50+ senior accountant interview questions to ask candidates

Accounting is the process of collecting and studying important financial information to help a company track its income and expenditures.

Those working in this industry require strong numerical skills and mathematical knowledge to complete demanding tasks. Using skills assessments and engaging interview questions is essential to hire the right professionals.

One test you should include in your skills assessment is the Advanced Accounting test. You can use this test to determine which candidates can manage financial records and accounting figures for your business.

So, are you ready to find top talent? Discover more than 50 senior accountant interview questions and sample answers to help you hire a professional for your financial team.

Table of contents

- 20 frequently asked senior accountant interview questions to ask candidates

- 8 sample answers to essential frequently asked senior accountant interview questions

- 18 challenging senior accountant interview questions to ask job applicants

- 6 sample answers to essential challenging senior accountant interview questions

- 16 situational senior accountant interview questions to help you hire the right candidate

- 5 sample answers to essential situational senior accountant interview questions

- When should you use senior accountant interview questions in your hiring process?

- Find experienced professionals using our skills tests and senior accountant interview questions

20 frequently asked senior accountant interview questions to ask candidates

Check out these 20 frequently asked senior accountant interview questions to learn more about your candidates’ experience, accounting skills, technical knowledge, and behavior in the workplace.

1. Explain the systems you have in place for keeping track of assignments given to staff members.

2. How do you stay organized as a senior accountant?

3. Talk me through the steps of meeting tight deadlines.

4. Describe how you would monitor your team’s performance.

5. How do you stay aware of accounting and auditing standards?

6. Are you comfortable learning new software?

7. How do you direct internal and external audits?

8. What is the accounting equation?

9. What are the main features of a financial statement?

10. Share some of your career goals in accounting.

11. What accounting software are you familiar with?

12. Are you able to explain complex financial information to those who don’t have experience in the accounting industry?

13. Explain what financial forecasting and projections are.

14. Explain your budget preparation process.

15. What are some common errors in accounting?

16. How would you deal with a difficult client?

17. What qualities do you believe make a good accountant?

18. Tell me about a time you made a mistake at work. How did you handle it?

19. What experience do you have in supporting and training beginner accounting staff?

20. Describe a time you were unhappy with an accounting process. What did you do to improve it?

8 sample answers to essential frequently asked senior accountant interview questions

Refer to these sample answers to some of the most important frequently asked accountant interview questions to hire the right person for your company.

1. How do you direct internal and external audits?

An internal audit is a process accountants use to review their own organization’s operations. They can also assist in risk management to identify any financial or legal issues.

On the other hand, an independent accountant who isn’t related to your company is responsible for conducting an external audit. In this case, they will examine your organization’s financial statements and important business records.

Senior candidates should understand how to direct these processes. They need to request external audits each year and internal audits on a continual basis, whether that’s weekly or daily.

Do you want to test candidates’ knowledge of audits? Send them an International Standards on Auditing test to determine whether they can plan and perform financial assessments for your business.

2. What is the accounting equation?

The accounting equation is a basic formula that calculates assets. Skilled candidates will know that the equation takes the following form: assets = liabilities + shareholder’s equity.

Senior accountants use this equation to calculate a company’s total assets. Experienced candidates should understand how to use the accounting formula when completing tasks on a double-entry bookkeeping system.

3. Explain your budget preparation process.

Each candidate may have their own unique budget preparation process, but learning about their personal accounting processes is still important.

For example, one candidate may prefer to learn your organization’s goals before creating a budget that aligns with your incoming and outgoing expenses. Other applicants could first determine the income and cash flow when evaluating income sources such as investments, returns, shares, and bonds.

A standard budget preparation process includes the following steps:

Understand the company’s goals

Estimate the income for the time covered by the budget

Identify fixed costs and variable expenses

Calculate the budget deficit or surplus

4. What experience do you have in supporting and training beginner accounting staff?

Senior accountants should be capable of training beginners in your organization. This requirement is key because top professionals usually have more experience in the accounting industry. An ideal candidate will explain their process for training new team members who have less work experience in accounting firms.

Use a Leadership & People Management test to find potential leaders among your group of candidates. Accountants with more advanced knowledge and expertise can encourage your team to develop new skills.

5. What accounting software are you familiar with?

Accounting software helps accountants record and organize transactions, financial statements, and standard bookkeeping tasks. It’s easier to store information in one place than handle paper documents that team members can misplace or damage.

Over the past few years, the accounting industry has generated more than $141bn just from accounting software and financial profit. Therefore, candidates must be prepared to use this technology.

Candidates should give examples of accounting software and how these programs helped them develop their financial skills. For instance, Xero is a cloud-based accounting program that accountants use to perform the following tasks:

Track projects

Accept payments

Manage contracts

Organize expenses

Senior candidates may know more about similar software, depending on their level of expertise.

A Xero test helps you discover which candidates have experience with this accounting program. The test gives them a chance to prove their ability to generate financial reports and process transactions.

6. How do you stay aware of accounting and auditing standards?

Staying up to date with accounting regulations and standards is critical. Candidates need to be aware of the latest trends, especially if they want to provide accurate and consistent information.

Senior candidates might:

Subscribe to newsletters from large accounting firms

Attend business conferences

Join industry associations

Check government websites for updated rules

Read online and print publications

7. Explain the systems you have in place for keeping track of assignments given to staff members.

Candidates with more experience may have the confidence to track completed team members’ tasks. You’re looking for senior professionals who can guide others and develop techniques for monitoring employee productivity.

Each candidate will have their own process, but you should focus on their organization and time management skills. Many accountants use project management software to track how long team members spend on each task.

Send candidates a Time Management test to see how they prioritize, delegate, and complete accounting tasks.

8. Tell me about a time you made a mistake at work. How did you handle it?

Everyone makes mistakes in the workplace, even advanced professionals. Making and learning from mistakes encourages employees to achieve their personal development goals. Therefore, senior candidates should be honest about past accounting errors and how they overcame them.

For example, accountants may include the wrong information on a financial statement, slowing down the company’s operations. To resolve this mistake, they can notify higher management and complete another statement to ensure the information is accurate.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

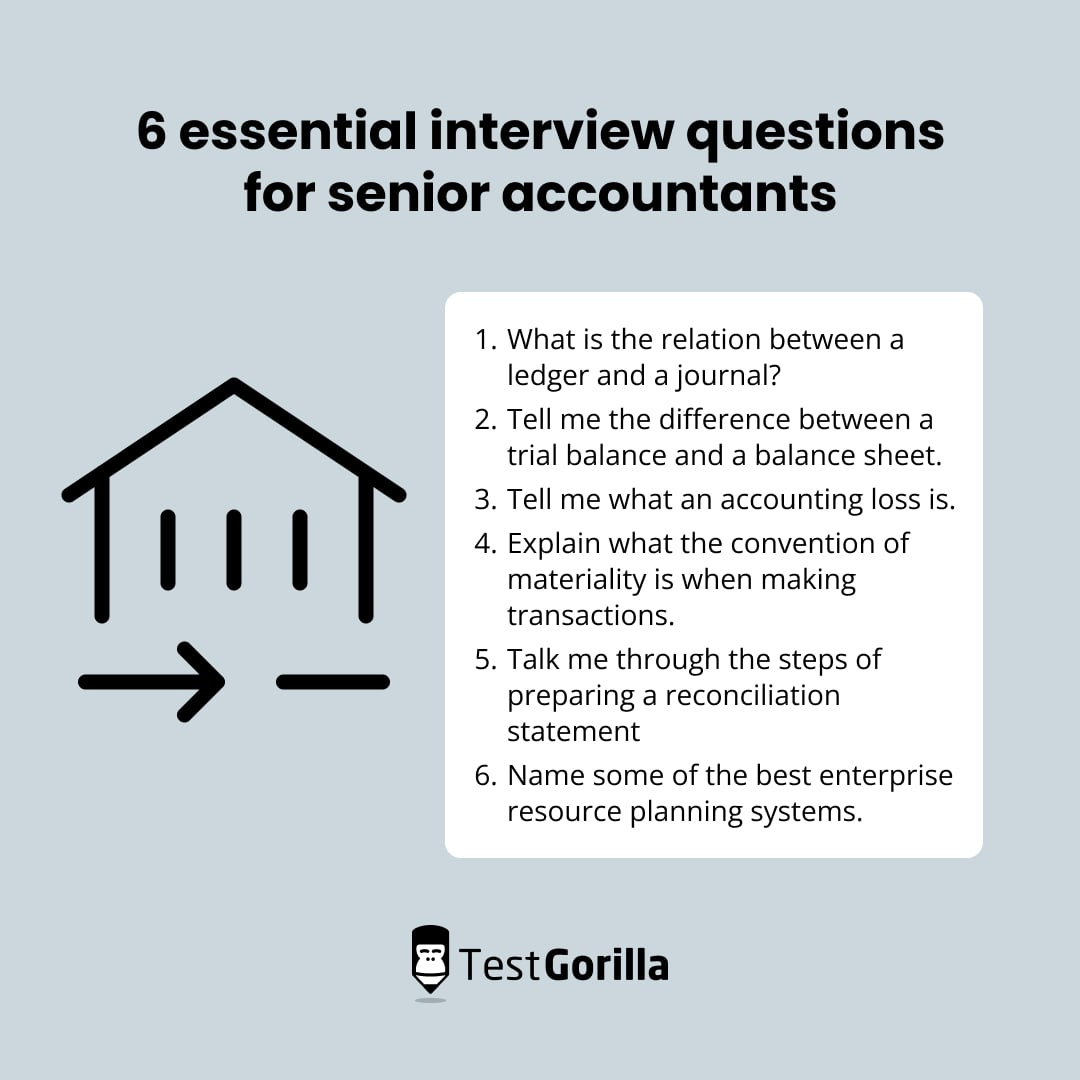

18 challenging senior accountant interview questions to ask job applicants

Below are 18 challenging senior accountant interview questions. Use these questions to determine how much experience candidates have in the accounting industry.

1. What is the relation between a ledger and a journal?

2. Name some of the best enterprise resource planning systems.

3. Tell me the difference between a trial balance and a balance sheet.

4. What is the difference between cash and trade discounts?

5. Talk me through the steps of preparing a reconciliation statement.

6. Name some essential terms you must include in a balance sheet.

7. What is deferred revenue expenditure? Give me some examples.

8. Why do we need accounting standards?

9. How do you calculate owner’s equity?

10. What is a bank reconciliation statement?

11. Explain what the convention of materiality is when making transactions.

12. Tell me what an accounting loss is.

13. What is creative accounting?

14. Share the differences between a debit note and a credit note.

15. What is the relationship between cost accounting, financial accounting, and managerial accounting?

16. Tell me the four phases of accounting.

17. What is computerized accounting?

18. Explain what real and nominal accounts are in accounting. Can you give me examples?

6 sample answers to essential challenging senior accountant interview questions

Compare your candidates’ responses with these sample answers when evaluating their skills, accounting knowledge, and talent gaps.

1. What is the relation between a ledger and a journal?

A journal is a subsidiary book of account that stores transactions. Ledgers are principal books of account that organize and summarize recorded transactions in a journal. They function in physical books or software, depending on how you prefer to keep financial information.

Senior candidates should understand what these accounting entries are and how they relate to business transactions.

Since candidates must be able to explain financial information and related processes, send them an Accounting Terminology test to see what terms they understand. Skills tests like this are the fastest way to review applicants’ expertise.

2. Tell me the difference between a trial balance and a balance sheet.

Candidates of all levels should know the main functions of a trial balance and standard balance sheet in accounting. This question will give you a better idea of whether they have enough experience for your open position.

A trial balance depicts the closing balance of standard ledgers. On the other hand, a balance sheet shows accountants the total assets, liabilities, and shareholder’s equity. These documents are crucial because they represent the financial affairs given to external stakeholders.

3. Tell me what an accounting loss is.

An accounting loss refers to a decrease in net income. This decrease means that the revenue generated from selling your products is less than the costs required to make them. Candidates should understand this basic term if they have experience working in accounting firms.

They can also mention the following possible reasons for an accounting loss:

Cash or goods lost because of theft

Low revenue stream

Competitive markets

Weak budgeting strategies

Inefficient accounting staff

Rising variable costs

4. Explain what the convention of materiality is when making transactions.

The convention of materiality is the concept that accountants should report only essential or relevant material items in financial statements. This helps companies record business transactions that accounting standards haven’t addressed.

Senior accountants should follow these practices when managing a significant business transaction in their organization.

Use a Financial Accounting test to find out which candidates can handle complex accounting transactions that focus on cash flow, income statements, and statutory compliance.

5. Talk me through the steps of preparing a reconciliation statement.

A reconciliation statement is a document that compares the balances of two different accounts to ensure they are in agreement and detect any errors.

Depending on the accountant’s preferences, there are a few ways to prepare this vital information. Candidates should understand what this statement is and how to organize one for your business.

Preparing a reconciliation statement involves the following steps:

Match the deposits:

Once your organization receives a bank statement, the accountant will compare issued checks and deposits. This action ensures every bank record aligns with the debit side of the bank statement.

Adjust bank statements:

Accountants write down how much the bank receives on a cash balance statement. They can also deduct any outstanding checks that the bank hasn’t cleared.

Make cash account adjustments:

Next, it’s crucial to adjust the cash balance (fees and interest) in the business account. An accountant may have to remove monthly service charges, overdraft fees, and accounting errors.

Compare balances:

This step determines whether the accountant has matched the bank and cash balance correctly. They must ensure the ending balances are equal on a reconciliation statement before including it in the company’s yearly audit.

6. Name some of the best enterprise resource planning systems.

Enterprise resource planning (ERP) is a type of software system that accountants use to manage financial resources.

Senior candidates should have experience with ERP if they want to support your organization’s day-to-day activities. It’s also essential for these professionals to understand basic budgeting and resource management when using this advanced software.

The following are some of the best enterprise resource planning systems:

Oracle NetSuite

SAP S/4HANA

SAP ERP

Microsoft Dynamics 365

Oracle ERP Cloud

Epicor ERP

Sage Intacct

Oracle JD Edwards EnterpriseOne

SAP Business One

Salesforce CRM

Send candidates a Financial Management test to see whether they can maximize your company’s profits and manage its overall finances using ERP.

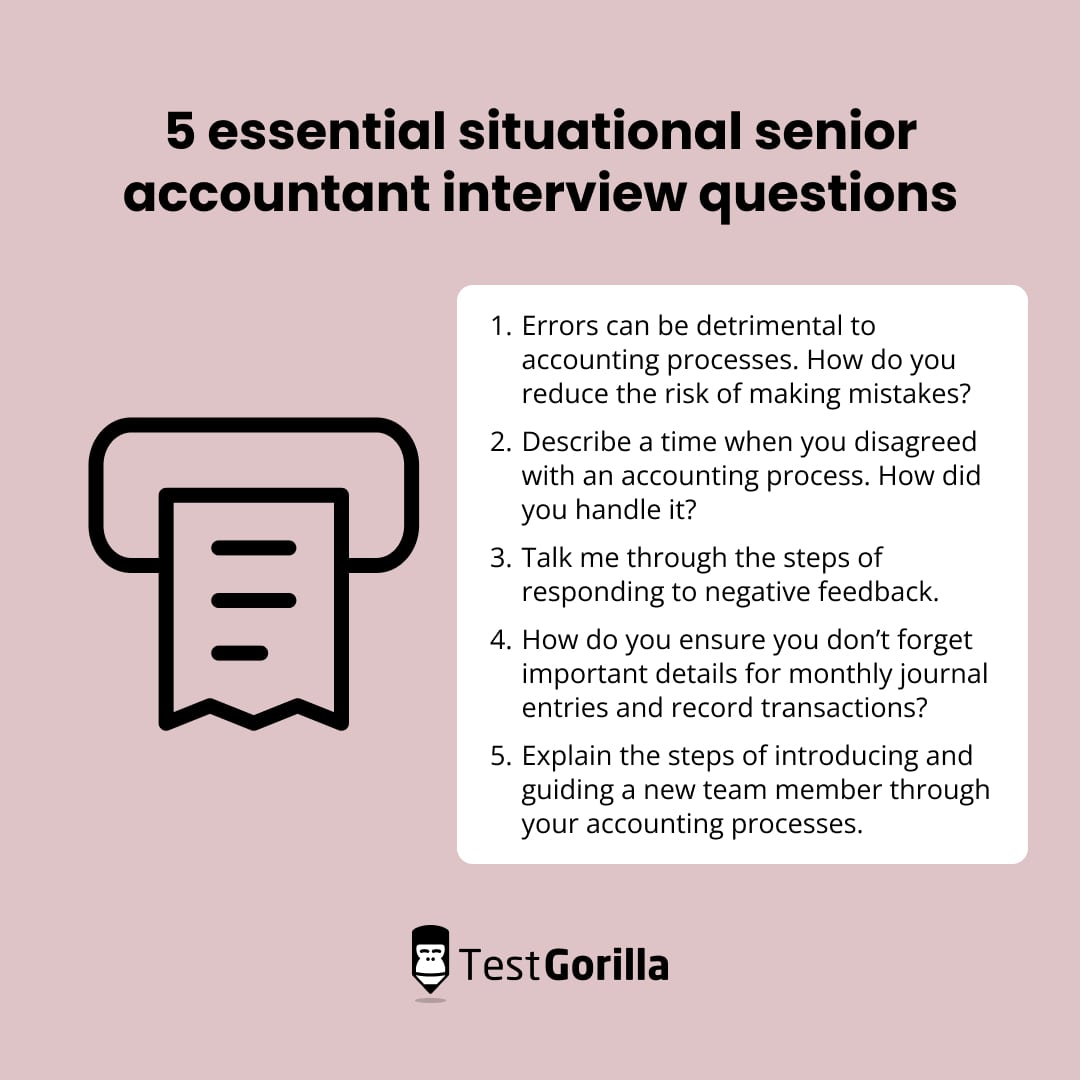

16 situational senior accountant interview questions to help you hire the right candidate

Use these 16 situational senior accountant interview questions to learn about candidates’ behaviors and accounting processes.

1. Describe a time when you disagreed with an accounting process. How did you handle it?

2. How do you maintain accounting accuracy?

3. Talk me through the steps of responding to negative feedback.

4. Errors can be detrimental to accounting processes. How do you reduce the risk of making mistakes?

5. Describe one of the biggest challenges in the accounting industry and how you plan to overcome it.

6. How do you respond when a colleague disagrees with you?

7. How do you verify the reliability of accounting information given to you by an outside source?

8. What would you do if you spotted an error in another team member’s work?

9. Tell me about a time you were able to reduce the cost of an accounting procedure.

10. Talk me through the steps of introducing a new team member and guiding them through your accounting processes.

11. If you have collected cash from customers but not recorded it as revenue, what happens to it?

12. How do you record PP&E? Why is this process important?

13. How do you ensure you don’t forget key details for monthly journal entries and record transactions?

14. Describe a time when you had to use numerical data or a graph to convince higher management to accept your idea.

15. Tell me about a time that you needed to be innovative to meet a customer’s demands.

16. If you had a chance to acquire any accounting skill you don’t currently have, what would it be?

5 sample answers to essential situational senior accountant interview questions

Here are some sample answers to situational accounting interview questions. Refer to these when reviewing candidates’ responses after the interviews.

1. Errors can be detrimental to accounting processes. How do you reduce the risk of making mistakes?

Accounting errors can negatively impact your company’s financial processes. Research shows that more than 66% of accounting firms provide continuous training just to prevent errors. Therefore, hiring a senior accountant who can minimize mistakes is important to ensure the financial department stays on track.

One way to achieve this goal is by using software that automatically detects errors in financial statements. Technology catches errors that the human eye may miss. Some accountants might also improve their record-keeping to reduce errors in accounting transactions.

2. Describe a time when you disagreed with an accounting process. How did you handle it?

Accountants will always have their preferences when completing tasks. Since accounting is challenging, these professionals may create processes to help them manage important information.

Sometimes other team members will disagree with specific methods, so it’s critical that your candidates know how to negotiate ideas when straying away from standard processes.

Send candidates a Negotiation test to see how they would influence conversations and convince higher management to try another accounting process.

3. Talk me through the steps of responding to negative feedback.

Negative feedback can feel daunting, but it’s vital to take the points on board. Even though senior candidates have more experience and skills, they can still benefit from constructive criticism on how they complete specific tasks. Therefore, you should hire a professional who acts upon feedback in a positive way.

For example, they might respond by creating an action plan that encourages them to achieve their personal development goals.

Use a Big 5 (OCEAN) personality test to evaluate the candidate’s openness, conscientiousness, extroversion, agreeableness, and emotional stability to understand how they might receive feedback and make changes.

4. How do you ensure you don’t forget important details for monthly journal entries and record transactions?

Senior candidates may respond that they check profit, loss, and balance sheets regularly to ensure the information is accurate. They can also make a checklist to help them complete a month-end journal entry.

Accountants usually create comprehensive reports containing important information or update journal entries that focus on transactions flowing in and out of your organization.

5. Explain the steps of introducing and guiding a new team member through your accounting processes.

Candidates with strong leadership skills should be able to guide others in your team and train new employees who don’t have as much financial knowledge. It’s essential that all employees receive the same warm welcome when joining a group of experts.

Senior accountants can teach beginners effective accounting processes that will help them avoid crippling errors.

The senior candidate could take the following steps:

Communicate your company’s core values

Outline expectations in the accounting department

Introduce the new hire to other team members

Give them a dedicated training day

Add them to a group chat for further communication

Being a leader requires strong communication, so it’s worth sending candidates a Communication skills test to see how they actively listen and react to verbal and non-verbal cues.

When should you use senior accountant interview questions in your hiring process?

Using skills tests before asking senior accountant interview questions in an interview can help you focus on only the most talented professionals. This process ensures you only interview candidates with relevant skills and knowledge of accounting practices and documents, such as transaction records and financial statements.

For example, sending candidates a Numerical Reasoning test will help you determine who has the most advanced numerical skills. The test results will show you whether candidates can understand number patterns and manage finances in accounting.

By using skills tests, you can also take advantage of the following benefits:

Reduce

Fill skill gaps in your organization

Avoid a bad hire

Speed up recruitment time

Enhance the candidate experience

Improve your brand

Reduce your employee turnover rate

Find experienced professionals using our skills tests and senior accountant interview questions

Now that you have some interview questions, what’s next?

Our test library can help you find relevant skills assessments for a senior accountant role. You can search through personality, cognitive function, situational judgment, and language tests to help you hire a professional for your company.

For more guidance, book a free 30-minute live demo to learn how skills tests can enhance your hiring process. We will also evaluate your recruitment strategies to determine their effectiveness in locating talent.

Hire an experienced professional using our skills assessments and senior accountant interview questions.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.