Phased retirement: Leverage this retention trend and keep top performers for longer

Are you grappling with the challenge of losing your best employees to retirement?

The gap in knowledge and leadership they leave behind can be daunting. It's a problem that looms large as the workforce ages, threatening the continuity and culture that gives your company its competitive edge.

Enter phased retirement.

As a trend that’s reshaping workforce management, phased retirement lets you retain the expertise of your veteran employees who aren't quite ready for a full retirement.

In this article, we outline the benefits of phased retirement and who’s eligible. We also explore eight best practices for leveraging such a program as part of your overall employee retention strategy. We then wrap up with four examples of companies offering phased retirement successfully.

Table of contents

- What is phased retirement?

- Why is phased retirement important?

- The benefits and drawbacks of phased retirement

- 8 best practices for leveraging phased retirement to retain your best performers

- Phased retirement: 4 examples of companies succeeding with this talent retention trend

- Embrace the future of work with phased retirement

What is phased retirement?

A phased retirement arrangement is an agreement between employers and employees that encourages workers to gradually adjust their employment status rather than fully retire at once.

It’s an approach that promotes flexibility in the workplace, encouraging a balance between work and personal life while also enabling your company to retain the experience and skills of your veteran employees.

The concept of phased retirement is a talent retention trend that has gained popularity in recent years.

This is due to factors such as the need for skilled and experienced workers in a competitive labor market and the desire for work-life balance among older employees. Although many workers look forward to retirement, some find it difficult to give up on their careers so suddenly.

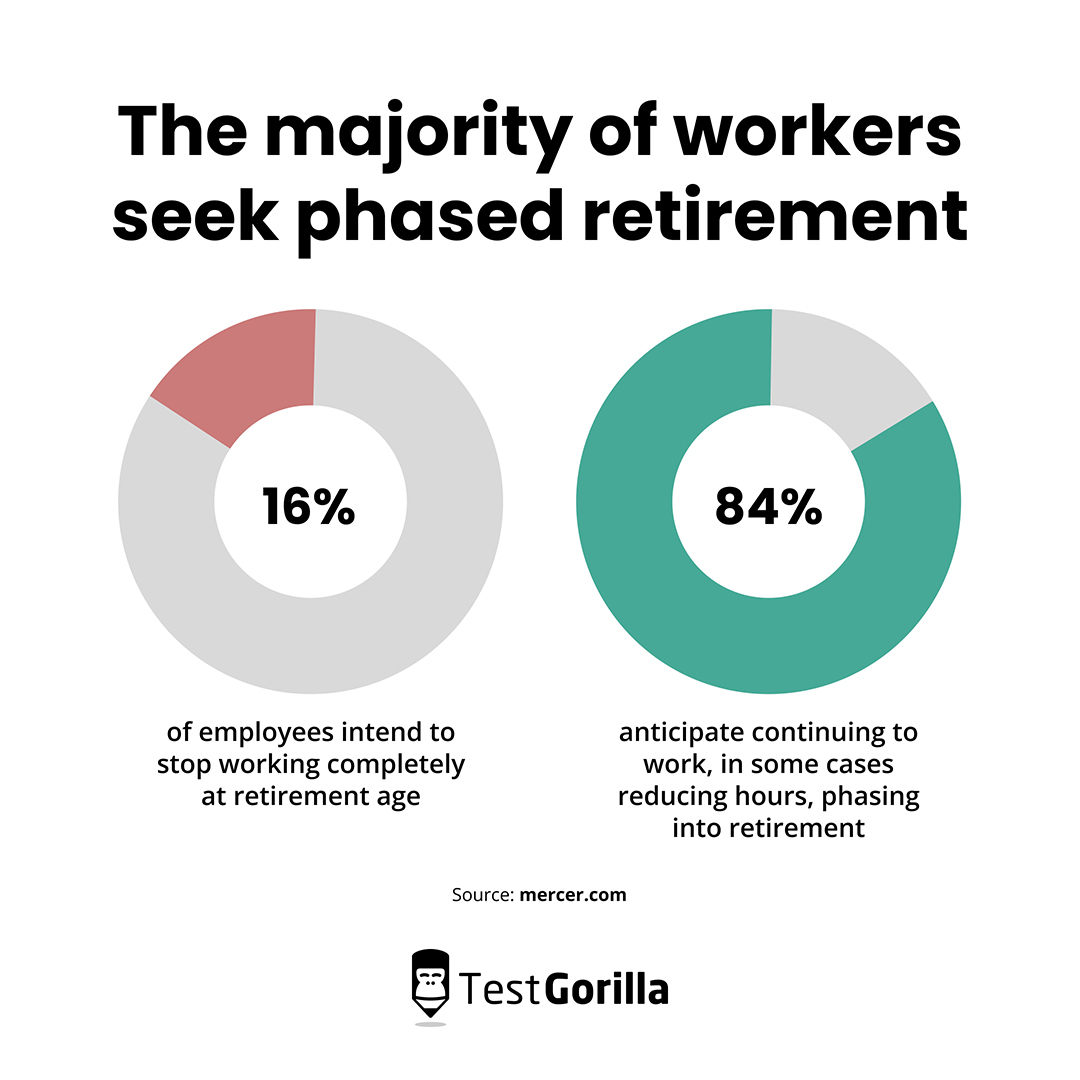

According to Mercer’s latest Global Talent Trends, only 16% of employees intend to stop working completely at retirement age. The remaining 84% of employees plan to continue working, cutting back on hours or phasing into retirement.

Phased retirement programs can take different forms, such as working part-time, working remotely, job sharing, or taking on a different role within the organization.

Who is eligible for phased retirement?

To be eligible for phased retirement, you must typically be a full-time employee approaching retirement age. However, the specifics vary depending on the employer's policies as well as the legal and regulatory framework of each country.

In the United States, there’s no federal law mandating or regulating phased retirement, so some employers may offer it as a voluntary option.

For example, the eligibility for phased retirement in the federal employee retirement system is determined by specific age and service combinations. If you fall under the Civil Service Retirement System (CSRS) or CSRS Offset, you must meet the following criteria:

Be eligible for immediate retirement

Have at least 30 years of service at age 55, or

Have 20 years of service at age 60[1]

As a private company, it’s your responsibility to determine who is eligible for phased retirement at your company.

Why is phased retirement important?

In short, phased retirement benefits both employers and employees.

For employers, phased retirement is an essential human resources tool for several reasons. It helps with upskilling and learning by giving veteran employees the opportunity to take on training and mentoring roles for younger employees.

An arrangement like this improves the employee experience and promotes a culture of continuous growth.

Phased retirement also helps companies hang onto high-quality workers for longer. Companies can retain invaluable experience and mitigate the knowledge loss that comes with retirement.

This strategy can also improve employer branding by demonstrating a commitment to well-being and employee work-life balance.

Phased retirement agreements also present multiple benefits for employees.

Retirees can ease out of their positions gradually during the phased retirement period, reducing the stress and abruptness associated with traditional retirement.

During their phased retirement, employees can enjoy some of the benefits of retirement, such as life insurance and Medicare, while still clocking in some hours at their old jobs.

This helps them maintain a higher retirement income and stay engaged professionally, which can lead to better financial and emotional well-being.

Next, let’s sum up the benefits and drawbacks of phased retirement in more detail.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

The benefits and drawbacks of phased retirement

Like most major changes to an employment structure, phased retirement comes with both benefits and drawbacks.

Here, we go over a few of each.

The advantages of phased retirement

Phased retirement presents six key advantages for your workplace:

It creates a smooth transition from full-time work to retirement, allowing your employees to maintain their income and benefits and enjoy increased leisure time and flexibility.

It improves employee wellness and helps them adjust to the psychological and social changes that come with leaving the workforce.

It helps employers retain the skills and expertise of their most experienced employees.

It increases generational diversity within your organization by retaining the invaluable experience of older workers.

Phased retirees can share their knowledge with younger workers, fostering a culture of learning and mentoring that prepares the next generation for leadership roles.[2]

It contributes positively toward your corporate reputation through word-of-mouth of satisfied retirees.

With phased retirement, your employees can enjoy a reduced workload while still contributing to your company's success.

The result is usually a more fulfilling work-life balance.

The disadvantages of phased retirement

Any change in a company’s system is bound to come up with some disadvantages, and phased retirement is no different.

One challenge is managing the payroll, benefits, and pension plans of phased retirees, which can create confusion and complexity for HR professionals. If you’re going to implement phased retirement, it’s important that your accountants are prepared for it.

Phased retirement may also be perceived as preferential treatment by other employees, potentially causing resentment and conflict within the workplace. For this reason, it’s important to emphasize the work that phased retirees put in to get into their privileged position.

Finally, some professionals may prefer to simply retire all at once instead of phasing out, so they may be unhappy if phased retirement is your primary retirement plan. You should always have traditional retirement as a viable backup option.

Despite these drawbacks, the advantages of phased retirement outweigh the negatives.

8 best practices for leveraging phased retirement to retain your best performers

Phased retirement can be a powerful tool for improving your employee retention rate.

This section introduces eight best practices to keep in mind when leveraging this talent retention trend.

Phased retirement best practices at a glance

Best practice | Main benefit |

1. Use talent assessments to help with succession planning | Ensures a smooth transition by identifying future leaders and preparing them early |

2. Identify skills gaps with talent assessments and target them with mentorship programs | Bridges skills gaps by pairing experienced employees with younger staff for knowledge transfer |

3. Determine your objectives | Aligns phased retirement strategy with organizational goals for maximum effectiveness |

4. Consider procedural and legal issues | Avoids potential legal complications and ensures compliance with employment laws |

5. Offer flexible work to facilitate phased retirement | Encourages retention by allowing older employees to reduce hours/workload gradually |

6. Educate leadership about phased retirement | Ensures buy-in and effective implementation by informing and training leaders |

7. Help employees make the shift by offering financial advice and planning | Supports employees in their transition, easing concerns about financial readiness |

8. Utilize employee pulse surveys to see how your people feel about phased retirement | Provides insights into employee attitudes and needs, enabling continuous improvement of the program |

Let’s dig into each of these best practices:

1. Use talent assessments to help with succession planning

Talent assessments play a crucial role in your organization's succession planning, which can be included as part of a phased retirement program.

Talent assessments identify the skills and competencies of both current and potential employees and align them with roles and tasks that best suit their abilities.

As a result, you're able to build employee training programs that complement your phased retirement strategies.

By using talent assessments, you can effectively create a talent pipeline for your company. This gives you ample time and resources to develop potential successors and seamlessly transition experienced employees into new roles.

As employees with phased retirement status gradually reduce their working hours, these successors will be ready to step in, making the process of filling key positions more efficient.

2. Identify skills gaps with talent assessments and target them with mentorship programs

Talent assessments are a powerful way to identify skills gaps and help with succession planning.

By performing a skills gap analysis with and without the phased retirees and comparing the results, you can determine which skills you’re losing as veteran employees leave.

A skills gap analysis can then help you develop mentorship programs with phased retirees to close these gaps.

Gradually retiring staff members can transfer valuable knowledge that younger workers may be lacking. Mentees can also benefit from the guidance and support of experienced employees, leading to enhanced learning, performance, and career development.

By fostering knowledge transfer between experienced employees and the next generation of leaders, you can ensure your company remains agile and competitive in today's rapidly changing business landscape.

Finally, skills gap analyses can also determine which roles will result in employee attrition because you no longer have a business need for that position after a worker retires (i.e., it can be absorbed into another role).

3. Determine your objectives

You must evaluate your goals when implementing any new company program.

Aligning your objectives with the needs and preferences of your employees creates a more efficient transition to phased retirement.

Here’s a quick step-by-step guide on how you might do this:

Start by identifying the problem you want to solve with phased retirement. Is it retaining experienced employees or helping with succession planning?

Next, assess the benefits and costs. The benefits may include preserving institutional knowledge and higher productivity. Costs may include time for training new employees or potential changes in benefits packages.

Establish clear criteria and eligibility requirements. Factors such as years of service, age, and specific qualifications should be considered when determining eligible employees.

Clarify the roles and responsibilities of phased retirees and their managers. This could involve creating a plan that outlines how employees can ease into a part-time schedule and the expectations of their managers during the transition.

Finally, have a plan for measuring success. Metrics such as employee satisfaction, retention of skilled employees, and efficiency in handover processes can help gauge the effectiveness of your phased retirement plan.

By determining your objectives and expectations for a phased retirement program, you're better equipped to create a plan that benefits both your organization and its employees.

4. Consider procedural and legal issues

When implementing a phased retirement program, you need to consider various procedural and legal issues.

This includes addressing the following key points:

How will you calculate and administer payroll, benefits, and pension plans for employees transitioning to phased retirement? You need to figure out how part-time employment affects the employees' incomes and benefits as well as compliance with relevant government agency regulations, such as the IRS.

How will you meet all required tax and labor laws for your phased retirement program? You need to understand the various legal requirements and applications for employees transitioning to a phased retirement schedule.

How will you handle the contractual and collective bargaining agreements that affect phased retirement? You need to scrutinize and reconcile these agreements with your phased retirement strategy and ensure all aspects are covered legally.

How will you communicate your phased retirement policies and procedures? Clearly outline the terms of phased retirement, the steps to create a retirement application, and the regulatory guidelines to be followed. Help employees understand their rights and responsibilities within the program.

Taking the time to implement proper procedures results in a well-structured phased retirement plan.

5. Offer flexible work to facilitate phased retirement

Flexible work arrangements empower your employees to adjust their work schedule, location, and hours according to their needs and preferences.

Not only does this help them transition into phased retirement, but your employees also enjoy a better work-life balance. With flexible work arrangements, your company benefits from increased productivity, satisfaction, and employee retention.

One way to facilitate phased retirement is through part-time work, where people work fewer hours than full-time employees. This gives them a steady income as they gradually cut back on work hours and become adjusted to retirement life.

Remote work is another popular option that gives employees the chance to work from locations other than the office.

By following remote work best practices, you can achieve high performance in a virtual setting and gain the flexibility needed for your phased retirement plan.

Job sharing is another flexible work alternative in which a person teams up with another employee to share the responsibilities and benefits of a single full-time position. This may be preferable for retirees who are experiencing physical or cognitive decline.

They can both reduce their workload and have a chance to mentor their job-sharing partner.

Finally, don’t forget that although flexible work’s main focus is to retain top talent as part of a phased retirement strategy, it can also be used to attract new talent as a desirable perk in your job postings.

6. Educate leadership about phased retirement

To ensure the success of any phased retirement program, you need to educate your leadership about the associated benefits and challenges.

First, leaders need to promote an inclusive culture, which is vital for embracing phased retirees and fostering an environment where everyone feels valued.

Encourage your leaders to adopt this mindset and recognize the contributions of phased retirees. Inclusivity helps to retain talent, reduce voluntary turnover, and enhance overall employee satisfaction.

Next, effective leadership styles can make a huge difference in how leaders manage and motivate phased retirees. A great leader can tailor their approach depending on the situation and employee dynamics. Different styles work better for different situations.

It’s also important to educate your leaders on the best ways to facilitate knowledge transfer and enhance succession planning to ensure a smooth transition and continuity of operations.

The bottom line is that you need an educated and informed leadership team to foster an environment that supports phased retirement.

Be sure to emphasize the benefits of phased retirement, encourage inclusivity, and provide leaders with tools and techniques to effectively manage phased retirees. Effective leaders create a positive experience for employees transitioning toward retirement.

7. Help employees make the shift by offering financial advice and planning

Phased retirement can have significant financial implications for your employees.

Income, compensation and benefits, taxes, and retirement savings may be affected. To help ease the transition, you should offer financial advice and planning services.

Having a clear understanding of how a phased retirement impacts their financial situation can help your people make informed decisions.

You can also offer access to financial counselors and planners who can help employees assess their financial situation and goals. Professionals can advise on balancing annuity payments and earned income during phased retirement.

Financial support can be invaluable in helping create a unique, personalized plan for your retirees.

Finally, you should also consider introducing compensation and benefits packages that suit the needs of employees looking to take advantage of phased retirement.

8. Utilize employee pulse surveys to see how your people feel about phased retirement

Employee pulse surveys can be a valuable tool to gauge your employees' thoughts and feelings about phased retirement.

These brief, regular surveys help you take the “pulse” on how your people feel about your organization in general. You can use them to measure engagement, satisfaction, and feedback on various aspects of work, including phased retirement options.

When incorporating questions about phased retirement into your pulse surveys, ask the following questions:

How interested are you in phased retirement?

How satisfied are you with the retirement options available to you?

How well do you understand the phased retirement policies and procedures?

How well do you balance your work and retirement activities?

These questions help you gain insight into employees' perceptions of your phased retirement program, helping you identify strengths and weaknesses.

Finally, it's crucial to provide sufficient resources to support your employees who are interested in phased retirement – pulse surveys enable you to identify the resources that employees find most helpful.

Phased retirement: 4 examples of companies succeeding with this talent retention trend

It should be clear by now that phased retirement is a win-win for both employees and businesses.

You might be wondering how you can use this strategy for your own company.

To give you a sense of how you might employ such a program, here are four phased retirement case studies:

Company | Summary |

Bon Secours Virginia Health System | To survive a nurse shortage, Bon Secours encouraged retiring nurses to take on different, part-time roles in a “rewire instead of retire” approach |

Washington University in St. Louis | Washington University grants multiple plans that give retiring faculty the opportunity to reduce their hours and salary while still maintaining all their benefits |

Owens Corning | With numerous highly specialized roles, Owens Corning preserves outgoing knowledge by placing its retiring employees in part-time mentorship positions to aid their successors |

SAP North America | When SAP North America encountered employees nearing retirement age who didn’t want to give up their jobs quite yet, it negotiated partial retirement plans for employees to stick with the job they love while enjoying the freedom of retirement |

Bon Secours Virginia Health System

Bon Secours Virginia Health System was facing a high employee turnover rate and an increasing number of retirements. As a solution, the company adopted a phased retirement approach to better recruit and retain nurses.

Its program addressed various factors leading to employee departure. These factors included:

Changing interests

Increasing physical job demands

Caregiving responsibilities at home

Bon Secours created a more appealing work environment by easing physical demands and providing caregiving support for employees' family members.

It also implemented a "rewire instead of retire" approach, where experienced nurses are repositioned into different roles.

To facilitate this transition, the organization offered retired nurses part-time work, a minimum of 16 hours per week, with retirement and regular pay and benefits.

Ultimately, the hospital benefited from retirees' flexibility and institutional knowledge during peak times like flu season or holidays.

Washington University in St. Louis

Universities have long been pioneers in implementing phased retirement programs for their faculty members.

Washington University in St. Louis has a phased retirement program offering both a basic and an enhanced plan for tenured and certain non-tenured faculty members.[3]

To qualify, an employee must be a full-time faculty member, at least age 55, and have provided at least five years of service, with their age and years of service totaling a minimum of 75.

The basic plan reduces retirees’ working hours to half the time. In return, they receive half their salary but maintain full benefits. This arrangement can extend for up to four years.

The enhanced plan offers half-time service with two-thirds of their salary and full benefits for up to two years.

One of the highlights of Washington University’s phased retirement plan is the continuation of various benefits. Programs such as health, dental, and vision insurance coverage remain in force as if they're still an active employee.

Owens Corning

Owens Corning, based in Toledo, Ohio, launched a phased retirement program for its salaried employees aged 55 and older.

The program is designed for those who have been with the company for at least five years. By offering part-time work with continued full-time benefits, including health insurance, Owens Corning aims to ease the transition into retirement for their valuable employees.

The phased retirement program typically lasts three to 12 months and is specifically designed to preserve institutional knowledge and intellectual capital.

Owens Corning is also able to recruit and train successors during this time, ensuring a smooth transition for the company and valuable employees.

Its phased retirement program is typically approved for employees with specialized skills, such as engineers, legal specialists, and R&D staff.

By participating in part-time retirement programs, these employees can enjoy a gradual transition into retirement. They can also maintain some of their job responsibilities and help the company retain its intellectual capital.

SAP North America

The last of our phased retirement examples is SAP North America.[4]

SAP is working on formalizing a phased retirement program due to increased interest from employees nearing retirement age.

Take, for instance, Kathy Bird. At 66, Kathy moved to North Carolina and was interested in retirement, wanting to devote more time to volunteering and playing golf. By discussing a part-time transition with her manager, she worked out an arrangement to work 20 hours a week and still maintain her full benefits.

This arrangement has enabled her to find the perfect balance between her work and personal interests.

Embrace the future of work with phased retirement

Phased retirement isn't just a policy.

It’s a strategic approach to rewarding and retaining talent for as long as possible. It goes beyond retention, fostering a culture of growth and continuity.

You can even use phased retirement as part of your recruitment marketing strategy. Once you begin integrating a phased retirement plan within your company, you’re sure to find that recruiting and keeping top talent becomes a repeatable practice.

Talent assessments are valuable assets to help you plan for phased retirement and other future needs of your organization.

Get started on your phased retirement approach with TestGorilla today.

Sources

“Phased Retirement for Federal Employees”. FEDweek. Retrieved November 15th, 2023. www.fedweek.com/reports/phased-retirement-for-federal-employees/

“Guide to Phased Retirement (With Benefits and Challenges)”. (December 13, 2022). Indeed. Retrieved November 15th, 2023. https://www.indeed.com/career-advice/starting-new-job/phased-retirement

“Phased Retirement (Faculty)”. Washington University in St. Louis. Retrieved November 15, 2023. https://hr.wustl.edu/benefits/change/phased-retirement-for-tenured-and-clinician-track-faculty

Tergesen, Anne. (March 15, 2022). “Part-Time Retirement Programs Are on the Rise”. The Wall Street Journal. Retrieved November 15, 2023. https://www.wsj.com/articles/part-time-retirement-programs-are-on-the-rise-11647336602

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.