Accounts Receivable test

Summary of the Accounts Receivable test

The Accounts Receivable test evaluates candidates’ skills in identifying, recording, and managing a company’s incoming payments and outstanding invoices. It helps you find skilled accountants who can effectively maintain financial records and ensure accurate tracking of your transactions.

Covered skills

Managing accounts receivable

Recording transactions

Finding missing information

Reconciling accounts receivable

Use our Accounts Receivable online test to hire

Accounts receivable specialists, accountants, auditors, payroll clerks, credit counselors, finance managers, and other roles that require a good grasp of accounts receivable.

About the Accounts Receivable test

Our Accounts Receivable skills test helps you find candidates with strong accounting skills who can effectively oversee and control your financial activity.

It assesses candidates’ skills in:

Managing accounts receivable

Recording transactions

Finding missing information

Reconciling accounts

Using our Accounts Receivable test ensures you find applicants who can handle all financial activities with the precision and professionalism required for a finance position.

We use practical, scenario-based questions that ask candidates to solve real-life issues that regularly come up when handling accounts receivable. These questions cover tasks such as:

Preparing records and passing them in the appropriate books

Guaranteeing timely collection of payments

Registering transactions to trial balances and final accounts

Identifying errors and ensuring data integrity

Understanding related documents that affect accounts receivable

Explore our preview questions to see examples of how we measure these skills.

Test takers who perform well have a strong grasp of accounting and can manage accounts receivable effectively, maintaining accurate records and supporting the financial health of your organization.

The test is made by a subject-matter expert

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Mary-Ann de W.

A Chartered Accountant with a Masters of Commerce Degree, Mary-Ann has been involved in all aspects of business, finance, accounting, taxation (both compliance and international), as well as financial systems, procedures, and designing and implementing internal controls over 20 years.

She has extensive experience in preparing budgets, forecasts, and business plans. Her interests include business and economic news, monitoring stock markets, and reading both technical material and fiction novels.

Reliability: Cronbach’s alpha coefficient = .64

Face validity: Candidates rated this test as accurately measuring their skills (average score of 3.84 out of 5.00).

Criterion-related validity: Candidates with higher scores on this test received higher average ratings from the hiring team during the selection process (r = .24, N = 195).

For an in-depth look at interpreting test results, please take a look at our Science series articles: How to interpret test fact sheets (part 1): Reliability, and How to interpret test fact sheets (part 2): Validity.

For an explanation of the various terms, please refer to our Science glossary.

Reliability and validity | Sufficient data available | Analyses and checks conducted | Outcome |

|---|---|---|---|

Reliability | ✔ | ✔ | Acceptable |

Content validity | ✔ | ✔ | Acceptable |

Face validity | ✔ | ✔ | Acceptable |

Construct validity | ✔ | ✔ | Acceptable |

Criterion-related validity | ✔ | ✔ | Acceptable |

Group differences | |||

Age differences | Pending | Pending | Pending |

Gender differences | ✔ | ✔ | Acceptable |

Ethnicity differences | Pending | Pending | Pending |

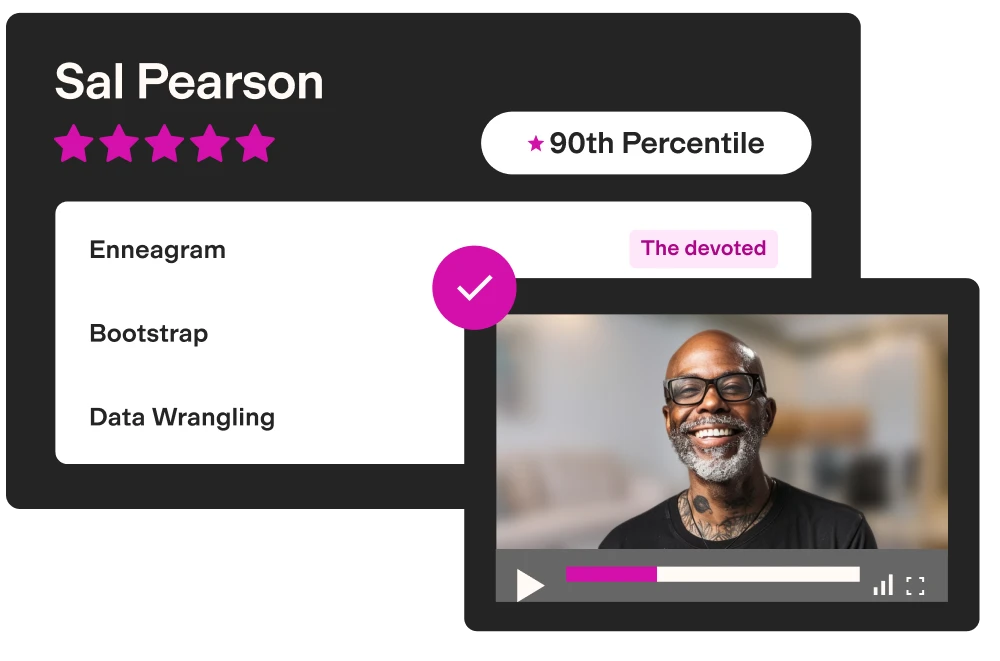

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

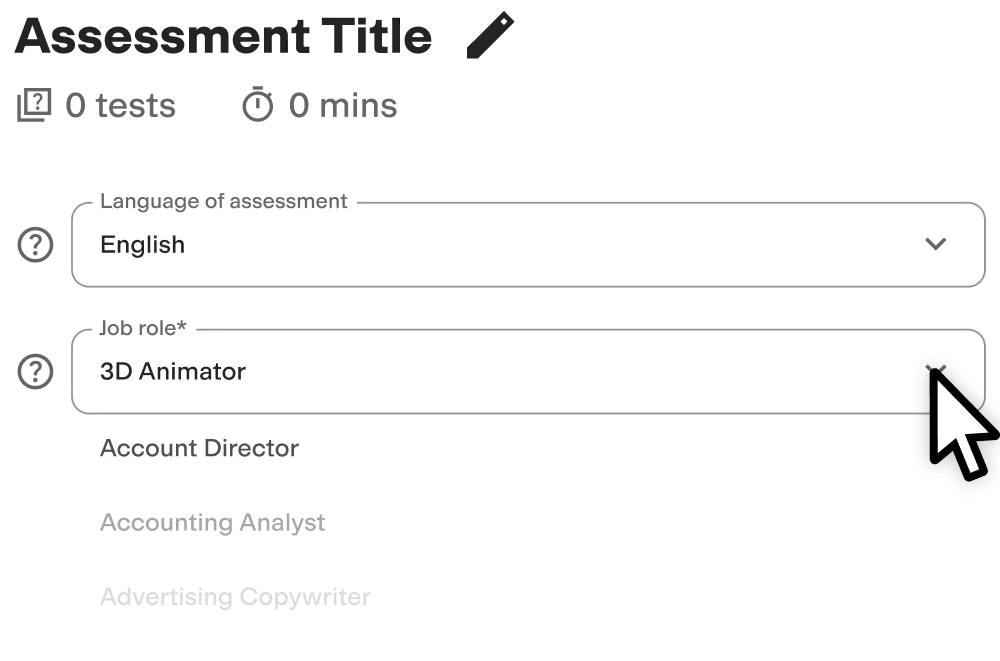

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

Why are accounting skills important to employers?

Accounting skills are important to employers because they maintain the company’s financial health. Employees with bookkeeping skills correctly record all transactions and promptly resolve any errors and issues.

With an Accounts Receivable assessment test, you find employees who ensure timely payment collection and reduce the risk of cash flow problems.

Delayed or missed payments affect the company’s ability to meet its financial obligations, such as paying suppliers and employees. These occurrences strain vendor relationships, result in missed opportunities, and even jeopardize the company’s operational stability.

Also, skilled accounts receivable professionals help businesses stay compliant by accurately maintaining financial records. They prepare for audits and tax filings, which reduces the risk of penalties and legal issues.

Lastly, understanding accounts receivable enables businesses to better assess their financial health and plan strategically. Employees with these skills provide insights into turnover ratios, payment trends, and budgetary performance. Having them on your team leads to better forecasting and budgeting.

4 accounts receivable competencies to look for

Using our Accounts Receivable assessment test together with accounts receivable questions in a structured interview helps you determine whether your candidates have the skills to:

Manage payment collection and invoicing: Individuals show the ability to issue correct invoices and follow up on overdue payments to maintain positive cash flow

Record transactions: Applicants accurately log all financial transactions and confirm entries are up-to-date

Find missing information: Candidates need excellent attention to detail to identify and resolve errors in financial records quickly

Reconcile accounts: Applicants can compare and match financial records to identify inconsistencies and make necessary adjustments

What job roles can you hire with our accounts receivable skills test?

The accounts receivable assessment test is a versatile tool to identify top talent for various financial roles. Whether you’re looking for specialists or managers, this test ensures applicants have the necessary skills to excel in managing accounts receivable.

For example, Pilgrims’ Friend Society uses our talent assessments to identify the best candidates for senior roles, including those in finance. As a result, the company effectively assessed technical skills and motivation, which helped hire better quality talent.

Use our Accounts Receivable online test to hire:

Accounts receivable specialists who guarantee timely and accurate payment collection and invoicing

Accountants who maintain precise financial records and adhere to accounting standards

Auditors who verify the accuracy of current records and regulatory compliance

Payroll clerks, skilled in managing employee payments and accurate documentation

Credit counselors who advise clients on managing debts and maintaining monetary health

Finance managers with the ability to oversee financial operations and ensure efficient cash flow management

Create a multi-measure assessment: 4 tests to pair with the Accounts Receivable test

Using the Accounts Receivable test is a great start, but the best approach involves combining it with other tests to get a holistic, data-driven picture of each candidate.

This multi-measure approach enables you to evaluate role-specific skills, personality traits, aptitude, and cultural add, which all contribute to a person’s success in the role.

We recommend combining our Accounts Receivable skills test with:

Intermediate Math test: Evaluate individuals’ mathematical skills to ensure they can handle complex calculations and data analysis crucial for financial roles

Financial Modeling in Excel test: Assess applicants’ ability to create financial models in Excel, which is crucial for analyzing monetary data and making informed business decisions

Motivation test: Understand what drives your applicants to assess whether they can shine and be satisfied in their role

Financial Management test: Evaluate candidates’ understanding of financial management principles, including budgeting, forecasting, and analysis.

FAQs

View a sample report

The Accounts Receivable test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.