Financial Due Diligence test

Summary of the Financial Due Diligence test

Our Financial Due Diligence test is designed to help hiring managers and recruiters assess the financial competency of candidates during the pre-employment screening process. This comprehensive online skills test evaluates candidates’ ability to determine the value of target company businesses, assess their financial health, and identify associated risks.

By verifying key financial information, this test enables companies to make informed hiring decisions. Whether you are hiring financial advisors, financial consultants, finance managers, financial analysts, or chief financial officers, our Financial Due Diligence test is relevant and effective.

Covered skills

Business valuation

Financial health, hygiene, and risk analysis

Verification of individual account heads

Use the Financial Due Diligence test to hire

The test is relevant for financial advisors, financial consultants, finance managers, financial analysts, chief financial officers, and sole proprietors and entrepreneurs intending to evaluate the financial health and business value of a targeted entity.

About the Financial Due Diligence test

Financial due diligence is crucial for organizations planning to undergo mergers and acquisitions, helping companies make informed decisions and avoid potential financial pitfalls. Hiring candidates with strong financial due diligence skills will ensure that your organization is equipped to handle these complex transactions with confidence.

This financial due diligence test evaluates a candidate's ability to determine earnings, assets, liabilities, cash flows, and the overall value of a business after taking into consideration factors including internal controls, associated risks, sensitivity, and future projections. It covers three key skill areas: business valuation; financial health, hygiene, and risk analysis; and verification of individual account heads. Candidates will be tested on their ability to determine the value of a business, identify potential financial risks, and verify the accuracy of financial statements.

Candidates who do well on this test will be able to provide valuable insights into the financial health of businesses and help you make informed decisions regarding mergers and acquisitions. Ultimately, hiring candidates with strong financial due diligence skills will help you navigate complex financial transactions with the expertise you can rely on.

The test is made by a subject-matter expert

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Abdul G.

Abdul is a chartered accountant and certified ISO 31000 risk manager with over 15 years of experience managing other accountants and staff in many businesses, large and small. Abdul also has an MBA with significant consulting experience across business sectors, including oil and gas, pharmaceuticals, food, and education.

He has worked as a university lecturer in accounting, finance, and tax-related subjects for more than five years and currently works on complex risk management policies as a senior risk management officer.

Use TestGorilla to hire the best faster, easier and bias-free

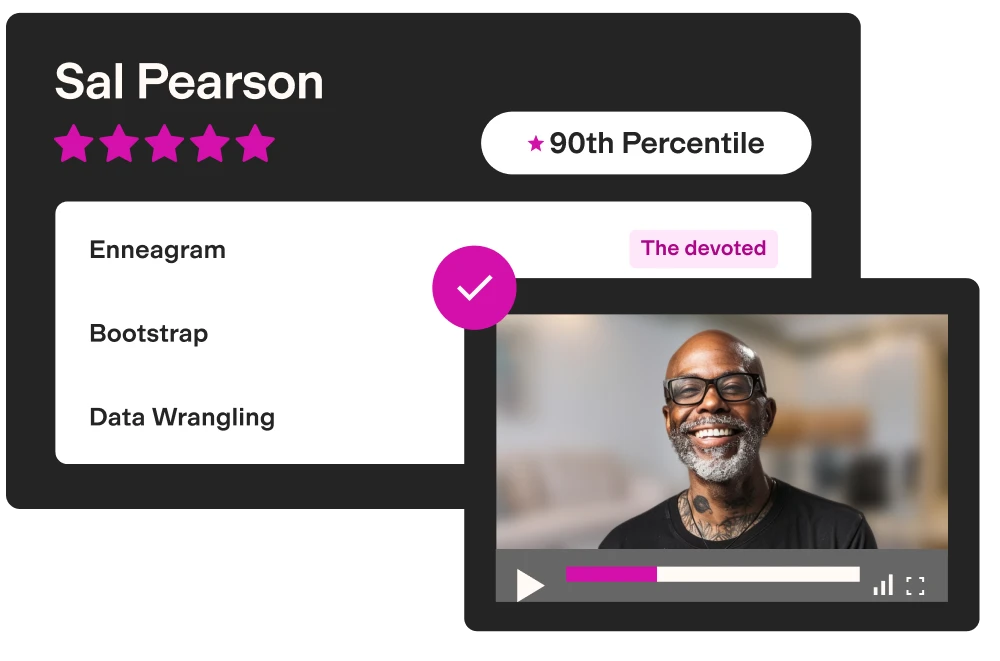

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

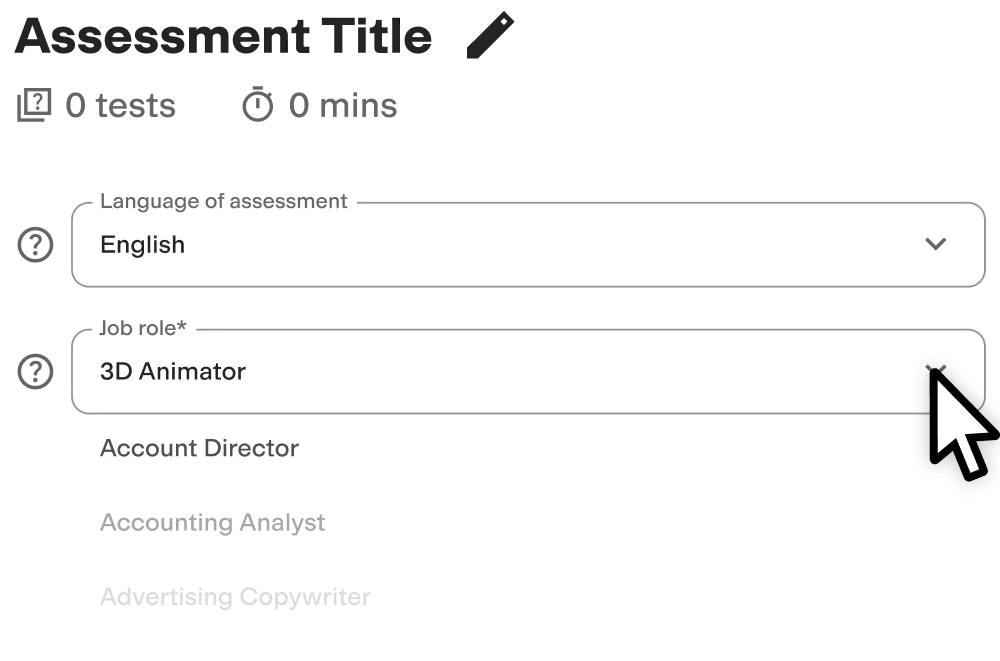

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

FAQs

View a sample report

The Financial Due Diligence test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.