Financial Management test

Summary of the Financial Management test

This test evaluates candidates’ ability to manage finance in order to maximize business profits and minimize risk. The test will help you to identify candidates equipped with practical skills to effectively handle the financial side of your business.

Covered skills

Working capital management

Investment appraisal and decision-making

Capital structure and cost

Forecasting and analyzing financial outcomes

Use the Financial Management test to hire

Financial controller, corporate accountant, comptroller, finance manager, treasurer, auditor, and anyone else responsible for managing and controlling the overall finances of a business.

About the Financial Management test

The survival of any business requires the availability of and access to financing. Every company wants to maximize its profits and minimize risk, but the availability of financing does not provide a guarantee for these outcomes.

Effective and efficient management of finance requires skilled oversight to ensure that sufficient funds are available to meet current liabilities and for the continued smooth running of business operations. This Financial Management test will help you find the person who can manage your business’s finances to ensure the short-, medium-, and long-term success of your business.

This hiring test focuses on capital management, investment appraisal, capital structure, and forecasting outcomes. Working-capital management includes understanding the most feasible credit period to be allowed to debtors and the most beneficial time to pay creditors, in addition to various decisions regarding inventory management. Investment appraisal includes allocating funds to invest in the most profitable business opportunities and having funds required for the business at the lowest possible cost.

The person managing your company’s finances should also proactively identify possible financial risks and devise mitigation strategies to prevent the occurrence and impacts of such events.

The Financial Management test will help to assess candidates’ financial-management skills. The candidates who perform well on the test are likely to possess excellent financial-management skills in real-world scenarios. The test ensures that successful candidates will be a good addition to your company’s finance team and that they will perform their duties efficiently and effectively right from the start.

The test is made by a subject-matter expert

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Abdul G.

Abdul is a chartered accountant and certified ISO 31000 risk manager with over 15 years of experience managing other accountants and staff in many businesses, large and small. Abdul also has an MBA with significant consulting experience across business sectors, including oil and gas, pharmaceuticals, food, and education.

He has worked as a university lecturer in accounting, finance, and tax-related subjects for more than five years and currently works on complex risk management policies as a senior risk management officer.

Reliability: Cronbach’s alpha coefficient = .61

Face validity: Candidates rated this test as accurately measuring their skills (average score of 3.19 out of 5.00).

Criterion-related validity: Candidates with higher scores on this test received higher average ratings from the hiring team during the selection process (r = .37, N = 187).

For an in-depth look at interpreting test results, please take a look at our Science series articles: How to interpret test fact sheets (part 1): Reliability, and How to interpret test fact sheets (part 2): Validity.

For an explanation of the various terms, please refer to our Science glossary.

Reliability and validity | Sufficient data available | Analyses and checks conducted | Outcome |

|---|---|---|---|

Reliability | ✔ | ✔ | Acceptable |

Content validity | ✔ | ✔ | Acceptable |

Face validity | ✔ | ✔ | Acceptable |

Construct validity | ✔ | ✔ | Acceptable |

Criterion-related validity | ✔ | ✔ | Acceptable |

Group differences | |||

Age differences | Pending | Pending | Pending |

Gender differences | Pending | Pending | Pending |

Ethnicity differences | Pending | Pending | Pending |

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

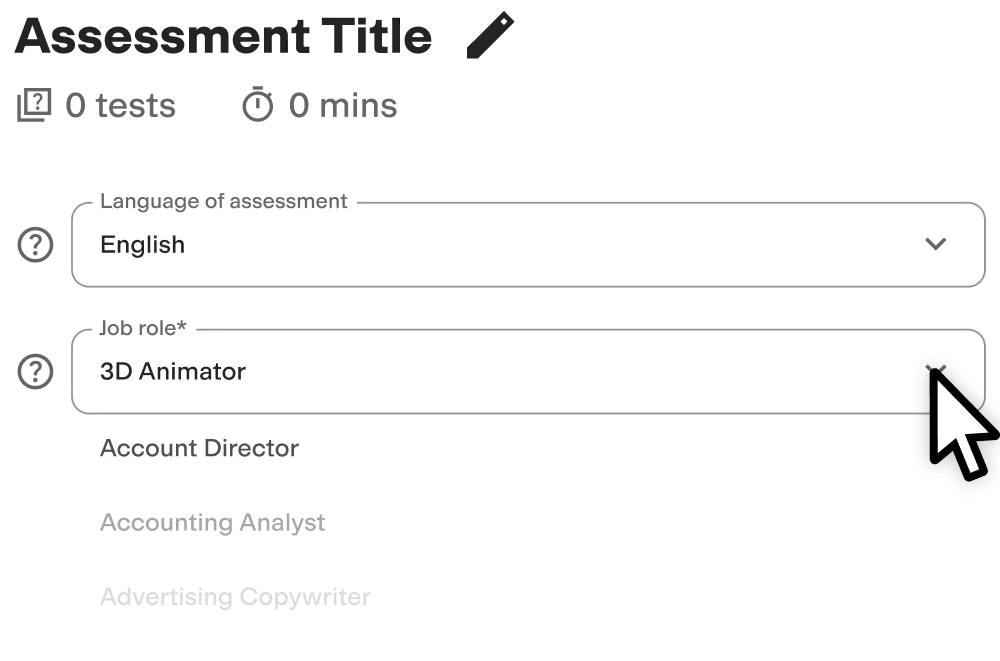

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

FAQs

View a sample report

The Financial Management test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.