Advanced Accounting (GAAP) test

Summary of the Advanced Accounting (GAAP) test

The Advanced Accounting test evaluates candidates’ accounting knowledge, including posting and calculating figures and managing records according to GAAP. It helps you identify candidates with excellent accounting/bookkeeping skills.

Covered skills

Defining basic terminologies and accounting concepts

Posting figures in the correct accounts and on the correct side (Dr/Cr)

Calculating accounting figures

Managing figures and financial records

Use the Advanced Accounting (GAAP) test to hire:

Accountants, accounting managers, bookkeepers, credit analysts, auditors, and other roles requiring strong accounting expertise.

About the GAAP Advanced Accounting skills assessment test

Hiring candidates with the Advanced Accounting skills test helps you find reasoned and confident financial decision-makers.

This test, in particular, enables you to find people comfortable with complex data handling, financial monitoring, and report creation.

Candidates scoring well on this test are self-motivated, data-driven, and genuinely care about data accuracy. This advanced (GAAP) test assesses an applicant’s ability to:

Define basic accounting concepts such as depreciation, accrual, and amortization

Create clear and accurate balance sheets and income statements

Issue financial reporting and forecasts

Handle accounting and auditing tools

Book and track inventory and current assets

Manage accounts payable and accounts receivable

Analyze records and account balances

Prepare financial statements that are easy for different audiences to understand

This Advanced Accounting test includes practical and theoretical questions to measure how your prospects react to problems on the job. The test follows the generally accepted accounting principles (GAAP) because all concepts, terminology, and test questions align with GAAP. We recommend our sister Advanced Accounting (IFRS) skills assessment for concepts in line with International Financial Reporting Standards (IFRS).

A prospective financial accountant who scores highly on our Advanced Accounting test is likely to:

Save your company money

Help streamline programs and processes

Ensure you’re financially compliant and sound

Prevent penalties

Build reliable financial forecasts

Track current liabilities

The test is made by a subject-matter expert

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation.Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

Tanuja C.

Financial planning, tax advisory, bookkeeping--these are only a few of Tanuja's professional expertise. A chartered accountant since 2015, Tanuja has worked with companies on a global scale, including Ernst & Young, one of the “Big Four” firms in accounting.

Tanuja loves going beyond day-to-day operations to apply her financial finesse through mentorship and by developing finance-related case studies for undergraduate, graduate, and MBA finance courses.

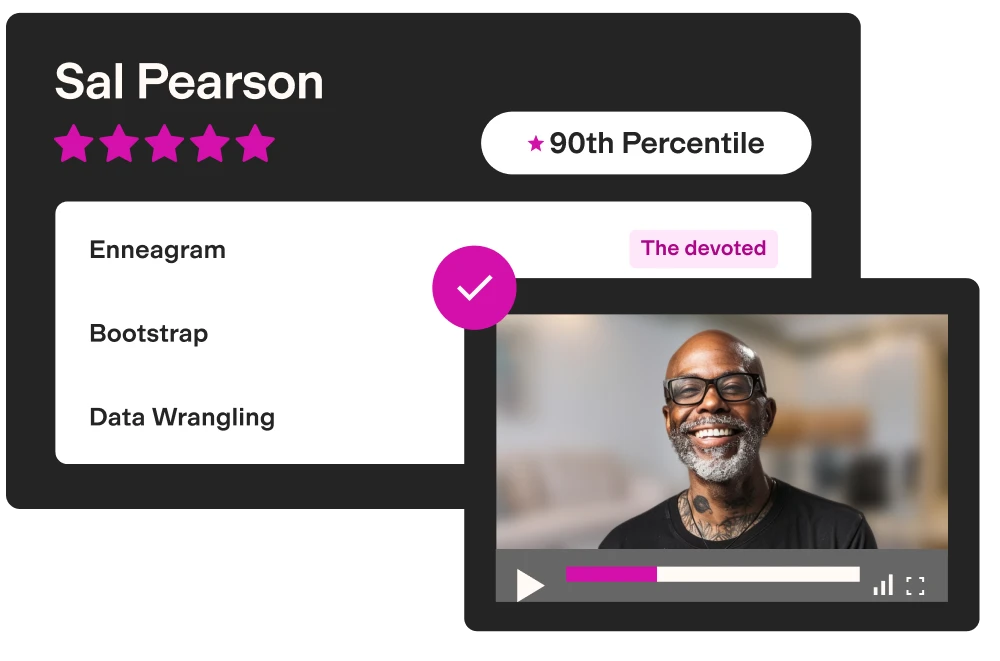

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

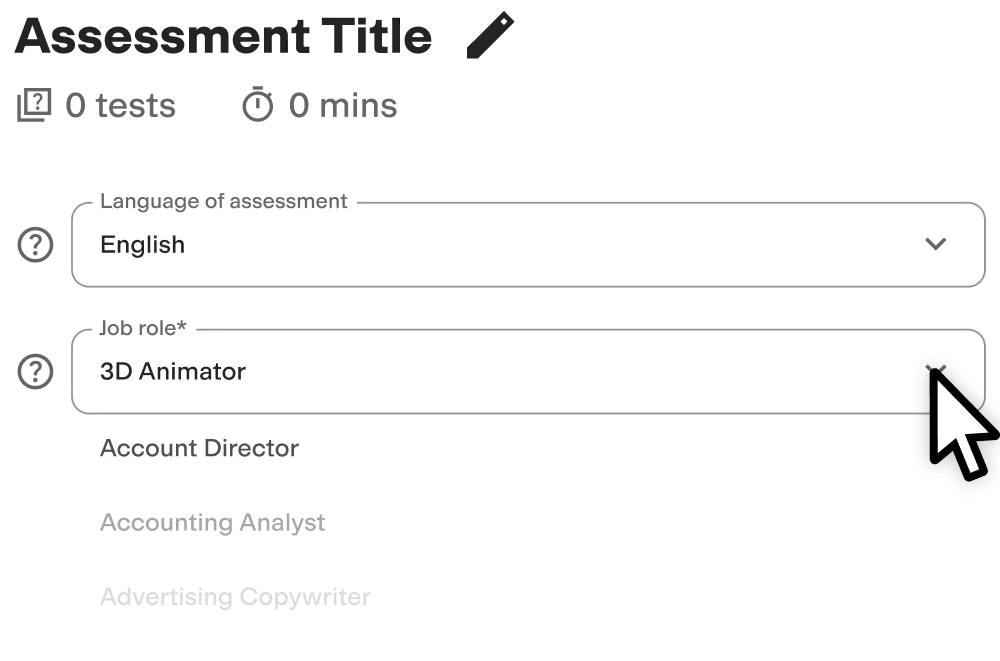

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

Why are advanced accounting skills important to employers?

Employers hire people with advanced accounting skills to track revenue and expenses and ensure they meet regulatory compliance.

Breaching compliance is costly and shatters reputations. For example, the maximum fine for breaching a Bank Secrecy Act (BSA) regulation is $500,000 plus a potential prison term of up to ten years.

Recruiters don’t just want to hire conscientious accountants – they need to.

Corporate finance is increasingly complex, meaning employers need advanced accountants to understand financial data, monitor changing regulations, make accurate calculations, and own important reports.

By hiring a proactive accountant with advanced financial management skills, your company can:

Save time: Talented accountants need little training and provide professional advice regarding tax and compliance, reducing guesswork.

Save money: Candidates with advanced accounting skills understand the latest regulations and the most efficient cost-saving tax measures. They also adapt systems and processes to cut further costs, such as accurately managing the cost of goods sold. Finally, they save you money and protect your reputation by keeping you compliant with tax laws and regulations.

Merge systems together: An advanced accountant can streamline processes and build all-in-one bookkeeping systems, integrating the general ledger and reducing hassle and needless software expenses.

Ensure you’re compliant: An advanced accountant ensures compliance with tax returns, business activity statements (BAS), and installment activity statements (IAS), properly recording all correct debit and credit entries.

Build financial forecasts: Talented accountants use extensive financial data, such as the book value of assets, to track debt, plan for expenses, and share gross margins – helping leaders make more informed decisions.

Recruiting on raw skills rather than experience should be a key part of learning how to hire an accountant. TestGorilla helps your candidates show you what they can do with an accounting test for job interviews and in-house training.

Take our case study with Studio Le Pera, an Italian accounting firm, as an example. By switching to skills-based hiring through TestGorilla’s talent discovery platform, the company saved €2,000 in per-hire recruiting costs and improved the quality of candidates attending interviews.

What job roles can you hire for with our Advanced Accounting Test?

You can hire for the following roles with our Advanced Accounting assessment test questions:

Accountants and Accounting Managers: Accountants need to make calculations, interpret complex figures, deliver reports, and translate financial data into action points. They also ensure the accuracy of consolidated financial statements and manage retained earnings.

Bookkeepers: Bookkeepers must manage and filter large amounts of financial data, prepare tax returns, and record income and expenditure as and when they arise, accurately tracking long-term assets and net income.

Credit Analysts: Analysts gather financial information, assess fair value, answer questions solvable by data, and build reports on different credit areas.

Auditors: Auditors interpret financial data without bias, organize complex information, and translate findings to different audiences. They also verify stockholders' equity and paid-in capital on the worksheet.

We recommend using our Intermediate Accounting test as a starting point for less advanced accounting needs.

Create a multi-measure assessment: 4 tests to pair with the GAAP Advanced Accounting skills test

With TestGorilla, you can build custom assessments that include up to five different tests – perfect for assessing your accountancy candidates on a wide range of soft and hard skills and getting a holistic view of their knowledge.

Here are four exams we recommend you include alongside our Advanced Accounting test in a multi-measure assessment:

Critical Thinking test: Evaluate applicants’ ability to make sound judgments based on objective evidence, handle high-pressure, confidential decision-making, and find patterns and sequences in complex financial data.

Communication test: Gauge a job seeker on how well they actively listen to instructions, ask questions, collaborate with various specialists, and explain their findings clearly and concisely to others. This test helps you ensure your future accountants are adept at using financial information to build insightful action plans.

Financial Accounting test (GAAP): Focus on your candidates’ practical financial accounting abilities. Put them to the test and if they can record, classify, and summarize accounting transactions according to US GAAP.

Culture Add test: Ensure your recruits mesh with your culture and ethos. Culture add is all about finding motivated people who innovate and push your brand further, not just blend with it.

After planning your online GAAP Advanced Accounting test, we recommend you consult our complete guide to accountant interview questions to create the perfect hiring process.

FAQs

View a sample report

The Advanced Accounting (GAAP) test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.