Hire skilled bank tellers with TestGorilla’s talent assessments

Learning how to hire a bank teller with the right skills to process financial transactions efficiently, delight customers, and enhance your brand’s reputation is crucial.

Tellers are your bank's number one representative. They influence customers' experiences with your institution, cultivating loyalty and trust with exceptional communication skills, problem-solving capabilities, and attention to detail.

Here, we explore the most important skills to screen for when hiring bank tellers and the pre-employment tests that help you identify the right candidates.

What is a bank teller?

A bank teller processes transactions and handles customer service in a financial institution. Tellers work in banks and credit institutions, dealing with everything from withdrawals and deposits to transfers and other customer requests.

These employees communicate directly with customers to understand and address their needs.

Bank teller duties include:

Building and strengthening client relationships

Raising awareness of new products and banking services

Managing financial transactions

Keeping financial institutions running smoothly

Common types of bank tellers

There are different types of tellers, each with their own specific responsibilities, such as:

Type of Teller | Role |

Head tellers | Oversee cash management, handle complex customer transactions, and train junior tellers. |

Currency exchange tellers | Focus on foreign currency transactions, monitoring exchange rates, and sharing information about commissions and fees. |

Loan tellers | Assist customers with loan transactions, process loan payments and applications, and track loan records. |

Drive-through tellers | Attend to customers’ needs without them needing to leave their cars. |

Universal tellers | Performs all the basic roles of a teller, including handling transactions and providing customer service. They may also promote a bank’s products and services. |

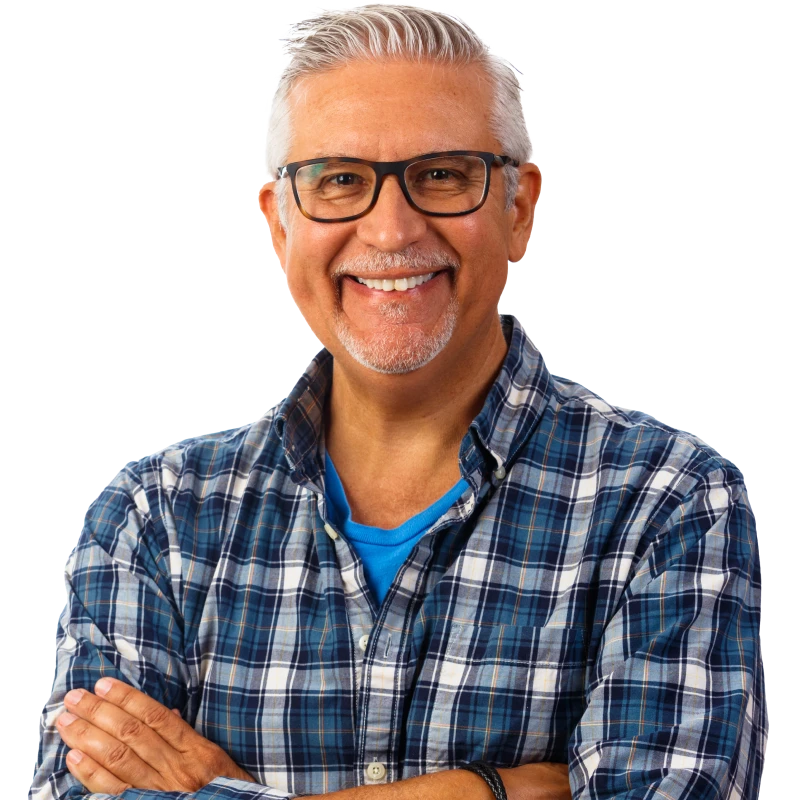

11 fundamental skills needed for a bank teller

Bank tellers ensure that banks and financial institutions can earn the trust of their clients, maintain loyalty, and differentiate themselves from the competition.

Essential bank teller skills include a mixture of technical skills (such as mathematical skills) and soft skills (such as communication and critical thinking skills).

6 bank teller hard skills

To identify exceptional tellers, watch for these critical hard skills.

1. Mathematics

A bank teller must understand mathematical operations, including addition, subtraction, multiplication, and division. They must feel comfortable working with various figures and performing calculations accurately.

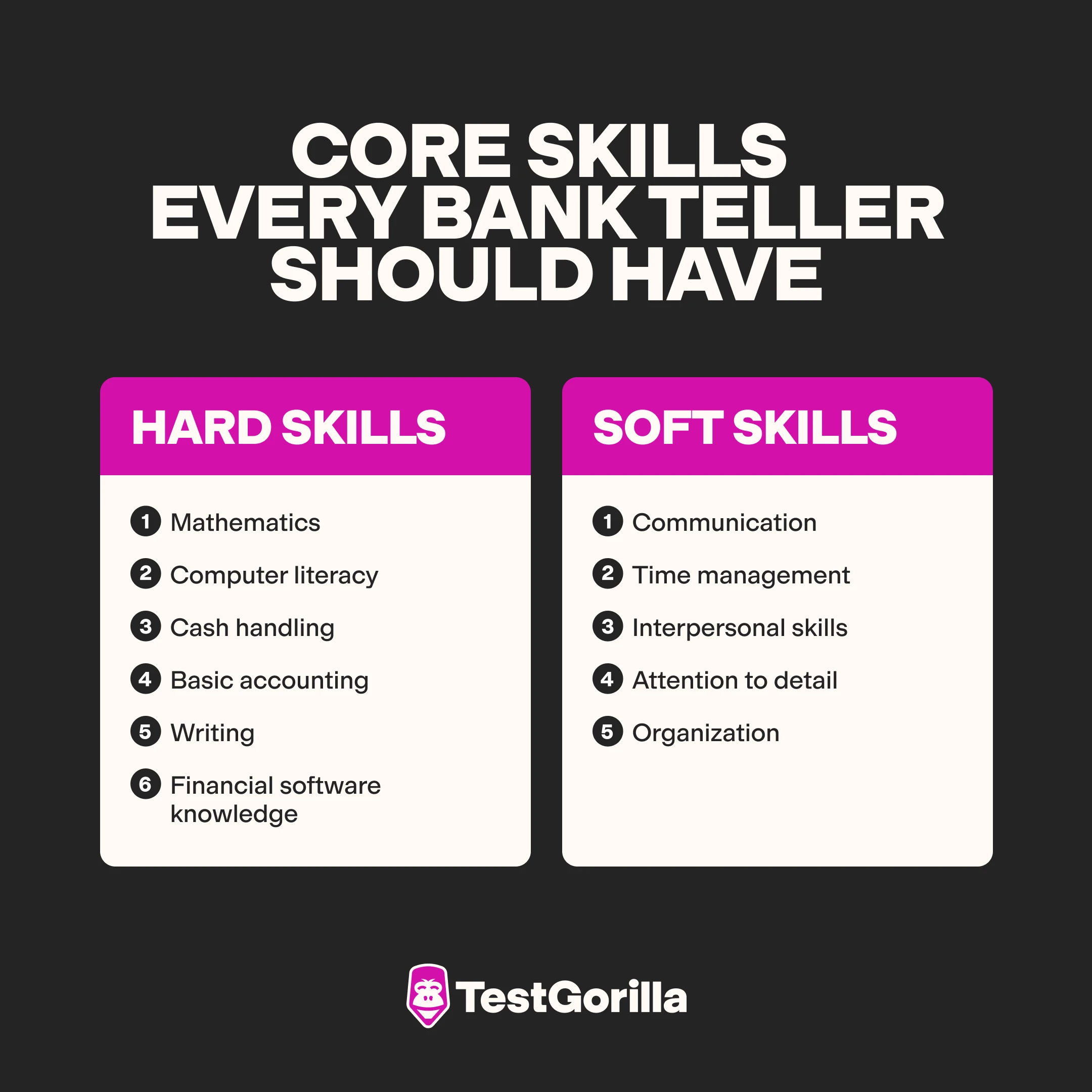

When you hire a teller, test for adequate math skills, such as dealing with fractions, decimals, and ratios. A numerical reasoning skills test may also help examine a teller candidate’s mathematical proficiencies.

TestGorilla’s Numerical Reasoning skills test examines a candidate’s ability to understand number patterns and sequences, interpret graphs, and calculate percentages with questions like the one below:

2. Computer literacy

Bank teller jobs rely heavily on computer systems for various tasks, from cashless transactions to customer account setups.

Computer literacy skills enable tellers to perform searches, open accounts, log complaints, and process transactions. They also ensure tellers can navigate websites, access customer accounts, and use software to address issues quickly.

3. Cash handling

The day-to-day activities of a bank teller regularly involve cash-handling experience. Make sure you hire a teller who can confidently account for all the money they’re responsible for and assist with accurate withdrawals and deposits.

Bank teller duties may include updating financial reports on software systems and tracking transactions. In this instance, testing for knowledge of platforms like Xero may be useful.

4. Basic accounting

Although most transactions are carried out on financial software, tellers need to know how to keep track of the numbers. Accounting skills enable bank tellers to monitor and record financial transactions.

These skills let them balance financial accounts for customers and track cash flow into and out of accounts. Sound accounting skills make identifying and troubleshooting problems like failed transactions easier.

5. Writing

From recording bank transactions to logging customer complaints, writing skills are critical for bank tellers.

Bank tellers with good writing skills can spell correctly and construct easy-to-understand sentences. These skills also help them write reports, assist customers in filling in their details, and compose emails.

6. Financial software knowledge

Most modern financial transactions are carried out online. This means that bank tellers don't perform their duties efficiently without adequate knowledge of how financial software works.

Financial software is specific to institutions, so tellers must know their organization’s applications. Although this is often accomplished with on-the-job training, a baseline understanding of the fundamentals helps ensure success.

Competency using advanced software features is also valuable. Studies show companies using AI to deliver personalized service are up to 3.5 times more successful than their competitors.

5 bank teller soft skills

Below are some soft skills to look out for when you hire a bank teller.

1. Communication

Robust communication skills are the basis of effective customer service. These skills enable bank tellers to understand customers' problems and easily procure solutions.

Active listening skills help tellers personalize product recommendations to each customer’s needs. Strong communication skills also improve collaboration between colleagues.

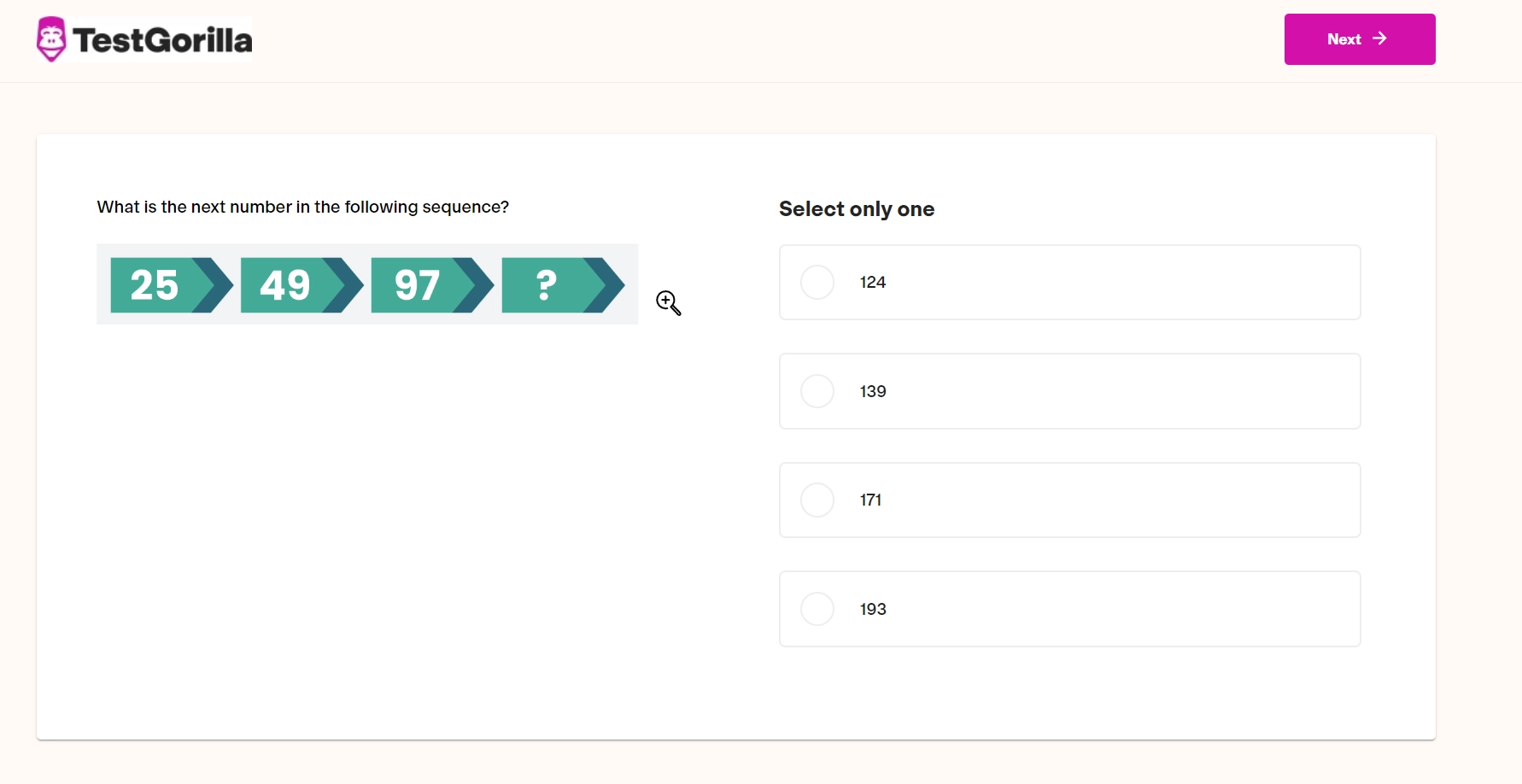

TestGorilla’s Communications Skills test identifies candidates who excel at verbal and written communication.

2. Time management

Tellers attend to numerous customers daily and need to resolve issues quickly and effectively. According to 57% of banks hiring tellers, speed and agility are two top skills they screen for.

Tellers need time management skills to perform efficiently, balancing problem-solving and fast-paced service.

3. Interpersonal skills

Tellers need strong interpersonal skills to collaborate with their coworkers, share ideas and suggestions, or even ask for help resolving an issue.

Furthermore, tellers need these skills to relate to customers, build trust, and deliver exceptional service.

Examine a teller’s interpersonal skills using behavioral interview questions to gauge their approach to teamwork, communication, and emotional intelligence.

4. Attention to detail

Attention to detail prevents a bank teller from making costly mistakes when handling cash.

An exceptional bank teller pays attention to even the smallest details and has a sharp eye for spotting errors and transactional irregularities.

Moreover, tellers with attention to detail are meticulous when drafting reports and recording transactions, reducing the risks associated with poor record keeping.

5. Organization

An organized bank teller plans their tasks ahead of time, develops a working schedule, and maintains an arranged workspace.

In contrast, tellers with disorganized workspaces spend more time searching for information while attending to customers, reducing the quality of their service.

Checking for organizational skills when you hire a bank teller ensures you’re selecting a candidate who can prioritize tasks and attend to pressing issues quickly.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How to hire a bank teller in 4 simple steps

Identifying candidates with excellent teller skills is challenging when you rely on resumes alone. Resumes only offer a basic insight into a candidate’s skills and experiences.

Pre-employment skills testing offers a more effective way to screen candidates for crucial skills, ensuring you choose the right people for your role.

Talent discovery platforms help you spot the best tellers, reduce bias during hiring, and accelerate recruitment. For instance, with TestGorilla’s language assessments, Revolut reduced its time-to-hire by 30%-40% while enhancing the candidate experience.

Find tellers with the right skills with TestGorilla

Use TestGorilla to start screening candidates with talent assessments for a deeper insight into their soft and hard bank teller skills.

1. Identify your needs and write a compelling job description

Start by identifying your company’s needs. Conduct a job analysis, examining the skills required for the posts you need to fill and determining salary expectations.

Next, write an enticing bank teller job description that paints a first impression of your business and open role to candidates.

Here’s a template to use:

Job title

The job title is the main header of the job description. Ensure it’s short and descriptive.

Example: Head teller needed at [COMPANY NAME]

Company overview

This is a concise paragraph introducing candidates to your organization. Here, clearly describe what your business does, its goals, and its values. This enables the candidate to determine if they’d be a good fit for your company.

Example: [COMPANY NAME] is a banking institution located in Tucson, Arizona, founded by [NAME OF FOUNDER]. We offer banking and loan services to our customers and ensure that we build trust with them through exemplary service.

Job overview

This section states the teller's role and how it aligns with your organization’s goals.

Example: As [COMPANY NAME]’s teller, you deliver excellent customer service to our clients. You are responsible for helping customers with transactions and addressing common issues.

Duties and responsibilities

Here, outline key bank teller position duties for your candidate. You can also include the person they would report to. Use gender-neutral sentences to reduce bias in your hiring process.

Example: As our [FULL-TIME or PART-TIME] bank teller, you are responsible for helping customers with transactions, keeping necessary records of transactions, and adhering to bank policies. Your duties include:

Receiving deposits from customers and crediting the correct amounts to their accounts

Processing checks and ensuring they’re genuine before cashing them

Answering customers’ inquiries concerning their accounts or transactions

Processing withdrawal requests

Balancing your cash drawer at the beginning and end of each working day

Qualifications and skills

State the qualifications and skills you’re looking for. Think beyond high school diplomas, GEDs, and bachelor’s degrees. Remember, many tellers may not need previous experience in this entry-level position, but they require specific skills.

Example:

Eligible candidates should have the following qualifications and skills:

Strong communication skills

Excellent customer service skills

Proficiency in accounting

Ability to pay attention to detail and maintain organization

Good time management

Ability to handle and account for cash

Familiarity with financial software

Company benefits

This section is where you list your organization’s offers. These include the position’s salary and other incentives.

Example:

As a teller for [COMPANY NAME], you have access to the following:

Medical and dental insurance

Career development opportunities

Retirement benefits

Employee discounts

Tuition reimbursement plans

2. Decide where to search for bank tellers

After drafting a stellar job post, the next step to recruiting proficient tellers is identifying your target audience. To find talented tellers, you should post the job opening on a platform that can reach qualified candidates.

Platforms like Indeed, ZipRecruiter, and LinkedIn are ideal for finding great tellers. When posting the open job role on these platforms, show job seekers the benefits of working with your company to attract attention to the job post.

Expand your talent pool by exploring various recruitment avenues. Ask for referrals from existing employees. Advise your hiring manager to attend job fairs or financial industry events. Consider using financial forums to find people looking for new roles.

3. Use skill assessments to screen candidates

When learning how to hire a teller, skills assessments help you evaluate your candidate's abilities objectively. TestGorilla offers access to a library of 400+ scientifically validated tests for teller assessments.

You can combine up to five tests in a custom talent assessment, simultaneously evaluating technical and soft skills. Here are some of the most important tests we’ve identified for the bank teller role:

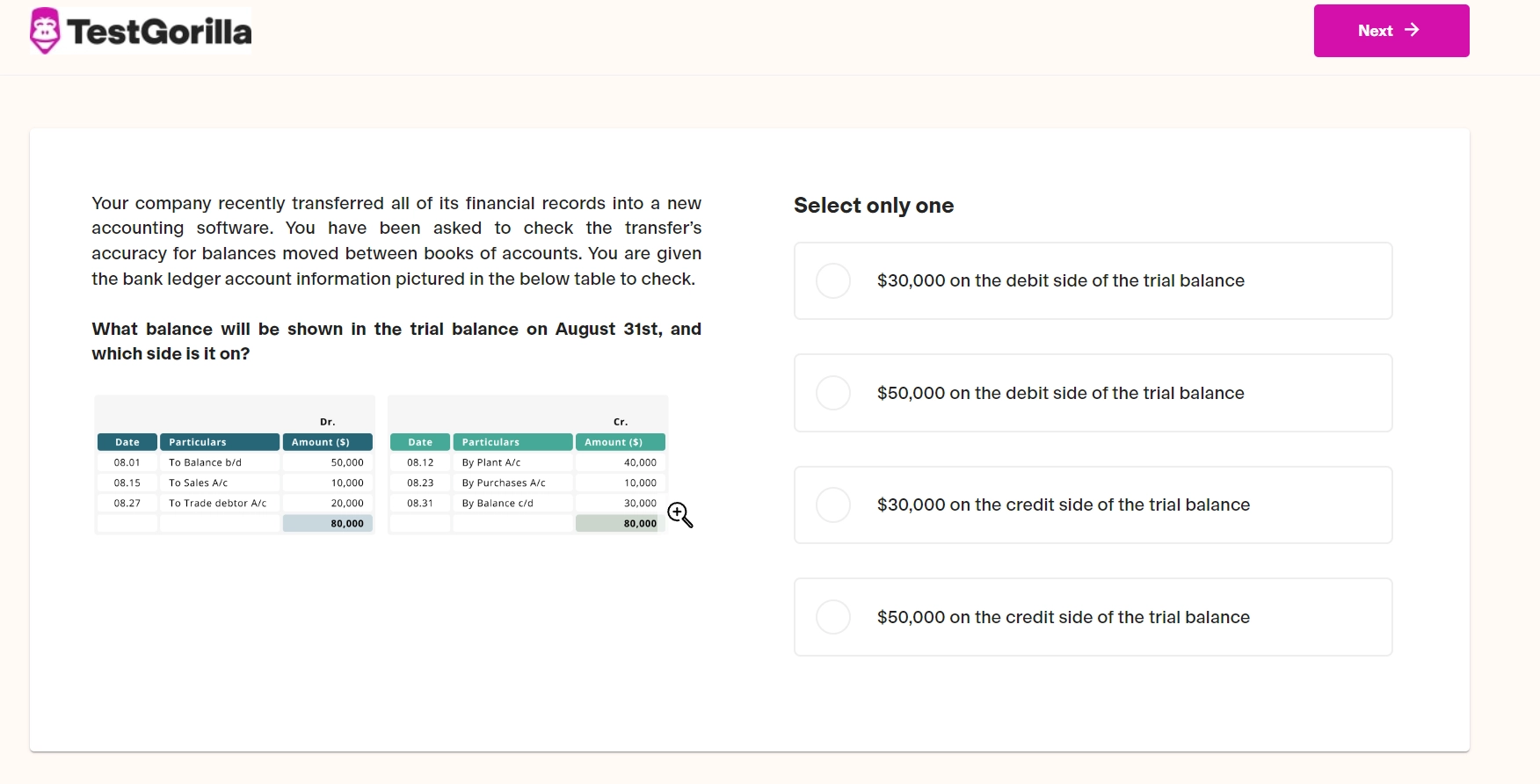

Accounting test

The Accounting (Intermediate) skills test checks candidates’ ability to keep books of accounts, prepare financial statements, and interpret financial information.

This test helps you find tellers who know standard accounting principles. Candidates who pass the accounting skills test know how to make year-end adjustments, understand account statements, and keep financial records. Here’s an example question from this practice test:

Communication test

Our Communication skills test measures how well applicants can understand and exchange information with others. This test evaluates speaking, listening, reading, and writing skills, which are vital for effective communication.

Candidates who succeed on this communication test effectively liaise with customers to solve any challenge.

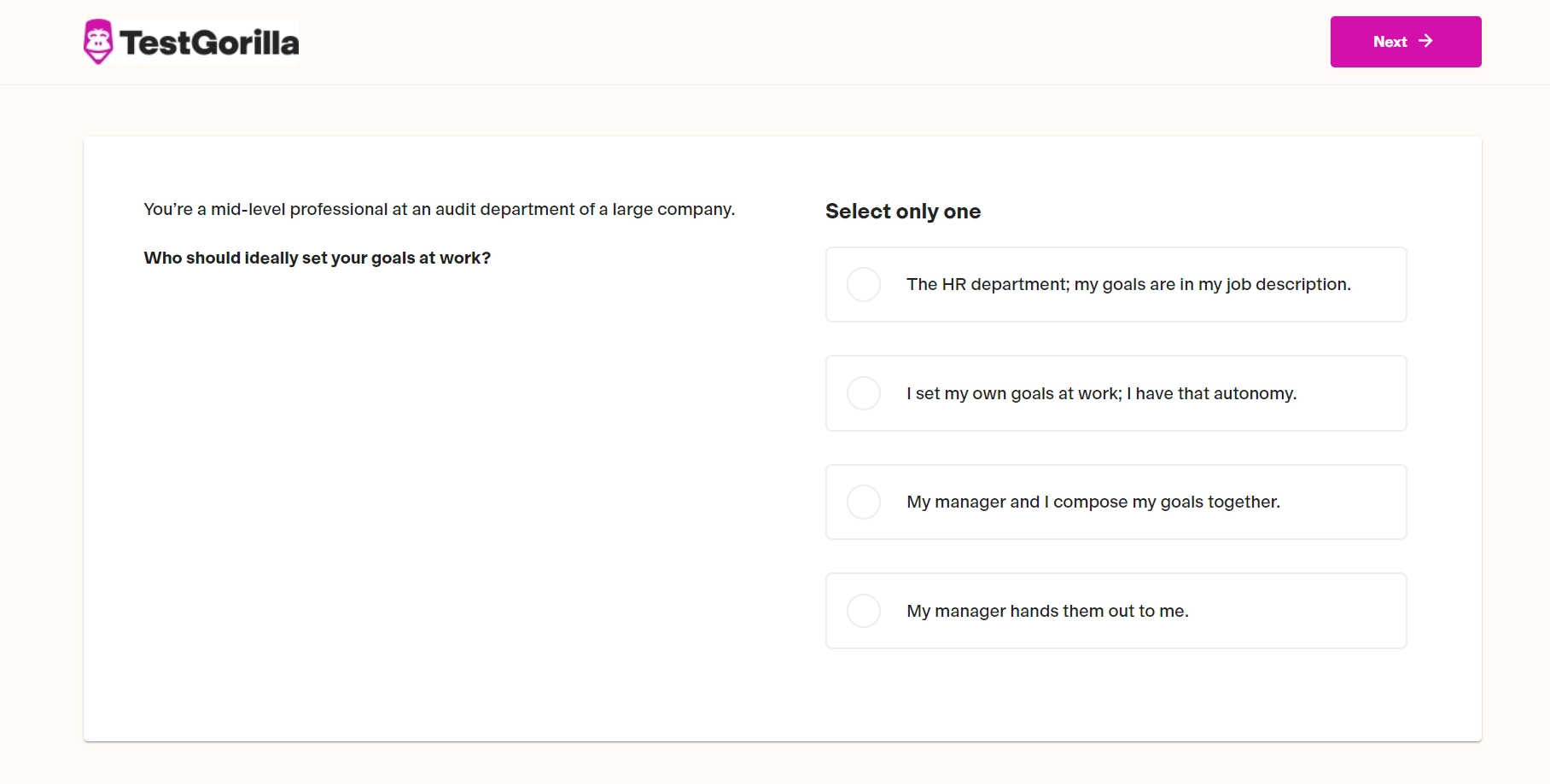

Time Management test

This test determines whether candidates effectively manage their time using realistic scenarios in a professional environment.

Our Time Management test also measures how well candidates can prioritize, plan, and execute tasks within a given period. Those who do well on this test excel at meeting deadlines and multitasking while delivering high-quality services.

Problem Solving test

TestGorilla’s Problem Solving test evaluates how well candidates analyze and solve problems. With this test, you identify tellers who can examine situations critically to provide the best solutions.

Our test also measures how well applicants apply logic to make decisions. It checks their ability to prioritize issues and maintain order while solving problems.

Mathematics test

Our Intermediate Math test examines how well candidates perform accurate calculations involving percentages and decimals.

The test goes beyond basic math operations like addition, subtraction, and multiplication. It also measures candidates’ ability to perform slightly more complex functions, like those involving ratios and time duration estimation.

Administering this mathematical test ensures you hire tellers with sound logic who can reconcile discrepancies with minimal supervision.

Create the ultimate skill assessment with TestGorilla

Screen candidates with talent assessments covering everything from mathematical skills to problem-solving capabilities with TestGorilla.

4. Prepare enlightening interview questions

Conducting an interview, although often hectic, is a delicate process. Interviews show how candidates act, speak, and carry themselves face-to-face.

Typically, in-person interviews last between 45 and 90 minutes. However, some interview sessions could be shorter if you administer skill tests before the interview.

Planning your questions before the interview improves the efficiency of the interview process, enhances candidate experiences, and helps standardize assessments.

Here are some of the types of interview questions to consider:

Question type | Example |

Personality assessment questions | How effective are you at dealing with stressful situations and tight deadlines? |

Ability-focused questions | What skills do you possess that make you a good fit for this role? |

Technology-based questions | What financial software can you operate? |

Behavioral questions | Tell me about a time when you provided excellent customer service. |

Technical questions | Can you describe how you handle large amounts of cash? |

Opinion-based questions | What would success in this role mean to you? |

Aside from these, you can also ask candidates interview questions about customer service and how well they pay attention to detail. Check out our bank teller interview questions for more ideas on what to ask during interviews.

How much does it cost to hire a bank teller?

From publishing your job posting to training new employees, the total cost of hiring a teller depends on multiple factors. Hence, when crafting your hiring plan, it’s best to know this information before you start recruiting. The bank teller salary you offer may vary depending on the specific role or type of financial institution.

The average head bank teller earns $17.48 per hour.

A head teller for a loan office or different financial agency could earn an average of $22.30 per hour.

Hire the best bank tellers with TestGorilla

Knowing how to hire a bank teller with the right skills using talent assessments can save you a lot of time and money during recruitment.

Talent assessments make it easy to spot great bank tellers without wasting time or effort. TestGorilla gives you access to all the key tests you need and more.

Our platform empowers you to design a bias-free teller assessment that suits your open role, equipping you to simultaneously evaluate hard and soft bank teller skills.

Sign up for a Free forever plan to access essential assessments like our Communication test.

Take a product tour to learn more about our talent assessments.

Book a live demo for guidance on creating the best teller assessment test.

How to hire a bank teller FAQs

Do you still have questions about how to hire a bank teller? Find answers to three commonly asked questions below:

Why hire a bank teller?

Bank tellers act as the face of a financial institution, assuring your company can deliver exceptional customer service experiences and handle financial transactions efficiently.

Tellers interact directly with customers, strengthen your brand’s reputation, and handle various tasks, from managing withdrawals and deposits to promoting new services. Learning how to hire a bank teller effectively ensures you can:

Deliver the right financial services to customers

Earn the trust and loyalty of your target audience

Manage financial transactions accurately and efficiently

Increase revenue and profits

Provide clients with exceptional support and service

What is the difference between a banker and a teller?

A banker, such as a corporate investment banker, completes more tasks for a financial institution. Bankers can provide financial advice on bank products and services, open and close accounts, and investigate fraud. Tellers typically focus on processing deposits and withdrawals and assisting customers with everyday needs.

How to hire a bank teller without experience?

Many bank tellers start their roles with no experience in a similar position. But if your candidate has the right transferable skills, such as mathematical, communication, and time management skills, they can thrive in a new teller role and develop experience and learn new skills as they work with your organization.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.