How to hire a financial advisor: Skills to look for and how to test them

Financial advisors play a strategic role in their clients’ financial health and help them make important financial decisions that will have effects for years to come.

So, if you’re looking to hire a personal financial advisor, finding the right person is crucial for your financial future. And if you’re looking to recruit an employee for your team, the same is valid for your clients’ financial well-being: The successful management of their investment portfolios will depend on the expertise of your next hire.

It’s easy to see why evaluating the knowledge and skills of your next financial advisor should be an essential part of your recruitment process – but how do you do that, exactly? Especially in the face of evolving finance skillsets?

Thankfully, there’s a simple answer to that. Skills tests help you assess key financial-advisor skills like financial management, budgeting, and communication, and ensure you’re making the right hiring decision.

In this article, we’ll look into the key responsibilities of financial advisors, what skills you should look for, how to evaluate candidates, how much you can expect to pay, and what interview questions to ask.

Table of contents

- What is a financial advisor?

- Financial advisor hard skills: What technical skills do financial advisors need?

- Financial advisor soft skills: What soft skills to look for in your future financial advisor?

- How to test financial advisor skills

- Financial advisor interview questions

- Where to find financial advisors

- How much does a financial advisor cost?

- FInancial advisor job description template

- Hire the right financial advisor with the help of skills tests

What is a financial advisor?

A financial advisor is a professional who offers financial advice to individuals – or, more rarely, companies – to help them manage their money and achieve their financial goals.

Financial advisors typically help their clients:

Define a budget that meets their needs and goals

Manage their debt, revenue, and investments

Build a sound financial plan for the future

Create a retirement strategy

Plan how to fund their children’s education

Plan how to buy property or make other important purchases

Decide what insurance options are best for them

Financial advisors often work at investment firms, insurance companies, or banks, but some might also offer their services as independent contractors.

There are many types of financial advisors out there – and financial advisors might carry different titles. Some examples include:

Financial planner or certified financial planner (CFP)

Wealth advisor or manager

Asset manager

Chartered financial consultant (ChFC)

Financial consultant

Investment advisor

Financial advisor vs. financial planner: What’s the difference?

The terms “financial advisor” and “financial planner” are often used interchangeably, but they mean slightly different things:

Financial planners focus specifically on clients’ financial plans for the future by helping them define their goals and come up with the right strategies on how to achieve them

Financial advisors, on the other hand, usually offer a broader perspective on a person’s financial situation and might also provide investment and insurance advice, in addition to budget planning and savings management

In practice, however, financial advisors and financial planners might often provide very similar services, so don’t get hung up on the title – rather, focus on their specific skills and how they can help you.

A certified financial planner (CFP) is a professional who has obtained certification from the US Certified Financial Planner Board of Standards, or CPF Board. For this, they undergo an extensive certification process, which can take up to a couple of years.

CPF Board’s certification program is widely recognized as the industry standard for financial planners – so, if you’re looking for a financial advisor, you might consider this certification a plus or even use it as one of your hiring criteria.

A certified public accountant (CPA), on the other hand, is an accounting professional in the US who has passed the Uniform Certified Public Accountant Examination (Uniform CPA Exam) and met state licensing requirements. Certified public accountants offer accounting advice to companies and individuals alike and some financial advisors might have CPA certification.

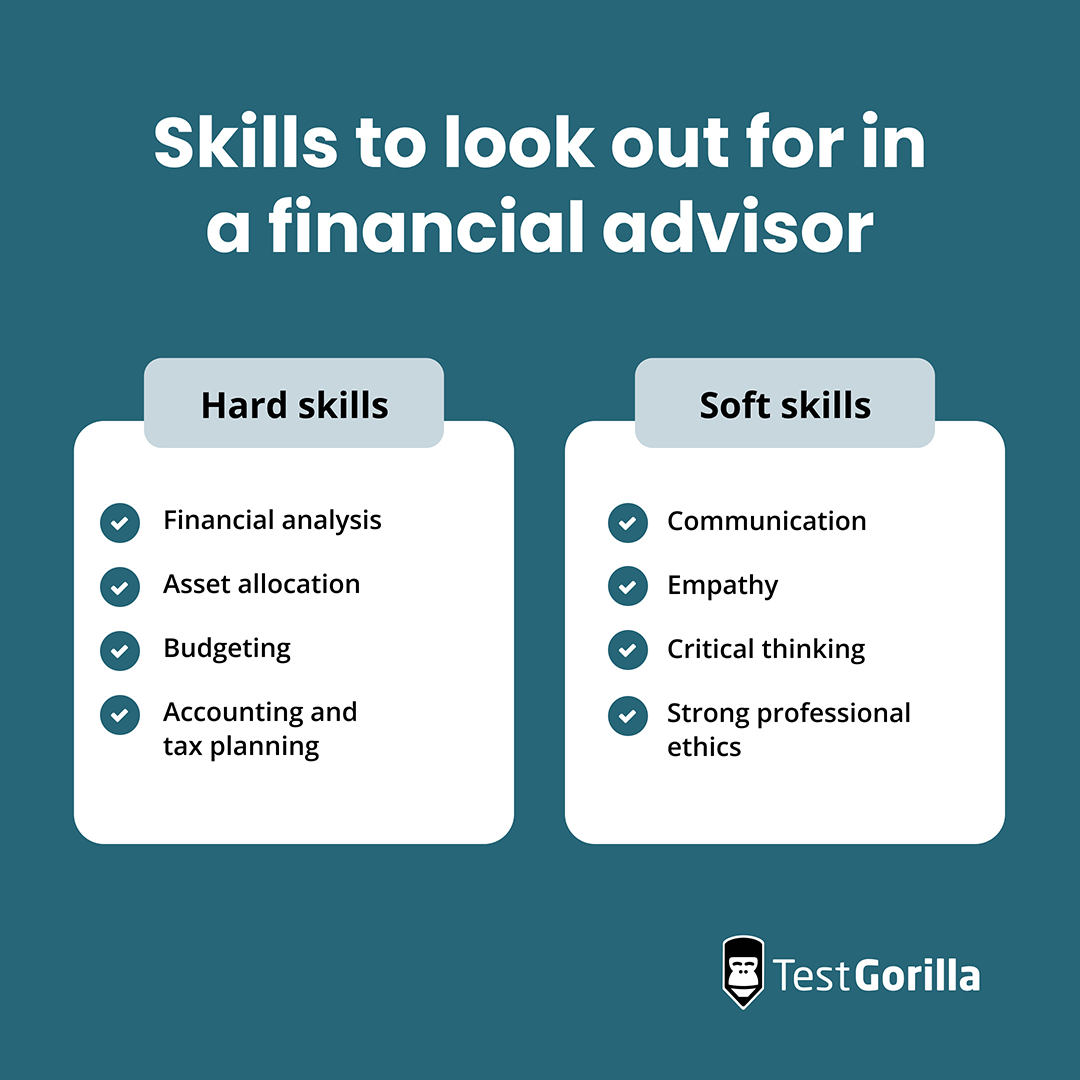

Financial advisor hard skills: What technical skills do financial advisors need?

Financial advisors need a number of hard skills to be able to provide solid financial advice to their clients. Let’s look at the most important ones:

Financial analysis

Financial advisors need excellent financial-analysis skills to be able to accurately evaluate the financial situation of their clients and give advice on their investment portfolios.

A sound analysis enables advisors to make informed decisions and recommendations and help their clients invest their money wisely.

Asset allocation

Asset allocation is the process of deciding how to distribute investment assets across various asset classes like stocks, bonds, funds, or real estate.

Proper asset allocation helps individuals optimize their returns at the risk level they’re willing to tolerate.

Budgeting

Budget planning is the cornerstone of any successful personal-finance strategy, so it’s crucial that your next financial advisor has the right budget-management skills.

For this, they need to know how to:

Read and interpret financial data

Estimate revenue and financial needs

Define goals and devise strategies to achieve them

Create a monthly, quarterly, and annual budget

Monitor, control, and adjust the budget as needed

Accounting and tax planning

Advisors need to be very well-informed of the tax and accounting implications of each investment and debt management strategy they use.

Effective tax planning enables their clients to manage their taxes proactively, rather than simply file their tax returns annually and pay whatever is due.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Financial advisor soft skills: What soft skills to look for in your future financial advisor?

Financial management and planning isn’t all about hard skills – financial advisors need a combination of soft skills like communication, empathy, and adaptability to understand clients’ needs, build trust, and give them personalized advice.

Here are some of the most important soft skills you need to look for in your future financial advisor:

Communication

Financial terms and concepts can be fairly complex, so advisors must be able to explain them in simple terms to their clients. This helps ensure that they’re on the same page and that clients understand each decision and how it’ll impact their financial future.

Additionally, financial advisors need to have excellent active listening skills to grasp the concerns, fears, and needs of clients and be able to propose personalized solutions that take them into account.

Empathy

An empathetic advisor can relate to clients' feelings and provide comfort and reassurance.

This can be particularly important during times of hardship, for example when sound (but potentially difficult) financial decisions can help individuals improve their financial situation, or during economic downturns, when clients might panic and make bad decisions out of fear.

Financial advisors should be able to give advice that takes into account their clients’ feelings and preferences, while also helping them make sound and rational choices.

Critical thinking

Financial planning comes with its set of challenges, such as market downturns, unexpected life events, or changes in goals.

An advisor's ability to think critically and propose new solutions adapted to their clients’ current situation is invaluable.

Strong professional ethics

Financial advisors must have a strong ethical compass for a number of reasons. In their work, on a day-to-day basis they:

Handle clients’ sensitive information that must remain private and confidential

Advise clients on how to manage their life savings and retirement funds

Must ensure compliance with financial regulations

To build trust, maintain their reputation, manage conflicts of interest, and ensure regulatory compliance, they need to uphold high ethical standards at all times.

How to test financial advisor skills

Now that you know what skills to look for in your future financial advisor, you’re probably wondering what you can do to assess them objectively.

Thankfully, there’s a simple answer to that: skills tests.

Skills testing enables you to evaluate professionals’ skills accurately and objectively, irrespective of whether you’re looking to hire:

A personal financial planner to assess your family’s financial situation

A financial advisor to help your company manage its assets better

A financial advisor to join your team and offer advice to your company’s clients

With TestGorilla, you can build an assessment of up to five skills tests to evaluate all candidates without bias – and make sure the one you hire has all the skills you need.

Here are some of the tests you can use when hiring a financial advisor:

Financial management: This test helps you assess your candidates’ ability to maximize profits and minimize risk when managing your finances.

Wealth management: Check whether candidates have the technical and analytical skills listed on your wealth manager job description including risk assessment, portfolio construction and performance monitoring, capital market knowledge, and more.

Budgeting: Budget-management skills are essential for nearly all financial roles, and even more so for the role of a financial advisor. Assess applicants’ ability to create, analyze, and manage budgets with this test.

Financial accounting (IFRS): With this test, you can make sure your applicants are able to correctly record, classify, and summarize accounting transactions according to the requirements of the International Financial Reporting Standards (IFRS) Foundation.

Communication: Evaluate your next financial advisor’s skills in active listening and communicating their ideas clearly and effectively.

If you need to evaluate other skills, head on to our extensive test library to select the right ones and build your first assessment.

Financial advisor interview questions

To pick the right financial advisor, it’s always a good idea to have an in-depth discussion with them and ask them questions about their experience, skills, and methods of work.

If you’re looking to hire a personal financial advisor, here are some questions you can ask:

Can you describe your typical client? (This can help you see whether they have experience working with people in situations similar to yours.)

What types of financial challenges have you helped clients overcome?

Do you provide comprehensive financial planning or specialize in specific areas?

How would you describe your approach to portfolio management? What financial tools do you recommend?

What is your fee structure and how do you charge for your services?

What software do you use to track and monitor clients' portfolios?

How do you handle situations when investments do not perform as expected?

How do you measure the success of your recommendations?

If you’re working for a financial organization or institution and looking to hire a financial advisor to join your team, here are some interview questions you could ask:

How do you define success in your role as a financial advisor?

How do you handle a situation where a client disagrees with your financial advice?

What steps do you take to ensure clear and transparent communication with clients?

What financial planning software or platforms are you most familiar with?

Describe your process for creating a comprehensive financial plan for a client.

A client is considering a major, life-altering financial decision (such as selling their business) you disagree with. What do you do?

Imagine two clients who have similar financial goals but different tolerances for risk, how would you adapt your strategy to each person's needs?

You start working with a client who has limited financial literacy. How do you make sure they're able to make informed decisions based on your advice?

In case you need more ideas and inspiration, check out our 100+ financial accounting interview questions or also 55 financial modeling interview questions.

Where to find financial advisors

Where to look for a financial advisor will largely depend on whether you’re looking to hire a consultant to advise you on your personal or business finances or a full-time employee.

Hiring a consultant

If you’re looking for someone to work with you for a couple of hours every week or month, you can simply hire a consultant. Here’s some of the ways to find one:

Ask your network for recommendations: Ask friends, family, and colleagues for recommendations of financial advisors or planners they have worked with and whom they trust.

Your bank or insurance agency: Financial institutions often offer financial advice or can put you in touch with experienced professionals.

Ask other professionals: If you’re already working with an accountant or a lawyer, ask them whether they know financial advisors who are taking on new clients.

Use an online platform that matches financial advisors with clients: Online platforms like SmartAsset or Paladin Registry can either match you with financial advisors or give you access to their directories.

Hiring a full-time financial advisor

When hiring a full-time employee for your team, your approach will be slightly different. Here are some of the ways to find your next financial advisor:

Use job platforms: Job platforms like LinkedIn, Glassdoor, Monster, and the like are always a good starting point when looking to hire new employees. You can also use LinkedIn to connect with passive candidates.

Professional associations: You can search the directories of professional financial associations like the Certified Financial Planner Board (CFP Board) or the Financial Planning Association (FPA).

Ask your network and employees for recommendations: Let everyone around you know that you’re looking to make a new hire. Recommendations from your professional network can be an excellent source of qualified candidates.

Networking events: Conferences, workshops, trade shows, or other events enable you to build a larger network and get in touch with potential applicants. Reputable conferences include IMPACT by Charles Schwab, the FPA Annual Conference hosted by the Financial Planning Association (FPA), and the Morningstar Investment Conference.

How much does a financial advisor cost?

Financial advisors who work as consultants charge either:

A percentage of the total amount of your portfolio, ranging from 0.25% to 1% a year, according to personal-finance website NerdWallet

A flat yearly fee, ranging from $2,000 to $7,500 a year

An hourly fee, ranging from $200 to $400

The fee will depend on the person’s expertise, experience, and qualifications. Don’t hesitate to discuss fee structures during the discovery call.

If you’re looking to hire a full-time employee, a financial advisor’s average annual salary is $123,000 but it might range anywhere from $92,000 to $172,000 per year.

The salary will depend on factors such as:

Your company’s type, size, and location

The person’s credentials and qualifications

Their experience and additional skills

Their expertise in specific niches

FInancial advisor job description template

Below, you’ll find a sample job description template for a full-time financial advisor at a financial institution. Feel free to copy it and adapt it to your own needs:

Position: Financial Advisor in [niche, sector, or type of company, f.e. investment banking]

Location: [City, state]

[Your company's name] is a [type of company, f.e. an investment bank] specialized in [type of service], committed to providing financial solutions tailored to our clients' needs. We're looking to hire an experienced financial advisor to join our team and assist clients in managing their portfolios and planning their financial future.

Responsibilities

In this role, we expect you to:

Analyze clients' current financial situation, understand their goals, and create personalized financial plans

Provide financial advice on a variety of financial tools and products

Make recommendations based on clients' objectives and risk tolerance

Build and manage long-term relationships with new and existing clients

Monitor clients' portfolios, prepare portfolio-performance reports, and offer clients advice on different portfolio-management strategies

Work closely with internal teams to provide services tailored to client needs

Adhere to all company rules and industry regulations, ensuring client interactions and transactions are compliant

Attend workshops and conferences to boost our presence at networking events

Qualifications

We're looking for a skilled financial advisor who has:

A Bachelor's degree in Finance, Economics, Business, or a related field

[Type of valid financial advisor license, if you require one]

[X years] of experience as a financial advisor, with a proven track record of successfully managing client relationships and growing portfolios

Excellent analytical, problem-solving, and decision-making skills

Strong interpersonal and communication skills

Proficient with financial planning software, such as [tools your team is using]

Benefits

...And here's what we offer:

A competitive salary ranging [from/to] with performance-based bonuses

A comprehensive benefits package, including [describe benefits, such as health insurance, a retirement plan, gym membership, etc.]

Excellent opportunities for professional growth

Access to in-house training and outside events

How to apply

Sounds intriguing? We’d love to hear from you! To apply, [describe your application procedure and mention skills tests if you plan to use them]

Recommended reading: How to write a financial consultant job description

Hire the right financial advisor with the help of skills tests

Expert financial advisors are hard to find – but not impossible. And if you know what skills to look for and how to evaluate them, the whole process becomes much simpler.

TestGorilla’s skills assessments enable you to make objective, data-driven decisions and ensure that the person you pick will have the right knowledge and expertise to make sound financial decisions and build solid strategies to protect your or your clients’ financial future.

To start building a bias-free, skills-first hiring process, sign up for a free live demo today – or check out our free plan to see for yourself why 10,000+ companies have chosen us to streamline hiring.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.