After months of talent sourcing, skills testing, and interview scheduling, you’ve just made the perfect new hire.

But the hiring process is just the beginning. Now it’s time for the long, confusing process of filling out new hire paperwork.

Not only do you need to go through all the federal forms and state forms, but you also need to fill out your company’s own internal documents and manage benefits paperwork, too.

New hire paperwork can be a lot to handle – but don’t worry, we’ve got you covered.

In this guide, we walk you through the different types of new hire paperwork. We cover the best practices for filling out new hire forms and provide a checklist to help you stay on top of your obligations.

Disclaimer: The information contained on this site is provided for informational purposes only and should not be construed as legal advice on any subject matter. If you have any questions on new hire paperwork in your area, please consult with a lawyer.

What is new hire paperwork?

New hire paperwork is a catch-all term for the documents a business needs to complete and file when bringing on a new employee.

You might also hear this paperwork referred to as new hire forms or new hire documents.

These documents are used to initiate an offer of work, record a new hire’s employment legally, and establish agreements on salary, benefits, and the responsibilities of the job.

Taken as a whole, new hire paperwork enables HR staff to compile a complete record of the conditions of a worker’s employment.

Paperwork for new hires: What forms do you need to fill out?

Paperwork for new hires is generally divided into four categories:

Federal and state government forms

Internal new hire paperwork

Employee benefits forms and paperwork

Employee information

In this section, we cover each category of new hire form you need to complete.

Remember that, while federal government forms tend to be consistent across the board, other employee new hire forms may vary depending on your company’s location and size. This makes it important to check your local requirements with a legal expert.

Federal government forms

Whatever state your company is based in, you need to know your obligations when it comes to these federal government new employee forms. These federal forms consist of:

E-Verify

Form I-9

Form W-2

Forms W-4 and W-9

Notice of Coverage Options

Reporting obligations under PRWORA 1996

Equal Opportunity Data Forms

E-Verify

E-Verify is a federal system used to verify a new hire’s identity and employment eligibility. It’s administered by the US Citizenship and Immigration Services (USCIS) and Social Security.

Employers in the following states are required to use E-Verify before hiring a new employee:

Alabama

Arizona

Georgia

Mississippi

North Carolina

South Carolina

Tennessee

Utah

Public employers and state government contractors have to use E-Verify in Florida, Indiana, Missouri, Nebraska, Oklahoma, Pennsylvania, and Texas.

Public employers (but not contractors) have to use this employment eligibility verification form in Idaho and Virginia, and state contractors (but not public employers) have to use it in Colorado, Louisiana, and Minnesota.

Form I-9

Form I-9 is another form used for employment eligibility verification in the US. Even if your company also uses E-Verify, you need to complete Form I-9 for every new hire.

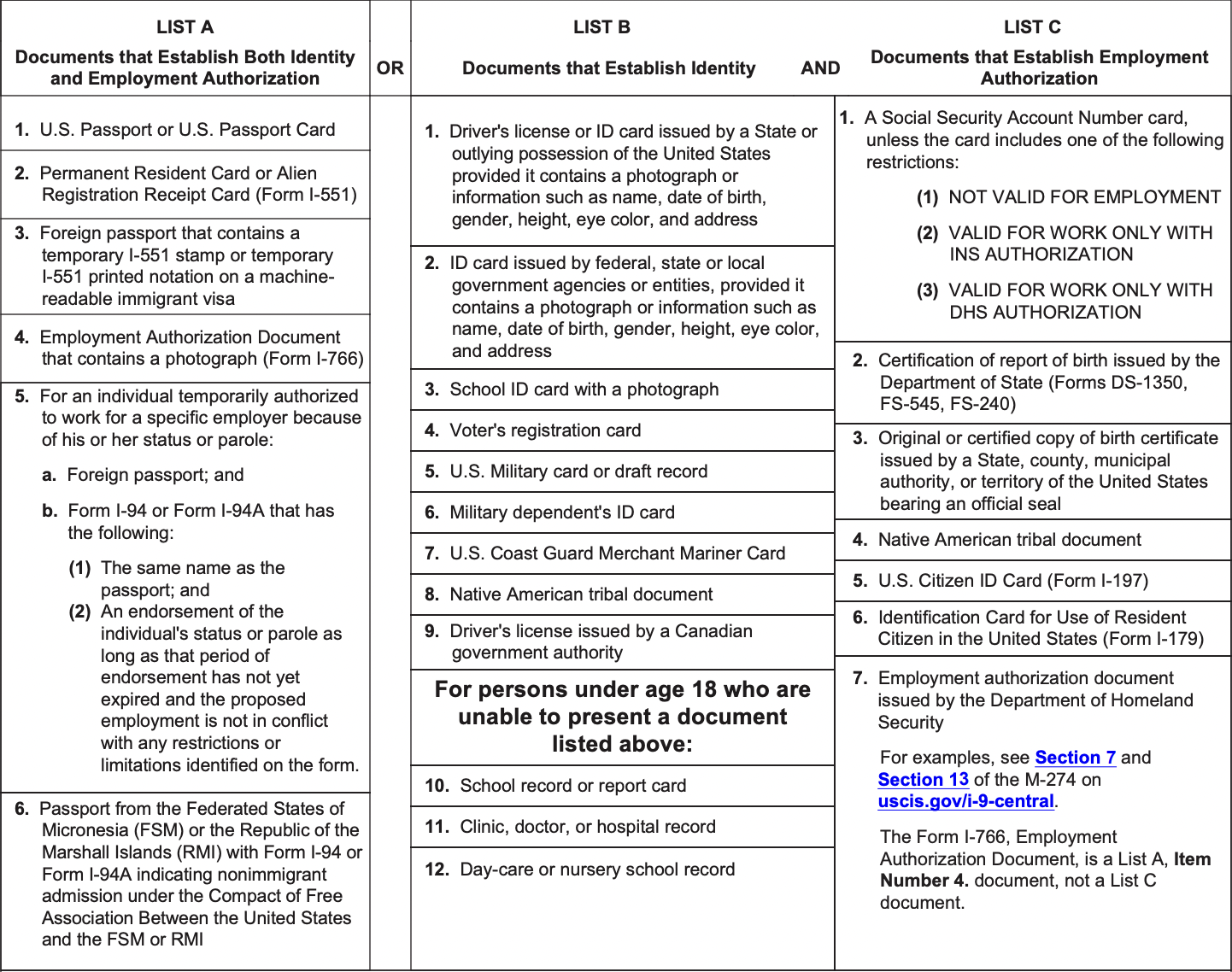

New employees have to provide you with proof of their identity and US work authorization. They need to present either one document from List A or one document from List B and one from List C.

As an employer, you need to complete Section 1 of this form by the end of your new hire’s first day on the job. Then your employee must fill out Section 2 within three business days.

You need to keep Form I-9 on file until at least three years after the hire date, or (if your employee leaves before then) at least one year after your employee has left the company.

Form W-2

You need to file Form W-2 with the IRS for each of your employees. It reports how much you’ve paid your employees in a yearly period, as well as how much you’ve withheld in taxes.

To file this form, you need your employee’s Social Security Number (SSN).

Form W-4

All new employees need to complete Form W-4 when they start working for you. It indicates how much federal tax you need to withhold from their paycheck.

Whenever the amount of tax you need to withhold changes, your employee needs to fill out the form again.

Once you have a completed W-4, you must keep it on file for at least 4 years. If your new employee doesn’t return this form, you should withhold income tax at a single rate with no allowances.

Form W-9

Form W-9 is roughly equivalent to Form W-4 – it’s just for contract workers, not direct employees.

As employers don’t withhold tax on behalf of contract workers, Form W-9 is mainly used for reporting purposes. Keep in mind that foreign independent contractors, including remote employees, need to use Form W-8 instead.

Notice of Coverage Options

Employers who are subject to the Fair Labor Standards Act (FLSA) need to provide a notice of coverage options to all new employees under the Affordable Care Act (ACA).

While it isn’t a form to sign, it’s still required information for new hires. This notice should inform them of:

How to access the Health Insurance Marketplace (HIM)

The potential impact of buying a plan through the HIM on taxes or employer-based health care coverage

The information necessary to apply for health care coverage through the HIM

The notice must be given in writing but can be delivered electronically.

PRWORA 1996 reporting requirements

The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA 1996) is welfare reform legislation designed to reduce welfare fraud and enforce child support payments, mainly through wage assignment and garnishment.

It applies to all businesses that pay wages, including federal agencies, labor organizations, and temp agencies.

Under PRWORA, businesses must provide all of the following information about each of their new employees to both the federal and state governments within 20 days of their hire date:

Name

Address

SSN

Business name

Business address

Employer Identification Number (EIN)

The employee’s hire date

When reporting to the federal government under PRWORA, you only need to provide information on W-4 workers. In the following states and territories, you also need to report independent contractors:

Arizona

California

Colorado

Connecticut

Delaware

Florida

Guam

Iowa

Maine

Massachusetts

Minnesota

Nebraska

New Hampshire

New Jersey

Ohio

Texas

Utah

Virginia

West Virginia

Equal Opportunity (EEO) Data Form

The EEO Data Form is required for employers with at least 100 employees. Federal contractors with at least 50 employees also need to complete this form.

It collects information on employees’ job categories, ethnicity, race, and gender. Many employers choose to gather this information from candidates digitally when they apply for jobs.

State government forms

As an employer, you also have an obligation to report information about your new employees to the relevant state. That’s because of PRWORA 1996, which we’ve already discussed in the previous section.

Almost all states require you to report the following information about a new hire:

Name

Address

SSN

Business name

Business address

Employer Identification Number (EIN)

The employee’s hire date

Some states let you file this information either electronically or on paper, while others require a specific method.

Your state might also request a tax withholding form for each new employee. In the first instance, you should check your state’s revenue site to learn more about new hire paperwork requirements by state.

If you have employees in more than one state, register with the Child Support Portal to choose a single state in which to report all of your new hires.

Summary of new hire reporting methods by state

Summary of new hire paperwork requirements by state

Internal new hire paperwork

Internal new hire documents aren’t legally required.

However, from a legal and business perspective, they clarify expectations between employee and employer and ensure your business has documentation for each new hire.

Here are the new hire employee forms we recommend that you use.

Offer letter

You should issue a formal offer letter to your new hires after they’ve accepted your offer of employment. At a minimum, it should include:

The employee’s job title

Their start date

Compensation details, even if you advertised them when hiring

Information about their eligibility for benefits

Your new hire needs to sign and return the offer letter to you. Keep that signed copy on file, so you have written confirmation that you both agreed to specific terms of employment.

Employment contract or agreement

Prepare an employment contract or agreement for your new hire, depending on the state or territory you live in.

In states with right-to-work laws, employment contracts aren’t required (though you can use them for limited-term employment).

A total of 28 states, plus the territory of Guam, currently have right-to-work laws in place. In these areas, consider using an employment agreement instead of a contract. In all other areas, use a contract instead.

If you aren’t sure about your new hire paperwork obligations in these areas, we recommend seeking legal advice.

Whichever document you use, it should include the following information:

The nature of the role

A work schedule

The obligations, rights, and responsibilities of both the employee and the employer

Any final hiring requirements, such as a drug screen or background check

The role’s compensation and benefits

Any technology or equipment to be issued to the employee

The conditions that would lead to the termination of employment

Employee handbook acknowledgment

Your company may have an employee handbook which contains information on the way the business works. A good employee handbook should review:

Operational policies and procedures

Legal information

HR policies

Business regulations

Benefits and programs available to employees

Information about disciplinary proceedings

Because this is such an important document, it’s worth your time to confirm that your new hires have read and understood it. Ask new employees to sign an acknowledgment stating that they have read the employee handbook, ideally on or shortly after their first day of work.

Direct deposit form

A direct deposit form enables employees to deposit their pay directly into their bank account. Enrollment in direct deposit is not required, but it saves employees time.

Both the employer and the employee need to complete and sign this direct deposit authorization.

Background check information

If you carry out a background check on a new hire, we recommend keeping the report resulting from that check on file.

They don’t usually contain in-depth information – background check results typically only indicate whether a candidate has passed or failed.

Nondisclosure agreement

Depending on the nature of your business, you may require employees to sign a nondisclosure agreement, commonly abbreviated as NDA.

This is a confidentiality agreement intended to protect intellectual property and other proprietary business data. It may cover client information, employee contacts, business plans, and more.

Under a nondisclosure agreement, your employee agrees to keep the specified details secret, even after they leave your organization.

Noncompete agreement

A noncompete agreement limits your new hire’s ability to work for a direct competitor when they leave your company.

It might prevent them from taking a position at another business in your industry within a certain timeframe or geographic area.

Noncompete agreements aren’t always necessary, but you may choose to request one from your new hire.

Employee benefits paperwork

This paperwork should formally set out the terms and conditions of any benefits you offer to your employees. That could include:

Health care

Retirement plans or 401(k)s

Life insurance

Stock options

Paid time off or other forms of leave, including unlimited PTO policies

Wellness benefits, including mental health care or fitness center membership

Reimbursement options for training and education

Other non-traditional benefits

Ask your new hires to sign to indicate acceptance of these terms.

Learn more about the laws surrounding employment contracts in our HR managers’ guide to employment contract law.

Employee information

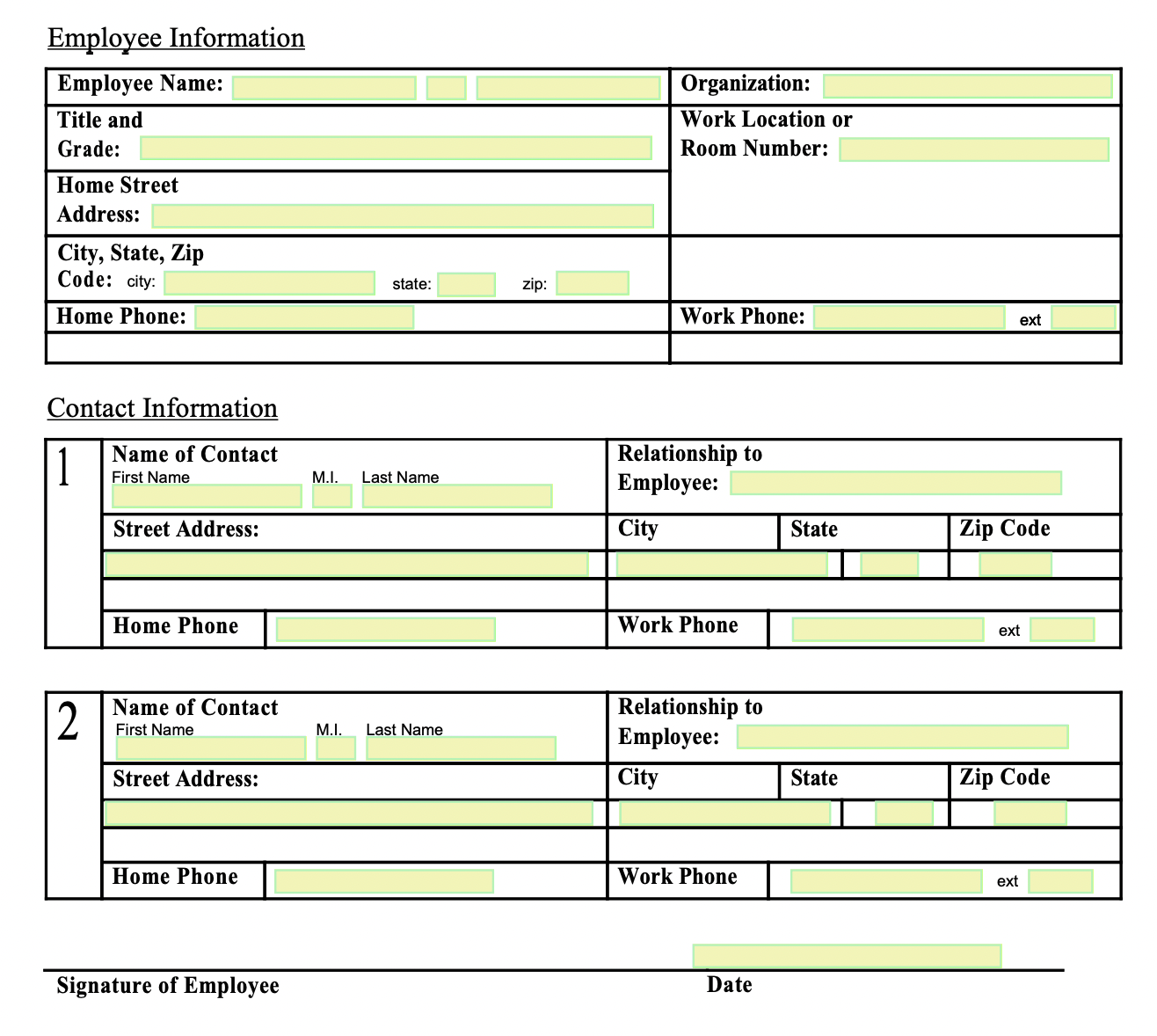

An employee information form is a way to gather information about your new hire, including emergency contact information. It may look something like this:

Ideally, it should contain your employee’s address and personal contact information, as well as the name and contact information of at least one emergency contact.

Remember to avoid collecting and storing information that you aren’t likely to need. In the event of a data breach, holding unnecessary information puts your employees’ confidential data at risk.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

6 best practices for new hire documents

We’ve covered the basics of how to fill out new hire paperwork, but the basics are just the beginning.

You need to make sure that your processes around new hire documents are as efficient and responsible as possible.

Otherwise, you risk failing to complete new hire paperwork, or losing it once it’s completed – and either way, you’re breaking the law.

Follow these 6 best practices to ensure that you gather and store your new hire paperwork carefully and thoroughly.

New hire paperwork best practices at a glance

Best practice | How it helps |

1. Complete paperwork before the first day | Limits the risk of registering your new hires or their information late and incurring fines |

2. Integrate new hire paperwork into your onboarding process | Ensures that new hire paperwork is completed routinely as part of your company’s standard practices |

3. Go paperless | Makes storing necessary data more efficient, and promotes an eco-friendly employer brand |

4. Maintain a safe, organized digital storage system | Reduces the danger of data losses or breaches, and leads to more reliable record-keeping |

5. Do a yearly paperwork review | Enables you to stay aware of any gaps in your paperwork and clear out old data regularly |

6. Apply these practices to ongoing performance reviews, too | Helps you to keep ongoing records of your employees’ progress and development |

1. Complete paperwork before the first day

As we’ve explained, federal and state new hire forms often come with deadlines.

Form I-9 must be completed within 3 days of your new hire’s start date, for example. And reporting under PRWORA 1996 must be carried out within twenty days of the hire date.

To avoid missing these deadlines, complete as much new hire paperwork as you can before your employee’s first day.

Send out an offer letter, employment contract, employee information form, and as many other forms as possible ahead of time.

Make them part of the preboarding process, so your new employee has someone to reach out to if they need help completing the paperwork.

Some forms, like the I-9, need to be completed when an employee has formally started work. For forms like that, we recommend filling them out on the employee’s first day.

2. Integrate new hire paperwork into your onboarding process

Following onboarding best practices doesn’t just make your new employee feel welcomed and grounded in their new work environment. It also takes care of important logistical processes surrounding their arrival, including new hire paperwork.

If you integrate the necessary new hire forms into your standard onboarding process, you limit the risk of key staff members forgetting about it. It becomes a matter of routine, and, therefore, more likely to be completed.

Plus, when you use an onboarding checklist to track each employee’s onboarding, you’re in a great position to check at a glance whether their onboarding paperwork has been filled out.

Lastly, sitting down to complete new hire documents on the first day makes a good impression on new hires. It shows that your company is organized and responsible, and sets the expectation of efficiency.

3. Go paperless

The phrase “new hire paperwork” conjures up images of box files and overflowing filing cabinets, right?

In fact, your new hire paperwork doesn’t need to be printed on paper at all. In most cases, it’s simple to keep your new hire forms paperless.

There are great reasons to do so:

It’s harder to misplace digital data than physical papers, especially if you manage your digital storage effectively (we’ll get to that in the next section).

The federal and state forms you need to complete are easy to file digitally. For example, most state authorities make it easy for you to register new hires under PRWORA 1996 electronically, and some require you to do it.

It’s more environmentally friendly, which is a great asset to your CSR strategy and your corporate identity.

All the same laws about retaining new hire paperwork apply to digital paperwork, too. Don’t make the mistake of deleting a file too early.

4. Maintain a safe, organized digital storage system

A digital filing system should be kept organized and secure, just like a paper one. After all, you’re storing all the same information; the only thing that’s changed is the format.

Keeping your filing system safe and organized limits the risk of data breaches or lost paperwork. It also makes it easier to keep track of the new hire paperwork you have on file, and collect anything you need as promptly as possible.

Here are some steps to take to keep your digital storage system secure:

Back up all your documents, and keep those backups under the same protection as your originals

Maintain a record of any revisions to your documents

Limit document access to the people who need it, such as HR or finance staff, on a case-by-case basis

Invest in your IT teams and cybersecurity for your organization

Establish a procedure for destroying documents you no longer need

5. Do a yearly paperwork review

That final point is one of the biggest reasons to carry out regular paperwork reviews, regardless of whether your system is paperless or not.

A yearly paperwork review gives you a set time to check the completeness of your new hire paperwork. It means it’s easier to spot any gaps promptly, and to chase up the information you need to fill them.

It also means you don’t end up holding on to old data you no longer need – which could put former employees at risk if you experience a data breach. A yearly paperwork review is a great time to clear out old documents you are no longer required to keep.

All of this contributes to a tidier and more organized storage system for your vital new hire documents.

6. Apply these practices to ongoing performance reviews, too

If you’re using talent assessment tests as part of skills-based hiring, it’s a great idea to hold onto workers’ initial scores alongside their new hire paperwork. Use those scores as a baseline to track how each staff member develops in their role.

It’s more than just a way to put skills assessment data to work in the long term. It’s a major advantage for building performance management strategies for each employee.

Keep using skills tests over time to gauge how employees’ abilities change, and keep storing their scores to measure their performance.

Then use that data to inform your approach to learning and development. Employees value learning opportunities highly: 94% of workers say they would stay in their roles longer if their employers invested in their careers.[1]

This approach feeds directly into your employee retention strategies, making skills-based hiring methods more than just a screening tool.

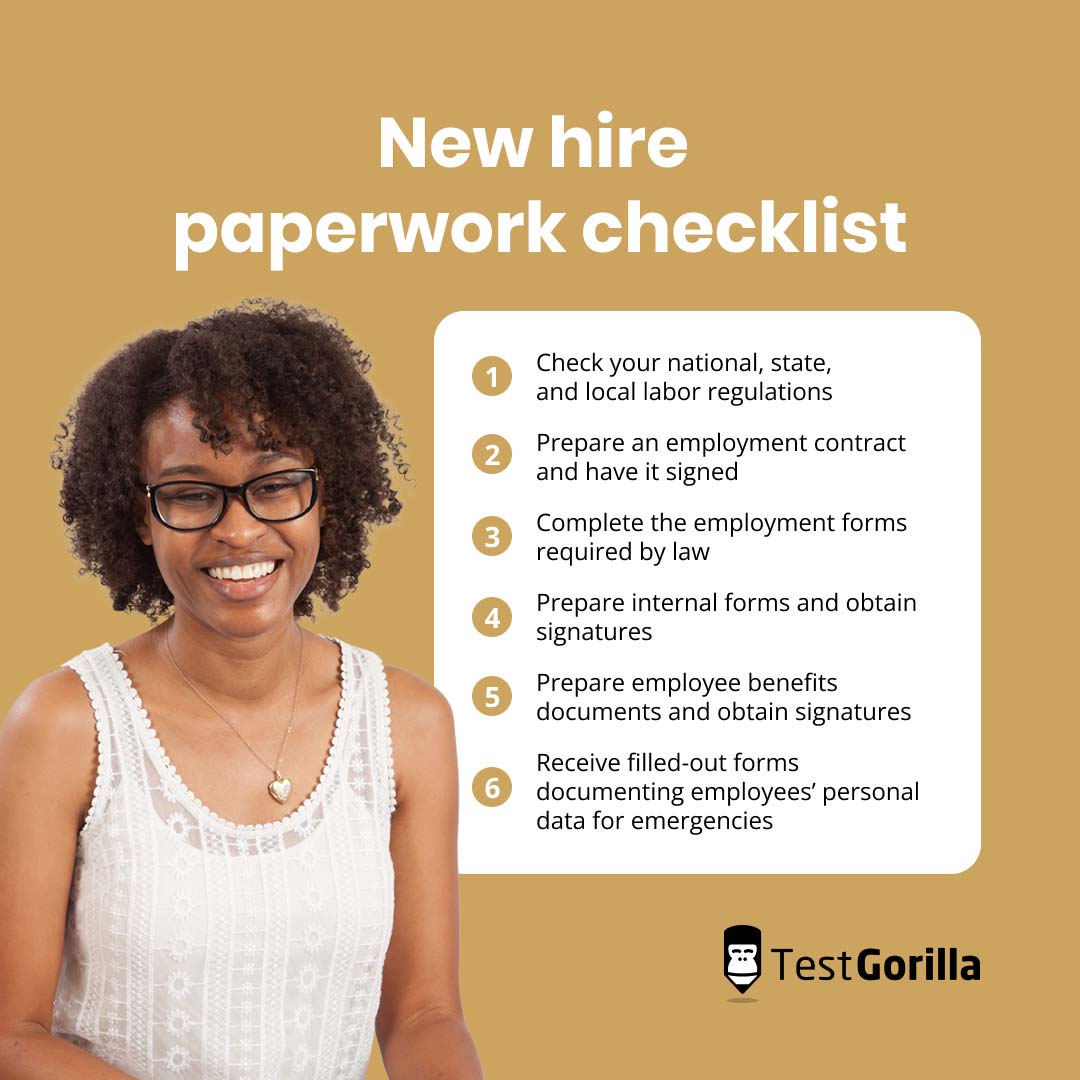

New hire paperwork checklist: 6 steps to follow

Now that you know how to manage your new hire paperwork effectively, it’s time to nail down the process for collecting it.

Follow this simple checklist to ensure you cover all bases when dealing with new hire forms.

New hire document checklist at a glance

Step | Whose responsibility? |

1. Check your national, state, and local labor regulations | Employer |

2. Prepare an employment contract and have it signed | Employer and employee |

3. Complete the employment forms required by law | Employer and employee |

4. Prepare internal forms and obtain signatures | Employer and employee |

5. Prepare employee benefits documents and obtain signatures | Employer and employee |

6. Receive filled-out forms documenting employees’ personal data for emergencies | Employer and employee |

1. Check your national, state, and local labor regulations

As we’ve seen, new hire paperwork requirements vary based on where you live. Before hiring a new employee, make sure you’re up to speed with:

Federal law

State law

Local law – some cities and municipalities have their own requirements for new hire paperwork

This is your responsibility, not your employee’s. If you have any questions about the requirements in your area, seek legal advice to avoid ending up in breach of the law.

2. Prepare an employment contract and have it signed

Depending on whether or not your state or territory is right-to-work, you need to prepare an employment contract or agreement for your new employee.

It’s a good idea to send this document to your employee in advance of their start date so they can sign it and return it ahead of time.

3. Complete the employment forms required by law

The exact forms you are required to complete may vary depending on your area. In most cases, however, you need to complete the following:

I-9 form

W-4 form (or W-9 form for contractors)

Federal and state PRWORA 1996 reporting forms

State tax withholding forms, where applicable

E-Verify, where applicable

Some of these forms have deadlines that you may be in breach of the law if you miss. Make sure you plan to complete them in a timely fashion.

4. Prepare internal forms and obtain signatures

To ensure all parties have agreed on their expectations of each other, it’s good practice to prepare these internal documents for your new employees to sign. Keep in mind that some of them may not be applicable to your business.

Payroll forms

Employee handbook acknowledgment forms

Job analysis forms (setting out responsibilities, goals, and performance evaluation criteria)

Confidentiality and security agreements (such as nondisclosure agreements)

Noncompete agreements

Inventory lists of issued equipment

Drug and alcohol test consent agreements

5. Prepare employee benefits documents and obtain signatures

Employee benefits forms set out the terms and conditions of any benefits you offer your staff, and give employees the opportunity to opt in (or out). They should cover major benefits like health care and life insurance, as well as non-traditional benefits like gym memberships.

6. Receive filled-out forms documenting employees’ personal data for emergencies

An employee information form collects the information you may need in an emergency. It should request your employee’s home address and contact details, as well as contact details for at least one emergency contact.

Collect this data promptly, as you never know when an emergency might happen.

Save time and effort by doing new hire paperwork right

A lot of new hire paperwork is legally necessary, but it’s so much more than just a legal requirement.

It’s a way for you to set and agree expectations with your new hires from the beginning of your relationship. It’s a means of gathering the data that could keep your staff safe in an emergency. And it’s an important step in building trust with new employees.

When partnered with a skills-based hiring approach, it even helps you to target your learning and development initiatives more effectively.

Done right, new hire paperwork is a crucial step in any preboarding or onboarding process.

Next, learn how you can use HR technology to improve your storage systems for new hire forms.

And, before you start your new hire paperwork, let our Motivation test inform your hiring decisions and increase the likelihood that you and your new hire share expectations for the role.

New hire paperwork FAQs

Still have questions about new hire paperwork? Check out these answers to the most common new hire document queries.

Are employers required to report new hires?

Under PRWORA 1996, employers are required to report new hires to both federal and state government authorities.

Do US citizens need to complete a Form I-9?

Whether your new hire is a US citizen or not, you need to complete a Form I-9 for each new employee you recruit to your business.

What forms do independent contractors fill out – W-2 or W-9?

Independent contractors don’t need to complete Form W-2 because they aren’t direct employees of a company. Instead, they should fill out Form W-9.

Independent contractors based overseas should fill out Form W-8 instead.

What are the types of new hire paperwork to complete during the onboarding process?

You should complete all of the following paperwork during the onboarding process:

Offer letter and employment contract

Benefits documents

Tax forms (both federal and state)

Payroll forms

Employee handbook acknowledgement

Form I-9

What happens if you fail to complete new hire paperwork?

If you don’t complete new hire paperwork, you may face fines. You also risk withholding employee taxes at an incorrect rate, or failing to enroll employees for benefits they’re entitled to receive – potentially harming your relationship with your new employee.

Source

"94% of workers say they would stay in their roles longer if their employers invested in their careers”. LinkedIn Learning. Retrieved August 9, 2023. https://learning.linkedin.com/resources/career-development/develop-employees

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.