What does the misclassification of employees mean?

Misclassifying employees and independent contractors can lead to costly legal consequences, including back taxes, fines, and lawsuits. It can also harm your company’s reputation and staff morale, especially when employees are misclassified as contractors and lose out on receiving employee benefits.

However, worker classification laws are complex and constantly changing, and staying on top of this ever-evolving issue can feel overwhelming.

To help you out, this article looks at the misclassification of employees – what it means, why accurate classification is essential, and the steps you can take to avoid misclassification when hiring independent contractors and employees. Let’s take a look.

Table of contents

- What is employee and worker classification?

- Differences between employee and contractor

- Why is it important to understand the difference?

- What are the risks of employee misclassification?

- How to correct employee misclassification

- How do I avoid employee misclassification as an employer?

- Support compliance and mitigate misclassification risks with TestGorilla

What is employee and worker classification?

Worker classification categorizes workers as either employees or independent contractors according to the relevant law. Worker classification identifies the legal relationship between a business and a worker, including tax and employment rights.

Misclassification occurs when a business incorrectly treats a worker as a contractor where the relevant law says they are an employee, and vice versa. The law that applies to your business depends on where it’s located and can also vary based on the purpose of classification.

Businesses may misclassify workers accidentally or intentionally, for example, in an attempt to avoid paying federal employment taxes.

Misclassifying employees as independent contractors deprives workers of a range of benefits and protections only available to employees and results in the organization’s non-payment of required employment taxes.

The misclassification of workers is a critical issue to look out for in your business. Research by the National Employment Law Project suggests that at least 10%-30% of employers misclassify employees as independent contractors, resulting in billions of dollars of loss to the government.

How to classify employees

Classifying employees isn’t straightforward. Federal, state, and local laws use different tests to categorize workers. These not only vary based on the location of your business and workers but also the reason for classification.

For example, at the federal level in the US, the Internal Revenue Service (IRS) uses one test to determine whether a worker is an independent contractor. In contrast, the Department of Labor (DOL) uses another when applying protections under the Fair Labor Standards Act (FLSA).

For these reasons, getting legal and tax advice about the worker classification laws that apply to you and how to classify your workers correctly is crucial.

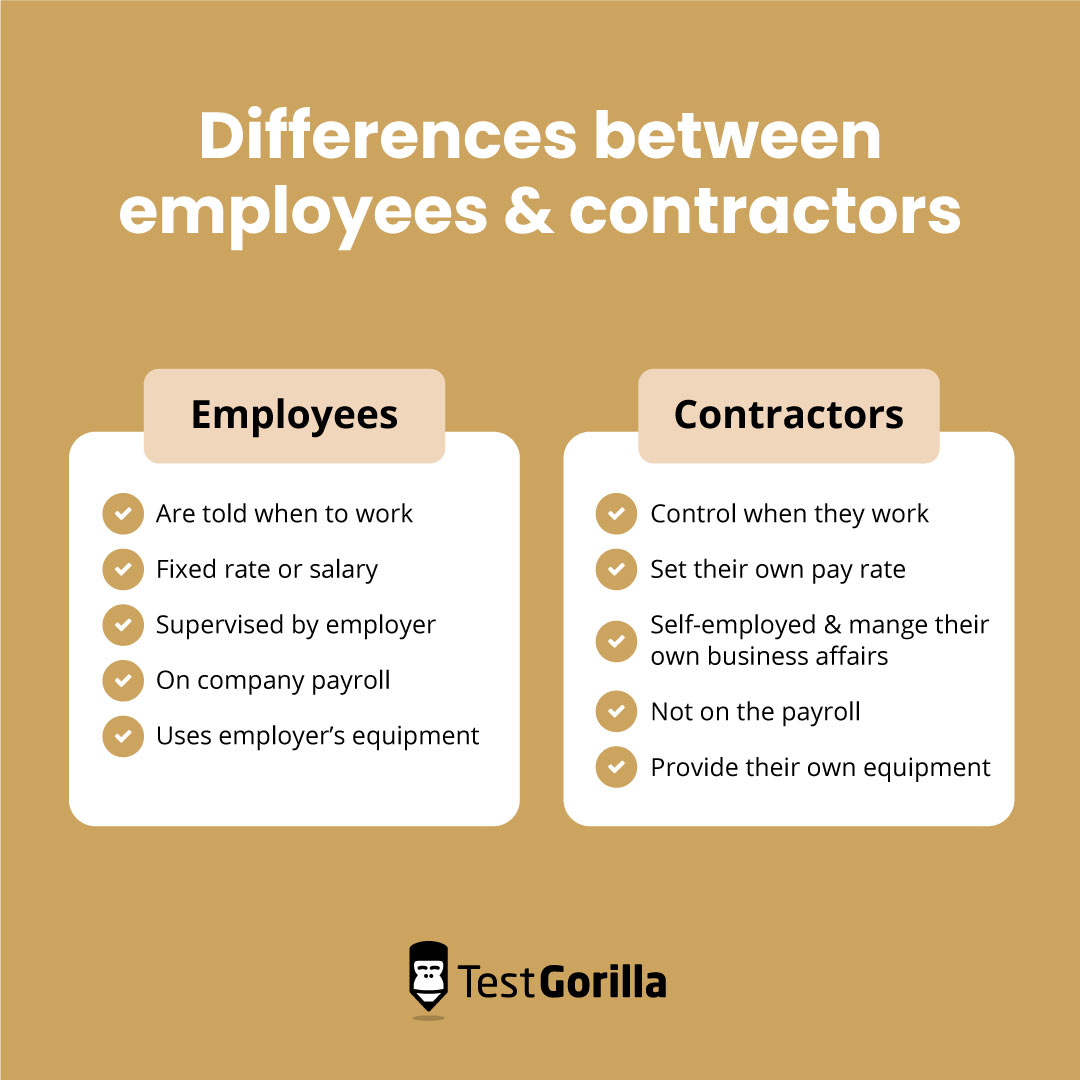

Differences between employee and contractor

Generally, independent contractors are hired as non-employees to provide services to a business. Below are some factors that may distinguish them from being classified as an employee:

Contractors have full control over how and when they work. In contrast, employees are told when to work and do so under the supervision of their employer.

Contractors set their pay rate, whereas employees are offered and choose whether or not to accept a fixed rate or salary.

Contractors are self-employed and manage their own business affairs.

Contractors are not on the payroll. Instead, they invoice the business for their services.

Contractors typically provide their own tools and equipment.

Contractors often work on projects with a defined timeframe and are engaged to provide services outside of the hiring company’s main line of work.

Possible examples of independent contractors include:

Content writers commissioned on a per-article basis to produce blog articles

IT consultants hired on a six-month contract to implement new software

Video editors engaged on a contingent basis to create new promotional material

It’s important to note that the above list isn’t definitive and whether a worker is an employee or independent contractor depends on the legal test that applies to the situation.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Why is it important to understand the difference?

The distinction between employees and contractors is important for several reasons.

Taxes

Businesses are responsible for withholding and paying employees’ federal payroll taxes, including income, social security, and Medicare taxes.

In contrast, independent contractors manage their own taxes. They invoice businesses for their services and the contractor pays the necessary taxes to the IRS.

Incorrectly classifying an employee as a contractor can amount to tax avoidance. You must also file different forms with the IRS depending on a worker’s classification – Form 1009 for independent contractors and Form W-2 for employees.

Employment protections

Many labor laws, including overtime, minimum wage, workers’ compensation, health insurance, and mandatory leave, only apply to employees, not independent contractors. If you misclassify an employee as an independent contractor, they lose these protections and benefits.

Other employee benefits

Businesses often offer additional benefits to employees, such as extra paid leave, wellness programs, and professional development support. Employees misclassified as contractors will miss out on the benefits they are otherwise entitled to.

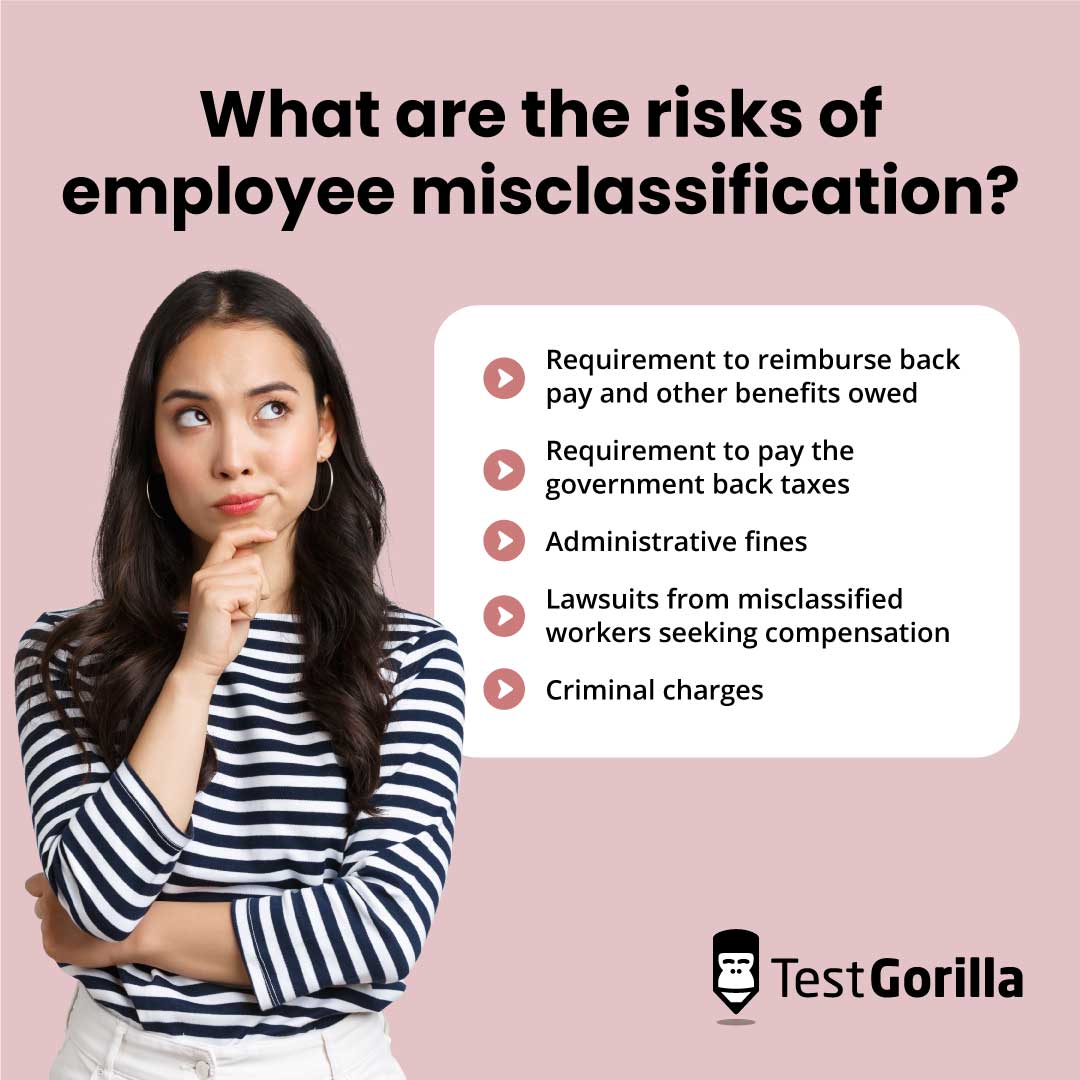

What are the risks of employee misclassification?

Whether it’s an honest mistake or intentionally actioned to avoid legal obligations, the misclassification of employees can have serious consequences for your business.

Misclassification can result in:

A requirement to reimburse back pay and other benefits owed to misclassified workers.

A requirement to pay the government back taxes.

Administrative fines of varying amounts, depending on the relevant law.

Lawsuits from misclassified workers seeking compensation for the benefits and protections they missed out on, including damages.

Criminal charges if the misclassification is intentional or repeated.

Misclassification can be costly, attracting penalties from different federal and state agencies that can quickly add up. Publicity around worker misclassification lawsuits and administrative actions can also hurt your company’s reputation as an employer.

How to correct employee misclassification

It’s important to be proactive about correctly classifying your employees to reduce the risk of misclassification.

The first step is identifying and understanding the worker classification laws that apply to your business and its workers. Remember, different laws can apply at the federal, state, and local levels depending on the purpose of classification.

It’s best to speak with an attorney who can advise you regarding the laws that apply to your business and its obligations. You can then review your workforce to check for misclassification. Conducting regular audits (annually, for example) is best practice to maintain ongoing compliance.

If you identify any misclassified workers, you should take the necessary steps to reclassify them. For instance, this likely involves changing their employment contract. You must also resolve any unpaid wages or taxes resulting from the misclassification. You should seek the advice of a legal or tax professional to help you with this.

How do I avoid employee misclassification as an employer?

You can take several steps to avoid misclassifying employees and support ongoing compliance with worker classification laws. For example, you can review your internal processes to identify ways to reduce the risk of misclassification.

These can involve:

Adjusting your onboarding processes to identify employees and independent contractors accurately.

Ensuring your employment contracts set out the employment relationship and comply with the relevant worker classification laws. It’s important to note that simply labeling a worker as an independent contractor or employee in an employment contract is not enough. The law looks at the true nature of the relationship, including how you treat the worker, to classify them.

Creating a policy for hiring and classifying independent contractors. A policy ensures everyone in your organization is clear about hiring contractors properly and prevents the business from accidentally hiring them as employees.

Provide training to your hiring team to support their understanding of your independent contractor policy and hiring processes, including how to classify workers correctly.

Support compliance and mitigate misclassification risks with TestGorilla

Understanding the worker classification laws that apply to your business is crucial to reducing the risk of misclassifying employees. By seeking legal advice and reviewing your internal policies and processes, you can ensure compliance and reduce the risk of legal pitfalls.

Whether you’re hiring independent contractors or employees, find the best person for the job by taking a skills-based approach. TestGorilla is a leading pre-employment testing service that lets you tailor assessments for employees and contractors to evaluate the abilities, skills, and personality traits relevant to the role.

To learn more about how TestGorilla can help you improve the quality of your hires, book a live demo with a helpful member of our team, or join for free to get started today.

Disclaimer

The information in this article is a general summary for informational purposes and is not intended to be legal advice. Laws are subject to constant change, and their application varies based on your individual circumstances. You should always seek legal advice from a qualified attorney about your legal obligations as an employer. While this summary is intended to be informative, we cannot guarantee its accuracy or applicability to your situation.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.