Credits require a relationship of trust between both parties, but sometimes, the borrower isn’t able to repay debt as anticipated. Diverging from the terms previously agreed upon creates a chain reaction further complicating the relationship.

Non-repayment poses challenges for lending institutions (such as banks, credit unions, and online lenders) and forces them to allocate resources and time to recover outstanding debts. At this point, the importance of having skilled debt collectors on board becomes evident.

But how can you make sure you’re hiring the right person?

This comprehensive guide will cover all the nuances of hiring a debt collector, such as:

What the role entails

What key skills you should look for and how to assess debt collector skills

What interview questions to ask

How much you can expect to pay, and more.

Find out how to hire the best debt collector for your business, bias- and stress-free.

Table of contents

- What is a debt collector?

- What hard skills do debt collectors need?

- Soft skills for a debt collector

- How to test debt collector's skills

- Debt collector interview questions: What should you ask during interviews?

- Where to find a debt collector

- How much does a debt collector cost?

- Debt collector job description template

- Hire the best debt collector stress-free

What is a debt collector?

When a borrower fails to repay their payments or defaults on a debt, the creditor or lender must find ways to recover the amount that is due. They can turn over the borrower's account to a debt collector or collections agency to reclaim the outstanding debt.

Lenders often turn to debt collectors as a last resort, typically when they haven't been paid for a period of three to six months – or more.

Examples of default payments that debt collectors might recover include:

Credit card bills

Loans

Taxes or fees

Utility bills

While some companies have in-house debt collection teams, others hire debt collectors instead of chasing clients themselves.

Debt collectors use their experience, resources, networks, and other tools to get in touch with the borrower and negotiate the retrieval of the money.

On rare occasions, borrowers might change phone numbers or even move to another place to avoid paying, but it's the responsibility of the debt collector to contact the person and ask them to pay.

Once the borrower agrees to pay, the creditor might pay a percentage of the debt to the collector or a flat fee they've agreed upon.

Individual debt collectors, who often work as independent contractors, can use a more personalized approach, while agencies, composed of specialized teams, offer efficiency in handling large-scale portfolios.

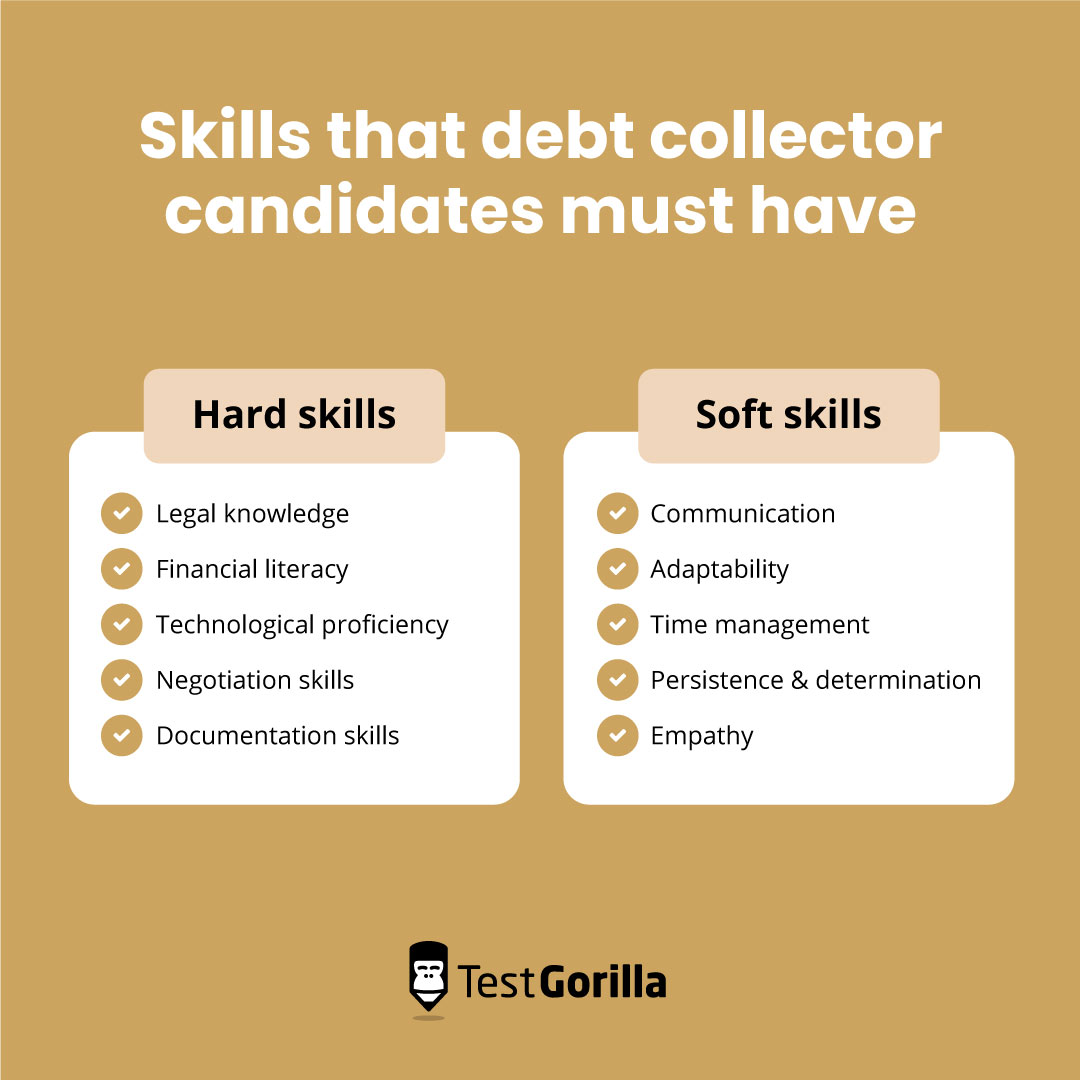

What hard skills do debt collectors need?

Debt collection is a challenging field – so, debt collectors need several important hard skills to succeed.

Legal knowledge

Debt collectors must have a comprehensive understanding of the laws and regulations governing the debt recovery process. They must be well-versed in the Fair Debt Collection Practices Act (FDCPA) and other relevant laws to ensure that whatever they do complies with the ethical and legal rules of the profession.

With a solid grasp of the legal framework, debt collectors can avoid engaging in practices that could lead to legal consequences for them and the creditors that hired them. While they need to recover the amount due, they also need to protect the debtor's rights.

Financial literacy

Financial literacy involves a deep understanding of financial principles and instruments. Debt collectors must be able to:

Analyze borrowers’ financial situation by looking at financial statements and other documents

Interpret credit reports

Comprehend debt structures and terms

They must be able to assess the financial situation of the debtor, determine their ability to repay, negotiate realistic payment plans, identify potential risks and make informed judgments about the most effective approaches to recovering the outstanding debt.

Technological proficiency

Debt collectors must be proficient in using specialized software and tools for tracking and managing debts, communicating with debtors, and generating reports.

Debt collectors who incorporate technology in their collection process can streamline their workflows efficiently, automate routine tasks, keep up with different collections, and adapt to the evolving landscape to stay ahead of the competition.

Look for professionals who have experience with FICO, Collect!, PaymentVision, and more.

Negotiation skills

Negotiation is at the heart of successful debt recovery.

Debtors might try to evade and avoid debt collection – or might sometimes simply be unable to pay.

Effective negotiation often results in quicker and more amicable debt resolution. Debt collectors should have strong negotiation skills that will help them build rapport, find compromises, establish realistic payment plans, and persuade borrowers to fulfill their financial obligations.

Documentation skills

Persuading debtors to pay is not the only responsibility of debt collectors. They also need to maintain accurate and comprehensive records of all interactions, agreements, and correspondence related to the debt-recovery process.

For this, they need to document payment plans, negotiation outcomes, and any relevant communication with debtors.

Detailed documentation serves as a crucial reference point in the future, especially in case of disputes, legal challenges, or internal audits.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Soft skills for a debt collector

While hard skills are key for the technical aspects of debt collection, soft skills play a crucial role in the human aspects of the job.

Communication

Communication is essential for debt collection.

Clear and empathetic communication fosters cooperation, mitigates misunderstandings, and ensures that both parties are on the same page. Additionally, debt collectors need to express themselves clearly to ensure that debtors understand the terms and consequences of not paying.

Active listening is crucial for understanding the debtor's perspective on why they defaulted, addressing concerns, and maintaining a professional relationship for successful debt recovery.

Adaptability

A debt collector must be able to adjust and thrive in changing circumstances. They have to deal with diverse situations and respond adequately to each one. An adaptable debt collector can pivot when necessary, ensuring their approach remains effective in different scenarios.

By tailoring their strategies based on the unique aspects of each case, a debt collector can ensure successful collection.

Time management

If you're working with a freelance debt collector, they must be adept at prioritizing tasks and allocating their time effectively.

Debt collectors often deal with a high volume of cases, each at a different stage of the recovery process, and they must have excellent time management to ensure that they’re able to meet deadlines.

Persistence and determination

No one can become an effective debt collector without the determination to stay on course despite facing setbacks.

Debt recovery can be lengthy and resolution can take weeks or even months. Persistence and repeated efforts to reach debtors increase the likelihood of successful outcomes and are crucial in dealing with complicated situations and debt evasion.

Empathy

Although debt collection asks for persistence and sternness, empathy is also an important soft skill to have.

Empathy builds trust and rapport and involves recognizing the challenges and circumstances debtors face. It allows them to:

Approach interactions with sensitivity

Maintain respectful communication

Connect on a human level to encourage the debtor to pay

How to test debt collector's skills

In debt collection, having the right professionals on your side can significantly impact the success of your financial recovery efforts. It's not about merely seeking qualification on paper; it's about real-world effectiveness in navigating the complexities of debt recovery.

To ensure that each person you hire possesses the necessary skills, pre-employment skills testing is an invaluable tool. With TestGorilla, you can combine up to five different skills tests to create a customized assessment for each role.

Here are our top skills-tests recommendations when hiring debt collectors. Use them to evaluate the skills of your candidates and make an objective and unbiased selection of the best talent:

Communication: Assess the communication and listening skills of each candidate.

Time management: Candidates must be able to prioritize different collection tasks and complete them within deadlines.

Motivation: Debt collection can be exhausting. Evaluate the drive of the candidate to go above and beyond and complete the debt-collection process by all means.

Negotiation: Evaluate whether candidates know how to negotiate debt terms with debtors and come to an amicable conclusion.

Financial due diligence: Use this test to assess the financial competency of your candidates.

Debt collector interview questions: What should you ask during interviews?

Once you identify your best applicants with the help of skills tests, it’s time to invite them to a face-to-face or virtual interview.

Interviews are an excellent opportunity to gain a more in-depth understanding of your candidates’ strengths and weaknesses – but for this, you need to be prepared with the right questions.

Here are some debt collector interview questions you can ask:

In which areas of debt collection do you feel most confident, and where do you see room for improvement?

How do you stay updated on current debt collection laws and regulations?

What debt-collection software tools have you used in the past? Are you willing to learn new ones?

What's your approach if a debtor becomes aggressive or confrontational during a call?

A debtor claims they've already paid the debt. What do you do?

A debtor tells you they've lost their main source of income and are therefore unable to pay. What do you do?

What do you do to manage stress? How do you maintain a positive attitude after difficult interactions?

Do you think that empathy has its place in the debt-collection process? How so?

What are some of the key provisions of the Fair Debt Collection Practices Act (FDCPA)?

Have you ever had to testify in court regarding a collection account? If so, how did you prepare?

How do you document your interactions with debtors?

How would you handle a situation where company policies are in conflict with how you think a particular case should be handled?

Where to find a debt collector

There are two ways to go when you're looking to hire a debt collector. If you're working for a big company that needs the services of debt collection often, then hiring an in-house debt collector is the better option.

However, if your borrowers only miss payments occasionally and you haven't had to work with a debt collector for months, then working with an independent contractor on a project or client basis might suit you best.

Below are the best methods to hire both.

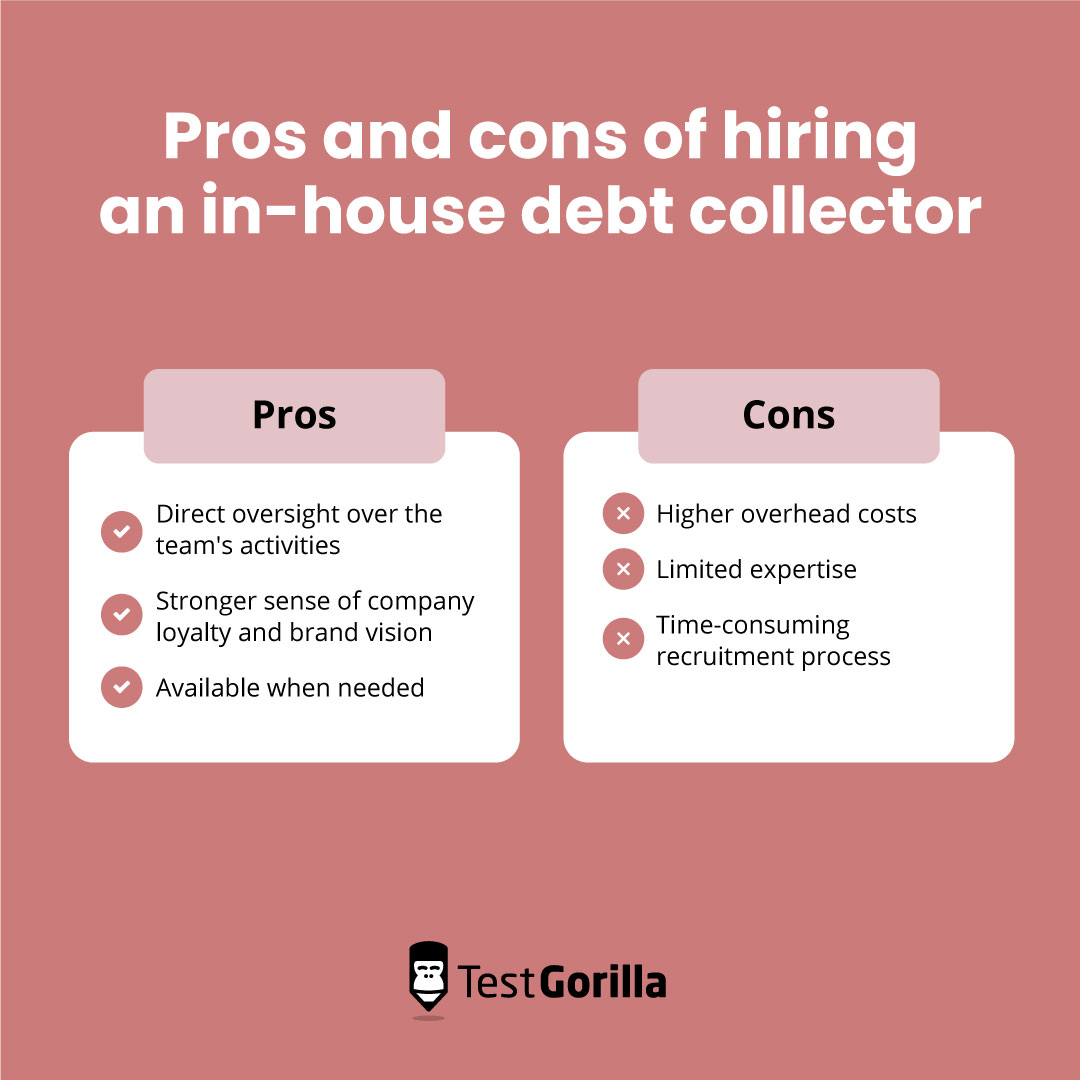

In-house debt collector

When hiring a full-time employee, you can use the following:

Job boards and recruitment websites

One of the best ways to find a reliable debt collector is to use job boards and recruitment websites such as LinkedIn, Indeed, Glassdoor, and more.

These websites give you access to a wide talent pool with candidates having a diverse range of skills, expertise, and experience.

Company websites and social media

You can also promote the job opening on your company website and social media platforms to enhance brand visibility and attract candidates who are genuinely interested in the role.

It will not only help you weed out candidates who don't read the job description but will also capture the interest of current employees who might refer suitable candidates to you.

Here are the pros and cons of hiring an in-house debt collector:

Pros:

Direct oversight: You get direct control and oversight over the team's activities.

Company loyalty and brand vision: In-house collectors have a stronger sense of loyalty to the organization and actively work towards achieving your vision.

Availability: In-house collectors are available when needed.

Cons:

Higher costs: Maintaining an in-house team requires fixed overhead costs.

Limited expertise: In-house collectors may lack the specialized skills of agencies or independent professionals.

Time-consuming recruitment process: Sorting through applications and doing interviews can be time-consuming.

Freelance debt collector

You can also hire an independent professional on a project or commission basis to help you out when needed. Here’s where you can find talented debt collectors:

Freelance platforms

Upwork, Freelancer, Fiverr, and other websites are the go-to platforms to find freelancers for any job. These platforms attract a ton of professionals from around the world who have diverse specializations and experiences.

Debt collection agencies

Debt collection agencies can not only do debt collection for you but can also assign a freelance debt collector to your account if you ever need one. They have a team of trusted professionals who have proven their skills and expertise in different projects and have an established and efficient debt-recovery process.

Here are the pros and cons of hiring a freelance debt collector:

Pros:

Cost-Effective: Freelancers often work on a commission basis, reducing upfront costs.

Specialized Skills: Freelancers may offer specific expertise in niche areas of debt collection.

Cons:

Limited control: You may have less direct control over a freelancer's workflow and processes.

Unavailability: Since they work on a commission or project basis, giving them new assignments depends on their availability.

How much does a debt collector cost?

Varied pay structures are used in debt collection. Some companies pay a percentage of the amount collectors are able to recover, while others agree on a flat fee structure, irrespective of how high or low the recovery amount is. Collectors often receive bonuses when they manage to recover due amounts quickly.

The complexity of the collection, the experience of the debt collector, and the efforts and resources they need to use can also influence the cost.

According to Salary.com, the average debt collector's salary in the United States is approximately $46,000 per year, while the range typically falls between $40,992 and $48,072.

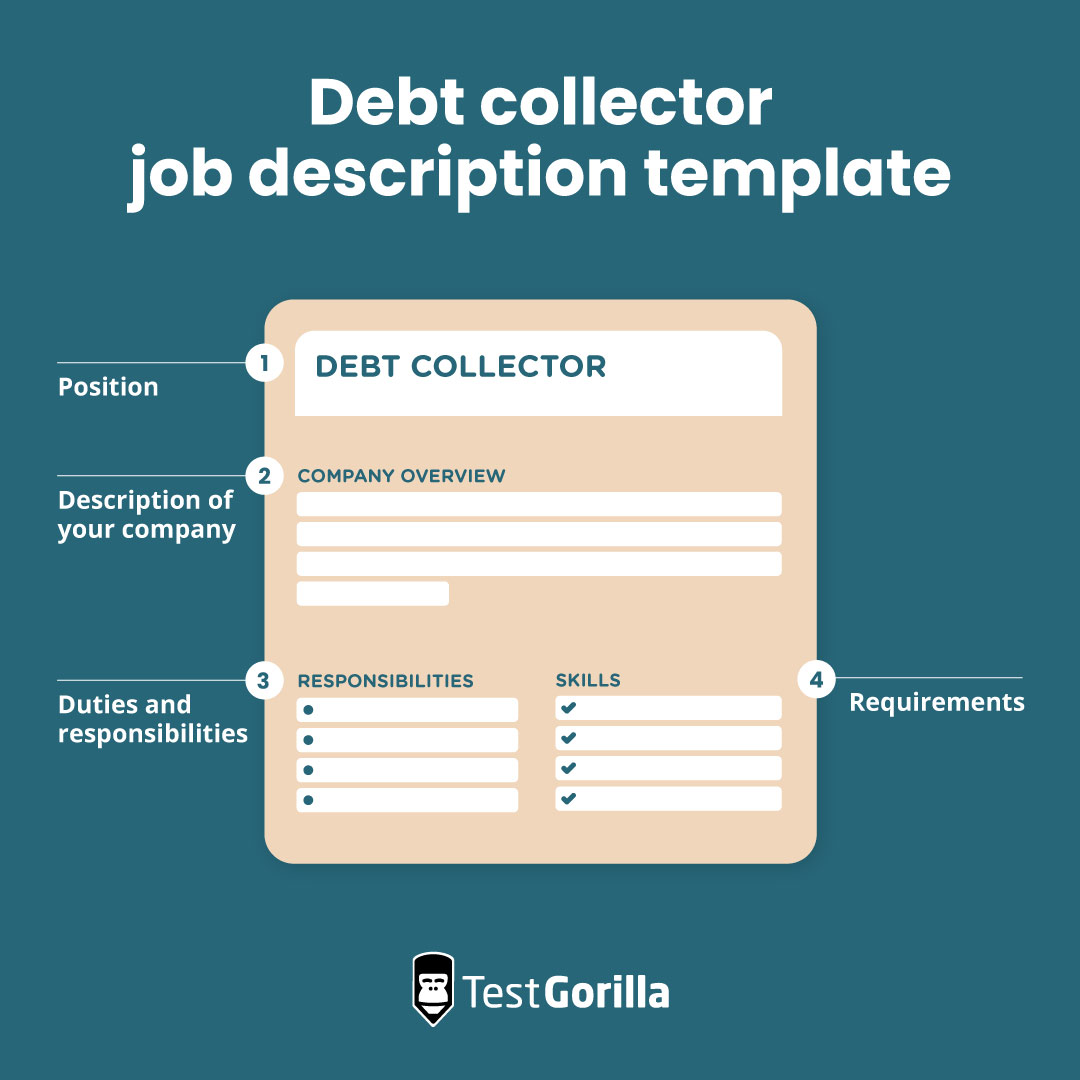

Debt collector job description template

[Your company name] is a leading [type of company, sector]. We're currently seeking a skilled debt collector to join our team and assist us in reaching our debt collection targets, while maintaining high ethical and professional standards.

Responsibilities:

Contact debtors to secure overdue payments

Negotiate repayment plans based on debtors’ financial situation and repayment abilities

Document all interactions accurately

Use skip tracing tools and techniques to contact hard-to-find debtors

Adhere to all federal, state, and local laws/regulations

Maintain a professional demeanor, prioritizing empathy and respect

Requirements:

Proven experience as a debt collector

Knowledge of relevant legal requirements

Strong negotiation and communication skills

Familiarity with debt collection software tools

High ethical standards and professionalism

Hire the best debt collector stress-free

Debt collection in the US is fragmented between big enterprises, small firms, and independent collectors. So, finding the perfect debt collector for your business can be a tough challenge.

A resume or portfolio won't give you the entire picture. Past results, testimonials, and skills assessments give you a better idea of what each candidate is capable of.

TestGorilla enables you to streamline the hiring process with the help of online assessments and get an accurate and objective idea of every candidate's knowledge and skill.

Sign up to our free plan to start creating your own customized assessment – and remember to check out our test library to see all the tests we offer.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.