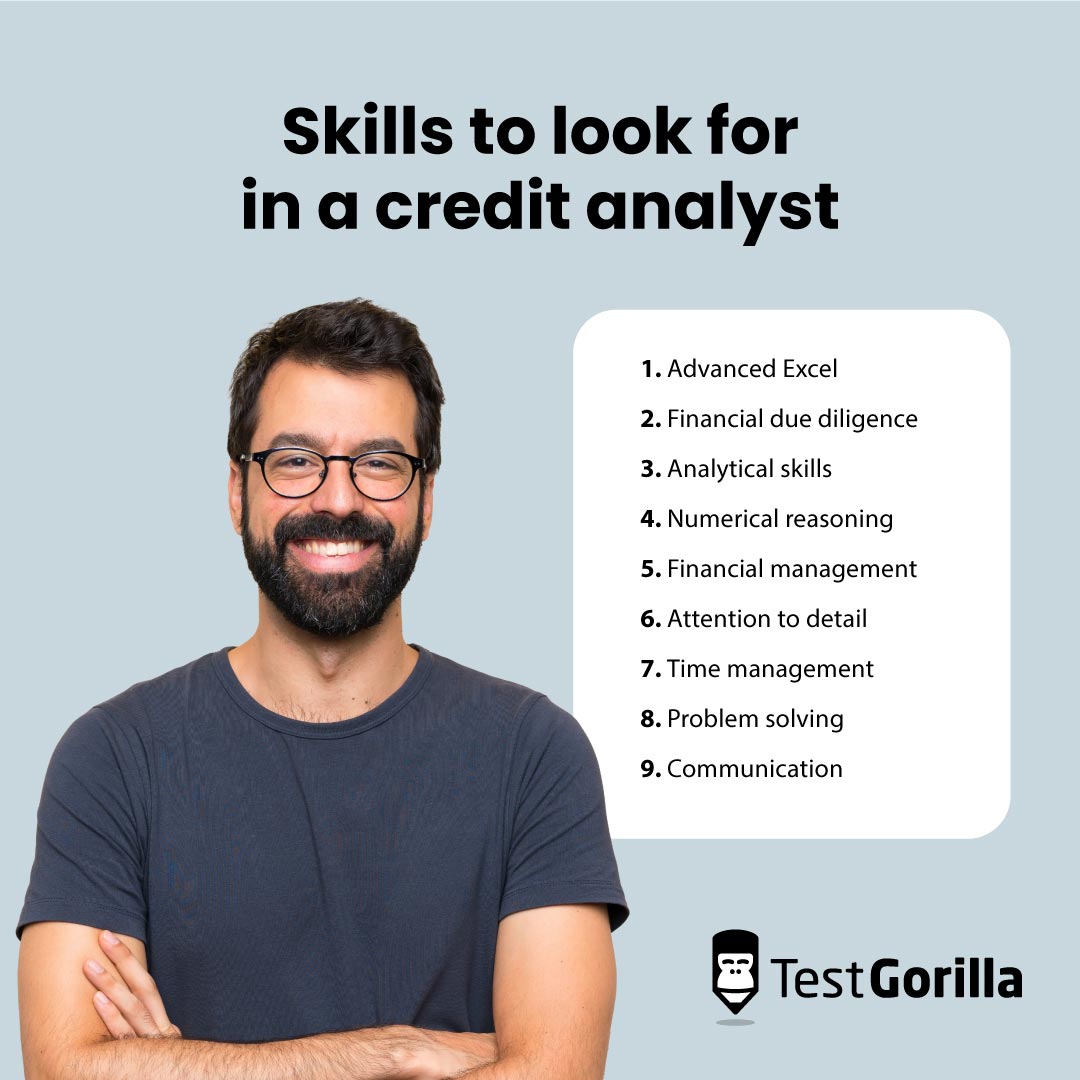

Skills to look for in a credit analyst

During your credit analyst hiring process, you want to look for specific skills that will help you identify the best candidates for the role and make the right hiring decision.

In this section, we’ve compiled hard and soft skills that are prerequisites for the role of a credit analyst. We’ve also added the corresponding tests for each skill you should use in your hiring process.

You can test for any of these skills — We recommend creating an assessment with up to five skills to evaluate your applicants and shortlist the best ones for an interview.

Hard skills

The hard skills you should be testing for are:

Advanced Excel

Anyone working in a financial institution, including your credit analyst, should possess a mastery of Microsoft Excel.

Our Microsoft Excel (advanced) test will evaluate candidates’ knowledge of various Excel functions and formulas. The test assesses the abilities to organize data, create reports and visualizations, and use Excel’s advanced features.

Candidates who perform well on this test will be disposed to use all Excel features and formulas, ensuring your data sheets are in excellent condition.

Financial due diligence

TestGorilla’s Financial Due Diligence test will evaluate candidates’ abilities to evaluate businesses, determine their financial health, assess risk factors, and verify critical financial information.

Applicants who perform well on this test can provide insights about other businesses and individuals, allowing you to make informed decisions when giving out a loan.

Essentially, you want your credit analyst to have financial due diligence so they can aid you in navigating complex financial transactions.

Analytical skills

Your credit analyst should possess analytical skills to perform their duties diligently.

Our Critical Thinking test will help you evaluate whether or not someone has the competencies to solve syllogisms, interpret sequences, and understand cause-and-effect relationships.

When determining if someone should receive a loan, your credit analyst should be able to use critical thinking and both deductive and inductive reasoning to make the best decisions.

Hiring a candidate who does well on this test will ensure you find someone who thinks independently, has an excellent working memory, and can solve complex problems.

Numerical reasoning

Another crucial skill to test for is numerical reasoning: the ability to use and understand numbers.

The Numerical Reasoning test will enable you to determine whether candidates can use and interpret numbers correctly in different situations.

With this test, you’ll find candidates who can interpret numbers, fractions, tables, number patterns, charts, and graphs.

A critical skill to look for when hiring a credit analyst, numerical reasoning will aid in finding people who can use numbers to determine loan applications.

Financial management

As mentioned, a part of the credit analyst’s role is to minimize financial risk for their organization.

TestGorilla’s Financial Management test will enable you to find candidates who are equipped to manage capital structure and cost, forecast and analyze financial outcomes, and perform investment appraisal.

Candidates who do well on this test will possess excellent financial-management skills, so you can rest assured that with them, your financial assets will be well taken care of.

Soft skills

Apart from the role-specific hard skills every credit analyst needs to possess, there are several soft skills you should also look out for. These are:

Attention to detail

Attention to detail is a crucial skill to look for when hiring a credit analyst since they’ll be working with numbers and financial statements.

Our Attention to Detail (textual) test will allow you to assess someone’s abilities to match information, compare statements, filter information, and check for consistency.

Candidates who score well on this test can process information quickly and spot mistakes and discrepancies, avoiding future problems.

Time management

Time management is another skill to look for when hiring a credit analyst: You’ll be chasing deadlines with applications and loans, so you need to hire someone who is capable of juggling multiple tasks and managing their time well.

The Time Management test will help you find candidates who can prioritize tasks, meet deadlines, and plan ahead efficiently.

Candidates who score well on this test can separate urgent from important tasks and determine how their immediate actions will affect the nature of a business in the future.

Problem solving

Problem solving is an essential skill for many roles: In all businesses, problems occur, and you need people who can assess and solve them quickly.

Our Problem solving test will help you identify candidates who have the right skills to determine the root cause of a problem and how to address it in the most efficient way.

Those who do well on this test will have the skills to interpret data, identify problems, use logic to make decisions, and find the best solutions, even in complex situations.

Communication

Communication is something every employer should be testing for, and we wholeheartedly recommend this evaluation for every role.

You want to hire a credit analyst who can communicate their ideas clearly and concisely, especially if they’ll communicate with clients on a daily basis.

Our Communication skills test will evaluate applicants’ abilities to listen actively, understand information, and summarize messages effectively.

Candidates who do well on this test can listen attentively, explain concepts, and communicate with ease. They’ll also have the skills to discuss with team members, clients, and stakeholders the next steps that need to be taken in order to reach specific goals.

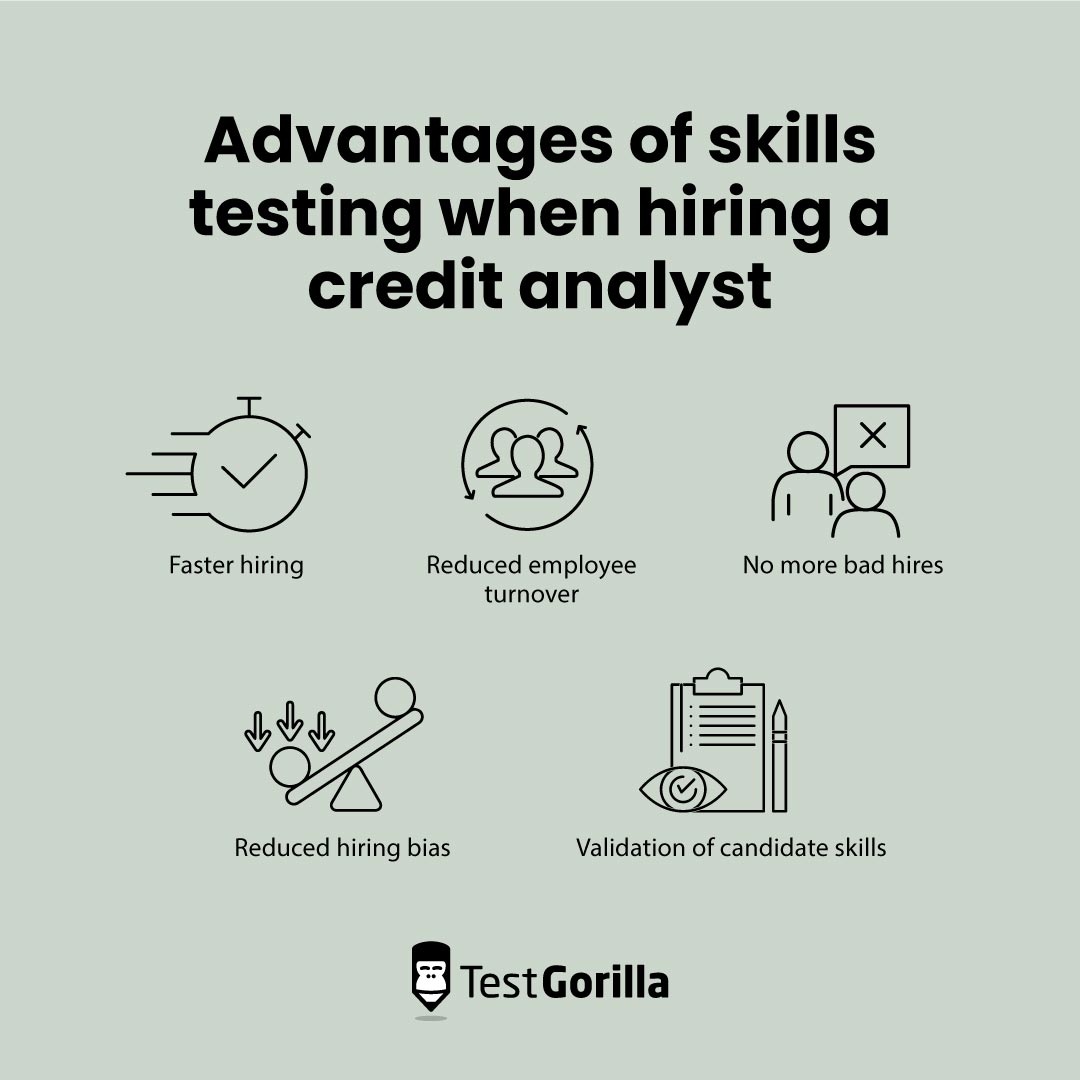

Why use skills testing when hiring a credit analyst?

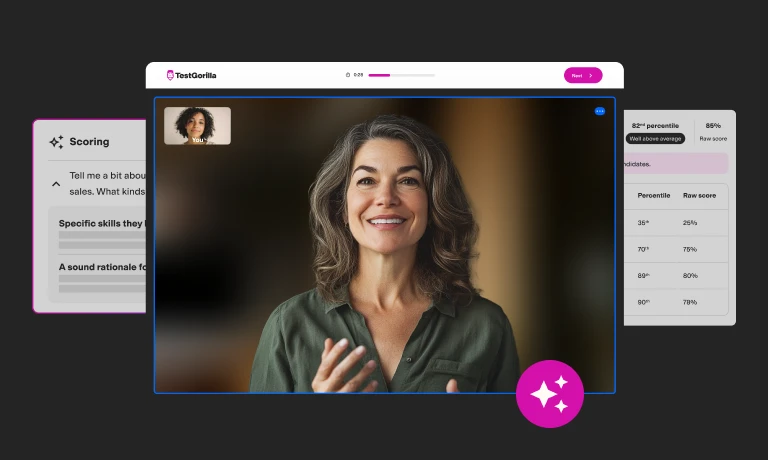

Pre-employment skills testing is the most straightforward and practical approach to finding top credit analysts for your organization. TestGorilla will aid you in assessing applicants’ skills, and you can automatically disqualify anyone who lacks the necessary skills for the role.

Skills tests enable you to assess candidates’ abilities and traits before they enter the interviewing process. As part of your recruitment funnel strategy, skills testing will allow you to make an informed decision and hire only the best credit analysts.

The advantages of skills testing are:

Faster hiring. As a hiring manager, you know that hiring can take as long as several months. With skills testing, you can cut that time in half and even more, as you focus only on top candidates and disregard those who don’t qualify simply by evaluating their skills beforehand.

No more bad hires. Bad hires can sap your company’s resources as you get stuck in a constant recruitment cycle of hiring someone, finding out they aren’t cut out for the job, dismissing them, and starting over again. You lose time and money doing this until you land a good candidate. With skills testing, you’ll know if someone is qualified from the start, and you won’t waste resources trying to find a replacement for a long time.

Reduced hiring bias. We all have biases that can influence our hiring decisions. Skills testing can help reduce hiring bias by ensuring all candidates are subject to identical testing and evaluated based on their applicable skills.

Reduced turnover. High employee turnover can be a financial burden for any company. If someone is not the right fit for your company, they will most likely leave soon after they’ve been hired. With skills testing, you’re bound to find someone with the necessary skills who shares your company’s values.

Validation of candidate skills. Candidates can claim to have skills they don’t possess. Skills testing allows you to verify those skills and sift through unqualified candidates from the start.

If you still need to explore skills testing, book a free 30-minute live demo with one of our representatives today and let us take you through the process of safe and reliable recruitment. We promise you won’t look back once you start using TestGorilla’s pre-employment skills testing.

Where to find credit analysts to hire?

Finding the right person to fill your open credit analyst position should be easy. You have several places where you can find credit analysts:

Job boards: Job boards are employment websites where you can find talent based on pre-selected criteria, like location, years of experience, and expertise. You can search on websites like Toptal, Upwork, and Fiverr for experts in the field. Many professionals on these websites offer their services as freelancers, but you can also find people who want a full-time job. Make sure to spend some time going over reviews and deciding who you want to approach based on their skills and qualifications.

Social media: LinkedIn is the top networking space for professionals in the finance and accounting industries, so you’re bound to find top-level credit analysts there. You can post a paid ad you’re hiring and wait for people to contact you. Alternatively, you can do some digging, find people with experience as a credit analyst, and contact them personally. Don’t be afraid of contacting people who’re already employed somewhere else. You never know when someone might be looking for a new job!

Networking events: Networking events are great places to search for new talent. Twenty-five percent of recent hires in a new firm found their job through networking. You should appear as often as possible at such events to build up contacts. Even if they don’t actively announce it, people are always looking for better opportunities, so expanding your professional networks is an asset. Make sure to follow our guide on networking etiquette to find and attract a suitable credit analyst the right way.

Industry associations: Credit analyst associations such as the National Association of Credit Management and the Association for Financial Professionals can be good sources of potential candidates. You can follow their events calendars and attend some of their events to find a suitable candidate. Associations also have job boards of their own, so you can search for credit analysts there as well.

Referral programs: Finally, referral programs are great ways of attracting new talent. Referred employees usually stay longer and perform better than non-referred employees since they’ll already be interested in the position you’re hiring for. They’ll also have some insight and knowledge of your company’s work etiquette and culture from your current employees, so they’re less likely to be a bad hire. Of course, even if they are the right fit for your company, referred employees need to go through the pre-employment process as well so you can validate their skills.

Credit analyst job description template

A clear and concise job description is the best way to find a top credit analyst for your organization.

Your job description should highlight all the necessary information in a way that applicants can scan quickly and decide whether to apply. Try to keep the description simple, straightforward, and focused on the skills you’re looking for.

Skills tests will let you sift through applications efficiently, while the interview phase lets you concentrate on your most skilled applicants and dig deeper.

We’ve created a credit analyst job description template you can use and modify:

Job Title: Credit Analyst

Job Summary: We’re looking for a credit analyst responsible for overseeing a portfolio of clients. The successful candidate will be tasked with evaluating the financial status of potential customers, monitoring existing clients, performing risk assessments, writing detailed reports, and making informed decisions when extending credit.

The ideal candidate for this position should possess a bachelor’s degree in finance, accounting, or a related field. Strong analytical skills and sound judgment are also essential to excel in this role. A background in the financial industry would also be beneficial.

Main responsibilities:

Conducting analysis and assessment of the financial statements and credit history of both existing and potential clients

Reviewing credit applications and running credit checks

Performing risk assessments

Demonstrating the ability to make informed decisions backed by sound assessments

Consulting and negotiating with clients about financial transactions, payment terms, and credit limits

Managing multiple projects and meeting application deadlines

Possessing an understanding of business, economic, and industry risks

Financial forecasting

Staying informed of financial news and trends

Practicing due diligence

Experience and qualifications:

3-5 years experience as a credit analyst

Bachelor’s degree in finance, accounting, or related field

Further certification is advantageous

Strong communication skills

Exceptional organizational, analytical, and time-management skills

Ability to prioritize tasks

Proficient in Microsoft Office, especially Microsoft Excel

Salary: See next section

Credit analyst salary

You can expect to pay between $42,000 and $92,000 annually in the US. The average amount you can expect to pay is around $64,115 per year, which includes the base salary plus additional bonuses, like cash bonuses, commissions, and profit sharing.

This amount is based on years of experience, seniority level, location, and other additional perks. However, you should be ready to pay even more, especially if you want to hire top-level credit analysts.

Credit analyst interview questions

After you’ve shortlisted your candidates, it’s time to conduct your interviews.

We’ve compiled several questions you can use for your credit analyst interview process. Feel free to adapt them as you wish. For more sample questions, check out our list of 40 credit analyst interview questions.

When developing a financial strategy for a client, which steps do you take and what information do you rely on? This question tests the planning skills of your candidate.

How do you present new strategies to clients? How do you manage resistance? This question assesses the presentation skills of your candidate.

How would you explain complex financial information to a client who lacks a finance background? This question evaluates the communication skills of your candidate.

Which computer programs have you used in your finance work? This question demonstrates the computer skills of your candidate.

Can you describe how you have dealt with financial strategies that did not work out? How did you address the issue with the client and resolve it? This question examines the problem-solving abilities of your candidate.

To further perfect your interviewing process, follow our step-by-step guide on conducting interviews.

Extending an offer and onboarding

Once you find your ideal candidate for the credit analyst position, you will have to extend your offer, negotiate if needed, and set a starting date.

Then, the next step is the onboarding process. The onboarding process involves preparing all the necessary documentation, software and hardware, training courses, and meet-and-greet events to ensure your new hire is welcomed by their new team.

An onboarding program helps to retain new employees for longer, so you can expect increased productivity levels and employee satisfaction rates.

A good onboarding process will ensure your new credit analyst familiarizes themselves with the company and its processes, and can start working on their own sooner rather than later.

Hire a credit analyst in no time with TestGorilla

A credit analyst is an integral part of your financial team, and taking good care to find someone with the proper skills and qualifications is essential.

A credit analyst is a professional who analyzes the investment risk of a loan before lending it to a borrower. They conduct research on behalf of the financial institution that employs them and determine whether or not to lend a loan. They also determine credit scores, monitor the loans they have granted, and ensure the assets of your financial institution are protected.

A good credit analyst will have excellent analytical, problem-solving, and financial due diligence skills. They will also be tech savvy and have a thorough knowledge of financial instruments and software that allow them to carry out their duties.

When looking to hire a credit analyst, the best way to do it is via pre-employment skills testing. TestGorilla will help you find the best credit analysts by evaluating their skills, so you can rest assured the person you’re hiring is qualified and up for the job.

Don’t waste time and resources on unqualified candidates. Create a free plan today or book a 30-minute live demo with one of our specialists to find out more.

Leave the testing to us and hire the best credit analysts today.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.