Offering the right pay to your internal auditors is crucial to attracting and retaining top talent. But knowing what to pay is tricky because of the varied expertise required across different industries, the impact of certifications like the CPA, and more.

By understanding market rates, the factors that influence salary levels, and aligning pay with candidates' skills, you can attract top talent while maintaining your budget.

Our guide can help you strike the perfect balance – offering a salary that’s competitive and sustainable for your business. This way, you can hire someone who has what it takes to drive growth and ensure regulatory compliance within your organization.

How we researched this topic

Our go-to source for salary statistics is the US Bureau of Labor Statistics (BLS). However, this government organization groups auditors with accountants and doesn't separate internal auditors from external auditors – which limits how specific to the internal auditor role its data is.

So, for this article, we’ve compiled 2024 data from nationwide employment websites like Zippia and PayScale. These sources have robust data collection methods and access to their own employee-reported, resume, and job data — and they provide up-to-date pay statistics that are specific to internal auditors.

Key takeaways

Based on data compiled by leading US recruitment and salary websites, internal auditors in the US typically earn $66,141 per year.

Salary figures for internal auditors vary widely depending on location, industry, experience, and certifications. The highest-paying industries offer significantly more than what most internal auditors make.

Non-salary benefits like comprehensive healthcare, flexible work options, and covering the cost of professional development can add significant value to your internal auditor compensation package.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

National salary statistics for internal auditors

According to Zippia, here’s what internal auditors typically make yearly and hourly:

Pay metric | Annual salary ($) | Hourly wage ($) |

Median | $66,141 | $31.80 |

Mean | $88,936 | $42.76 |

Top 10% earners | $89,000 | $42.79 |

Bottom 10% earners | $51,000 | $24.52 |

Median salary vs. mean salary

Knowing the difference between median and mean salary figures is key to understanding what internal auditors are truly paid.

The mean salary is the mathematical average. It’s calculated by adding up every internal auditor’s salary and dividing the result by the total number of internal auditors. Mean data can be skewed by extremely high or low salaries, but it’s useful for identifying overall trends.

The median salary is the middle salary – half the internal auditors earn less than this, and half earn more. Extremely high (or low) salaries don’t affect this, so looking at median figures gives a more accurate picture of what most internal auditors really earn.

Factors influencing salaries

Geographic location: Cost of living plays a large part in setting salaries. It’s far more expensive to live in New York City than Baton Rouge, so NYC-based internal auditors earn more. There’s also much greater demand for internal auditors in New York than there is in smaller cities, which further drives up salaries.

Industry: Industries with strict regulatory requirements – such as finance and investment banking – often pay higher salaries due to the need for thorough auditing. In contrast, fields like hospitality or retail, which have lower demand for internal auditing, offer lower average salaries.

Experience level: Like many professions, internal auditors see their salaries increase as they gain more experience. Entry-level roles typically earn less, while senior auditors with extensive expertise and the ability to handle complex audits command significantly higher pay.

Education and certifications: Advanced education and professional certifications – such as the CPA, CISA, or CFE – can substantially boost salaries. These credentials demonstrate expertise and specialization, making internal auditors more competitive in the job market and valuable to their employers.

Responsibilities and skills required: Internal auditors with specialized skills or knowledge or who take on additional responsibilities often earn more. For example, auditors involved in IT audits, fraud investigations, or compliance audits within highly regulated industries typically receive higher compensation due to the complexity and importance of their work.

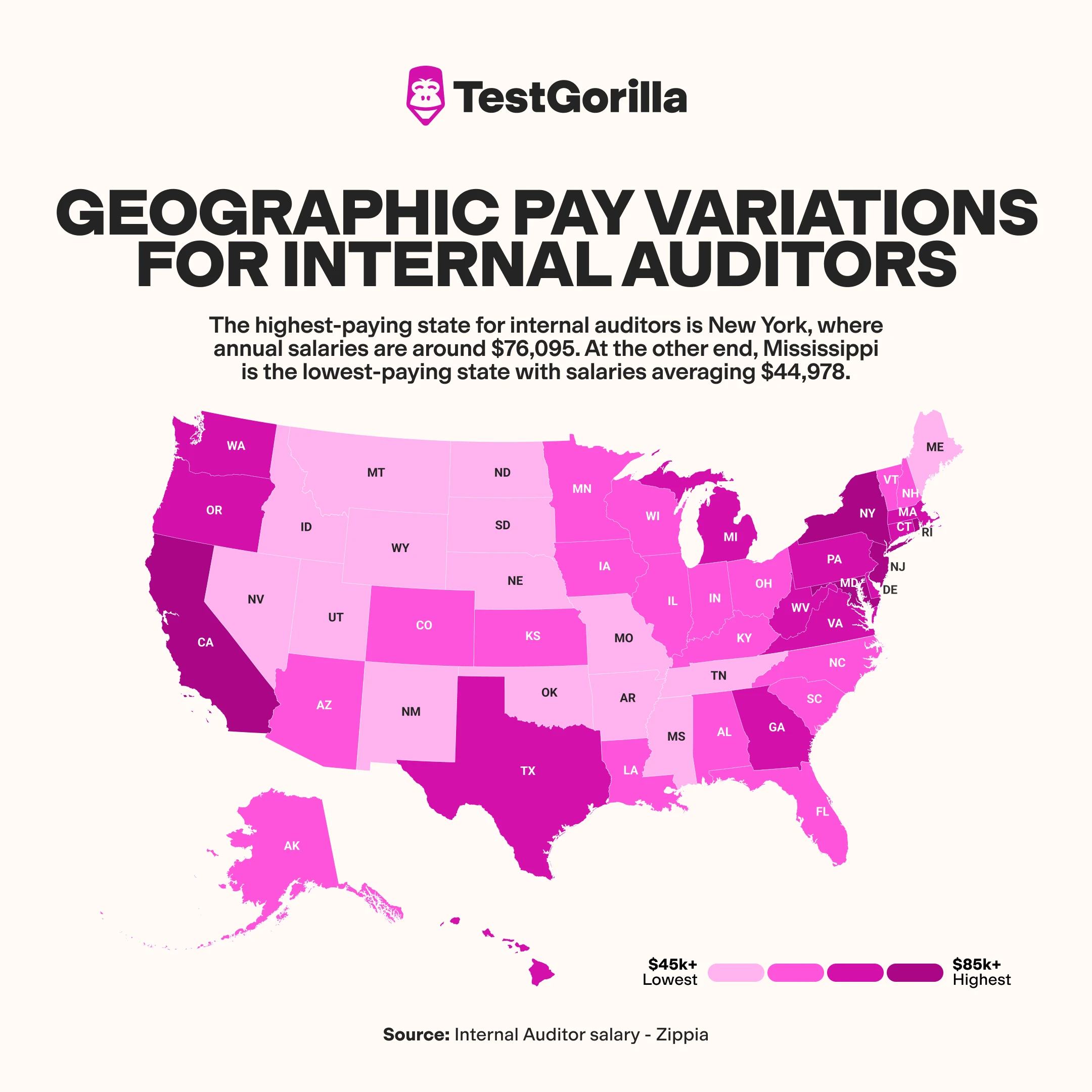

Geographic pay variations

The highest-paying state for internal auditors is New York, where annual salaries are around $76,095. At the other end, Mississippi is the lowest-paying state with salaries averaging $44,978.

Highest-paying states:

New York

Rhode Island

Connecticut

Michigan

New Jersey

Pennsylvania

Lowest-paying states:

Mississippi

Idaho

South Dakota

Arkansas

New Mexico

Regional variations

Looking at what internal auditors earn at a county level shows that there can be significant variation within state averages. California is a good example – the lowest salaries are found in the southern part of the state, and internal auditors generally earn more as they move further north.

The highest-paying region and city is Washington DC – internal auditors here earn around $81,653 per year. Given that DC is the capital and home to government agencies, regulatory bodies, and private companies that support them, the higher salaries here are unsurprising.

Highest-paying cities:

Washington, DC

New York, NY

San Francisco, CA

Boston, MA

Stamford, CT

The top-paying US cities for internal auditors have several things common that justify higher wages. The most impactful factors are:

Economic hubs: Alongside the capital is New York – a global financial powerhouse, San Francisco – tech and startup central, and Boston and Stamford – which are in close proximity to Ivy League colleges, research institutes, or finance and corporate headquarters.

High demand: Being economic hubs, these top-paying cities handle complex business and financial transactions, so there’s high demand for skilled internal auditors.

Large corporations: Internal auditors are generally employed by mid-large size companies and institutions – and these cities have many of those. Smaller companies might not need to employ internal auditors or have the budget for them, so they’re more likely to outsource their auditing.

High cost of living: These cities are some of the most expensive places to live – New York, Boston, and San Francisco are infamous for their high cost of living. So, employers here must offer higher than average salaries to attract and retain competent internal auditors.

Industry-specific pay data

According to Zippia, the three highest-paying industries for internal auditors are:

Industry | Average salary |

Manufacturing | $66,055 |

Finance | $65,055 |

Health care | $63,776 |

The lowest-paying industry for internal auditors is hospitality, where internal auditors earn an average of $49,512 per year.

That said, Zippia data covers just a handful of industries. Other sources, like the BLS and Glassdoor, can provide more insight into industry-specific pay for internal auditors.

For example, according to the BLS, the highest-paying industry is mining, while the lowest-paying industry is Accommodation and Food Services. Remember, though, that the BLS groups its internal auditor salary data into a single category with data for accountants and external auditors, so the data might be skewed by these other roles. Still, this government organization has access to more comprehensive industry data, so it’s worth checking out.

Why there’s such variation between salaries across industries

It may come as a surprise that the highest average salary for internal auditors is found in the manufacturing industry. However, several factors contribute to the higher compensation offered in manufacturing, finance, and healthcare.

Capital-Intensive: The top-paying industries are typically capital-heavy sectors that involve large investments. Manufacturing, finance and healthcare all need significant investments in infrastructure, equipment, and technology. Handling such large financial operations requires meticulous financial oversight and internal auditing.

Stringent regulatory oversight: Companies within manufacturing, finance, and healthcare must work according to strict regulatory requirements. Internal auditors are needed to keep everything in check and avoid costly penalties.

Dominated by large corporations: The manufacturing, finance, and healthcare industries are dominated by large, multinational corporations. Companies of this size need robust internal auditing to safeguard large-scale, complex operations and ensure compliance across multiple regions.

Increased risk: High investment, stringent regulations, and large-scale complex operations increase the risk involved in the top-paying industries. Internal auditors are invaluable for mitigating this risk and maintaining companies’ integrity.

These factors make internal auditing an essential part of business operations – the higher than average salaries are a reflection of this.

Industries where internal auditors earn below the national average tend to have a lower demand for dedicated auditing roles. Companies in these industries may be smaller, have less complex financial operations, and have fewer regulatory requirements to navigate.

Pay by experience and education

According to Payscale, here's the typical salary progression for internal auditors:

Entry-level internal auditor (0-1 year experience): $57,358

Mid-level internal auditor (1-9 years’ experience): $64,653

Experienced internal auditor (10-19 years’ experience): $74,390

Late career internal auditor: (20+ years’ experience): $82,362

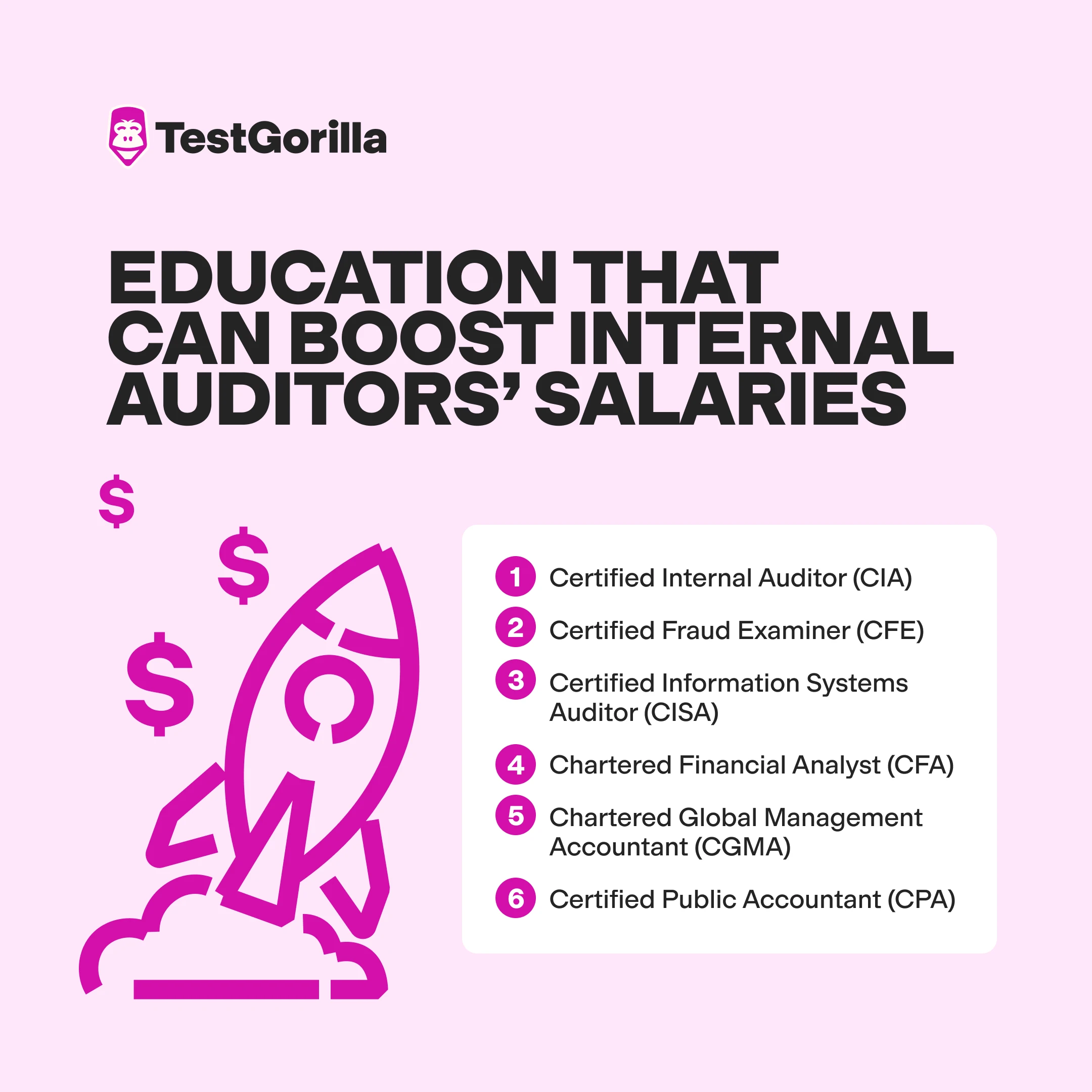

Certifications and education that can increase pay

Auditing is a profession where continuous learning is a must. As well as demonstrating that internal auditors have relevant skills and knowledge, these certifications can boost pay:

Certified Internal Auditor (CIA): This is a globally recognized internal audit certification from the Institute of Internal Auditors. According to PayScale, Internal auditors in the US who achieve this certification have an average salary of $97,000.

Certified Fraud Examiner (CFE): This certification is highly valuable for internal auditors, as it tests and validates their ability to analyze financial data for fraudulent activity. It also ensures their knowledge of laws and regulations to remain in compliance.

Certified Information Systems Auditor (CISA): This certification from the Information Systems Audit and Control Association (ISACA) demonstrates IT auditors’ ability to use the latest technology, plus their expertise in auditing IT and business systems.

Chartered Financial Analyst (CFA): Internal auditors that achieve the CFA designation earn a globally recognized certification that proves their expertise in complex financial analysis and risk assessment. It enables them to bring a higher level of proficiency to their auditing work and provide valuable insights for strategic decision-making.

Chartered Global Management Accountant (CGMA): This leading management accounting certification is beneficial for internal auditors in management or strategic advisory roles. Completion of this credential enhances proficiency in strategy and management – while giving internal auditors a deep understanding of how various parts of an organization work together.

Certified Public Accountant (CPA): This widely recognized accounting designation can boost an internal auditor’s credibility and career advancement. It proves that those who pass the rigorous exams have in-depth knowledge of accounting practices and that their work meets state and national standards.

Benefits beyond salary

When deciding between job offers, the benefits each company offers is often the deciding factor. The following benefits can add a lot of non-salary value to your compensation package:

Health insurance: Comprehensive health insurance that includes vision coverage for employees and their dependents can give you an edge as only 76% of internal auditors are covered for vision.

Wellness programs: Internal auditing involves detail-oriented, high-stakes work which can be mentally and physically taxing. Therefore, offering gym memberships and other wellness support may be particularly appealing.

Retirement plans and savings contributions: Being in a field where risk is such a central focus, long-term security is going to be especially important to internal auditors. So, offers like matching a slightly higher percentage of employees 401(k) contributions can be a strong selling point.

Professional development: Internal auditors must stay current with emerging technologies and evolving regulations to remain effective in their roles. Covering the costs of training, certifications, and conferences is a great way to appeal to top-tier internal auditors.

Level up your hiring process with talent assessments

Knowing the salary benchmarks for the role you’re hiring for is essential, but aligning your offer with a candidate's actual skills and abilities is key to hiring right.

With TestGorilla’s library of more than 400+ science-backed tests, you can speed up your hiring process by honing in on the best applicants right away. We recommend you use our assessments as an initial screening tool.

You can combine up to five tests to assess candidates on the specific skills you’re looking for. Here are some tests you might want to start with:

Internal Auditing test

The International Standards on Auditing (ISA) test

Advanced Accounting (IRFS) test

Artificial Intelligence test

Data-Driven Decision Making test

Sign up for an account or schedule a live demo to explore TestGorilla today.

FAQs

How much do the top-paying companies pay their internal auditors?

Zippia’s data shows that the top five highest-paying companies for internal auditors in the US all have average internal auditor salaries over $100k.

How much do internal auditors make in NYC?

According to ZipRecruiter’s job posting data, internal auditors in New York City earn an average salary of $83,349 per year. However, salaries can range from $36,650 to $130,737 – it all depends on the industry, job responsibilities, and amount of experience.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.