70 payroll interview questions to hire skilled payroll staff

Hiring the right payroll staff is crucial for the financial health of your business.

Payroll clerks and specialists process and manage employee payments, verify timesheets, calculate wages, handle tax deductions, and answer employees payroll-related questions. For all this, they need a keen eye for detail, excellent communication skills, and the right technical knowledge to support employees and the organization effectively.

When hiring payroll staff, you need to evaluate candidates’ skills accurately and objectively to find the best fit. Resumes and certifications give you an idea of applicants’ qualifications but don’t reveal their actual payroll and accounting knowledge, time management, or problem-solving skills.

The best way to build a skills-first hiring process and hire top candidates is to combine pre-employment skills testing with targeted payroll interview questions. Use Attention to Detail, Accounting, and Microsoft Excel tests to evaluate candidates’ skills – and then invite the best ones to an interview.

Below, you’ll find the best interview questions to ask future payroll staff, along with sample answers and guidelines to help you evaluate answers.

Top 30 payroll interview questions to hire the best candidates

Below, you’ll find 30 interview questions and answers that will help you assess applicants’ payroll skills and knowledge. You can use them for all payroll roles, from payroll clerks to payroll managers.

1. Can you walk me through the steps of processing payroll from start to finish?

Candidates should outline a process that has the following steps:

Gather data: Collect employee time sheets and verify hours and days worked

Calculate wages and salaries: Calculate gross wages by multiplying hours worked by pay rates for hourly employees or using the fixed salary for salaried employees

Determine taxes and other contributions: Deduct taxes and other withholdings like health insurance or retirement contributions

Make payments: Issue payments via direct deposit, bank transfer, or checks

Record all transactions: Record the payroll in the accounting system and file payroll reports

2. How do you ensure accuracy in payroll processing?

Top applicants will know they need to regularly review and reconcile payroll reports, double-check time sheets, and ensure all employee information is up-to-date.

For this, they’d use reliable payroll software with built-in error checking and maintain open communication with employees for any discrepancies.

3. What payroll software have you used in the past?

Expect candidates to list payroll software they have experience with, such as ADP, QuickBooks, Paychex, or Gusto.

To evaluate candidates’ QuickBooks skills, you can use our QuickBooks Online test.

4. Can you explain the difference between salaried and hourly employees?

Salaried employees receive a fixed amount each pay period, regardless of hours worked, while hourly employees are paid based on the number of hours they work.

5. How do you process overtime pay?

Skilled payroll clerks will explain they’d calculate overtime pay by taking the hours worked over 40 in a week and pay them at one and a half times the regular pay rate. They’d also point out it’s critical for the business to ensure compliance with federal and state labor laws.

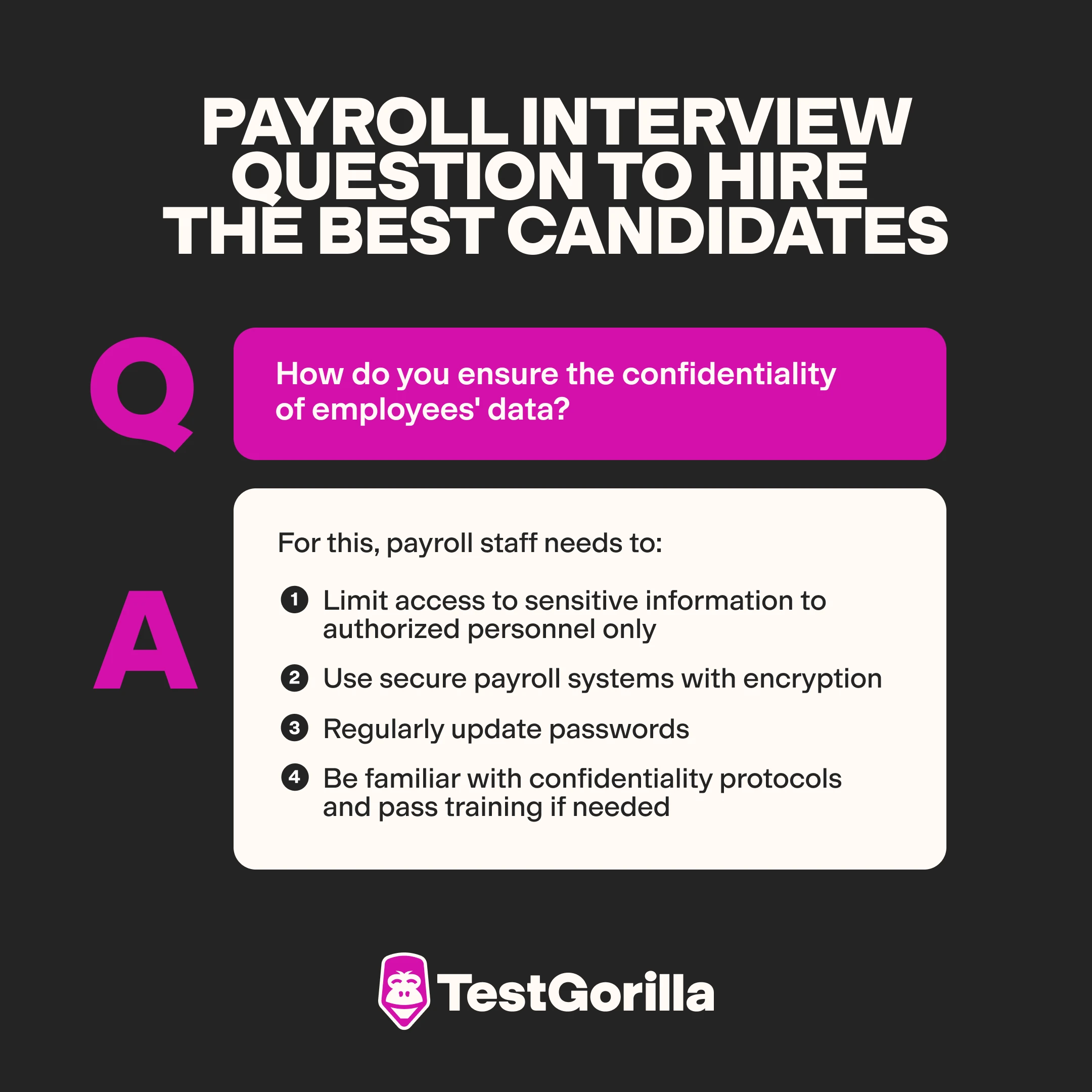

6. How do you ensure the confidentiality of employees' data?

For this, payroll staff needs to:

Limit access to sensitive information to authorized personnel only

Use secure payroll systems with encryption

Regularly update passwords

Be familiar with confidentiality protocols and pass training if needed

7. What is your experience with direct deposits versus paper checks?

Expect candidates to explain the benefits of direct deposits, such as faster, more secure payments and reduced administrative tasks.

Applicants should also describe their experience managing paper checks, which involves printing and distributing checks, and handling potential issues, if they get lost or stolen.

8. How do you handle payroll for employees in multiple states or jurisdictions?

Candidates should explain they’d use payroll software that supports multi-state payroll processing and ensure they stay updated with different state tax laws and regulations.

Top applicants will also point out the business needs to register for state tax IDs where needed and accurately calculate state-specific taxes and withholdings.

9. What steps do you take to ensure compliance with company policies and procedures during payroll processing?

Answers should outline a process that looks something like this:

Follow a standardized payroll checklist

Regularly review company policies and updates

Conduct internal audits and training sessions

10. Can you explain the different types of payroll taxes?

Payroll taxes include:

Federal income tax

State income tax

Social Security

Medicare (FICA)

Local taxes (optional)

Employers must withhold these taxes from employees' wages and pay their share of Social Security and Medicare taxes.

11. How do you handle tax deductions for employees?

Expect candidates to explain that payroll staff need to:

Ensure they have accurate employee information

Record all withholding allowances

Calculate and deduct federal, state, and local taxes based on current tax tables

Deduct other mandatory withholdings like Social Security, Medicare, and any voluntary deductions like retirement contributions or health insurance

12. What is FICA? How does it impact payroll?

FICA stands for Federal Insurance Contributions Act. It requires employers to withhold Social Security and Medicare taxes from employees' wages and contribute an equal amount. This impacts payroll by determining the amounts to be deducted and matched for each paycheck.

13. How do you process tax forms such as W-2s and 1099s?

Expect candidates to explain that:

For W-2s, they’d need to gather all wage and tax information for employees, verify accuracy, and issue forms by the January 31 deadline

For 1099s, they’d need to collect payment details for independent contractors, ensure their accuracy, and issue forms by the same due date

They can use payroll software to generate and file these forms with the IRS and distribute them to employees and contractors.

14. What steps do you take to correct payroll tax errors?

Candidates should explain they’d first identify and review the error and then calculate the correct amounts to adjust payroll records.

Additionally, they’d need to file amended tax returns if necessary and notify affected employees. Lastly, they’d have to implement measures to prevent future errors, such as additional training or system checks.

15. How do you ensure compliance with federal, state, and local tax regulations?

Top candidates will explain they stay updated on tax laws and regulations through continuous education, subscriptions to industry newsletters, and double-checking information frequently to make sure they’re aware of all changes.

Expect them to mention that using payroll software that incorporates these updates can be very useful, but that independently verifying information is also necessary, as is conducting regular audits and reviews.

16. Explain the process for handling tax levies and garnishments.

Experienced candidates will mention the following steps:

Receive the levy or garnishment notice and review its details

Notify the affected employee and explain the process

Calculate the required deductions according to the notice

Deduct the specified amount from the employee’s wages and remit it to the appropriate agency

Keep detailed records of all transactions

This requires excellent precision and accuracy, which you can assess with the help of our Attention to Detail test.

17. How do you manage payroll tax audits?

Expect candidates to explain they would:

Ensure all payroll records are accurate and up-to-date

Organize documents such as payroll registers, tax filings, and employee information

Cooperate with auditors, provide requested information promptly, and clarify any discrepancies

Implement any audit recommendations to improve future compliance

18. Describe your experience with integrating HRIS systems with payroll software.

Candidates should provide details about their experience in connecting HRIS (Human Resource Information Systems) with payroll software to streamline data flow. This includes ensuring seamless transfer of employee data, automating updates for new hires or terminations, and ensuring accurate benefit deductions and tax withholdings.

19. What steps do you take to backup payroll data?

Top candidates will explain they:

Regularly schedule automatic backups using secure, encrypted methods

Store backups in multiple locations, including cloud-based and physical storage

Test backup systems periodically to ensure data can be restored effectively

Maintain a disaster recovery plan

20. Explain the relationship between payroll and general ledger.

Payroll entries impact various general ledger accounts such as wages expenses, payroll taxes, and benefits. Accurate payroll processing ensures correct postings to these accounts. Regular reconciliation between payroll records and the general ledger is essential to maintain accurate financial statements.

To gain a deeper understanding of candidates’ accounting knowledge, use our Accounting test.

21. How do you reconcile payroll accounts?

Top candidates will explain they’d compare the payroll register with the general ledger entries to ensure they match.

Then, they’d verify that all payroll expenses, taxes, and withholdings are accurately recorded and address any discrepancies found by reviewing supporting documents, such as bank statements and payroll reports, to ensure everything balances.

22. How do you ensure payroll expenses are accurately reflected in financial statements?

Payroll staff should immediately record payroll expenses in the appropriate accounts after each payroll run and reconcile payroll accounts regularly to ensure all entries are accurate.

Top candidates might mention they’d review financial statements to confirm that payroll expenses are correctly classified and reported.

23. Describe a time when you had to explain a payroll accounting concept to a non-accounting colleague.

Expect candidates to describe a specific instance where they simplified complex payroll terms. For example, they might’ve explained how overtime pay is calculated by breaking down the basic formula and why it impacted the overall payroll budget, using easy-to-understand language and relatable examples.

24. How do you manage payroll liabilities in the accounting system?

Candidates should record all payroll liabilities, such as taxes and employee withholdings, in the payroll liabilities accounts, and regularly review and reconcile these accounts to keep them accurate and up-to-date.

They should also ensure timely payments to respective agencies to avoid penalties.

25. Explain the process of month-end and year-end payroll reconciliation.

At month-end, payroll staff should:

Verify that all payroll transactions are recorded correctly

Reconcile the payroll register with the general ledger and bank statements

Address any discrepancies immediately

At year-end, they should:

Ensure all payroll data is accurate and complete

Generate and distribute W-2s and 1099s, file year-end tax reports, and perform a final reconciliation to confirm everything is in order for the financial year

26. Tell us about your experience with Excel macros and automation.

Here, candidates should discuss their experience in creating and using Excel macros to automate repetitive payroll tasks. This can include generating payroll reports, calculating tax deductions, or updating employee records, all of which save time and reduce errors.

Use our Advanced Microsoft Excel test to further evaluate applicants’ experience with Excel.

27. How do you handle large datasets in Excel?

Expect candidates to explain they’d:

Use features like pivot tables, filters, and formulas to manage and analyze large payroll datasets

Ensure data integrity by validating inputs and using conditional formatting to highlight discrepancies

Utilize Excel’s data analysis tools to gain insights and streamline payroll processing

28. Can you give an example of a complex Excel task you completed for payroll?

Look for examples such as creating a comprehensive payroll calculator that includes various pay rates, tax brackets, and deductions. Another example might be consolidating multiple payroll reports into a single, detailed financial summary for management review.

29. How do you communicate payroll policies and procedures to employees?

Skilled candidates will know they should:

Use clear, simple language in written documents, emails, and presentations

Hold informational meetings if needed

Provide easy-to-understand handouts or guides

Make sure all communication is accessible and available in multiple formats to accommodate all employees

30. How do you handle employee inquiries about payroll?

Expect candidates to discuss how they’d respond promptly and professionally to all employee questions and explain payroll details clearly and patiently. They should always make sure to provide accurate information and, if needed, follow up with additional details or documentation.

40 more payroll interview questions you can ask payroll staff

If you need more ideas for your structured interview, here are 40 additional payroll questions you can use to evaluate applicants’ skills:

Describe your experience with filing payroll tax returns.

How do you troubleshoot issues with payroll software?

How do you handle software updates and system maintenance for payroll systems?

Tell us about a time when you had to learn a new payroll system. How did you approach it?

What do you do to ensure data security within payroll software?

How do you handle payroll discrepancies?

What methods do you use to keep track of employee hours worked?

How do you manage user access and permissions in payroll software?

What’s your experience with cloud-based payroll solutions?

Explain your process for auditing payroll data.

What tools do you use to manage and organize payroll information?

How do you handle large volumes of payroll data?

Describe a time when you identified and corrected a data entry error.

Can you customize payroll software reports? If so, how?

What methods do you use to verify employee information before processing payroll?

How do you handle data discrepancies or conflicts?

Describe your experience with data migration in payroll systems.

How do you maintain organized and accurate payroll records?

Tell us about your experience with accruals and payroll-related journal entries.

How do you handle payroll-related adjustments in the accounting system?

What is your understanding of debits and credits in payroll accounting?

What’s your process for working with the finance team to ensure payroll accuracy?

Discuss your experience with creating and using pivot tables.

What steps do you take to protect sensitive payroll data in Excel?

What formulas and functions do you frequently use in Excel for payroll tasks?

How do you use Excel to generate payroll reports?

Tell us about a time when you used Excel to solve a payroll problem.

Describe a challenging payroll problem you faced and how you solved it.

How do you prioritize tasks when handling multiple payroll issues?

What tools do you use for payroll analysis and reporting?

Describe your process for verifying the accuracy of payroll calculations.

How do you handle conflicting information in payroll data?

Tell us about a time when you improved a payroll process through analysis.

How do you ensure compliance with regulations while solving payroll problems?

What’s your experience working with other departments on payroll-related matters?

How do you ensure clear communication with remote or off-site employees regarding payroll?

What’s your approach to managing communication during payroll system changes or updates?

How do you provide training to new payroll staff?

How do you ensure effective collaboration with the finance or HR team?

Describe a situation where you had to resolve a conflict related to payroll.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Hire top payroll clerks and specialists with a skills-first approach

To hire the best people for your payroll department, build a skills-first hiring process featuring skills tests and structured interviews.

Above, you have 70 payroll interview questions to help you prepare for the interview stage. Next, head on to our test library to pick the best tests for each payroll role you’re looking to fill – and start recruiting.

Book a free 40-minute demo to chat with one of our experts – or jump in and sign up for our Forever free plan to try out our platform today.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.