Accounts Payable test

Summary of the Accounts Payable test

Our Accounts Payable test evaluates candidates’ skills in identifying, recording, and managing accounts payable. The test helps you identify accountants who have the required skills to deal with accounting matters related to accounts payable.

Covered skills

Managing accounts payable

Recording transactions

Finding missing information

Reconciling accounts payable

Use the Accounts Payable test to hire

Accounts payable specialists, accounts payable managers, finance managers, auditors, and other roles that require a good grasp of accounts payable.

About the Accounts Payable test

People with strong accounts payable skills keep your business compliant, from recording transactions to preparing purchase orders and maintaining cash flow.

You can use our Accounts Payable knowledge test to find the best candidates who can confidently and accurately manage invoices and outgoing payments.

It uses practical, scenario-based questions that ask applicants to solve issues that regularly arise when handling accounts payable, such as preparing records and passing them in the appropriate books, registering transactions to trial and final accounts, and understanding related documents that affect accounts payable.

What’s more, TestGorilla helps you assess candidates’ knowledge in the following topics:

Work with the balance sheet, liabilities, and financial statements independently with confidence

Maintain accurate financial accounting records

Communicate accounting issues clearly with relevant parties

Source data and record and prepare financial reporting

Ensure businesses remain financially compliant

Want to know more? Look at some multiple choice preview questions from the Accounts Payable assessment test practice before you start.

The test is made by a subject-matter expert

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Abdul G.

Abdul is a chartered accountant and certified ISO 31000 risk manager with over 15 years of experience managing other accountants and staff in many businesses, large and small. Abdul also has an MBA with significant consulting experience across business sectors, including oil and gas, pharmaceuticals, food, and education.

He has worked as a university lecturer in accounting, finance, and tax-related subjects for more than five years and currently works on complex risk management policies as a senior risk management officer.

Reliability: Cronbach’s alpha coefficient = .67

Face validity: Candidates rated this test as accurately measuring their skills (average score of 3.71 out of 5.00).

Criterion-related validity: Candidates with higher scores on this test received higher average ratings from the hiring team during the selection process (r = .31, N = 520).

For an in-depth look at interpreting test results, please take a look at our Science series articles: How to interpret test fact sheets (part 1): Reliability, and How to interpret test fact sheets (part 2): Validity.

For an explanation of the various terms, please refer to our Science glossary.

Reliability and validity | Sufficient data available | Analyses and checks conducted | Outcome |

|---|---|---|---|

Reliability | ✔ | ✔ | Acceptable |

Content validity | ✔ | ✔ | Acceptable |

Face validity | ✔ | ✔ | Acceptable |

Construct validity | ✔ | ✔ | Acceptable |

Criterion-related validity | ✔ | ✔ | Acceptable |

Group differences | |||

Age differences | Pending | Pending | Pending |

Gender differences | ✔ | ✔ | Acceptable |

Ethnicity differences | Pending | Pending | Pending |

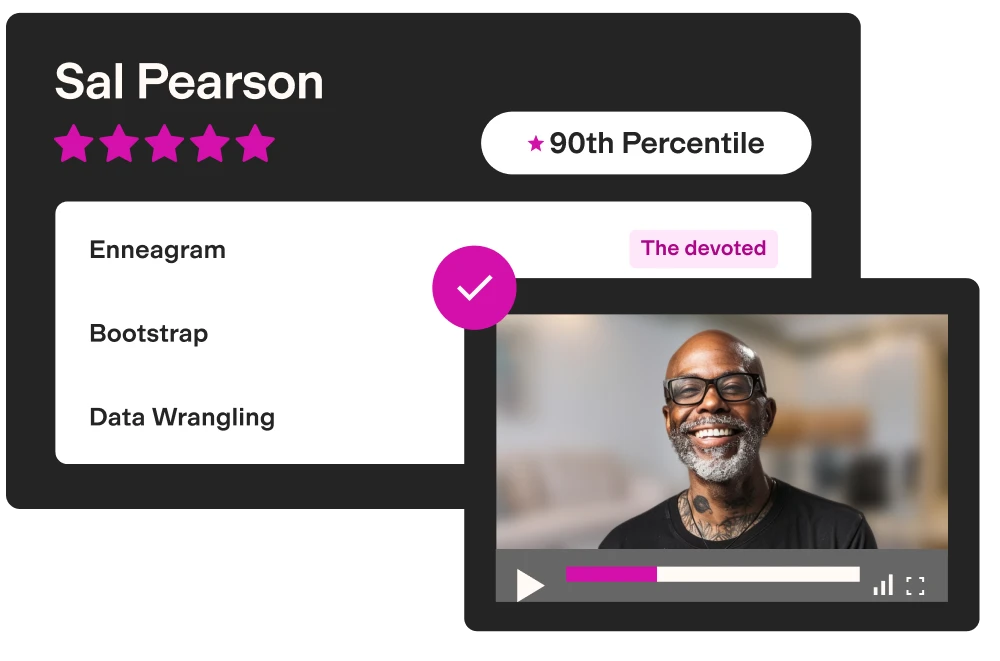

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

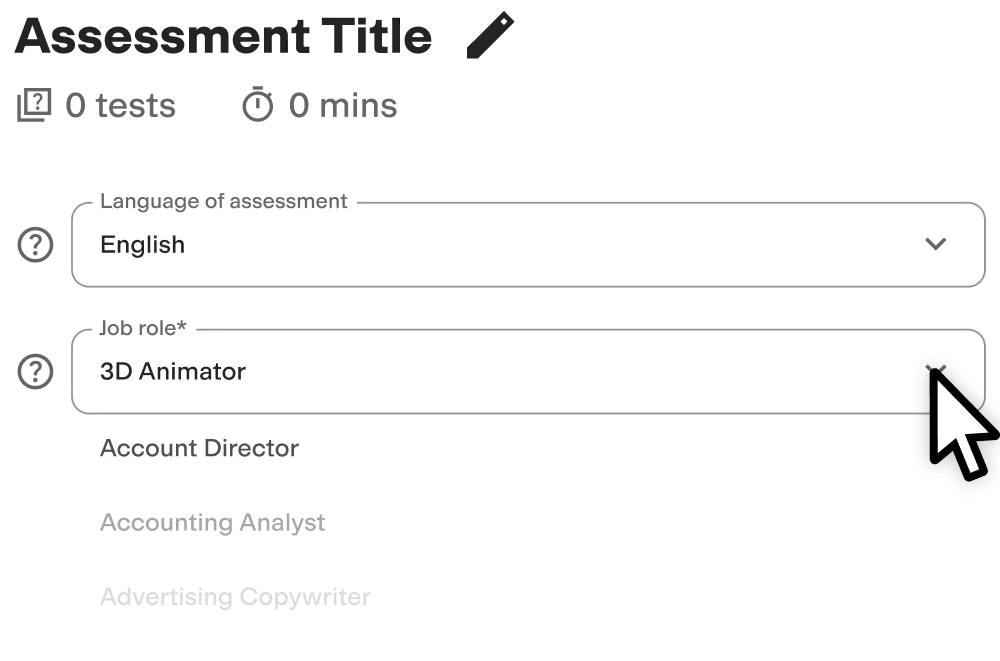

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

Why are accounts payable skills important to employers?

To run an efficient, compliant business, employers must understand accounting principles and keep accurate records of outgoing and incoming money.

Managing accounts payable is a crucial part of maintaining a healthy cash flow, and employers hire specialists who can accurately record and process accounts and transactions on their behalf.

No company can exist without the accounts payable function, so organizations can’t afford to be lax when hiring individuals responsible for the processes involved. Hiring people with accounting skills protects businesses against penalties, legal action, and reputational damage.

Failure to record expenses and outgoing payments effectively can lead to complex disputes regarding taxation and employment law, for example.

Moreover, if you don’t validate candidate skills and instead focus your recruitment process on resumes and interview answers alone, you risk hiring an accountant prone to making costly mistakes.

4 competencies to look for in our Accounts Payable assessment test

Our Accounts Payable aptitude test is based on four key competencies, helping you narrow your hiring pool in minute detail – which can be crucial during high-volume hiring.

Accounting fundamentals: The candidates’ ability to manage accounting basics is proven – e.g., creating reports, making entries in the general ledger, calculating complex figures, using internal controls, and recording expenses using software

Reconciling accounts: Applicants resolve accounting gaps and inconsistencies by bringing matching statements and records together

Recording transactions: Candidates excel in logging money spent with precise dates, amounts, and payee details

Finding missing information: Applicants carefully assess accounts and search for expense data that can solve accounting errors

What job roles can you hire with our Accounts Payable test?

Many roles require accounts payable skills. If you’re hiring for any of the following positions, consider evaluating candidates’ responses to Accounts Payable test questions:

Accounts payable specialists and managers manage outgoing invoices and expense reports accurately to help firms keep track of cash flow and meet compliance needs. Our test specifically measures applicants’ attention to detail and their accounting acumen.

Accountants and bookkeepers oversee a business’s financial records, making sure they’re precise for forecasting, tax reporting, and performance reviews. Our test assesses candidates on how they calculate, sort, and record this important information.

Finance managers use accounts payable skills to oversee a firm’s financial performance and make important cash flow decisions. Our Accounts Payable skills test measures applicants' confidence when making decisions with complex financial data.

Auditors assess and verify outgoing financial records to ensure compliance and accuracy. Reconciling skills measured in our test helps you find people who can fill accounting gaps and explain calculations.

In short, the Accounts Payable test helps you identify top candidates for various roles without needing to screen scores of resumes, which can cause major delays in the hiring process.

Take Ocean Outdoor UK (OOUK), for example. The digital advertising firm partnered with TestGorilla and introduced skills-based hiring to boost hire quality and trim time-to-hire in its finance department.

The result? OOUK now saves five hours per interview thanks to skills test insights – and it’s reduced bad hire rates by 44%.

Create a multi-measure assessment: 4 tests to pair with the Accounts Payable test

Our Accounts Payable test helps you measure candidates’ hard skills, but it’s also important to create a balanced skills assessment to gain a broader perspective of each candidate’s full profile when making hiring decisions.

With TestGorilla, you can build multi-measure assessments to gauge your applicants’ personality traits, transferable soft skills, and culture add. Here are four tests we recommend running alongside the Accounts Payable test:

Accounting Terminology test: Hire an accounts payable expert with demonstrable knowledge of key US accounting terms

Attention to Detail (Textual) test: Recruit an accounting specialist who looks at the minute details of invoices and outgoing records with exceptional accuracy

Communication test: Find a professional accounts payable hire who can build strong relationships with suppliers and vendors

Financial Management test: Assess your candidates’ general financial management skills, such as accurately recording, reconciling, and analyzing financial data

Still unsure about how much value skills-based hiring could bring to your firm? Use our free recruitment ROI calculator and discover just how much time and money you could save!

FAQs

View a sample report

The Accounts Payable test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.