Financial analysts most often work at banks, financial institutions, or medium-sized to large enterprises. They’re responsible for analyzing financial data and helping businesses define and manage their overall financial and investment strategy.

To accomplish this, they analyze all sorts of financial data related to:

The company: forecasts and reports of past performance, investment opportunities, and financial strategy

National and international financial markets: stock market data, economic trends, forecasts, conditions, business news, and more

The job of a financial analyst is complex and requires knowledge of financial markets, accounting skills, financial modeling skills (such as financial modeling in Excel), problem-solving skills, leadership skills, communication skills, and more.

Financial analysts typically have either an MBA or a bachelor’s or master’s degree in finance, accounting, mathematics, business management, or a related field.

In this article, we’ll look into the job description of financial analysts and discuss their typical duties and responsibilities, education, skills and qualifications, and experience.

We’ll also give you a quick step-by-step guide on how to hire a financial analyst for your organization without bias, guesswork, or countless rounds of interviews.

A financial analyst’s job description

So, what do financial analysts do, and what skills and knowledge do they need to be successful?

In this section, we’ll look into the different parts of a typical job description for the role of a financial analyst.

Of course, the actual job description will depend on the role, sector, and company, but there are some key components that you’ll likely encounter often.

Psst! Here’s a great financial analyst job description template.

What are financial analysts’ duties and responsibilities?

Financial analysts provide financial analysis, advice, and guidance to stakeholders to help them make key business decisions.

Some of the typical duties of a financial analyst include:

Preparing and analyzing past financial data (reports, balance sheets, market information)

Analyzing present financial performance and making strategic recommendations

Performing periodic reviews and financial evaluations

Preparing projections and forecasts based on past and present financial data

Creating financial models (often in Excel) to inform strategies and forecasts

Working with big data sets to analyze market, industry, and sector trends and their impact on the business

Identifying investment opportunities and studying risk factors

Developing reports, tools, and Excel dashboards for financial reporting, analysis, and forecasting

What are the education requirements for financial analysts?

There are no strict career-wide requirements for financial analysts like there are in medicine or law, so education requirements will vary by company and sector.

Typically, financial analysts are expected to have either an MBA or a bachelor’s or master’s degree in finance, accounting, economics, mathematics, statistics, or a related field.

The field is fairly competitive, and large enterprises and financial institutions often recruit financial analysts straight out of top colleges or universities.

The CFA Institute offers a globally recognized certification program for Chartered Financial Analysts.

Additionally, the Financial Industry Regulatory Authority (FINRA) offers three more exams for financial analysts:

The Series 7 exam

The Series 63 exam

The Securities Industry Essentials (SIE) exam

What skills do financial analysts need to succeed?

Financial analysts need various skills to be successful. We can roughly split these skills into two categories:

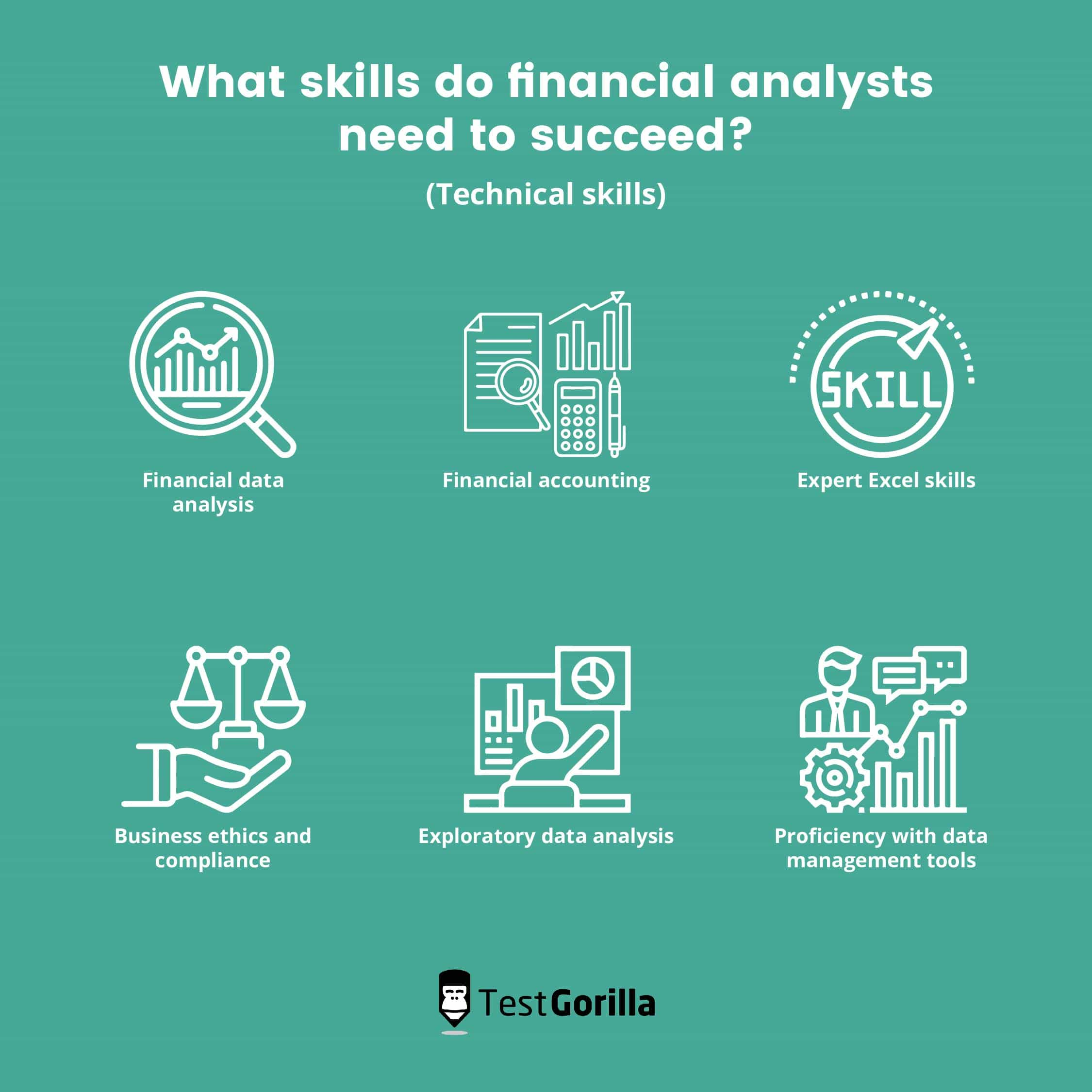

1. Technical skills

Key technical skills that financial analysts need include:

Financial data analysis skills

Financial accounting skills

Expert Excel skills, including financial modeling in Excel

Business ethics and compliance

Exploratory data analysis

Proficiency with data management tools, such as Tableau, SQL, SQLite, SAP BusinessObjects, and Power BI

2. Soft skills and cognitive abilities

Financial analysts also need the following soft skills to perform well on the job:

Math and numerical reasoning skills

Problem-solving skills

Critical-thinking abilities

Communication skills

Leadership skills

Attention to detail

In essence, financial analysts need to be able to analyze data and present their findings concisely and convincingly to stakeholders and peers.

What are the experience requirements for financial analysts?

Junior financial analysts can start out with no experience and move up to more senior positions with time. The typical requirements for junior financial analyst roles include:

Zero to three years of experience

Strong financial analysis and financial modeling skills

Familiarity with other relevant data management tools

For more senior roles, companies usually require a certain number of years of experience and a proven track record. Experience requirements might look something like this:

Three to five years of experience in a similar role

A proven track record within a similar organization

Excellent financial analysis and financial modeling skills

Proficiency with Excel and multiple data analysis tools

Relevant certifications

How to hire a financial analyst: a step-by-step guide

When hiring a financial analyst, assessing applicants’ skills accurately and objectively is a must – but it can also be challenging.

Thankfully, it becomes much easier when you use the right tools.

In this section, we’ll guide you through the process of hiring a skilled financial analyst for your organization, even if you’ve never done so before. We’ll also show you how to use skills tests to streamline your hiring process and hire the best candidate without bias.

Here’s how to hire your next financial analyst:

Write a detailed job description: Create a detailed job description based on the job’s specifics. Include information about the project or team, and decide on must-have and nice-to-have skills. For guidance, check out this auditor job description template.

Decide on the skills you need to assess during the recruitment process: Define the crucial skills for the job that you need to evaluate during the hiring process, either with a skills test or during the interview.

Build a skills assessment: Create a skills assessment consisting of up to five skills tests. Some examples of financial-analyst tests you can use are the Financial Modeling in Excel test, the Financial Accounting (US GAAP) test, and the Exploratory Data Analysis test.

Post a job ad on job boards and collect applications: Post an advertisement for your open position on job boards, LinkedIn, and your website and collect applications.

Ask applicants to complete the skills assessment: Send candidates a link to the skills assessment you prepared in step 3. Provide applicants information on your hiring process to give them context – this will help you increase engagement and build a strong employer brand.

Analyze the results to identify your best applicants: Once the test results are in, you’ll be able to identify your best candidates instantly. TestGorilla enables you to quickly compare applicants and look at individual test scores to understand each candidate’s strengths and weaknesses better.

Invite the most qualified applicants to a structured interview: Select your most skilled applicants and invite them to an interview to get a deeper insight into their expertise and knowledge. Use structured interviews to minimize bias and assess candidates objectively.

Make a hiring decision based on the data you’ve collected: Based on all the information you’ve gathered up to now, you’ll be able to make an objective hiring decision. Extend an offer to your best candidate, negotiate conditions, and define a start date.

Inform unsuccessful applicants: Don’t forget to let unsuccessful candidates know your decision. Most companies still don’t do this, so it’s an excellent opportunity to stand out and show applicants that you care about them.

Onboard your new hire: You can use your new employee’s test results and your interview notes to tailor the onboarding process to their needs. This will help them become productive faster and enable you to provide a better employee experience.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Hire a skilled financial analyst the easy way

Even though the job of a financial analyst is complex, hiring one doesn’t have to be difficult.

If you have the right tools in your toolbox – such as skills tests and structured interviews – and use the right approach to hiring, hiring can be almost effortless.

Skills testing enables you to evaluate applicants’ skills accurately, objectively, and without bias, helping you quickly identify the best talent in your talent pool.

Build a skills assessment of up to five tests (remember to include the Financial Modeling in Excel test), and send it to prospective employees to see who has the right skills for the role.

This way, you’ll only interview your best applicants, streamlining and shortening your hiring process and helping you save a lot of time, money, and energy. And, as we all know, the best talent is scarce, so to recruit it, you need to move quickly.

Don’t waste weeks or months in hiring limbo: With TestGorilla, you can hire the right financial analyst for your organization in a fraction of the time you’d otherwise need.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.