New skillsets are changing finance recruitment

80% of finance employees prefer a skills-based hiring process (12 percentage points higher than the industry-wide average). Read the report to learn more.

Finding the right financial consultant is crucial for your company's financial health. They're key players in shaping your investment strategies and keeping your finances robust.

But, hiring someone who's not the right fit can lead to poor financial management, which can negatively impact your company's financial well-being and put your organization at risk.

Many companies struggle to pinpoint and draw in the right talent for their financial consultant roles. This is getting even harder as finance skillsets evolve. But your business doesn’t have to face this challenge alone: We’re here to help you navigate attracting and hiring the best financial consultants.

In this guide, you'll discover the skills and qualities to look for in your applicants, ways to evaluate candidates’ financial expertise, creative sourcing strategies for finding top talent, and tips on avoiding common hiring pitfalls.

Table of contents

- What you need to know before hiring a financial consultant

- Skills and qualifications to look for in a financial consultant

- Where to find skilled financial consultants

- How to select the best financial consultant candidates

- Common mistakes when hiring a financial consultant

- Find the right financial consultants with TestGorilla

What you need to know before hiring a financial consultant

Here are three factors to consider before hiring a financial consultant.

1. The scope of work

Before bringing a financial consultant on board, it's essential to understand what their job entails.

Financial consultants, also known as financial advisors, do more than manage investments and give generic advice. They tailor financial strategies to fit client profiles, including risk tolerance and life goals. They also stay ahead of market trends to provide timely guidance, construct diverse portfolios to weather financial storms, and create comprehensive plans for wealth management.

Understanding what consultants do makes it easier to identify the skills and traits that make them a great fit for your financial journey.

2. Your financial goals and needs

Before your hiring search begins, map out your organization's financial goals and needs. Ask yourself the following questions:

Is the business looking for growth, stability, or a combination of both?

What’s the current financial health of the organization?

Does the business need someone with expertise in risk management, retirement planning, or international investment strategies? What about a combination of these expertise areas?

Getting a grip on these details doesn't just sharpen your financial consultant job description. It also gives potential candidates a clear picture of your business’s objectives so they can assess their suitability for the position before applying. This can help ensure only those well-aligned with your company’s needs apply for the position, making it easier for you to find your perfect hire.

3. Your organizational culture

A financial consultant’s fit with your company’s culture is just as important as their professional expertise.

To get a sense of your company culture as it relates to financial consulting roles, consider the following:

Does your organization value aggressive growth, or does it take a more conservative approach to financial management?

How do your teams communicate, and what are the decision-making processes?

How does your company prioritize and navigate risk management in financial decision-making?

In what ways does your business encourage learning and development for financial consultants?

Reflecting on these questions will help you identify a consultant who not only has the technical skills but also the interpersonal abilities to thrive within your company. For example, knowing your company’s approach to risk helps you determine if your ideal financial consultant should be more cautious or embrace calculated risks to align with your organizational values.

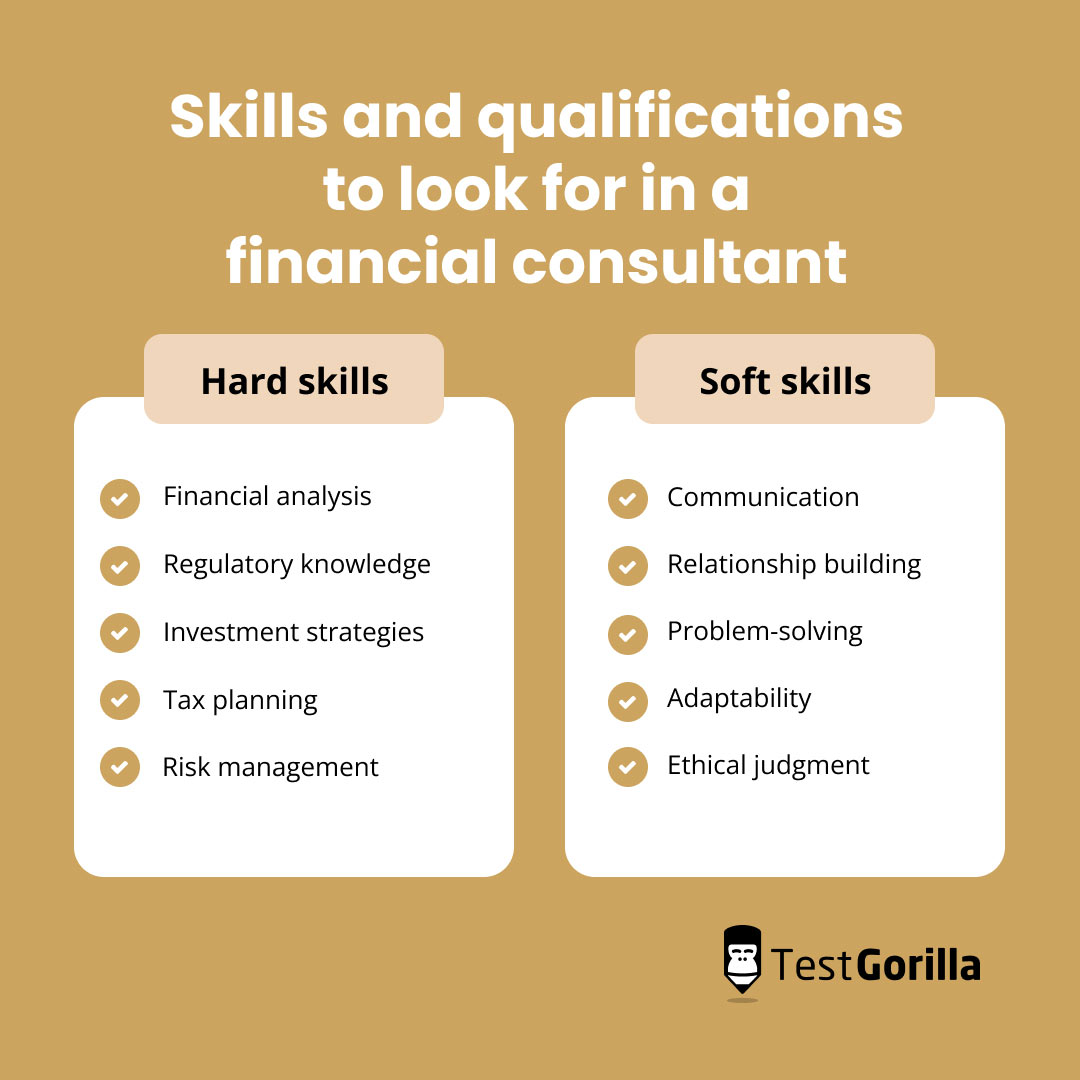

Skills and qualifications to look for in a financial consultant

Financial consultants require a mix of hard and soft skills to excel in their roles. Below are five of each kind.

Hard skills

Financial analysis: The ability to analyze financial data, interpret financial statements, and understand market trends to make informed decisions.

Regulatory knowledge: An understanding of relevant financial regulations, compliance standards, and ethical guidelines.

Investment strategies: Proficiency in developing and managing investment portfolios tailored to client needs and risk profiles.

Tax planning: Knowledge of tax laws to assist clients in minimizing their tax liabilities and maximizing returns.

Risk management: The skill to assess and manage various types of financial risks, providing strategies to mitigate them.

Soft skills

Communication: The ability to clearly and effectively communicate complex financial concepts to clients with varying levels of financial literacy.

Relationship building: Fostering strong relationships with clients based on trust and understanding of their financial goals and personal values.

Problem-solving: Creatively and efficiently solving problems as they arise, often under time pressure.

Adaptability: The ability to adapt to a rapidly changing financial environment and continuously update one’s skill set.

Ethical judgment: Maintaining high ethical standards and integrity to make decisions in clients’ best interests.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Where to find skilled financial consultants

When you're searching for financial consultants, sticking to the usual job boards such as Indeed and LinkedIn can be limiting. The finance world is packed with talent – and often, the real gems aren’t actively job hunting.

That's why getting creative with your recruitment strategy can make a big difference in attracting high-caliber professionals waiting for the right opportunity to catch their eye.

3 creative ways to find financial consultant candidates

Here are three unique methods to source talented financial consultants.

1. Engage with alumni networks

Connect with alumni associations of universities known for their finance or business programs. Alumni often have a network of professionals who might not actively be seeking new opportunities but could be interested if approached.

You can contact the heads of these programs via email, LinkedIn, or telephone. Consider offering to host exclusive webinars, leading workshops, or putting together networking events for alumni. Doing so can help you meet skilled financial professionals who could become potential candidates for your consultant position.

2. Collaborate with professional finance associations

Partner with professional finance associations and groups – such as Chartered Financial Analyst (CFA) societies and local finance clubs – to sponsor events or workshops.

This provides a platform to network with professionals who are already engaged and invested in their financial careers. Additionally, these associations often have job boards or newsletters where you can advertise your openings to a targeted audience.

3. Interact with financial podcasts and blogs

If you’re not in a big rush to land a hire, engage with popular financial blogs, podcasts, or YouTube channels as a guest contributor or sponsor. This strategy allows you to reach a dedicated audience of finance enthusiasts. You can share insights about your company and mention your interest in connecting with potential candidates, reaching individuals who are passionate and knowledgeable about finance.

How to select the best financial consultant candidates

After you've gathered applications for your financial consultant role, it's time to dive into evaluations. The easiest, most efficient approach is to use a pre-employment screening platform like TestGorilla.

We offer a range of specialized tests that measure the key technical and interpersonal skills necessary for a financial consultant. This comprehensive approach to candidate screening helps you identify individuals who truly match what you’re looking for, helping you avoid costly mis-hires.

94% of finance employers improve retention when they switch to skills-based hiring.

Source: The Fintech Factor: How New Skillsets are Changing Finance Recruitment

Below are some tests you can use to assess your financial consultant candidates:

TestGorilla’s Financial Due Diligence test assesses candidates’ financial competency, covering skills in business valuation, financial health, and identifying risks.

Our Financial Management test measures how well candidates can manage finances to boost your business’s profits while keeping risks low.

The Financial Math test is also ideal for assessing financial management skills – focusing on equations, time value of money, and linear programming.

TestGorilla’s Communication Skills test assesses candidates’ written and verbal communication skills in professional environments.

Our Problem Solving test evaluates candidates’ analytical and critical thinking skills to see how they address complex problems.

TestGorilla’s Enneagram, DISC, and Big 5 (OCEAN) tests are great tools to learn candidates’ personality types, motivations, and goals.

Our Culture add test studies test-takers’ behavioral traits based on a customizable survey you fill out. This helps you learn how your candidates will impact your existing workplace culture.

For candidates who make it to the interview stage, try asking them behavioral interview questions for roles in finance. These questions enable you to drill down into candidates’ skills and experience so you can better assess how they’ve applied their financial expertise in real-world scenarios.

Common mistakes when hiring a financial consultant

Hiring a financial consultant can be a bit of a tightrope walk, and even seasoned hiring managers can make mistakes. Here are three common pitfalls to watch out for.

1. Overemphasizing technical skills

Having a strong understanding of finance is key, but it’s only part of what makes for a great financial consultant. Sometimes, hiring managers get too caught up in technical prowess and overlook soft skills like communication, adaptability, and problem-solving.

Avoid this by remembering that a financial consultant needs to explain complex financial concepts in simple terms, adapt to varying client needs, work well with others, and develop creative solutions to problems. Ensure your job description emphasizes these requirements, and ask behavioral questions during interviews to probe candidates’ soft skills.

2. Rushing the hiring process

When you rush recruitment, you might miss red flags. For example, a hasty hiring process might overlook a candidate's limited experience in a crucial area like tax optimization or investment strategy.

Steer clear of this mistake by taking the time to vet candidates thoroughly. Look into their references, experience, education, and credentials. During interviews, listen carefully to how they respond to situational questions, and avoid hiring anyone who can’t demonstrate a solid understanding of the expertise required for the role.

3. Neglecting to test practical skills

Often, hiring managers place too much value on a candidate’s resume and credentials and not enough on their practical, hands-on skills. It’s essential to test financial consultants on how they apply their knowledge in real-world scenarios. Skipping this step can lead to hiring someone who looks great on paper but can't quite deliver when it comes to actual financial strategizing and problem-solving.

Find the right financial consultants with TestGorilla

Hiring a financial consultant is about more than just finding someone who's good with numbers. It's about choosing a skilled professional who understands the complexities of finance and can contribute to your business’s financial health.

Not fully understanding the scope of this role could lead to financial mismanagement, increased risks, and even missed investment opportunities.

Luckily, TestGorilla offers various online tests designed to assess financial consultant candidates. From financial analysis and risk management skills tests to personality and cultural fit assessments, our test library has all the tools you need to identify the perfect fit for your financial team.

Start your hiring process on the right foot by signing up for your free TestGorilla account today. You can also check out our free live demo or take a quick product tour to explore everything we have to offer.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.