Mergers and acquisitions manager job description template: Everything you need to include

People often assume mergers and acquisitions (M&A) managers are just high-powered negotiators closing big deals, but the reality is much more involved. The role involves deep financial analysis, risk management, and post-merger integration.

This misconception is why some job descriptions focus only on deal-making. This can attract candidates who excel at getting deals signed but struggle with due diligence, integration, or long-term value creation.

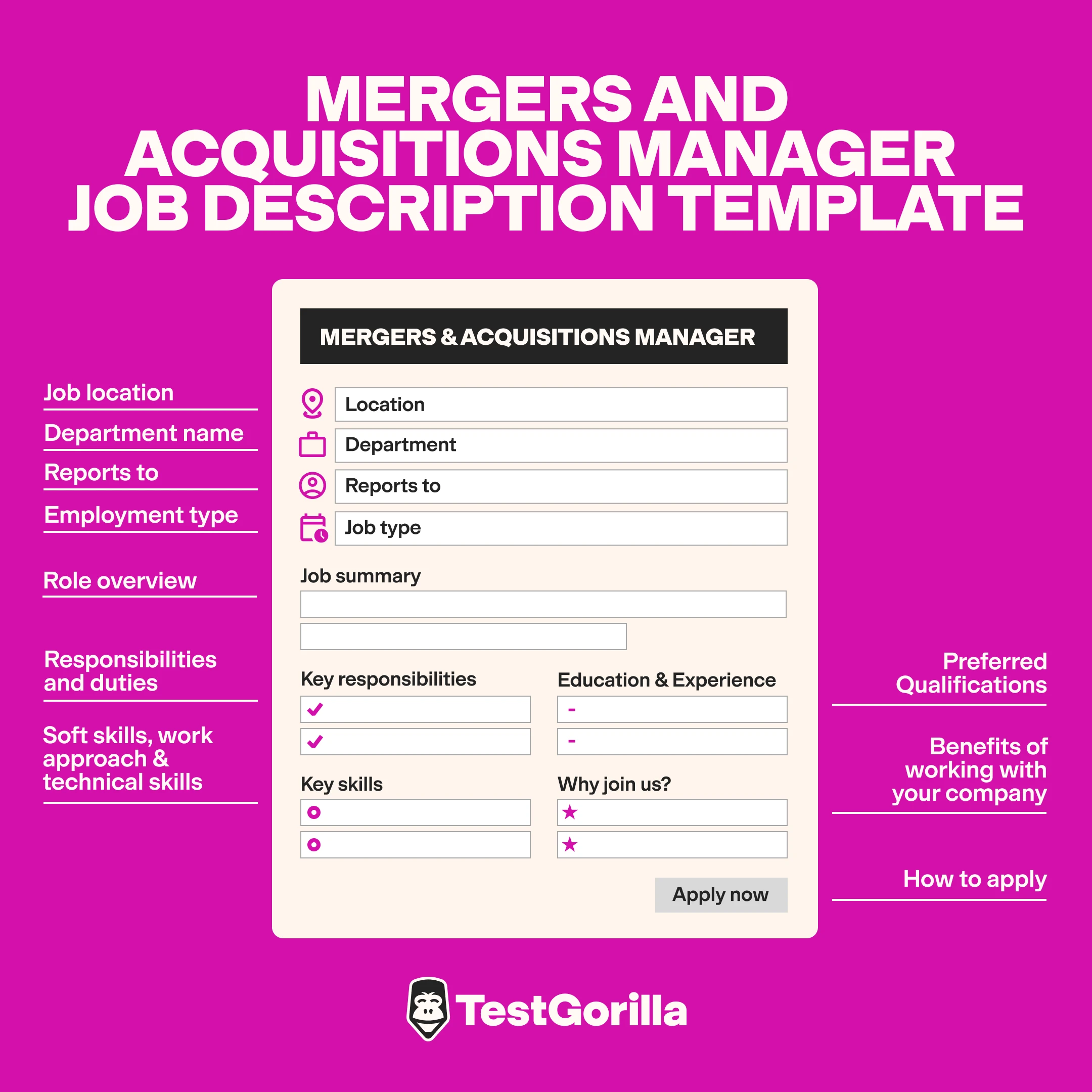

That’s why we’ve created a mergers and acquisitions manager job description template you can use to attract top-tier talent. Below, we’ll walk you through the template and show you how pairing it with a skills-based approach can help you make confident hiring decisions.

Mergers and Acquisitions job description

Job Title: Mergers and Acquisitions (M&A) Manager

Location: [City, State/Remote]

Department: [Department Name]

Reports To: [Manager/Supervisor Title]

Job Type: [Full-Time/Part-Time/Contract]

About the Role

We seek a dynamic and strategic Mergers and Acquisitions (M&A) Manager to lead and oversee business acquisitions, divestitures, and strategic partnerships. In this role, you will be critical in identifying growth opportunities, conducting due diligence, structuring transactions, and integrating businesses post-merger. You will work closely with senior leadership, financial analysts, and legal teams to drive successful deal execution and ensure alignment with corporate growth objectives.

We encourage you to apply if you have a strong background in financial analysis, negotiation, and business strategy and a proven track record of executing successful M&A transactions.

Responsibilities

Identify and evaluate potential M&A opportunities aligned with corporate growth strategy.

Conduct financial modeling, valuation analysis, and due diligence on target companies.

Develop and execute M&A strategies, including deal structuring, negotiations, and transaction execution.

Collaborate with cross-functional teams (finance, legal, operations, HR) to ensure seamless integration post-acquisition.

Assess market trends, competitive landscapes, and industry developments to inform M&A strategies.

Lead risk assessments and provide strategic recommendations to mitigate potential deal risks.

Prepare and present reports, financial analyses, and strategic recommendations to executive leadership.

Manage relationships with investment banks, private equity firms, venture capitalists, and external advisors.

Drive post-merger integration efforts, ensuring smooth transitions and maximizing synergies.

Requirements

Soft Skills & Leadership Approach:

Strong strategic thinking and analytical skills.

Excellent negotiation, communication, and presentation abilities.

Ability to work cross-functionally and collaborate with diverse teams.

Strong problem-solving skills with a detail-oriented approach.

High adaptability and ability to work in a fast-paced environment.

Technical & Industry Skills:

Expertise in financial modeling, valuation techniques, and due diligence processes.

In-depth understanding of corporate finance, deal structuring, and risk assessment.

Knowledge of M&A legal frameworks, compliance, and regulatory requirements.

Experience working with investment banking, private equity, or venture capital firms (preferred).

Proficiency in financial software and data analysis tools.

Education & Experience:

Bachelor’s or Master’s degree in Finance, Business, Economics, or a related field (MBA preferred).

X+ years of experience in M&A, investment banking, corporate development, or financial advisory.

Proven track record of successfully executing M&A transactions and integrations.

Why Join Us?

Strategic Influence: Lead high-value transactions that shape business growth.

Dynamic Opportunities: Work on diverse M&A deals across industries.

Collaborative Culture: Engage with top executives, investors, and key stakeholders.

Career Growth: Expand your expertise in a high-impact, leadership-oriented role.

Why this mergers and acquisitions manager job description template works

We created this template to be clear and engaging, speaking directly to the kind of high-performing M&A managers you’d want leading your deals.

Job details

There’s no fluff in the Job Title, Location, Department, and Reports To sections – just the essentials. Mergers and acquisitions managers value precision, hierarchy clarity, and strategic alignment in job descriptions. These details help candidates assess if it’s a good fit at a glance.

Job summary and responsibilities

Here, we quickly tell candidates about the role’s strategic impact, deal scope, and execution focus. M&A managers want to know details like whether they’ll shape acquisition strategy or manage deal execution. This information makes it easy to decide if this role is the challenge they’re looking for.

This responsibilities section makes expectations clear. M&A managers oversee complex deals, so listing tasks like finding acquisition targets, leading due diligence, negotiating deals, and managing integrations shows they’ll handle the full deal cycle. Highlighting collaboration with finance, legal, and executives reinforces the role’s strategic impact and cross-functional teamwork.

Requirements

We’ve broken this section into three key areas that outline what makes candidates a strong fit for the role:

Soft Skills & Leadership Approach: We put this first because M&A relies on influence, decision-making, and leadership. Deals don’t close on technical skills alone; they require negotiation, collaboration, and the ability to align stakeholders across finance, legal, and executive teams. Strong leadership and strategic thinking drive deals forward, making this the most critical requirement.

Technical & Industry Skills: Technical skills come next because technical expertise enables strong decision-making and execution. M&A managers use financial modeling, valuation, due diligence, and legal frameworks to assess and structure deals. These skills create the foundation for smart, strategic choices, but leadership determines how effectively those choices turn into successful acquisitions.

Education & Experience – We list education and experience last to keep the focus on what candidates can do rather than just where they’ve been. A solid background in corporate development, investment banking, or private equity matters, but skills and leadership drive success in this role. Prioritizing education and experience too heavily can create unnecessary barriers, so we ensure they support – rather than define – the ideal candidate profile.

Why join us?

The last section highlights company culture, growth opportunities, and the role’s impact, giving candidates a compelling reason to apply. This is where you showcase what sets your company apart – whether it’s leading high-profile deals, collaborating with top executives, or driving major business decisions. It’s also the perfect place to highlight key perks, like career advancement, mentorship, or flexible work options. A strong “Why Join Us?” section helps you attract top M&A talent in a competitive market.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Next steps: Attracting and assessing merger and acquisitions manager candidates

Once your M&A manager job description is ready, share it across relevant job platforms and begin the candidate assessment process.

However, evaluating candidates to shortlist for interviews can be time-consuming and prone to bias. And old-school methods like resume screening don’t give you the full picture of what a candidate can do.-

To overcome these hurdles, consider using TestGorilla's talent assessment platform.

We offer more than 400+ scientifically backed tests that measure candidates' soft skills, personality traits, and more. By integrating these assessments into your hiring process, you can efficiently shortlist top talent, reduce time-to-hire, and enhance the overall quality of your hires.

TestGorilla has a collection of tests for mergers and acquisitions managers, which include:

Role-specific skills tests

Business Ethics and Compliance test

Fundamentals of Statistics and Probability test

Software skills tests

Cognitive ability tests

Critical Thinking test

Problem Solving test

Situational judgment:

You can pair these with personality and culture tests, like our Enneagram and Culture Add tests, for a comprehensive evaluation of candidates' abilities and behavioral tendencies.

Ready to get started with TestGorilla? Request a free live demo or sign up for a free account today.

FAQs

What is the typical career path for someone in mergers and acquisitions (M&A)?

Many start as financial or investment analysts before progressing to roles as associates or managers within M&A teams. With proven success, professionals can advance to senior roles such as Director or Vice President of Corporate Development or M&A.

How does the mergers and acquisitions process impact company growth?

M&A activities can accelerate growth by opening access to new markets, technologies, and customer bases. They drive economies of scale, enhance market share, and strengthen competitive positioning, significantly contributing to overall financial performance and strategic expansion.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.