A critical analysis of PTO payouts (plus an alternative approach)

PTO, or paid time off, is a huge bonus for many employees. But what happens if they don’t use their allotted vacation days before they quit?

Are they entitled to an extra financial boost on the back of any leftover PTO?

For those workers employed by companies offering PTO payouts, the answer is yes.

However, poorly implemented PTO strategies lead to personnel working while sick, reduced quality output, and increased corporate expenditure.

So, what’s the answer? Is there an alternative to PTO payout, and do you need to offer paid time off at all?

In this guide we:

Break down what “PTO payout” means

Explore PTO laws by state

Consider PTO cash out pros and cons

Propose an alternative way to compensate your employees if they need time off

Before booking interviews and testing applicant skills, it’s vital to get your PTO policy down pat. Here’s why.

What are PTO payouts?

With a PTO payout policy, an employer must pay employees for any unused time off at the time of separation. The terms “PTO cash out,” “paid time off payout,” and “vacation payout” all explain the same idea.

For example, if an employee leaves a company with 15 hours left from their last year of allowance, the company pays the value of those hours when they leave.

US companies don’t have to offer PTO by law, but it’s an incentive that sets a company apart from the pack. Almost a third of US employees have zero access to any form of paid leave.

PTO is highly attractive to working parents, guardians, and people with disabilities or long-term medical requirements.

If you choose to offer PTO, you must select one of three systems:

PTO payout

“Use it or lose it” PTO

A combination of the two

“Use it or lose it” (UI/LI) means staff don’t carry over their banked PTO hours to the next year. This encourages workers to ensure they take their allotted time off within 12 months.

For organizations, this system makes absenteeism easier to predict and prevents workers from piling up paid sick leave.

A simple, final PTO cash-out setup is often more appealing to potential applicants. We’ll cover the details why a little further down.

PTO payout laws by US state

There’s no federal law regarding PTO payout in the US. However, if you offer paid leave, you must still follow certain guidelines depending on the state you operate in.

State laws fall under one of three categories, where PTO payout is:

Mandatory

Optional

Mandatory and your only option (UI/LI is illegal)

Let’s explore these categories a little more, and where your state fits.

PTO payout is mandatory

If a state requires mandatory unused PTO payouts, you must outline payout as an option for employees in your company policy.

However, issuing UI/LI policies is legal, meaning time off resets every year.

PTO payout is optional

The states observing this rule are the most flexible on payout rules. You’re free to use the policy if you wish, and issuing UI/LI is legal.

PTO payout is your only option (UI/LI is illegal)

States observing this ruleset are the least flexible but frequently appeal to workers looking for more financial security.

You must offer cash out PTO to terminated employees by law in these territories – but without UI/LI.

An overview the PTO cash out rules in the 50 US states

US state | Is PTO cash out mandatory? | Is UI/LI legal? |

Alabama | No | Yes |

Alaska | No | Yes |

Arizona | No | Yes |

Arkansas | No | Yes |

California | Yes | No |

Colorado | Yes | No |

Connecticut | No | Yes |

Delaware | No | Yes |

Florida | No | Yes |

Georgia | No | Yes |

Hawaii | No | Yes |

Idaho | No | Yes |

Illinois | Yes | Yes |

Indiana | Yes | Yes |

Iowa | Yes | Yes |

Kansas | No | Yes |

Kentucky | No | Yes |

Louisiana | Yes | Yes |

Maine | Yes | Yes |

Maryland | No | Yes |

Massachusetts | Yes | Yes |

Michigan | No | Yes |

Minnesota | No | Yes |

Mississippi | No | Yes |

Missouri | No | Yes |

Montana | Yes | No |

Nebraska | Yes | No |

Nevada | Yes | Yes |

New Hampshire | No | Yes |

New Jersey | No | Yes |

New Mexico | No | Yes |

New York | No | Yes |

North Carolina | No | Yes |

North Dakota | Yes | Yes |

Ohio | No | Yes |

Oklahoma | No | Yes |

Oregon | No | Yes |

Pennsylvania | No | Yes |

Rhode Island | Yes | Yes |

South Carolina | No | Yes |

South Dakota | No | Yes |

Tennessee | No | Yes |

Texas | No | Yes |

Utah | No | Yes |

Vermont | No | Yes |

Virginia | No | Yes |

Washington | No | Yes |

West Virginia | No | Yes |

Wisconsin | No | Yes |

Wyoming | No | Yes |

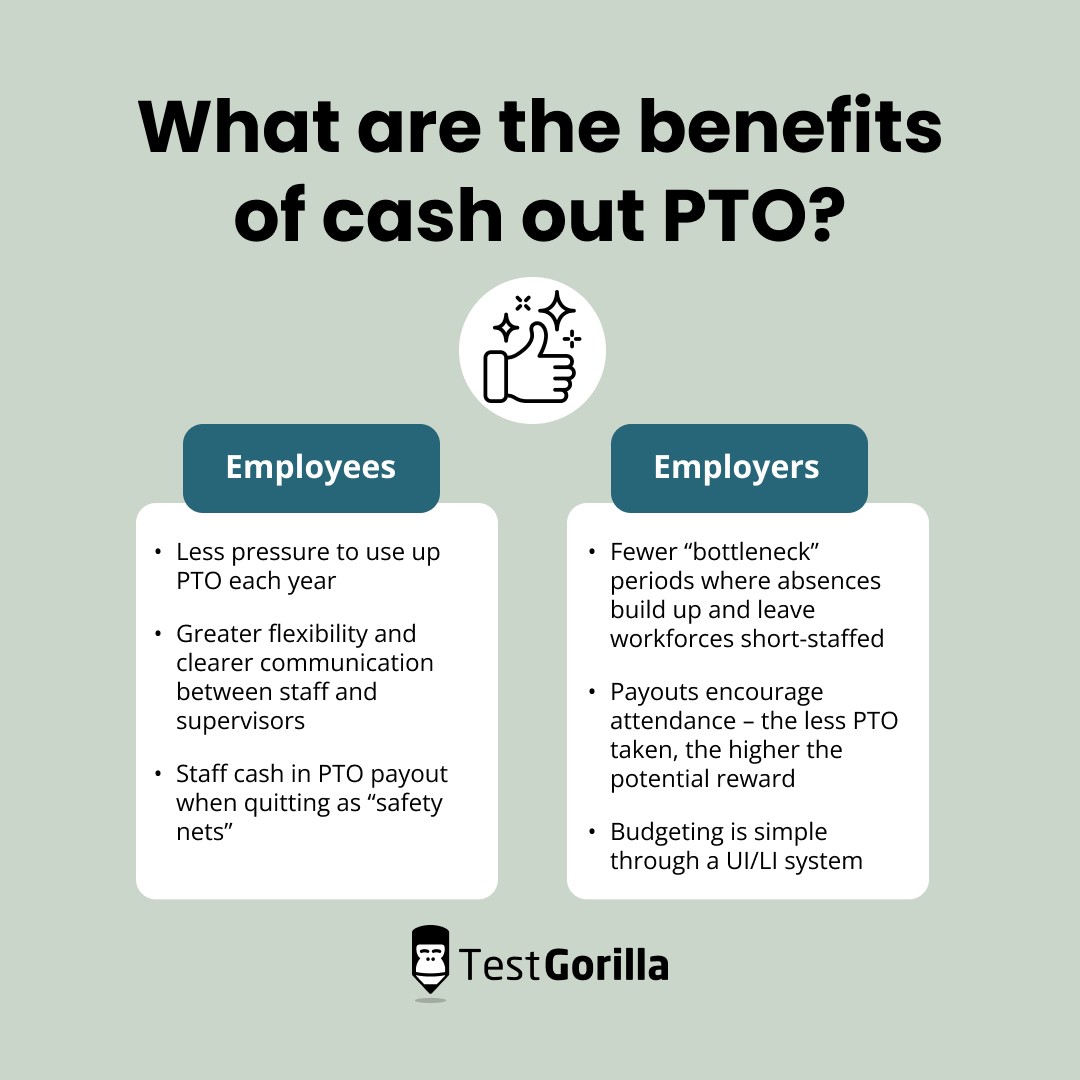

What are the benefits of cash out PTO?

Personnel across the US widely support PTO. More than three-quarters of employees say paid vacation time is important.

It’s a powerful recruitment tool for companies, too. However, there are more benefits for workers and business owners if this leave is available as payout.

Here’s a quick summary.

Benefits for employees | Benefits for employers |

Less pressure to use up PTO each year | Fewer “bottleneck” periods where absences build up and leave workforces short-staffed |

Greater flexibility and clearer communication between staff and supervisors | Payouts encourage attendance – the less PTO taken, the higher the potential reward |

Staff cash in PTO payout when quitting as “safety nets” | Budgeting is simple through a UI/LI system |

The pros for employees

PTO generally helps to foster a healthy culture of taking time away when needed, but having the option to “cash out” provides further incentives.

There’s greater freedom

Employees benefiting from a PTO payout policy don’t feel pressured to use their accrued vacation time up, even if UI/LI is in place for the year.

Over a third of personnel leave unused vacation time on the table each year. Should they not need their entire PTO, they benefit financially when they quit.

PTO cash out systems boost healthy communication between employees and supervisors. Those working under a restricted or non-PTO system feel pressured to justify their need for time away from work.

Communication is clear, and rules are flexible

Companies offering PTO payouts encourage staff to use their earned vacation time wisely, and set clear rules and boundaries for use.

Clear conversations about PTO and payouts creates a healthier, more open working culture.

Clear PTO and payout boundaries ensure everyone’s informed on who gets what, and the financial value in leave. Employers laying this groundwork are less likely to guilt their staff over taking time away, and said workers don’t need to ask for endless support.

There are “safety nets” for employees who quit

Under PTO payout, workers know there’s a chance of unpaid leave to “cash in” on severance. This “safety net” is easy to calculate based on hourly rates.

Such a model helps workers calculate their severance pay and manage their paid leave. It’s attractive to those with short-term plans who only need a little leave during the year.

The pros for employers

Employers using PTO payout (by law or not) expect improved productivity and attendance – but there’s more to consider.

Absence “bottlenecks” reduce

UI/LI systems encourage employees to use all their leave within 12 months. Sometimes, this leads to personnel taking time off en masse, especially toward the end of the year.

While it’s important to manage absence bottlenecks with internal systems and ensure departments are always covered, a PTO cash out policy encourages personnel to hold onto their leave, using it only when necessary.

Organizations expect a more even distribution of leave across a year without struggling with a lack of personnel during critical periods.

Overall attendance increases

Since PTO payouts encourage staff to hold onto vacation days, employers expect more working hours per year compared to a non-payout system.

Employees aiming to leave in the short term keep their PTO hours to cash out within their company’s rules. They’re less likely to take vacations, although organizational expenses increase when they cash out.

Take caution, though. Using a PTO payout policy to encourage attendance isn’t healthy. It’s a route that frequently leads to employee burnout and poor-quality output, which we discuss a little later.

Budgeting is simple alongside UI/LI

In states where firms balance unused vacation pay with UI/LI, calculating the total potential loss on max payout per employee is simple.

Payout rolls over year to year – there are clear ceilings to financially prepare for in the event of resignations.

This benefit doesn’t apply if UI/LI is illegal in your state, which puts you at the mercy of near-unlimited payout (more on this below).

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

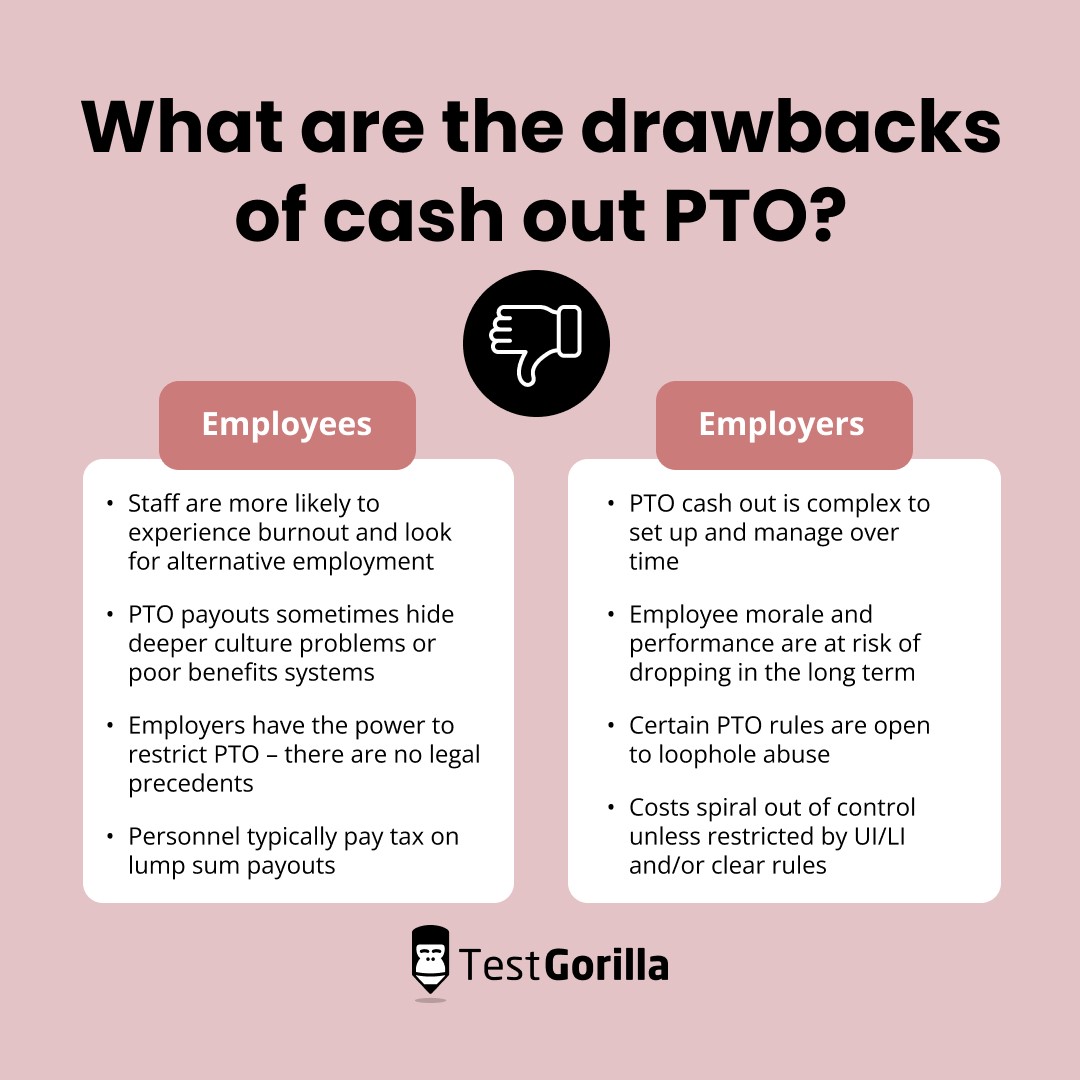

What are the drawbacks of cash out PTO?

These pros might seem like they offer mass appeal, but there’s actually an even longer list of cons for employee PTO payout systems, largely impacting employee mental health and employer expenses.

Let’s consider the drawbacks.

Drawbacks for employees | Drawbacks for employers |

Staff are more likely to experience burnout and look for alternative employment | PTO cash out is complex to set up and manage over time |

PTO payouts sometimes hide deeper culture problems or poor benefits systems | Employee morale and performance are at risk of dropping in the long term |

Employers have the power to restrict PTO – there are no legal precedents | Certain PTO rules are open to loophole abuse |

Personnel typically pay tax on lump sum payouts | Costs spiral out of control unless restricted by UI/LI and/or clear rules |

The cons for employees

Payout policies, while financially appealing, don’t promote healthy work-life balances. Organizations are free to change rules to suit their needs, too.

Burnout is likely to increase

Employees who avoid using PTO to financially benefit from the payout risk burning out.

Working constantly isn’t healthy – and 60% of workers already feel their supervisors need to set clearer boundaries.

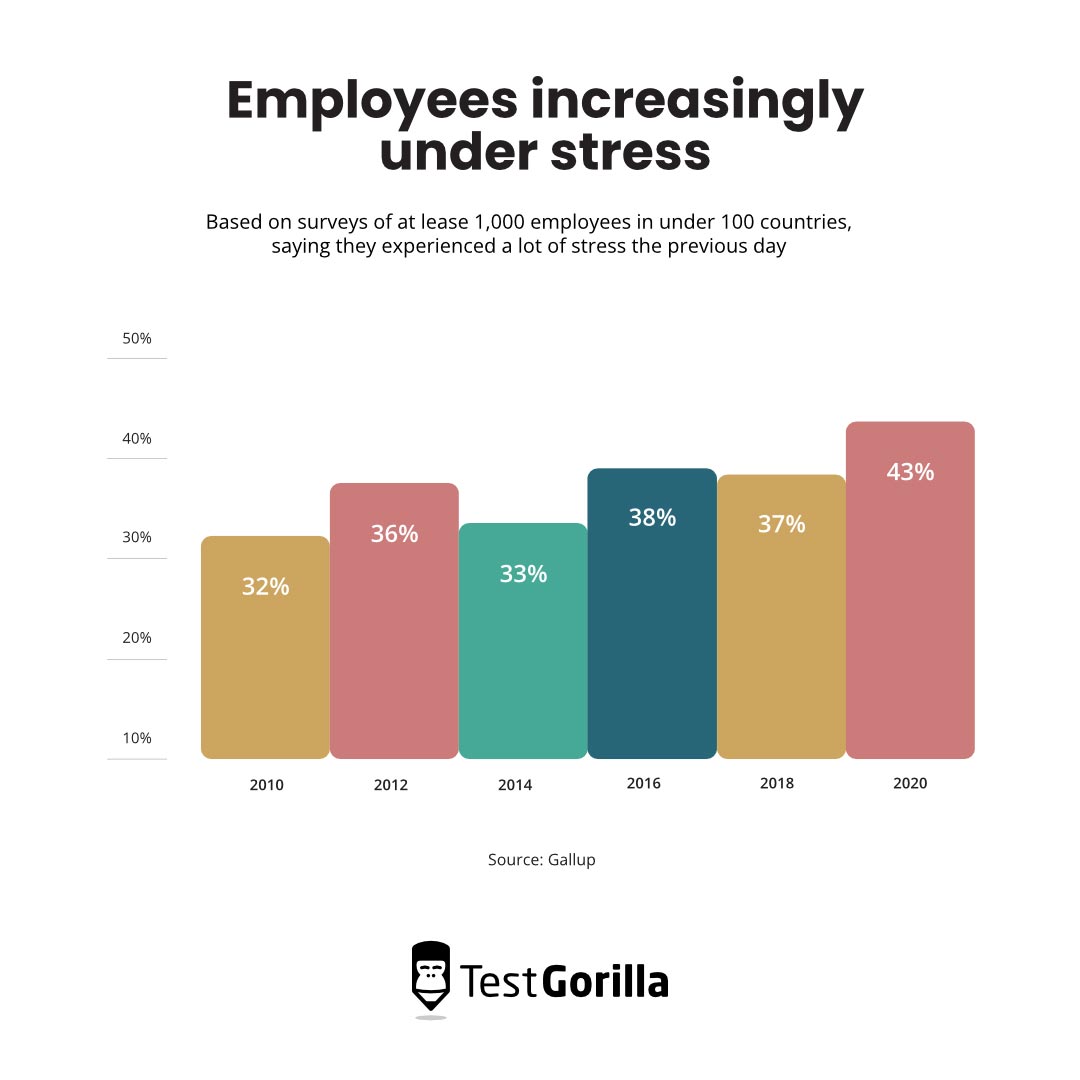

Workplace stress is already increasing year on year without PTO payouts entering the fray:

The additional effects for employers aren’t healthy, either. Up to 70% of burned-out employees actively look for healthier work elsewhere.

PTO payouts hide deeper culture or support issues

Sometimes, PTO payout acts as a “bandage” to cover multiple internal company problems (low base wages, for one).

Some hires jump to accept PTO cash out deals without considering their pay. Is the promise of a lump sum at the termination of employment legitimately worth sacrificing ongoing income or other benefits?

Responsible companies offering payouts balance the benefit with other perks. For example, healthcare, memberships, and on-site gym and spa facilities are common workplace benefits.

Some businesses opt to push PTO payout as a sole benefit because it’s costly. Genuinely supportive employers, unfortunately, are at risk of falling into the same category in the eyes of applicants previously burned by payout focus.

Providing diverse, non-traditional employee benefits boosts employee morale and improves recruitment results.

Employers control payouts without legal recourse

While state employment laws dictate whether or not payout occurs should companies offer PTO, there are zero federal rules on how employers establish and carry out such policies.

PTO policies are, therefore, wide open to loophole abuse:

The US is the sole economy of its size without a PTO mandate – meaning some businesses offer it as a perk

Companies have the power to adjust and control the amount of PTO payout they offer without a legal mandate

Some firms bury PTO rules in legalese (leaving workers without legal advice stuck in undesirable contracts)

Tax is payable on lump sum payouts

Within IRS guidelines, PTO payouts are typically lump sums, which makes them taxable in addition to employee income.

Employees lose money on PTO they receive as payments. It’s better value overall, then, to use PTO as vacation or sick time when required.

The cons for employers

Employers, like their staff, risk financial loss via payout system. Firms risk output quality dropping significantly, too.

PTO payout rules are complex

As a business operator, you must set clear expectations for your workers and carefully produce an employer’s policy that ensures you’re not open to abuse. It’s delicate work that often requires legal support.

What’s more, with US companies employing staff remotely worldwide, leave rules vary from nation to nation. In the UK, for example, full-time working people receive up to 5.6 weeks of paid leave a year by law.[1]

In this case, an employer needs a vacation policy for workers in all territories they wish to approach. It’s restrictive and highly impractical to manage as a company grows.

Employee performance is at risk

The downside to increasing attendance with payout policies is that performance dwindles with burnout. Burned out employees suffer from poor mental health and feel less motivated to perform well.

Research shows that up to 46% of staff feel that mental health issues impacted their work during 2022. More than half of employers surveyed noticed similar trends.

Additionally, 26% of employees experiencing burnout claim it impacts their motivational energy at work, while 19% claim it directly affects the effort they put in overall.

Payout systems risk workers choosing work over personal health, disrupting their work-life balance, thus leading them to burn out.

If anything, businesses should do more to support employee well-being – not less.

Loopholes are open to abuse

PTO payout encourages high employee turnover unless rules and boundaries are transparent and easy to understand.

Potential abuse of the system is likelier in states without UI/LI backing because PTO payouts are hypothetically unlimited. It is only so much a problem if employers fail to curb the upper rates via contracts.

Costs increase

Companies pay out more if employees cash in their PTO upon leaving, and costs increase if there’s no UI/LI policy.

Alternatively, with an unlimited (non-payout) or restricted UI/LI PTO system, company directors always know how much they stand to lose.

Limitless payout models, meanwhile, encourage turnover and increase costs for business owners from year to year. Turnover costs are already complex to calculate, meaning many companies avoid this.

Clear documentation lowers the risk of costs spiraling. Although not backed by federal precedents in law, companies curtail how much gets paid. Some applicants see this as a drawback.

The alternative to PTO payouts: Competitive compensation and an unlimited PTO policy

There are clear benefits and drawbacks to PTO payout for all parties, but these often come at the expense of worker health and company capital.

Therefore, many high-profile businesses adopt an unlimited PTO policy to avoid all risks.

Under this system, employees take as much time off as needed without feeling pressure to do so within restrictive time limits.

It’s a policy that encourages staff to focus on taking care of themselves and their private demands, ready to return to work refreshed, engaged, and happy.

Poor mental health boosts potential absences by up to four times. Keeping personnel morale in clear sight benefits everybody.

Provided they create a culture of trust and clear guidelines, employers won’t have to worry about:

Complex payout expenses and max losses

Absence bottlenecks during critical service periods

Morale and work quality decreasing

TestGorilla is a working example because we’re strong proponents of unlimited PTO. It’s simple, it’s cost-effective, and our system thrives on open communication.

We provide unlimited paid leave on the condition that it doesn’t negatively affect either the employee’s or the team’s workload.

We encourage our staff to check other team members’ workloads and submit clear vacation requests for all to see – at team and supervisory levels – in the interest of open communication.

Of course, unlimited PTO isn’t appropriate for all workforces, so you should always offer competitive compensation. For example, consider providing:

A financial bonus structure

Healthcare and dental insurance

Investment opportunities

401K matching

On-site perks

Off-site memberships

Flexible working

Unlimited PTO alone, however, is consistently popular with hiring companies and applicants. Research shows an increase of 178% in businesses pitching unlimited time off between 2015 and 2019.

Four out of five millennials applying for work value unlimited PTO as a desirable benefit (70% of Gen X and 63% of Baby Boomers agree). It’s proving popular across broad age groups and backgrounds.

Is a PTO payout the healthiest option for your employees?

Although PTO payout models offer some benefits, they’re not great for long-term employee or business health.

Payout systems are fast falling behind more appealing, sustainable unlimited PTO contracts and competitive compensation packages.

While they seem lucrative, PTO payouts give your team few incentives to keep working.

In an age of declining mental health and increasing burnout, you’re risking reputation and revenue.

While not governed by law, PTO should be a basic working right. Alongside a strong hiring system based on skill testing, competitive benefits packages (including paid leave) attract people eager to stay with the right business.

Recruiting eager, motivated applicants with unlimited PTO is a great start, but remember to use a Culture Add test to ensure they’re the best fit for your team.

You can also explore how to build incentive programs for employees elsewhere on our blog, too, if you’re struggling for ideas.

Source

“Holiday entitlement”. (n.d.). GOV.UK. Retrieved April 30, 2023. https://www.gov.uk/holiday-entitlement-rights

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.