7 quant interview questions (+ answers to expect)

Hiring talented quantitative analysts (quants) can be tough – they need strong math and real-world problem-solving skills, plus the ability to manage risks, work with complex data, and build predictive models that drive smart financial decisions. It’s a difficult combination of skills to find, and you need to ensure the candidate meshes well with your culture, too.

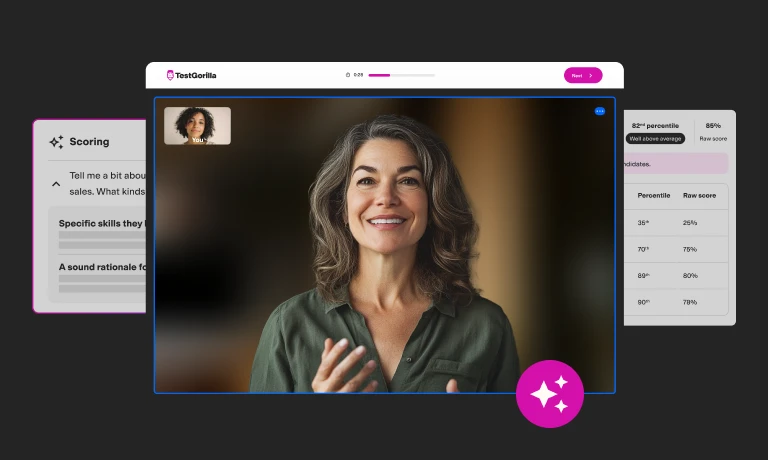

If you want to avoid the costly mistakes of a bad hire and get real insights into a candidate’s thinking and potential job performance, you need to assess candidates thoroughly before the interview. A talent assessment program like TestGorilla is perfect for this.

But while pre-employment screening can help you whittle down your pool of candidates, you’ll eventually need to interview them. This is where our seven quant interview questions can help. Read on to learn exactly what skills they test and what a good answer looks like.

Table of contents

Key takeaways

Finding talented quantitative analysts is challenging due to the unique blend of math, statistics, and problem-solving skills required for the role.

Traditional hiring methods like cover letters and resumes may not reveal how a candidate thinks or how they’ll perform, making a more targeted approach essential.

By using creative quant interview questions, recruiters can better assess technical abilities, logical thinking, and risk management skills.

A multi-measure approach, such as combining TestGorilla’s skills tests with interview questions, provides a comprehensive view of a candidate’s abilities, helping avoid costly hiring mistakes.

Tailored assessments that include cognitive and personality tests offer deeper insights, making the hiring process more efficient and predictive of on-the-job performance.

Get to know your quant candidates

Before diving into technical questions, recruiters and hiring managers should gauge candidates’ analytical skills – how they think – and their personality traits, which reveal what motivates them and how they’ll tackle challenges.

For example, asking what they enjoy most about quantitative analysis reveals what genuinely gets them excited about the field.

Look for responses that connect their professional motivations to the organization's growth, such as their enjoyment of mathematical problem-solving, appreciation for quantitative precision, and ability to thrive in collaborative environments.

For the best results, you should implement pre-interview assessments that help evaluate technical skills, cognitive ability, and personality type.

For example, you can try our Python (Coding) Working with Arrays test to assess candidates’ skills in data manipulation, algorithm development, and statistical calculations. Plus, our Numerical Reasoning test covers candidates’ more general skills with numbers and the ability to interpret them in various scenarios.

To really get to know your quant candidates, combine these tests with our DISC or Enneagram personality tests.

This way, you’ll know precisely what your candidates’ skills are, how they deploy them in professional scenarios, and how they work with others to accomplish goals.

Seven interview questions and answers for quantitative analysts

Learn from the following examples of quant interview questions:

1. Imagine you’re playing a game where you draw cards, one at a time, from a shuffled deck of 52 cards. You stop drawing as soon as you pull the first ace, or when you’ve drawn 15 cards, whichever comes first. What’s the probability that you’ll draw an ace within these 15 cards? Outline your approach.

This question helps interviewers assess candidates’ probability and analytical skills. If time allows, you can ask candidates to work through the math, but even without a full solution, it’s a strong test of their ability to set up and explain a probability problem – often more valuable than a precise numeric answer.

Here’s a solid response to look out for:

Setting up the probability of not drawing an ace: The probability of drawing only non-ace cards for the first 15 draws begins with calculating the probability of each draw individually.

Starting with 48 non-ace cards out of 52, the probability of drawing a non-ace on the first card is 48/52. For the second card, it would be 47/51, and so on, following this pattern for each of the 15 cards.

Multiplying the probabilities: To find the total probability of drawing no aces in the first 15 draws, each of these probabilities would be multiplied: 48/52 × 47/51 ×… down to 34/38. This product would indicate a low probability of no aces appearing, as aces are relatively few in the deck.

Finding the probability of drawing at least one ace: Finally, subtracting this probability from 1 would yield the probability of drawing at least one ace within the first 15 cards.

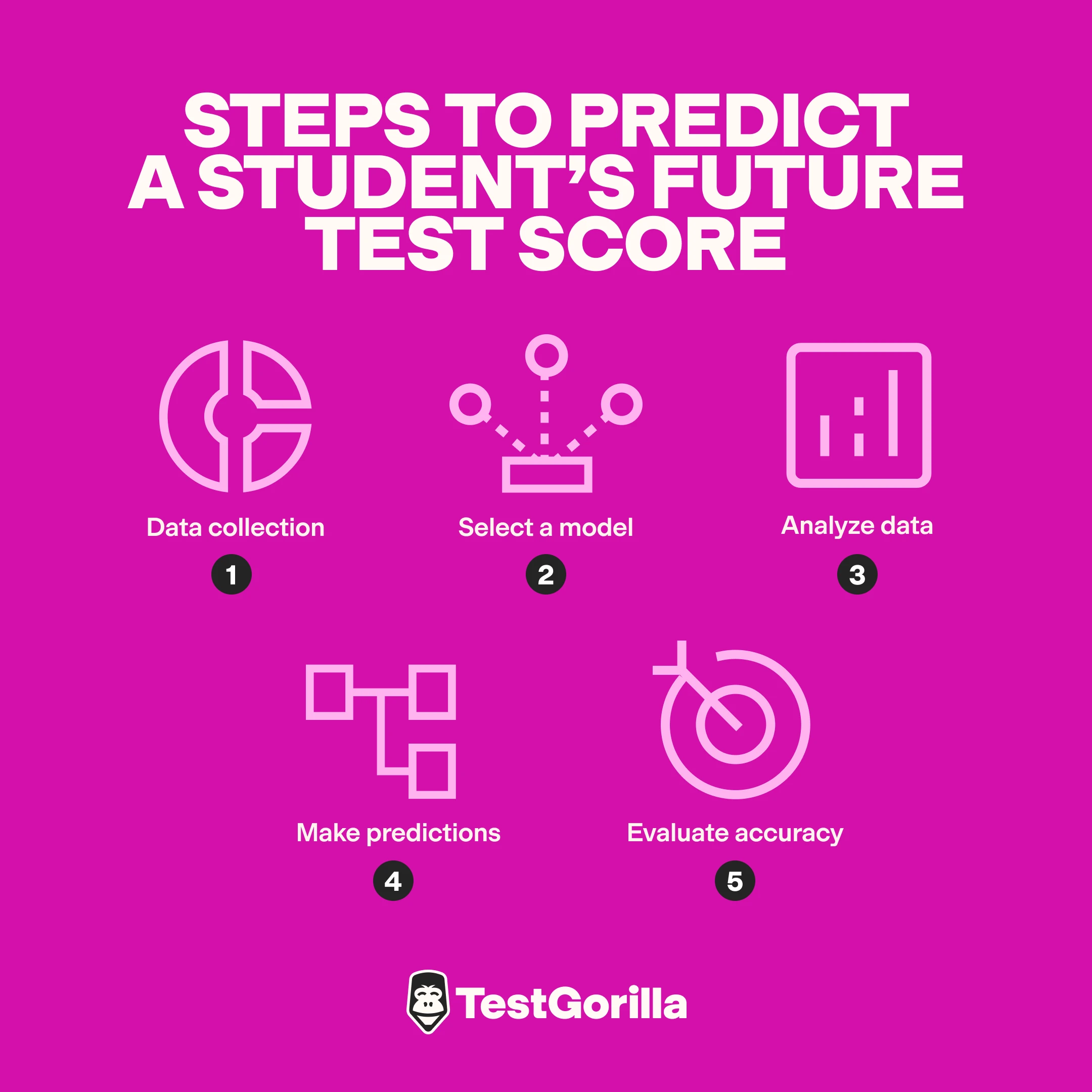

2. You're analyzing data about students' test scores. How would you use a statistical model to predict a student's future test score based on their past performance?

This question determines whether candidates understand how to use data and math to make predictions. It tests their ability to choose the right model, analyze information, and see patterns in data. Quants often use this practical skill in finance to predict future prices and make data-backed decisions.

A successful answer should lay out these steps:

Data collection: Gather information about the student's past test scores, including other factors that could affect their performance, like study time, sleep, and stress levels.

Select a model: Choose a statistical model, like linear regression, which provides straightforward insights into how past test scores and other variables affect future scores. It’s a solid baseline to see if a linear relationship explains the data well before considering more complex models.

Analyze data: Input the student’s past test scores and study habits into the model to find a clear mathematical relationship between past test scores and future scores. By examining the coefficients of these input features, the model reveals how each factor contributes to predicting student performance.

Make predictions: Once the model is ready, plug in a student's past data and the other variables to predict their future test score.

Evaluate accuracy: Check how accurate the predictions are by comparing them to actual test scores. If the predictions are close, the model is doing a good job.

3. Explain how you would create a computer program to help decide when to buy or sell stocks based on certain rules or patterns you've observed in the stock market.

Quants need to know how to use coding and logic to make decisions in a fast-moving financial world. This question assesses candidates’ ability to turn their trading ideas into a computer program and their understanding of risk management – a crucial aspect of trading.

Candidate responses should touch on the following key aspects:

Algorithm design: This is the process involved in designing the trading algorithm, including the rules, patterns, or strategies they've developed for buying and selling stocks.

Data analysis: This includes identifying and validating trading patterns by collecting historical stock market data, cleaning and reprocessing it, and conducting statistical analysis to confirm the patterns’ reliability.

Programming languages: Determine the programming languages and tools that would be used to implement the trading algorithm, such as Python, R, or specialized trading platforms.

Risk management: This includes measures such as stop-loss orders, position sizing, or portfolio diversification to mitigate potential losses.

4. Describe how you would clean and organize a large dataset of weather data to analyze temperature changes over the past year.

It’s common in many data-driven jobs to be able to handle and clean inconsistent, or disorganized data. This question assesses whether your quant candidates can organize data for analysis, which is vital for making accurate predictions and decisions.

A solid answer should cover three main areas:

Data preprocessing techniques: A strong response should begin with specific techniques for cleaning a dataset, like handling missing values (e.g., filling gaps with averages or interpolating data), detecting and treating outliers, normalizing data for consistency, and removing duplicates. These steps ensure the dataset is complete, accurate, and ready for analysis.

Time series handling: Candidates should discuss handling date and time information, essential for temperature analysis. This might include parsing timestamps, converting them to standard formats, aggregating data into relevant time intervals (such as daily or monthly averages), and identifying trends. These steps allow for meaningful insights into temperature changes over time.

Data storage and optimization: Finally, candidates should discuss how they’d store and access the data efficiently. They might suggest saving it in a simple format like CSV or using SQL or time-series databases for faster searches and analysis. This shows they can keep data organized and easy to access when needed.

5. Explain the Black-Scholes mathematical model and its practical applications.

The Black-Scholes model is a fundamental financial model that most quants should be familiar with. This question is a great way to assess quants’ understanding of the model and its real-world applications.

What to look for in the response:

Purpose of the Black-Scholes Model: A candidate should explain that it’s used to price financial instruments like stock options, futures, and other derivatives.

Key variables and concepts: They should touch on the main variables – current asset price, strike price, time to expiration, interest rate, and volatility – and how they influence the model.

Practical applications: Ideal answers will include practical uses, such as helping firms determine fair pricing, hedge risks, or make trading decisions.

6. Explain how stress testing is applied in finance to assess the resilience of a portfolio or financial institution during extreme market conditions.

This question looks at a candidate’s skills in risk management, quantitative analysis, and scenario planning – all key for a quant role. By explaining stress testing, they show they understand how to prepare for tough situations and use data to spot potential risks.

What to look for in the response:

Purpose of financial stress testing: Candidates should explain that stress testing in finance is used to simulate extreme scenarios (e.g., economic downturns, market crashes) to evaluate how a portfolio or institution might respond.

Quantitative methods and assumptions: They should discuss key quantitative techniques and assumptions, like adjusting asset correlations, volatility, or interest rates to assess vulnerabilities.

Practical application: Strong candidates will mention how insights from stress testing help firms strengthen risk management, ensure regulatory compliance, and prepare for worst-case scenarios.

7. You have a bag with 10 marbles: five red, three green, and two blue. If you draw two marbles without replacement, what's the probability you'll get one red marble and one green marble?

This question tests candidates' ability to work with probability, handle events without replacement, and calculate sequential outcomes. These skills are at the heart of quantitative analysis and are key for real-world financial or statistical work.

To calculate this probability, candidates should think of it as two separate events:

Event 1: A red marble is drawn on the first try. The chance of this happening is five red marbles out of the ten total marbles in the bag, which is 5/10 or ½.

Event 2: On the second try, a green marble is drawn. As one marble has already been removed from the bag, there are only nine marbles left. Of those nine, three are green. So, the probability of picking a green marble on the second try is 3/9 or ⅓.

To find the overall probability of both events happening in sequence, multiply their individual probabilities:

½ x ⅓ = ⅙

Therefore, there’s a ⅙ chance of picking one red and one green marble when you draw two marbles from the bag without replacement.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

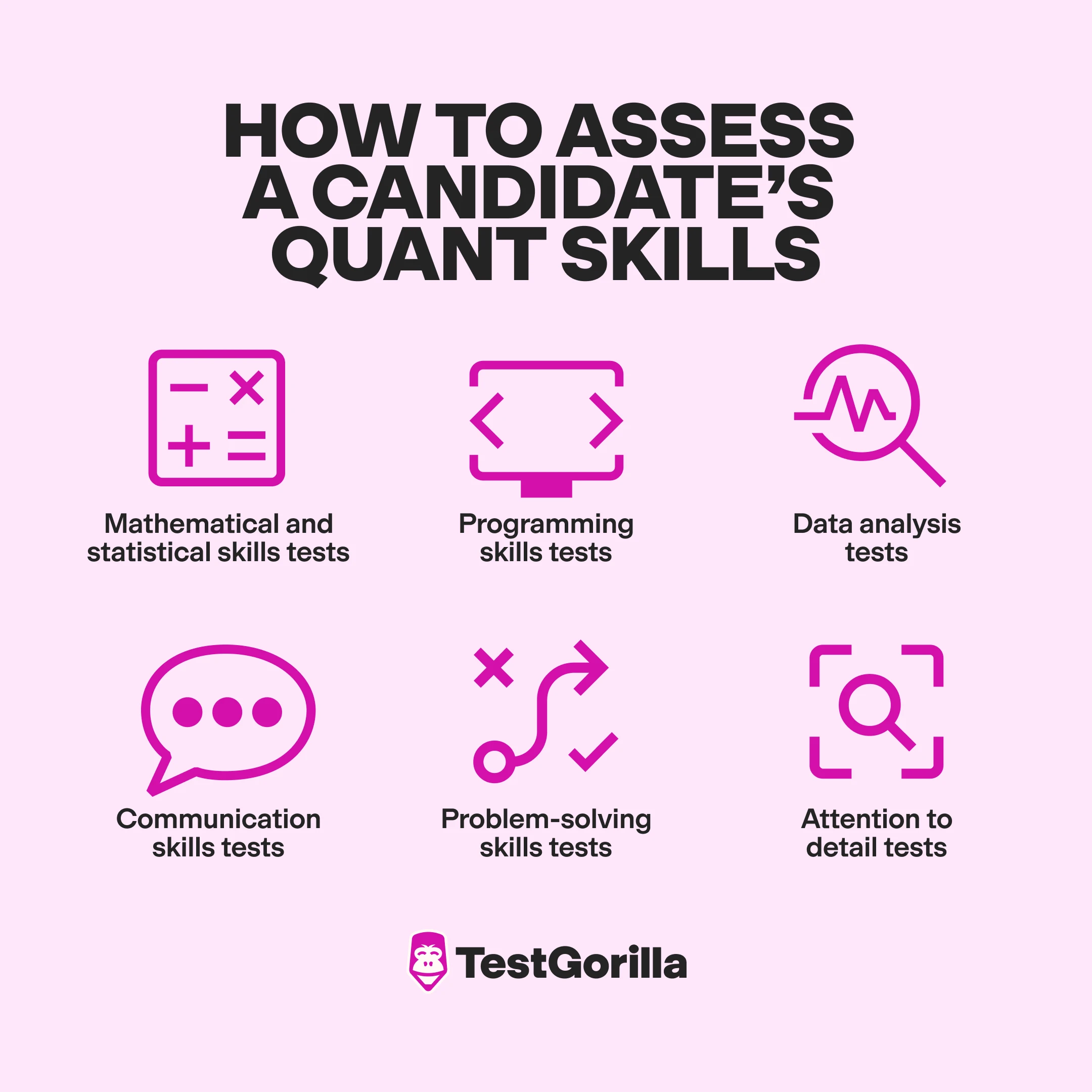

How to assess a candidate’s quant skills

Creative quant interview questions are a great way to gauge a candidate's skills, but they shouldn’t be the only factor in making a hiring decision. Relying solely on these questions can miss the bigger picture of a candidate's experience, fit, and overall potential.

For a comprehensive assessment of your quant candidate, consider taking TestGorilla’s multi-measure approach, combining role-specific skills tests, cognitive ability tests, and personality assessments with quant interview questions.

This way, you get a well-rounded view of their technical abilities, problem-solving skills, and personality – helping you make a confident hiring decision.

Start by mixing and matching tests from TestGorilla’s extensive test library to create a tailored assessment.

Here are some helpful tests to consider:

Mathematical and statistical skills tests evaluate candidates’ overall numerical aptitude and ability to interpret numbers in various practical contexts.

Programming skills tests assess candidates’ practical experience with coding languages and working with arrays.

Data analysis tests evaluate how candidates understand and statistically interpret data to make decisions.

Communication skills tests measure candidates’ abilities to communicate professionally with clarity and effectiveness, considering written and spoken communication, as well as active listening skills.

Problem-solving skills tests look at candidates’ capacity to define problems, analyze data, and process textual information to make accurate decisions.

Attention to detail tests assess candidates’ ability to focus on textual details while processing information.

Take a multi-measure approach to recruit skilled quants

Quantitative analysts are highly skilled professionals who have a range of expertise in math, statistics, and programming. Finding the right quant for your business can be challenging, so it’s important to use the right hiring tools.

First, draw in strong applicants with an effective quantitative analyst job description. Then, assess the most promising candidates to determine if they can handle your sensitive and complex data.

When it comes to interview time, you’ll need to include specific quant interview questions to assess candidates’ technical, cognitive, and interpersonal skills in real time.

However, for best results, you should consider taking a multi-measure approach to hiring and combine these questions with skills-based assessments to obtain a comprehensive profile of a candidate.

Want more tools to recruit quantitative analysts? Sign up for TestGorilla’s Free plan or request a free 45-minute live demo today.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.