If you’re looking to hire a financial manager, you should be sure to make the best hire.

Financial managers are in charge of the financial health of your organization. They are responsible for overseeing all financial operations and making strategic financial decisions.

That’s why this role is crucial for the success of any business. Hiring the right person will greatly impact your profitability.

However, hiring the wrong person can lead to a lot of negative consequences for your organization. Not using your financial resources effectively might result in missed opportunities for growth, a profit loss, and even bankruptcy.

To avoid this, look for a financial manager with:

In-depth knowledge of financial management, accounting, and bookkeeping

Financial trend and market pattern literacy

Experience using financial software like Microsoft Excel

Alignment to your company’s values and mission

This article will help you learn how to hire a financial manager for your company who has the right skills and experience. You can read more about the hard and soft skills a good financial manager should possess, as well as how to evaluate these skills effectively with the help of skills assessments.

We will also provide a sample job description template, suggested sources to find suitable candidates, information about the typical salary range, and interview questions and tests that can help you identify the best financial manager for your company.

Table of contents

- What is a financial manager?

- Financial manager hard skills

- Financial manager soft skills

- How to test financial manager skills

- Where to find a financial manager

- Financial manager job description template

- How much does a financial manager cost?

- Financial manager interview questions

- Find the best financial manager with no stress or bias

What is a financial manager?

So, why hire a finance manager — and what do they do, exactly?

Every business needs effective financial management to succeed. Financial managers are accounting professionals who advise the upper management about important financial decisions.

Your financial manager’s main goal is to ensure the financial stability of your company. They do so by monitoring the cash flow, managing expenses, and developing effective profit strategies.

The financial decisions that financial managers are expected to take can be divided into three main categories:

Investment decisions

Financing decisions

Dividend policy decisions

The responsibilities that financial managers take on can vary depending on the type of organization, but they usually include monitoring and analyzing the cash flow, keeping track of the market and competitors to forecast future trends, identifying promising investments, minimizing financial risks, and ensuring everything is following financial laws and regulations.

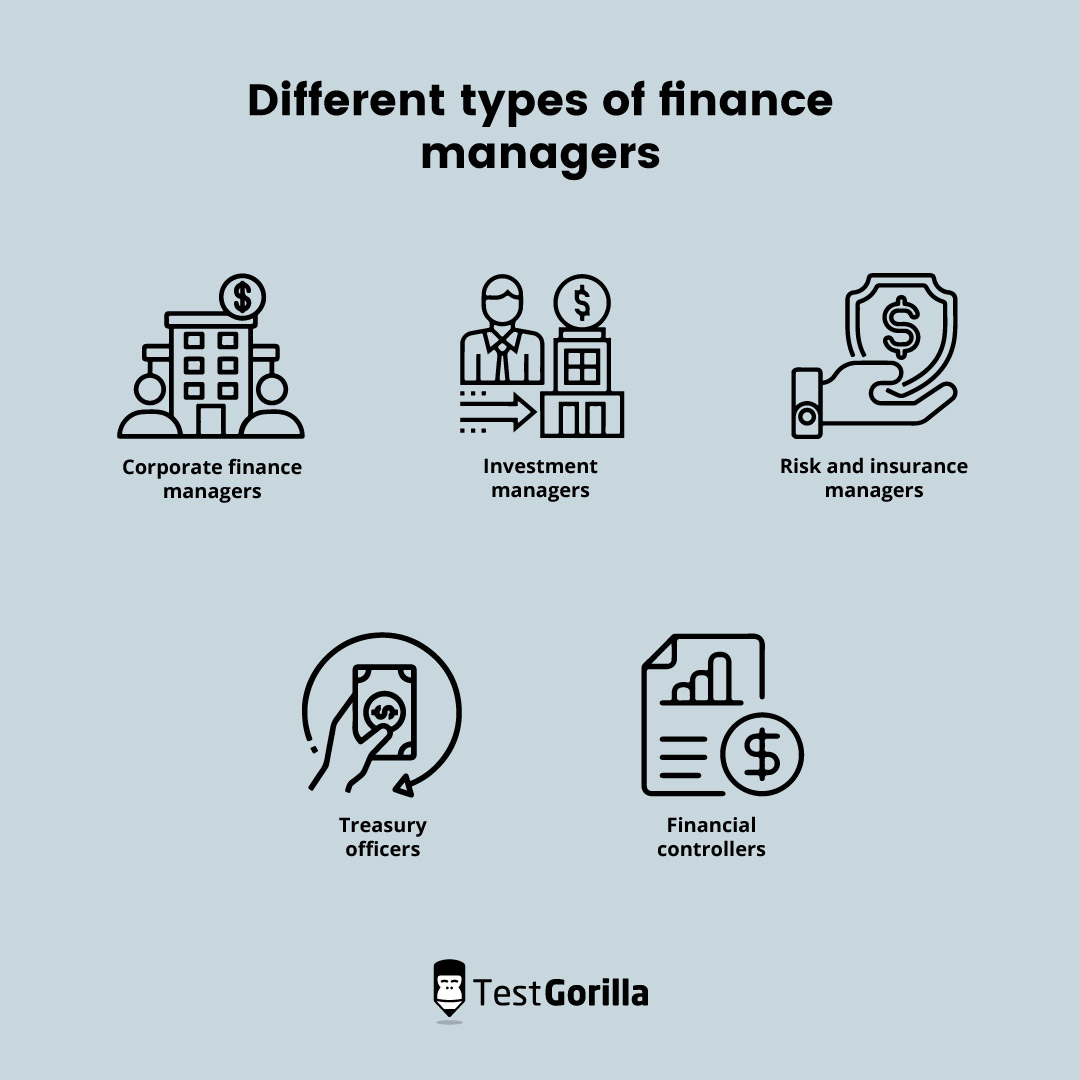

To be sure you’re looking for the right kind of financial manager for your company, learn more about the different types of finance managers:

Corporate finance managers. They oversee the management of financial resources in corporations.

Investment managers. They work in banks, investment firms, and other kinds of financial institutions. They are responsible for market analysis, building investment portfolios, and making investment decisions that benefit their clients’ returns.

Risk and insurance managers. They work for all kinds of organizations and their goal is to minimize the risks that can damage the company’s financial health. Insurance managers are particularly involved with purchasing insurance policies that minimize the company’s risks against various threats.

Treasury officers. They are in charge of the company’s cash flow and liquidity. Treasury managers build the company’s budget, manage relationships with financial institutions, and oversee the financial part of merging with other companies.

Financial controllers. They work in a variety of organizations and oversee financial reporting and accounting. Financial controllers are hired to make sure everything is in accordance with the legal standards and regulations.

Financial manager hard skills

To successfully recruit a finance manager, you need to know what skills to look for, starting with their hard skills. Strong financial management skills are obviously a must, but what about the rest?

Some of the hard skills that a financial manager must have are:

Accounting skills

Accounting is a key component to any finance manager’s job.

Financial managers are accounting specialists. To understand the methodologies related to the finances of your company and to be able to communicate them with coworkers, they must have strong accounting knowledge. This includes:

Skills in standard principles of accounting, such as GAAP and International Financial Reporting Standards

Knowledge of accounting terminology

Practical knowledge of key accounting concepts such as keeping books of accounts and interpreting financial statements

Budgeting skills

A lot of the work that a financial manager has to do revolves around budgeting. As Harvard Business School states, budgeting is vital for the success of any business. Budgeting skills enable your organization to:

Optimize your profit

Plan for short- and long-term expenses

Avoid spending more than you’re making

Embrace better investment opportunities

So, any business looking to hire top performing financial managers needs to look for people with outstanding budgeting skills.

Mathematical proficiency

Mathematical proficiency is a must for analyzing and interpreting complex financial documents and transactions. People in financial roles must be able to perform the mathematical computations necessary for calculating and evaluating financial outcomes. Mathematical proficiency is a blend of:

Identifying problems

Formulating strategies to solve them

Using procedures flexibly and effectively

Understanding concepts, operations, and relations

When hiring a financial manager, look for someone who has excellent financial math skills.

Technical skills

Much financial management work is done with the use of specialized software. Financial managers must know how to use the right tools for their job so they can find, sort, and explore data efficiently. Some examples of commonly used financial software are:

QuickBooks

Microsoft Excel

MoneyGuidePro

Knowledge of accounting software is important for a financial manager, too.

Financial literacy

Financial literacy doesn’t refer to knowing accounting lingo. It’s the ability to use skills to manage financial resources. Some of the basics of financial literacy that every financial manager should be familiar with are:

Banking

Investing

Budgeting

Handling debt and credit

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Financial manager soft skills

The successful finance manager’s skills and qualities extend well beyond their technical financial skills: Soft skills are just as important as hard skills.

They are especially important for people in management roles who must be particularly team-oriented and set an example for their coworkers.

Here are a few examples of soft skills that are important to look for when you hire a financial manager:

Analytical skills

Financial managers are required to identify and define problems related to the organization’s finances. To do that, strong analytical skills are necessary.

Financial managers must be able to:

Think critically

Identify and interpret problems

Extract key information from data

Analyze solutions to determine pros and cons

Problem solving

Whatever field you’re working in, problems will arise. An effective financial manager must rise to the challenge and build a strategy to solve the matters at hand. Excellent problem-solving skills include:

Logical decision making

Flexibility to manage emergencies

Interpreting data effectively to identify issues

Following through when you have developed a solution

Time management

Deadlines are an important part of financial management. To make sure your financial manager will be able to meet them, look for someone who can:

Prioritize tasks

Plan strategically

Organize their time well

Delegate responsibilities effectively and with a deep understanding of the task

Communication

Communication has long been a challenge in the finance field, as AFP (Association for Financial Professionals) reports. This skill is of vital importance for any financial manager because they must be able to thoroughly explain and justify complex financial decisions, and communicate effectively with their coworkers.

Being a good communicator means:

Sharing your knowledge with strong speaking, writing, and presentation skills

Explaining complex trends, patterns, and forecasts in a clear and concise manner

Adapting to your audience

Listening actively so you can extract essential information

Attention to detail

Detail-oriented financial managers are more likely to catch and prevent errors. In finance, this makes for avoiding costly oversights and major losses.

When you’re building or reviewing a financial report, a seemingly minor mistake can snowball, because the data is being used at different stages of the reporting process. Having a skilled eye for detail:

Helps ensure the information you work with is accurate at every stage

Prevents time- and resource-consuming errors

Allows for better time management

Helps you identify good opportunities for investment and profit optimization

For these reasons, it’s important to hire candidates with strong attention to detail. To do this, you can use our Attention to Detail test.

Below, you’ll find more ideas of the tests to use to hire a financial manager.

How to test financial manager skills

Once you’ve decided which soft and hard skills to concentrate on during the financial manager recruitment process, your next step is determining how to test your candidates.

It can be challenging to sift through all the resumes and evaluate them objectively, especially if you have little to no relevant experience in the field.

However, you can rely on pre-employment skills tests to assess a candidate’s level of expertise in the job-specific skills you require of them.

Some of the advantages of using pre-employment testing are:

Hiring the top candidates. Skills assessments allow you to evaluate immediately the abilities of your candidates and to identify the best ones easily. You can write whatever you want in a resume but actions always speak louder than words.

Decreasing your time-to-hire. Pre-employment skills testing will save you the effort of going through hundreds of resumes, most of which are sent by people who spam all available job offers without even bothering to read the description. This means hiring faster and better.

Reducing hiring bias. Shortlisting candidates with the help of unbiased, data-based testing allows you to hire from a more diverse candidate pool and pick the best employee objectively.

Decreasing turnover. Pre-employment tests help you hire candidates who are aligned with your company’s values and mission. This results in reducing your turnover rates and cutting down your hiring costs.

But is pre-employment skills testing reliable?

Much research exists on the different methods for hiring personnel.

An entire specialty in psychology — industrial/organizational (I/O) psychology — is dedicated to the topic. I/O psychology is the study of human behavior in the workplace. I/O psychologists study worker behavior, evaluate companies, and conduct training to improve the hiring, training, and management processes.

A priority on the industrial end of I/O psychology is to study which selection methods predict performance most efficiently. One of the most influential studies on the matter, published by Frank L. Shmidt and John E. Hunter, states that:

Selection methods drastically impact business outcomes.

Work sample, cognitive ability, and personality tests are some of the best ways to hire the best candidates.

Based on this study and other research, we advise you to use multiple relevant tests to build a pre-employment skills assessment. TestGorilla’s large test library offers you a variety of science-backed tests to use when hiring.

A skills assessment consists of up to five tests. Next we will recommend some tests that can help you identify the best financial manager for your company.

Financial manager skills tests

Depending on which type of financial manager you’re hiring and what duties will be prioritized, we recommend choosing five of these tests for your skills assessment:

Financial Management. This test evaluates the candidate’s skills in handling finances to maximize business profit and minimize potential risks. Find out firsthand if your candidates have sufficient knowledge of capital management, investment appraisal, and forecasting financial outcomes.

Financial Modeling in Excel. Financial managers frequently use Excel for financial modeling and valuation. This test will assess if your candidate can maintain and create financial models using Excel.

Budgeting. A financial manager should be able to understand and apply financial policies, as well as create, maintain, and analyze budgets. To make sure your future employee is good at budgeting, use this assessment to determine their understanding of financial analysis and cash flow management.

Accounting Terminology. Every financial manager must be able to understand and use accounting lingo, considering the role requires analyzing and creating financial statements and reports. This test will help you evaluate the candidate’s knowledge of accounting terms related to finances. The assessment is focused on US terminology.

QuickBooks. QuickBooks is an accounting software package used by many financial managers. This test assesses the candidate’s ability to work with it efficiently in four key categories: setting up a company and maintaining its lists; setting up products and services and processing sales transactions; processing supplier purchases; setting up the banking function along with additional accounting functions.

Financial Math. Using math is essential for identifying and evaluating potential financial outcomes. A financial manager has to do a lot of computations in their daily tasks. Use this test to assess their ability to perform those calculations accurately.

Attention to Detail (textual). A small error can lead to a variety of negative consequences, from giving an impression of being unprofessional to causing a major loss of time and resources. That’s why you need candidates who pay close attention to detail and handle complicated intricate processes with care and thoroughness.

Communication. This test will help you assess if your candidates can communicate clearly and coherently while using professional etiquette. Communication can seem to hold less importance than most of the other relevant skills, but it’s key for effective collaboration with others.

Financial Due Diligence. This test evaluates a candidate’s ability to do business valuation after taking into consideration various factors such as internal controls, associated risks, and future projections.

Critical Thinking. Identify candidates who are able to evaluate information and make sound judgments based on logic and analytical skills.

Time Management. Financial managers have to meet important deadlines to make sure the financial health of your organization is in check. Use this test to evaluate a candidate’s ability to prioritize their tasks well and act effectively in accordance with deadlines.

Where to find a financial manager

Now that you know how to effectively evaluate the essential skills of a financial manager, it’s time to move to the next step — sourcing the candidates.

Depending on whether you’re looking to hire an in-house financial manager or a freelancer, there are different platforms that can serve you best.

Find in-house financial designers

Career Bank. This is a financial service job board that directly connects employers to candidates for all kinds of job roles related to finance, banking, and accounting. It has a reach of over 260,000 job seekers.

Association of International Certified Professional Accountants. There are free and paid options, and an extensive database to source qualified professionals.

LinkedIn. It’s the largest professional social network, giving you access to an unlimited candidate pool, suited for every preference.

FinancialPositions. This is a career site built specifically for financial professionals, which can save a lot of time for people hiring financial managers.

SimplyHired is a job aggregator that distributes job listings from thousands of international websites, helping you recruit a diverse and highly-qualified team.

Find freelance financial designers

Upwork. This is one of the most popular freelance job platforms where you can find thousands of professionals from various countries. Posting a job is free.

Fiverr. There are many highly qualified financial managers on Fiverr. The difference between Upwork and Fiverr is that Fiverr is mostly used for smaller, one-time projects.

Financial manager job description template

Below, you’ll find a financial manager job description template that you can use and adapt to fit the needs of your company.

–

[YOUR COMPANY NAME] is looking for a reliable financial manager who can analyze financial activities and manage the cash flow.

What will be your role as a financial manager?

As [COMPANY’S NAME]’s financial manager, you will be responsible for evaluating, optimizing, and maintaining the financial health of the company.

The goal is to aid upper management in making important financial decisions and to keep the company’s financial health in check.

Financial manager job responsibilities

As a crucial member of the finance management team, your responsibilities will include, but not be limited to:

Monitoring and analyzing key elements of the cash flow.

Performing regular evaluations of the company’s financial health.

Keeping track of market trends and competitors, and using the results to create financial reports.

Building budgets that meet the company’s requirements, limitations, and objectives.

Managing the company’s investments and making sure they are aligned with the company’s goals.

Developing risk management strategies that serve to identify potential risks and eliminate them.

Ensuring financial legal requirements are met and that the financial statements are accurate and comply with accounting regulations.

Forecasting financial performance.

Predicting future market trends.

Finding ways to reduce or maintain the company’s costs.

Crafting strategic business goals that will improve or maintain the company’s financial state.

Financial manager job requirements

2 years of experience in the financial field

BA or BS in Accountancy, Finance, Economics, or Management

Proficiency with financial software [NAME OF SOFTWARE]

Working knowledge of GAAP principles

Strong analytical skills

A detail oriented mind

Understanding of the market

Strong communication and organizational skills

How much does a financial manager cost?

Now that you have determined what your requirements are and which responsibilities you expect to be fulfilled by your financial manager, it’s time to think about salary.

The amount you can expect to pay a financial manager will depend on their education, experience, and responsibilities. According to Accounting.com, the salary of financial managers ranges between $70,830 and $208,000.

However, many factors can affect salary, such as:

Education. A financial manager with a Bachelor of Finance degree has an average annual salary of $64,000, while one with an MBA earns $100,000 on average.

Experience with in-demand software.

Cost of living.

Financial manager interview questions

Read on for our top financial manager interview questions:

Which kind of financial reports does upper management need and why?

What did you learn from your experience working in this industry?

Do you work well with others?

What is your favorite part of your job?

Do you feel comfortable in a fast-paced environment?

When you have to deal with multiple priorities, how do you manage?

Can you remember a situation in which your financial advice to upper management resulted in higher profits?

Do you see yourself as a leader and why?

How do you conduct yourself when you disagree with upper management?

If you want more inspiration and ideas, check out our interview questions for financial accounting and financial modeling roles. You can use some of these interview questions for financial manager roles as well.

Find the best financial manager with no stress or bias

Finding a suitable financial manager can be quite time consuming. This job role requires a lot of analytical skills and practical knowledge, which can be difficult to evaluate just by looking at a resume.

With pre-employment skills testing, you can assess directly the candidate’s level of expertise in the relevant skills for the job role.

Doing this at the start of the hiring process allows you to invite only the most qualified candidates for an interview, which can then be personalized based on the acquired data from the skills assessment. Skills testing is also a great way to future-proof your finance recruitment as skillsets evolve and change.

Start a free trial at TestGorilla today to hire with a data-driven approach and simplify your financial manager recruitment process.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.