Financial Modeling in Excel test

Summary of the Financial Modeling in Excel test

The Financial Modeling test assesses candidates’ essential finance and valuation skills and their ability to create and maintain financial models using Excel. Using this test helps you hire finance professionals who need to work with Excel frequently.

Covered skills

Finance fundamentals

Valuation

Financial modeling in Excel

Using Excel formulas

Use the Financial Modeling test in Excel to hire

Investment bankers, financial controllers, business analysts, venture capital professionals, equity researchers, and other finance experts who need to have solid financial modeling skills in Excel.

About the Financial Modeling test

The Financial Modeling test helps you identify talented professionals with strong finance, analytical, and Excel skills. It assesses how well your candidates develop sophisticated financial models, project a company's economic performance, and conduct various financial analyses.

Our Financial Modeling test in Excel assesses:

Finance fundamentals: Evaluates a candidate’s understanding of essential financial concepts, including financial statements, debt schedules, cash flow analysis, cash balance, and budgeting

Valuation: Assesses applicants’ ability to value assets, companies, and investments using techniques such as discounted cash flow analysis, comparable company analysis, and precedent transactions

Financial modeling in Excel: Examines how well a candidate can create detailed financial forecasts, sensitivity analyses, and scenario planning in Excel files

Using Excel formulas: Gauges whether applicants can use advanced Excel functions and formulas, such as VLOOKUP, INDEX-MATCH, pivot tables, and complex nested formulas

This Excel Modeling test challenges your applicants to answer the fundamental questions about finance modeling, such as:

What is the financial impact of a strategic initiative?

How long is the cash flow runway of a startup?

What is the effect of a reduction in working capital on key financial ratios?

Your candidates’ answers help you hire employees with the right skills to create more comprehensive financial insights and contribute to data-backed decision-making.

You can check out our Financial Modeling test preview questions for actionable examples of pre-interview questions your candidates can face in this test.

The test is made by a subject-matter expert

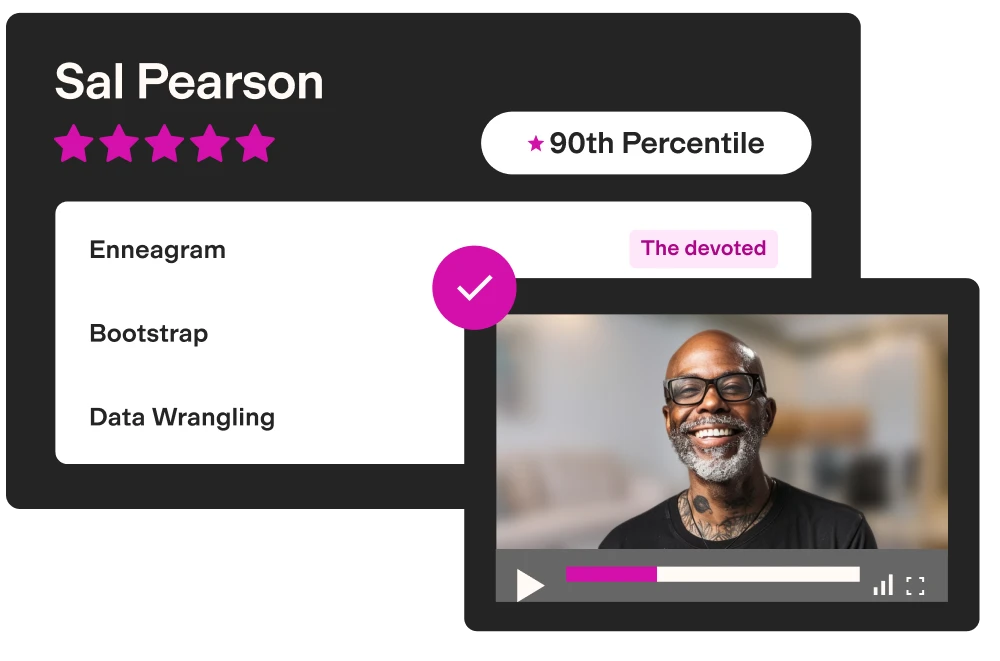

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Andrew B.

With a degree in International Business & Finance from the Moore School of Business and studies in Chinese Enterprise at the Chinese University of Hong Kong, Andrew started his career as an investment banking analyst at Morgan Stanley with postings first in Hong Kong and later in Australia.

Currently, Andrew helps run a hostel in Lake Taho and funds his mountain lifestyle by helping small and growing businesses use Excel to help make important financial decisions.

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

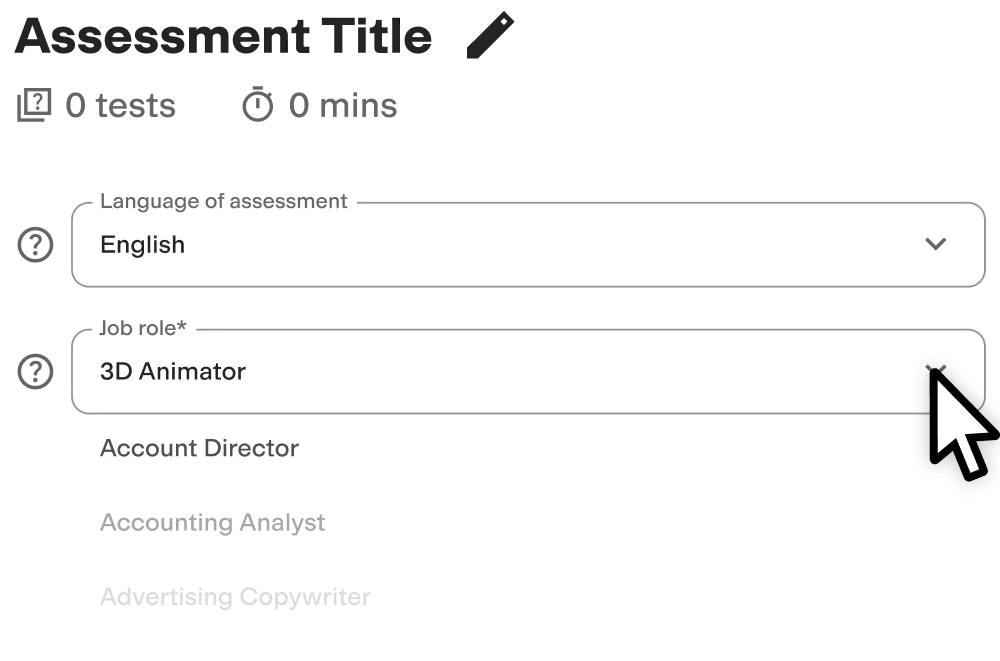

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

Why are financial modeling skills important to employers?

Financial modeling skills are important to employers because they support financial performance and enable leaders to make the right business decisions to help their company grow.

Employees with good financial modeling skills can evaluate the potential impact of strategic initiatives, assess investment opportunities, and determine the organization's economic health.

These capabilities enable better planning by providing accurate forecasts and risk assessments, which guide strategic decisions. They also ensure that companies use resources wisely, matching investments to the organization’s most pressing needs.

The best way to achieve these benefits is to use an Investment Banking Financial Modeling test to find the candidates with the right skills. Use our recruitment ROI calculator to see how much this approach can improve your hiring process.

Many financial institutions have experienced these benefits firsthand. For example, Revolut, a financial services leader, used our skills tests to create a more objective hiring process. With TestGorilla, the company managed to find better candidates and reduce hiring time by 40%.

4 financial modeling competencies to look for

Finance companies can use our Investment Banking Financial Modeling test example to identify candidates with the right competencies to thrive in many roles. That includes the four most important financial modeling skills:

Building and managing financial models: Proficiency in Excel and a deep understanding of economic principles enable candidates to construct and maintain complex financial models to support decision-making

Accurately performing valuations: Understanding valuation approaches such as comparable company analysis, precedent transactions, and discounted cash flow analysis are crucial in strategic planning

Collecting and analyzing data: Using data analysis tools and techniques helps candidates gather relevant information from multiple sources and analyze it to identify trends, risks, and opportunities

Creating reports: Organizing complex financial data into clear, concise reports helps present findings, recommendations, and insights to stakeholders

What job roles can you hire with our Financial Modeling in Excel test?

Our Financial Modeling test in Excel assesses key financial analyst skills necessary to perform well in various roles.

Here are the roles you can hire with this test:

Investment bankers use finance fundamental skills to handle complex financial models and make informed investment decisions using the balance sheet, cash flow statement, and income statement

Financial controllers apply financial principles and Excel skills to create and maintain accurate financial records and forecasts

Business analysts use financial modeling in Excel and data analysis techniques to investigate financial data and provide actionable recommendations

Venture capital professionals employ valuation and financial analysis skills to put together private equity for startups and investment opportunities

Equity researchers apply their expertise in finance fundamentals and market analysis to investigate financial statements and market trends

Complement this test with a list of financial modeling interview questions to gain an even better understanding of your applicants’ skills.

Create a multi-measure assessment: 4 tests to pair with the Financial Modeling test

Assessing financial modeling skills is useful but doesn't give you all the pertinent information about your candidates. To hire the right people for the job and avoid mis-hires, you should use a multi-measure approach that lets you evaluate skills, personality traits, and role-specific attributes.

With our talent assessments that contain five skills tests, you can use objective data to improve the accuracy of your hiring decisions.

We suggest combining our Financial Analyst Excel test with these four tests:

Accounting test: Assess candidates’ intermediate accounting skills like understanding financial statements, depreciation, amortization, bookkeeping, and financial analysis, which are crucial for ensuring the accuracy of data inputs in financial modeling

Working With Data test: Evaluate applicants’ ability to work with large datasets, interpret information accurately, and make data-driven decisions – skills that directly support transforming complex data into actionable financial strategies

Financial Due Diligence test: Measure the ability to conduct thorough financial assessments to support financial investments and acquisitions, providing the meticulous attention to detail needed for precise financial modeling

Culture Add test: Determine how your applicants’ values and behaviors can contribute to your company culture and teamwork, supporting the necessary collaboration across departments often required for financial modeling

FAQs

View a sample report

The Financial Modeling in Excel test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.